Using duration as a counterweight to credit can improve investor outcomes

Active duration exposures are often seen by investors as more of a tactical tool within fixed income portfolios, reflecting a directional view regarding interest rates. Though this is often the case, duration can also be used as a more strategic lever to offset the credit risks within a fixed income portfolio. To highlight this more strategic role for interest rate duration, a very simple framework will be utilised to illustrate how duration can be used to balance the credit risk within a fixed income portfolio.

Credit as the core source of return enhancement

For many active fixed income funds, an overweight exposure to credit is often the dominant source of return enhancement utilised. Such a bias should not be surprising, especially with respect to higher quality investment grade credit markets where the overall risk of default is low. With a low risk of default, the credit spread becomes one of the more predictable premiums investors can use to enhance returns over a cycle.

To better understand why an overweight to credit would appear to provide the best of both worlds, it is important to consider the two key risks in fixed income markets; namely interest rate risk and credit spread risk. These are the main risk factors behind the underlying betas of both a fixed income market and any return enhancement from active management. The benefit of these two sources of beta is that they tend to be negatively correlated. This is important as for most ‘high quality’ fixed income markets there tends to be more interest rate risk compared to credit spread risk. Given this bias, it is possible for investors to enhance the risk/return characteristics of a portfolio by holding a higher proportion of credit risk within a portfolio, i.e. achieving a greater balance between interest rate risk and credit spread risk.

To illustrate how this occurs, consider a simplified example where there is a benchmark which is composed purely of Commonwealth government bonds:

Benchmark = 100% * Commonwealth Government Bonds (“Benchmark”)

Accordingly, the Benchmark is 100% interest rate risk and 0% credit risk. To this portfolio the investor can now add an ex-benchmark exposure which includes credit spread risk:

Ex-benchmark Exposure = Corporate Credit (“Ex-benchmark”)

To simplify the analysis, the duration of the Benchmark and Ex-benchmark exposures are calculated so that they are the same. As the durations of the Government Bond and Corporate Credit sub-portfolios are assumed to be equal, then (a) the investor can add credit risk without impacting the overall interest rate risk, and (b) the only difference between the Benchmark and Ex-benchmark exposures is credit spread risk. The investor now adds a 25% Ex-benchmark exposure of Corporate Credit to their previously Government Bond-only exposure, i.e. Benchmark, to create what will be referred to as an Active Portfolio (”Active”).

Active = (Benchmark * 75%) + (Corporate Credit * 25%)

