VGI lifts the lid on new look portfolios

Global equities manager VGI Partners is looking to put a tough June quarter behind it with concentrated long-term bets on several global stocks. The high conviction long-short equity manager runs VGI Partners Global Investments Limited (ASX:VG1) and VGI Partners Asian Investments Limited (ASX:VG8), both of which are available to retail investors, in addition to unlisted wholesale funds. The portfolios invest in a relatively small number of high-quality businesses, complemented with short selling of low-quality businesses that are typically structurally challenged, are playing accounting shenanigans or sell faddish products. For now, the latter part of the strategy appears to be largely on hold given stimulus packages are shielding vulnerable companies, so cash is king in both absolute return funds.

Speaking at an Investor Briefing on Wednesday, VGI Partners founder and portfolio manager Robert Luciano suggested the last few months had been a time of reflection for the manager. He and his team gave an indication of just how much the manager's outlook on markets has changed over 2020 and where they see opportunities over the next 12 months. The manager’s short selling positions did very well in March, but were exposed by the significant market rebound in April. The Aussie dollar also performed strongly in the June quarter, creating a further headwind as VG1 and VG8 were predominantly exposed to the US dollar.

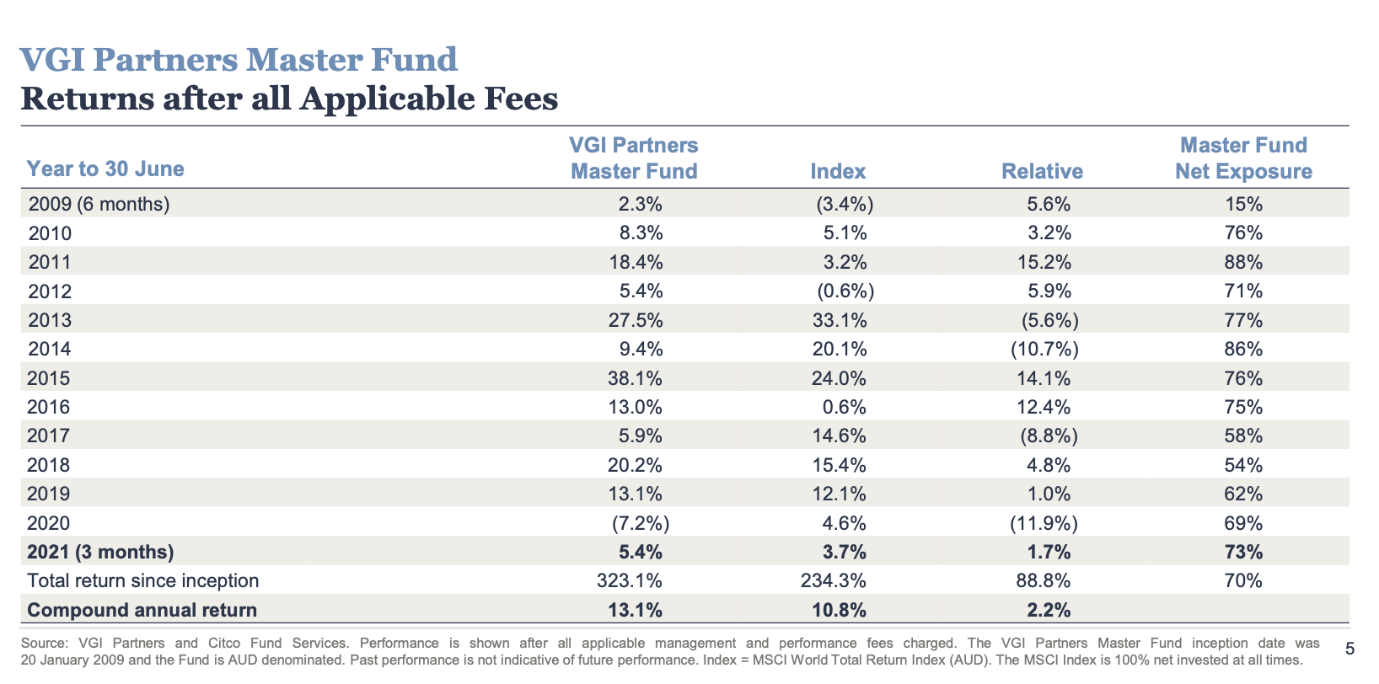

Despite these recent challenges, VGI Partners Global Strategy, which includes the unlisted funds and VG1, has delivered a compounded annual return of 13.1% (net of all fees and charges) — well within its target range of 10 to 15% — since its inception 12 years ago, while the Asian fund was only launched in November 2019.

VGI Partners looks for six key attributes when screening businesses for its two funds:

Global Strategy movements

While the manager has traditionally been tight-lipped about fund holdings, it is now happy to divulge its top 10 long positions with some commentary. The manager aims to be concentrated enough in its best ideas so as not to dilute overall returns but hold enough long investments in order to provide an appropriate level of diversification. There are currently 22 long investments and one short position, with the top five long investments typically representing 40-50% of the portfolio.

The largest holding is Amazon (NASDAQ: AMZN) at 15% and while this has come down from 20% as the position has been trimmed, the company has been a core constituent of the VGI Partners Global Strategy since 2014 and is presently the only Big Tech representative. Mastercard (NYSE: MA) constitutes 12% of holdings as the payments industry benefits from a strong secular trend toward electronic payments over cash during the COVID-19 pandemic. More significantly, the manager recently cut back its ownership of CME Group (NASDAQ: CME), the world’s largest financial derivatives exchange, from 12% to 6% of the portfolio.

New positions include Pinterest (NYSE: PINS — 6%), Olympus Corporation (TYO: 7733 — 5%) and Otis Worldwide Corporation (NYSE: OTIS — 4%). Thomas Davies, a senior analyst at VGI Partners, said Pinterest, the image sharing and social media service with 400 million monthly active users, was attractive as the company was in the early stage of commercialising its activities outside of the United States.

“The amount of data Pinterest has on its users’ tastes and preferences allows adverts to be very targeted, leading to high ROI for advertisers,” he said. “90% of users say Pinterest gives them ideas for what products to purchase and this allows advertisers targeted access to consumers with high intent to purchase at the primary stage of their research process.”

He also noted that Facebook, Google and Amazon have tried to compete with Pinterest but have been unable to get any traction in the market.

Based in the USA, Otis is the world’s largest manufacturer of vertical transportation systems, principally focusing on elevators, moving walkways and escalators. Otis was spun off as an independent company in April 2020, 44 years after it was acquired by United Technologies (now Raytheon). Marco Anselmi of VGI Partners said the company had a number of attractive features including having sticky customers with high retention rates, providing mission-critical infrastructure and a stable, recurring earnings stream.

“We have followed United Technologies (Otis’ former parent company) for several years and can now invest in an undervalued asset that was milked for its cashflows,” he said. “Otis now has focused management prioritising long-term growth and returns while independence will improve its competitive position in certain markets.”

Asian investments

VGI Partners has a long history of researching and investing in companies in the Asian region. These capabilities have been supplemented by an on-the-ground team of four in Tokyo. The Asian Fund was launched in 2019 and currently has 17 long investments and no short positions. The top five holdings are Nintendo Co (TYO: 7974), Kikkoman Corporation (TYO: 2801), Olympus Corporation (all 7%), Yakult Honsha Co (TYO: 2267) and Cie Financière Richemont SA (SWX: CFR — both 6%). Olympus, Nintendo and Pernod Ricard are relatively new positions.

Olympus Corporation launched the world’s first commercial gastro-camera in 1952 and is presently a leader in gastrointestinal endoscopes with global market share of over 70%.

“Olympus have divested the camera business they are known for and now have a dominant market position in a highly engineered product with significant IP,” said Davies. “They have announced a transformation plan with a focus on improving profitability and we see clear and tangible evidence they are progressing towards their targets. There is also a high switching cost for medical practitioners already using this equipment as they would have to retrain on a new device.”

Finally, the new stake in Nintendo comes as the Japanese-listed multinational consumer electronics and video game company looks to increase its digital penetration. Anselmi said the company’s attractive features include a high-quality, under-monetised IP library that includes Mario, Pokémon, Donkey Kong and Zelda and a strong balance sheet. He added that Nintendo is attractively priced as it is often overlooked by investors scarred by historical volatility of the console cycle.

“VGI Partners believes there is an opportunity for Nintendo to continue to grow margins with higher digital penetration, shift to subscriptions, growing downloadable content and expanding its mobile business,” Anselmi said.

Q&A

The Q&A section of the briefing saw Luciano acknowledge that government stimulus packages may mean that traditional short selling approaches do not currently work as well as in the past. Weak underlying profits are simply too easily explained away by management teams as a symptom of COVID-related business disruption.

He also explained the manager’s shift in currency position as it moved to 100 per cent Australian dollar exposure. VG1 started the year with 100 per cent exposure to US dollars before moving to a 50 per cent hedge position in June.

“This decision was made after several months in which the performance of the AUD was highly correlated with global equity indices, with the consequence that currency exposure was a significant driver of VG1’s underperformance in the June quarter,” said Luciano.

Finally, VGI Partners provided an update on the share buyback currently being undertaken by VG1. While Luciano noted that a buyback at a discount is accretive to NTA per share, there is no quick fix.

“We've seen from the experience of other listed investment companies that a buyback generally does very little to nothing to close a discount to NTA. We know there are no easy fixes on that front outside of fund performance, which we're extremely focused on and enhanced shareholder communication,” he said.

Diversification preserves wealth. Concentration builds wealth

VGI Partners are a high conviction global equity manager, focussing on businesses that they understand and where they believe they possess insights not appreciated by the wider investment industry. For further information, please visit their website.

1 topic

2 stocks mentioned