Virtual Gaming Worlds - Australia's online game-changer

Back in June of 2019, we wrote a Livewire article called Private Punting that talked about several online sports betting businesses.

One of the companies we held and discussed in the article is not a gambling business but is now getting a significant amount of media attention due to its run away success.

So successful in fact the founder, Laurence Escalante, is now appearing high within Rich Lists in Australia.

That company is Virtual Gaming Worlds (VGW).

This update is very topical as this position has now grown so much inside our fund that we have decided to spin it out into a new class of units. Meaning the holding will now sit away from our flagship long/short strategy inside the progressive global fund. And, given the significant interest from outsiders in the company, we thought we would also share some of the information we sent to our fund investors about their ownership in this incredible company.

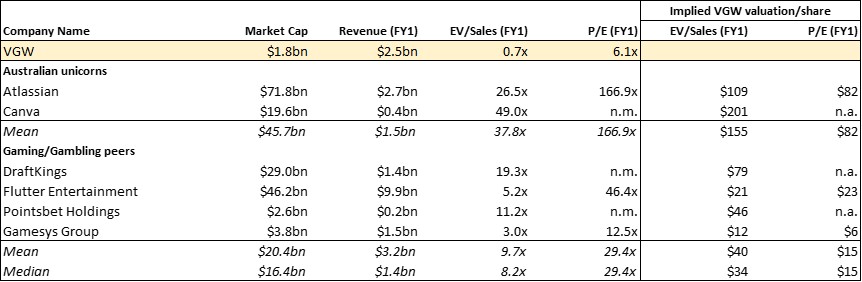

Firstly, when comparing VGW to other well-known Australian tech success stories, such as Atlassian or Canva, the numbers are truly astounding. While Canva is a privately owned/reporting company, it is now valued at $19.6B and has raised over $500m in equity over 13 funding rounds (while VGW raised less than $20m of equity in the early years).

VGW, however, is now self-funding and paying dividends while still rapidly growing revenues and profits. While it is difficult to obtain Canva’s revenue/profit figures, they recently mentioned in an article the company is earning $500m in annualised revenue (so revenue at a guess is perhaps around $400m for FY21) vs estimated $2.5b revenue for VGW in the same period.

Canva stated this recent growth was a 130% increase YoY vs a forecast 220% increase for VGW, yet Canva commands a private valuation nearly 10x higher.

Atlassian, which is a public company listed on the NASDAQ, trades on a forward P/E of around 167x. This business has a valuation of A$72B and is expecting similar revenues as VGW of around A$2.5B for FY21, with net profit of around A$380m (has been loss making previously). Atlassian is a more mature business, growing revenues at around 30% p.a.

To put this into perspective, at $3 per share for VGW ($1.8B valuation) and forecast NPAT of ~$300m, VGW is trading on a P/E multiple of 6.

The above table shows some relative comparisons.