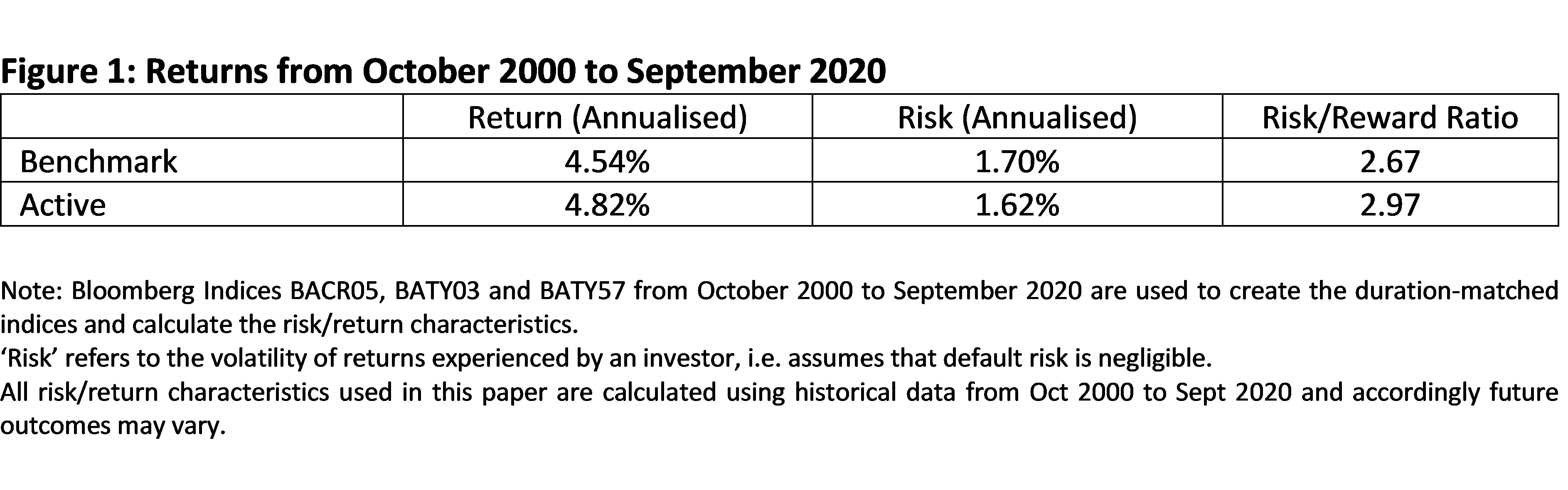

The resulting risk/return characteristics for the two portfolios are shown in Figure 1.

By adding credit spread risk to interest rate risk, the investor has been able to not only increase returns but also reduce total volatility given the negative correlation between the two betas. Put another way, by achieving a greater balance between interest rate risk and credit spread risk within the portfolio, the investor would appear to be enjoying the ‘best of both worlds’.

Adding credit is not a ‘free lunch’

It must, however, be noted that adding credit is not a ‘free lunch’, as the portfolio may now underperform during periods of heightened risk aversion, or ‘risk off’ events, i.e. underperform when credit spreads move higher. Though the investor has achieved a greater balance between interest rate risk and credit spread risk, there may not be enough interest rate exposure to offset the adverse impact on performance during ‘risk off’ events. To see if this is the case, an investor can consider the behaviour of the two portfolios during periods when credit spreads are rising.

Figure 2 shows the average annualised return for the two portfolios only in those months that credit spreads widen. The performance numbers highlight that there is not enough interest rate exposure to completely offset the negative impacts on the performance of the Active portfolio from adverse movements in credit spreads.

