Valuations vs fundamentals: Are stocks adrift from reality?

We have a new Reserve Bank governor! But don’t let that distract you from what matters.

As my What’s Not Priced In co-host Greg Canavan said, whether it’s Philip Lowe or Michele Bullock, ‘they’re all life-long bureaucrats; expect more of the same’.

And, in any case, we shouldn’t mistake news for research.

Investors speak of the harsh impacts of a rapid hiking cycle. But let’s not underestimate the blunting effect of the news cycle.

News can help make sense of the world, but that’s not the same as understanding it.

Investor James Valentine made the point well (emphasis mine):

‘While the news may be interesting and provide new data points, it doesn’t forecast the future, which is the job of an equity analyst. You can waste a lot of time reading stories that don’t help pick stocks.

‘The financial press will often follow a herd mentality by having a party when the Dow Jones Industrial Average hits new levels and predicting the next Great Depression when the market hits a near-term low. Don’t look for the press to take an out-of-consensus money-making stance…’

Humbly, if you can’t look for the press to assume an out-of-consensus stance, you can look for Fat Tail to.

That’s what our podcast is all about! So what did Greg and I cover this week?

This episode, we pondered the implications of the positive inflation data in the US. The key question -- is the cause behind the disinflation falling aggregate demand or normalising supply?

The former doesn’t bode well for markets.

We then discussed the divergence between market fundamentals and stock valuations with real yields still high but stocks rising. The market always looks ahead, but how far is too much?

Greg then looked at some gold stocks, ending on a general discussion of his valuation approach.

The takeaway? Remember, it’s not a stock market, but a market of stocks.

Disinflation — but why?

We’ve all seen the numbers.

US headline inflation rose 0.2% in June and ‘only’ 3% over the last 12 months, down from 4% year-on-year in May, the lowest inflation level in over two years.

Consensus forecasts expected 3.1%, so inflation surprised to the downside (hooray!).

That said, core inflation remained elevated, falling from 5.3% YoY in May to 4.8% in June.

That’s the numbers. But what do they mean?

The key question for us is whether the rate of inflation is slowing because of waning aggregate demand or the normalisation of supply.

The former is not nearly as propitious for markets as the latter.

In any case, disinflation doesn’t mean the quick end of high interest rates. As we elaborate in the episode, this sober fact remains underpriced by the market.

Core inflation is still running at 4.8%, well above the target range of 2%. And now economists are warning of the ‘last mile’ inflation challenge — getting inflation down from 3% to 2%.

Late last month, the Bank for International Settlements released its annual economic report, stating (emphasis mine):

‘Inflation could well turn out to be more stubborn than currently anticipated. True, it has been declining, and most forecasters see it moving within target ranges over the next couple of years. Moreover, inflation expectations, albeit hard to measure reliably, have not rung alarm bells. Even so, the last mile could prove harder to travel.

'The surprising inflation surge has substantially eroded the purchasing power of wages. It would be unreasonable to expect that wage earners would not try to catch up, not least since labour markets remain very tight. In a number of countries, wage demands have been rising, indexation clauses have been gaining ground and signs of more forceful bargaining, including strikes, have emerged. If wages do catch up, the key question will be whether firms absorb the higher costs or pass them on. With firms having rediscovered pricing power, this second possibility should not be underestimated.’

Who knew central banks and retailers are dealing with similar problems?

Valuations adrift from fundamentals

It’s not just Twiggy and Nicola Forrest separating. Valuations and market fundamentals are uncoupling too.

We canvassed this before, but the split between market fundamentals and stock valuations remains.

Morgan Stanley researchers just covered this, too. Last week, the investment bank’s Lisa Shalett warned valuations are unmoored from fundamentals:

‘Experienced investors know that in the short run, valuations are poor predictors of return. When we look ahead to periods of one year or more, however, they matter a lot.

‘Notably, current price/earnings (P/E) ratios have decoupled from one of their most fundamental drivers — the 10-year US Treasury real yield. This rate is the basic building block for discounting future cash flows, especially for long-duration growth stocks.

‘The current 10-year real rate is in line with last October’s cycle high, which correlated with a stock market trough and P/E ratios below 17.3. Today’s forward P/E ratio of 20 thus looks completely unjustified.’

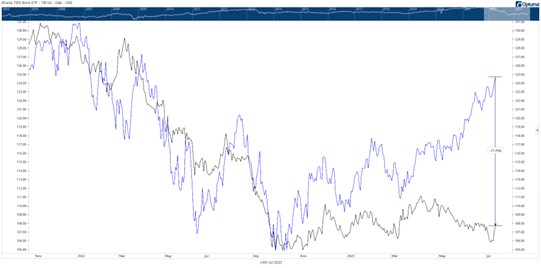

The tight relationship between the S&P 500 and real yields (represented below by the price of TIPS, black line) has broken down in recent months:

Greg and Shalett weren’t the only ones to notice the divergence.

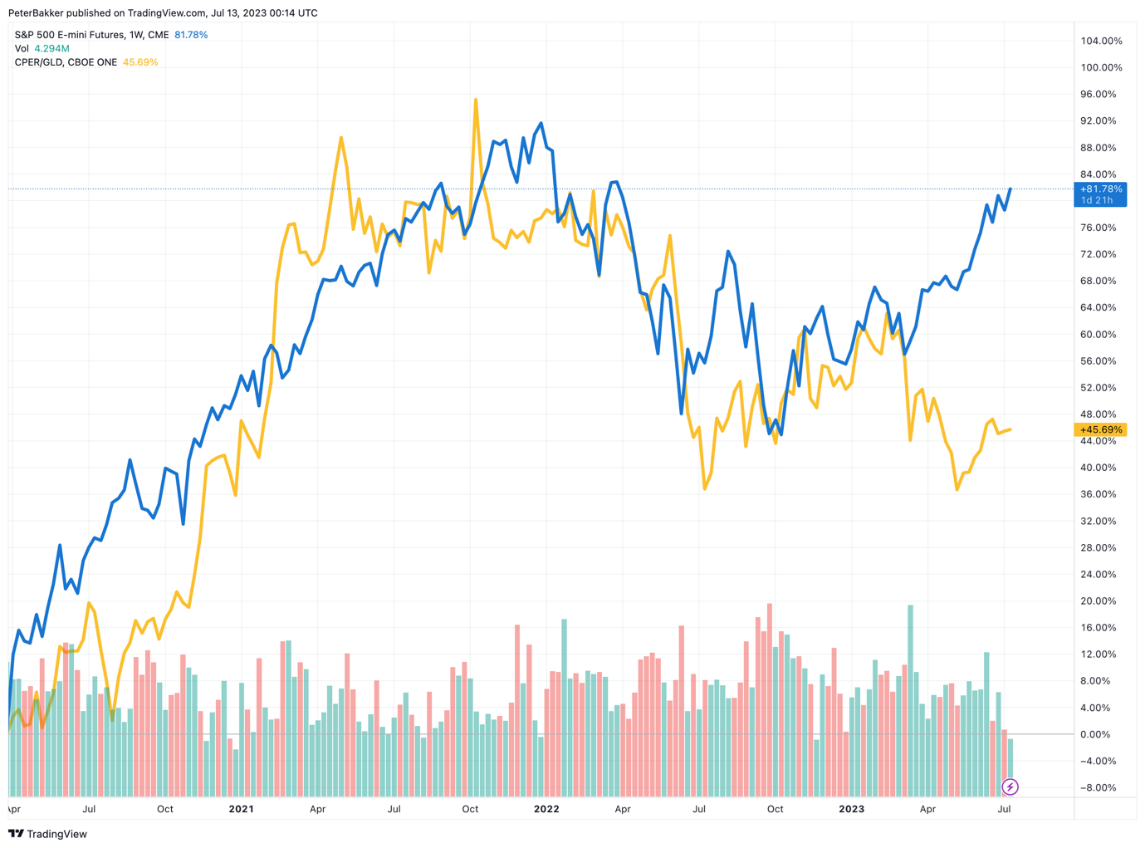

Another Fat Tail colleague — Peter Bakker — picked up on the trend by looking at the copper-gold ratio’s correlation with the S&P 500.

The pair correlated well…until recent months.

The jaws of death

What do these ‘jaws of death’ mean?

It seems the market is pricing in a ‘soft landing’, where inflation comes down without too much of a fuss.

Overnight, for instance, the Wall Street Journal published a piece headlined 'Markets Appear Convinced the Fed Can Pull Off a Soft Landing'.

Simplistically, for the tight relationship between real yields and valuations to resume, either stocks correct, or real yields collapse.

The market is clearly pricing in the latter and seeing past current rates (Greg sees an outcome where real yields and valuations meet in the middle).

The market is betting on high interest rates working their way through the system to rid it of inflation without adverse effects.

How reasonable is that bet?

Monetary policy without the sacrifice...

Optimism over a 'soft landing' also has something to do with a lack of collateral damage.

Winning the battle against inflation entails consequences ... and often casualties.

Economists speak of a sacrifice ratio when assessing the trade-offs of disinflation. Here's Greg Mankiw explaining the sacrifice ratio in terms of unemployment:

'We can also express the sacrifice ratio in terms of unemployment. Okun’s law says that a change of 1 percentage point in the unemployment rate translates into a change of 2 percentage points in GDP. Therefore, reducing inflation by 1 percentage point requires about 2.5 percentage points of cyclical unemployment.'We can use the sacrifice ratio to estimate by how much and for how long unemployment must rise to reduce inflation. If reducing inflation by 1 percentage point requires a sacrifice of 5 percent of a year’s GDP, reducing inflation by 4 percentage points requires a sacrifice of 20 percent of a year’s GDP. Equivalently, this reduction in inflation requires a sacrifice of 10 percentage points of cyclical unemployment.'

Yet so far these big employment sacrifices have not been needed in the US. It looks like the Fed is winning the battle and sustaining minimal losses.

The Nobel-winning economist Paul Krugman mused last week the 'idea that we would face an ugly sacrifice ratio is looking hard to defend.'

Krugman offered an explanation -- one that would bolster the market's current optimism for a plush landing:

'The original Team Transitory [inflation] proposition was that inflation would subside without the need for a big rise in unemployment. Not looking so wrong now.'

Short positions unwind…and stoke rally?

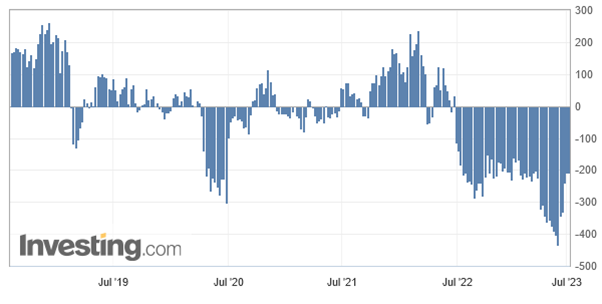

Greg and I then also canvassed whether the recent bull run in US stocks is being partly driven by short sellers covering their positions.

Greg noted that short positions peaked last month and have steadily unwound since.

How much of recent market performance is attributable to positioning and how much to fundamentals?

Golden stocks of the week

Gold miners took out the week’s top spot.

Out of the 20 best-performing stocks on the ASX 300 last week, 11 were gold stocks, hence the spotlight this episode.

Greg pointed to the weakening US dollar as a contributing factor. In fact, Greg thinks investors should keep an eye on the greenback.

If the dollar continues to soften against other major currencies, it bodes well for commodities, like gold.

Battle of the valuation models: return on equity versus dividends

Half-jokingly, Greg and I ended the episode with a call-out.

If viewers were so inclined, we would stage a valuation contest.

I’ve been writing about the handiness of the dividend discount model to value stocks in recent weeks, much to Greg’s indifference, even outright consternation!

Greg doesn’t buy the model’s logic.

His preferred approach uses return on equity.

He actually sets out the ROE methodology in his book You, Your Brain & the Stock Market.

But I don’t want to talk up his method too much if we ever do host that episode.

Anyway, if you’re interested in something like that, let us know in the comments.

Hope you enjoy the latest episode!

3 topics

1 contributor mentioned

.png)

.png)