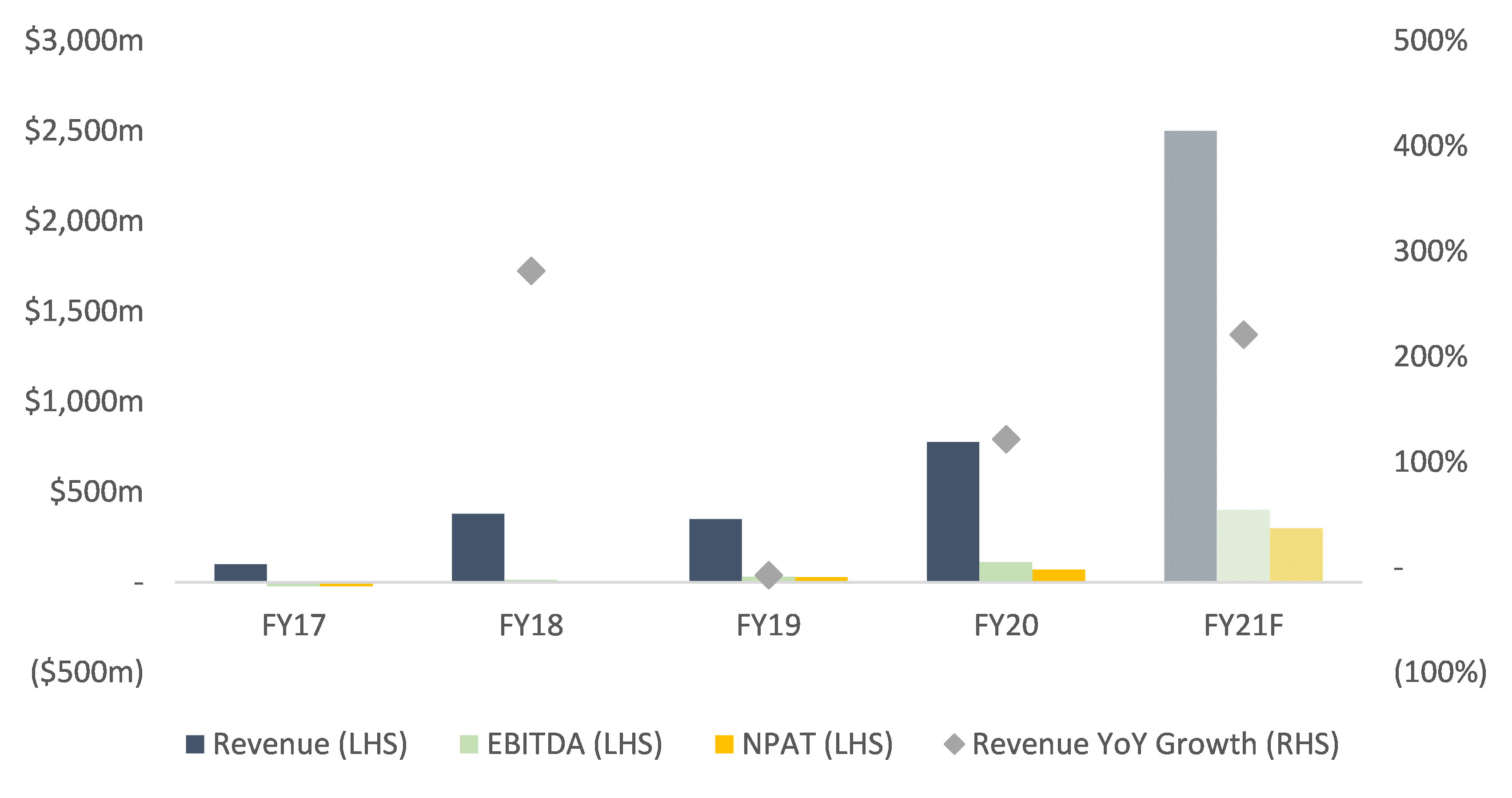

At the time of writing the original livewire article shares in VGW were transacting at a share price of around 30c per share. At that price, the market capitalisation of VGW was around $165m and the company achieved gross revenue for FY19 of $350m and EBITDA of $28m. Which, in the article we compared to PBH which listed at a valuation of over $220m with revenue of $12m and losses of $8.5m.

VGW Historical Financials above

Fast forward to the recent FY21 half-year results and VGW did an astonishing $945M of revenue and profit after tax of $115M, and even paid a 13c dividend for the quarter ending March 21, compared to PBH, which did a comparable $75M of revenue and lost $72m in the same period (obviously no dividend).

As the shares are privately held (not listed on any exchange) the majority of trading takes place on a private markets platform called Primary Markets. With the shares in VGW now transacting at around $3 on the PrimaryMarkets platform the market capitalisation sits around $1.8B, still below PBH which has a market capitalisation larger at $2.6B. While private, the company still trades with equity valuations far below any other relevant or irrelevant business on almost any multiple you consider.

For greater detail and analysis, please enjoy the read below which we sent to our investors to give more information about this incredible company and arguably Australia’s best kept secret unicorn.

VGW BY THE NUMBERS

- First half FY21 $945M Revenue & $115M NPAT

- Private Market Cap ~ $1.8B (~$3 on Primary Markets)

- Forecasted $2.5B FY21 Revenue (220% YoY increase)

- Forecasted NPAT of ~$300M, which equals a 6x P/E multiple

- Dividend yield estimated ~20% yield in FY22 (at $3)

VGW Company Summary:

VGW is a disruptive online social gaming business that operates casino-style games predominantly for players located in North America. As part of its marketing activities, the company operates promotional sweepstakes to give players the chance to win cash prizes. The company has offices around the world but is primarily based out of Perth, where it was founded.

VGW currently has around 613M shares on issue, valuing the company at just over $1.8B, at our marked price of $3. As of December 31st 2020, the company earned revenues for the half-year of $945M (up over 300% from the prior corresponding period) and earned a profit of $115M (up from a $5m net loss the year prior).

As of 31st December, they held $68M in net assets on the balance sheet. In the latest update (Mar 21), the company has given commentary that in the recent months since December the company has continued to print record revenues.

Given these updates, we believe it is reasonable to expect that the company could deliver revenue of more than $2.5B for the FY21 result. If the company maintained the same margins as the half-year, this could deliver an estimated $300m in net profit after tax (EPS of 49c).

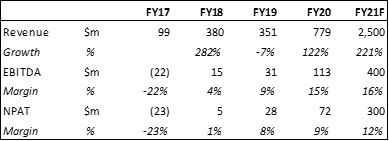

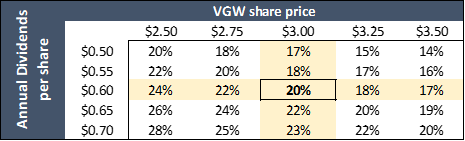

VGW has also continued paying (qtrly) dividends to shareholders, with the March 2021 dividend being 13c (guided for 8-12c). Given the record months of revenue proceeding the previous strong half, the next dividend could easily exceed this 13c figure. We estimate it might be in the range of 15-20c per share. Since 30 June 2020, the company has paid out an incredible 35c in dividends: a COVID beneficiary to say the least! At $3 per share, this accounts for a historical dividend yield of 11.6%. If these record numbers can be maintained with a 15c dividend paid per quarter, the company would pay 60c in dividends for FY22. At a $3 price, this is an indicative 20% future dividend yield.

Dividend Forecast / Yields

Why the disconnect in this Aussie tech success vs the others? We think this is because VGW is unique. Unfortunately, this has put the company in somewhat of a ‘valuation purgatory’. What do we mean by this?

Well, in the traditional venture capital-funded businesses (like a Canva for example) there are ongoing revaluations, as more and more equity is raised and invested to grow the company. These are traditionally done at ever-higher valuations until they become ‘eye watering’ based on these ever-going mark-ups. It is simple, more cash = more marketing for growth. More growth = higher valuation.

Investors in the current market environment have focused heavily on growth over profits. As valuations increase, the revaluation continues upward based on more growth numbers without much focus on profits. Therefore, these comps continue to feed other comps and the charade continues until an eventual IPO/listing, at which point the public market will determine the end valuation (or not in the case of WeWork).

Unfortunately, or fortunately, depending on how you look at it, VGW has been mostly self-funding for a few years and hasn’t needed venture capital investors marking up the value of the equity.

This means it looks cheap on a relative basis against venture capital comparative businesses. Even though it has still managed to grow and make substantial profits without this funding/mark up.

The disconnect is even more extreme when comparing to listed businesses such as DraftKings, a US-listed fantasy sports/wagering business, that has a market cap of $31b, $1.3b of revenue and losses of an estimated ~$800m. Comparing this to VGW, on a like for like revenue multiple basis, VGW would trade at +$80 equivalent share price (comps are somewhat irrelevant but certainly interesting).

Again, this puts the company in an interesting position where it is arguably a superior business to many of its nearest competitors yet trades at a much cheaper valuation. Hence, it sits somewhere where traditional investors in these sorts of companies struggle to find the middle ground… or what we like to call valuation purgatory!

While the company has indicated they have no intention of pursuing an IPO at this stage, it is not to say it never does. No one can ever say never, and with the valuation discrepancies to both listed and private peers, there may be more of a drive to explore the options as a public company in the future. That said, the company moved away from a listing due to the risks involved.

With a unique business model, there can always be criticism and scepticism from investors (think Afterpay changing payments/credit environment), and VGW is no different. While within the laws and regulations, there is always the potential for regulatory changes or other competitive threats that could arise. No business is immune from these including VGW.

This implies any owner of a private company of this nature needs to understand the risks associated with shares in a private (public unlisted) company and the different reporting standards required. Outside of the obvious lack of potential liquidity, there are countless other risks that could impact the company’s valuation or ability to pay dividends in the future (which must also be accounted for in the current valuations).

CONCLUSION

How much of a discount should be applied for these risks is the question that any investor needs to answer. Therefore, investors need to weigh up the risk to reward in having such a position in their portfolio and how much of their wealth it makes up.

Although, as one investor said to us (jokingly); “in terms of unlisted investments, this is far more appealing than the moose pasture I keep accumulating out the back of Kalgoorlie”.

Personally, I have been involved with the company from their first external funding round around 2012, when we raised seed capital for them during my broking career.

Since then, I’ve seen the company face many challenges and emerge stronger than ever each time. It has been a wild ride as can be expected from any early-stage investments. No doubt there will be plenty more ups and downs along the way, as there generally is with investing. In any event, VGW is one unicorn to watch.

2 topics