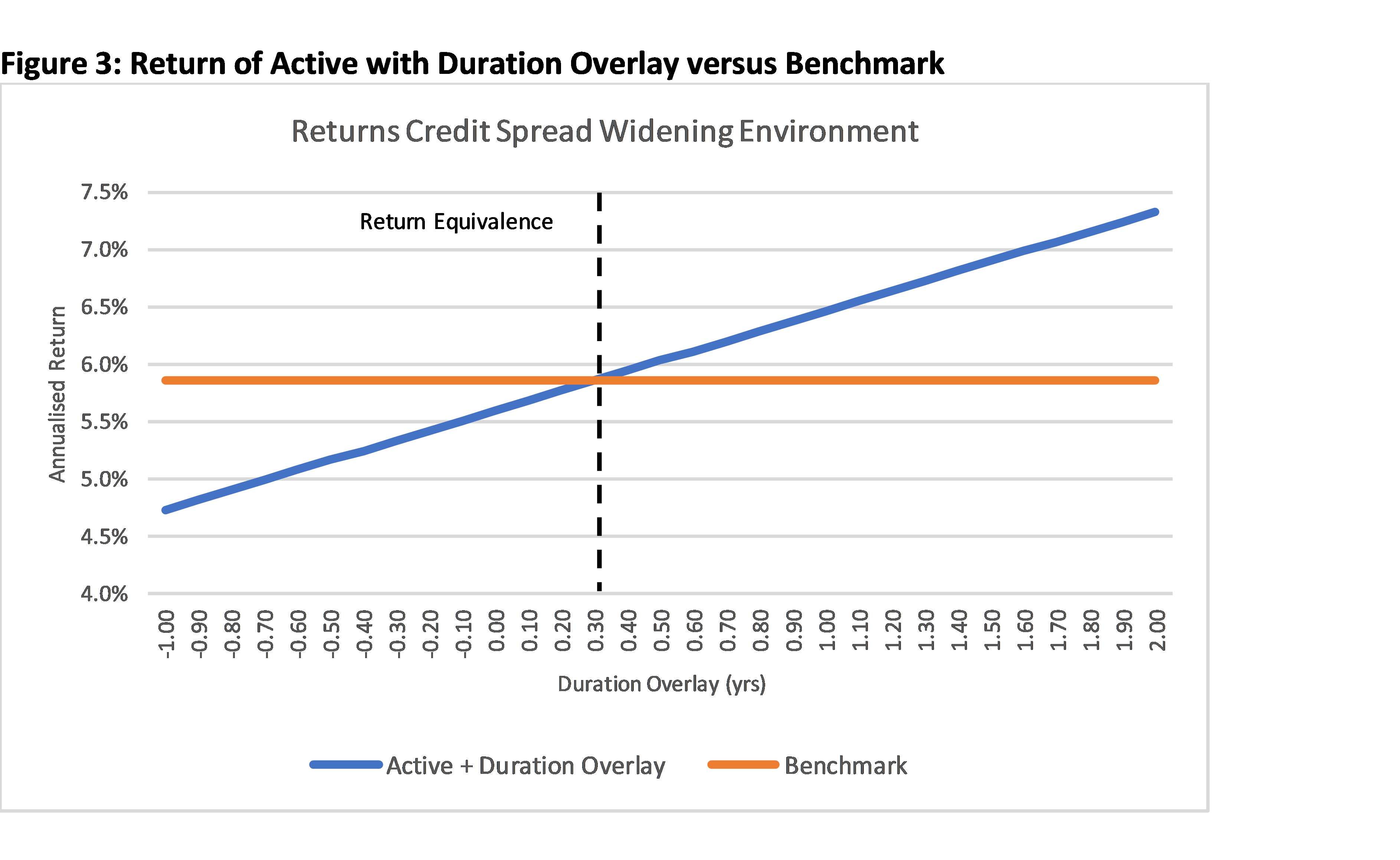

To deal with this increase in risk, the investor can now add duration to the portfolio. In this example, it is assumed that the investor adds duration in 0.05-year increments using a derivatives overlay of 10-year government bonds. The aim within this simplified model is for duration to be added to the Active portfolio until the return in an environment of rising credit spreads equals that of the Benchmark portfolio (See Figure 3).

Using data for the last 20 years suggests that, on average, an active duration exposure of around 0.30 years is required to offset the adverse impacts on performance associated with a 25% overweight to Australian corporate credit. It needs to be recognised that the result has limitations, as it is an average over a period exhibiting particular characteristics with respect to credit and interest rate conditions. Accordingly, it overlooks the fact that the effectiveness of duration as an offset for credit risk at any point in time depends on a range of factors. This highlights that whilst a strategic bias to being long duration can offset credit risk, such an exposure is best managed proactively by taking into account (a) the outlook for credit risk, i.e. the amount of protection desired, and (b) the level of interest rates, i.e. the amount of protection provided per unit of duration.

Investors often mistakenly believe that the justification for having a structural bias to being long duration is the generation of a higher yield or carry on a portfolio. Unfortunately, this is not the case, as it is the non-linearity of the yield curve, and not how steep it is, which is the key determinant of the return on a bond over a holding period. However, this does not mean that, outside of a distinct directional view, there is not a justification for being strategically long duration. Duration as a tool for managing the overall risk within a portfolio is particularly relevant where a portfolio is using a strategic overweight to credit to enhance returns. With such a bias to earn credit premiums, an appropriate longer-than-benchmark duration can assist in offsetting the additional credit risk. Of course, interest rate duration may at different times prove more (or less) effective at offsetting credit risk. This means that rather than a static allocation, a dynamic approach to managing duration as a risk management tool is appropriate and can assist in improving the investment outcomes for investors; i.e. active interest rate management becomes an extension of credit risk management.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics