US manufacturing ticked up to 49.0, Swiss CPI m/m dropped– 0.1% in September

Let’s hop straight into five of the biggest developments this week.

If you’d prefer to watch this update, rather than read it, please click below.

1. US manufacturing marginally ticked up to 49.0

Activity in the manufacturing sector of the US reported a measly rise in September. A survey report of core stakeholders stood at 49.0, far better than the previous 47.6 and the 47.8 priced in by market participants. The sector remained in contraction despite the uptick due to seasonality, which points to overall structural weaknesses.

2. Australia held interest rates steady at 4.1%

The RBA sat on its hands for the fourth consecutive time to leave interest rates unchanged at 4.1%, in line with market expectations. This was despite tentative signs that inflation was re-emerging, which has been driven by soaring energy prices. The decision to hold was largely to allow time for the effect of successive hikes completed over the last 18 months.

3. Swiss CPI m/m slowed – 0.1% in September

Inflation in Switzerland slowed much faster than expected in September. From the previous 0.2% in August, a reading of – 0.1% was reported, lower than the market expectation of a reading of 0%. This shows that high interest rates are having a major effect on prices and Switzerland is mitigating the inflation conundrum in Europe better than most economies.

4. New Zealand left interest rates unchanged at 5.5%

The RBNZ held interest rates for the third successive time, holding steady at 5.5%. The statement also expressed concerns of continued inflationary pressure and is taking time to get a clearer picture of the trajectory of current policies. It also signaled to markets that the odds for further tightening remained high and cannot be ruled out as the economy is proving far stronger than expected.

5. US ADP non-farm employment change slumped to 89k

The US labour market took a turn for the worse with the ADP non-farm employment change tumbling to 89k in September, the lowest figure since early 2021. This was a significant reduction in jobs from the 154k anticipated by markets. Manufacturing, trade and transportation accounted for the biggest job losses. .

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The VIX spiked up on fears of a worsening debt crisis and political fragmentation in the US after a temporary funding bill narrowly averted a costly government shutdown. Investors squared off risk for cash, causing a rise in the dollar, JPY and CHF, all considered safe currencies. Global indexes tumbled on capital fright. Treasuries were flat investors positioned themselves after a very weak non-farm employment number.. Orange juice was up poor off season conditions, while ethanol and natural gas were up on seasonality. Equities, precious metals, and most commodities experienced a very poor week of performance, with catalysts related to China slowdown, seasonality, repricing of fixed income markets and expectations of future monetary policy dovishness.

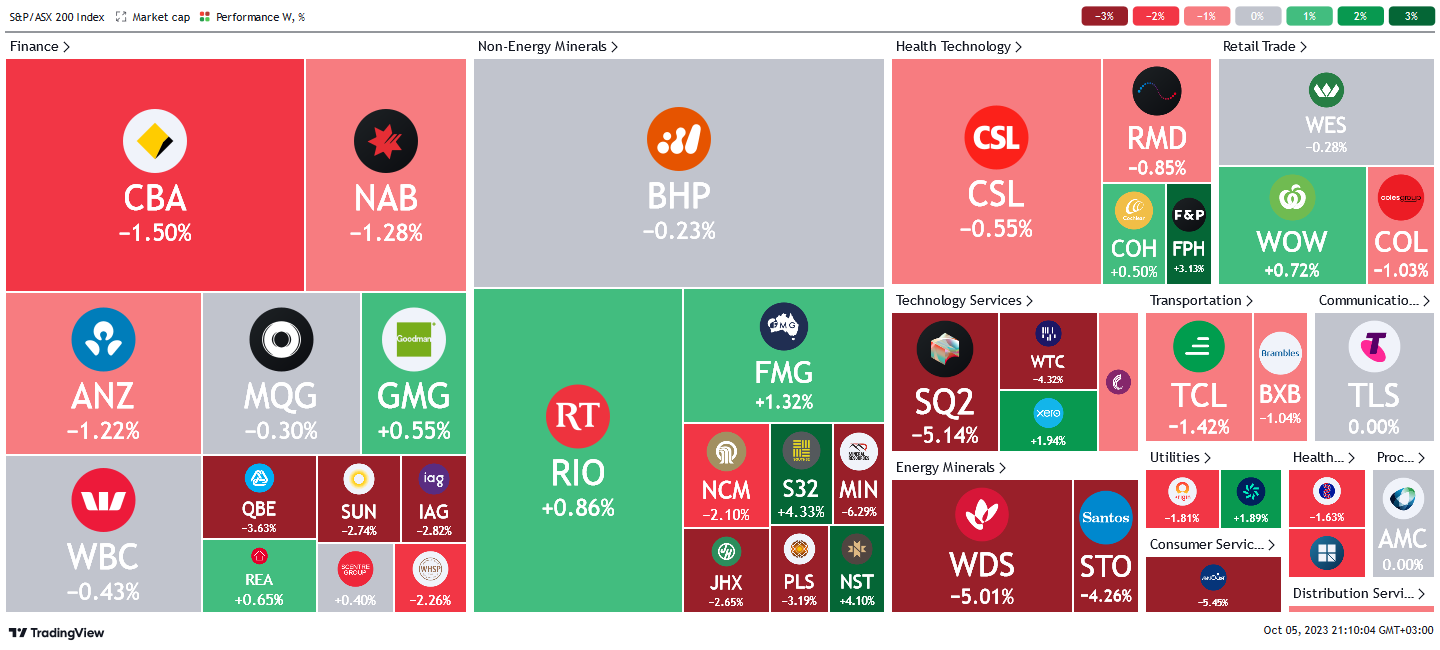

Here is the week's heatmap for the largest companies in the ASX.

Another choppy week as various sectors posted mixed performances on the ASX. Financials leaned heavy on the downside with CBA, ANZ and NAB, all declining by over 1.5%. GMG and REA were rare patches of green. Miners were mixed with the largest movement coming from MIN as they completed a $1.1bn not offering. Defensive names generally received money flow, with WOW, COH and TLS all flat to positive. Energy names were the worst performers, with WDS and STO down over -4%, as crude prices plummeted by around -9%.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

10 stocks mentioned