Walk the talk: 12 compelling funds to go green

Whether you are a self-confessed "greenie" or adamantly believe that fossil fuels are not destroying the planet, there's no denying that a hell of a lot of money is flowing in "sustainable" and "ESG" funds' direction.

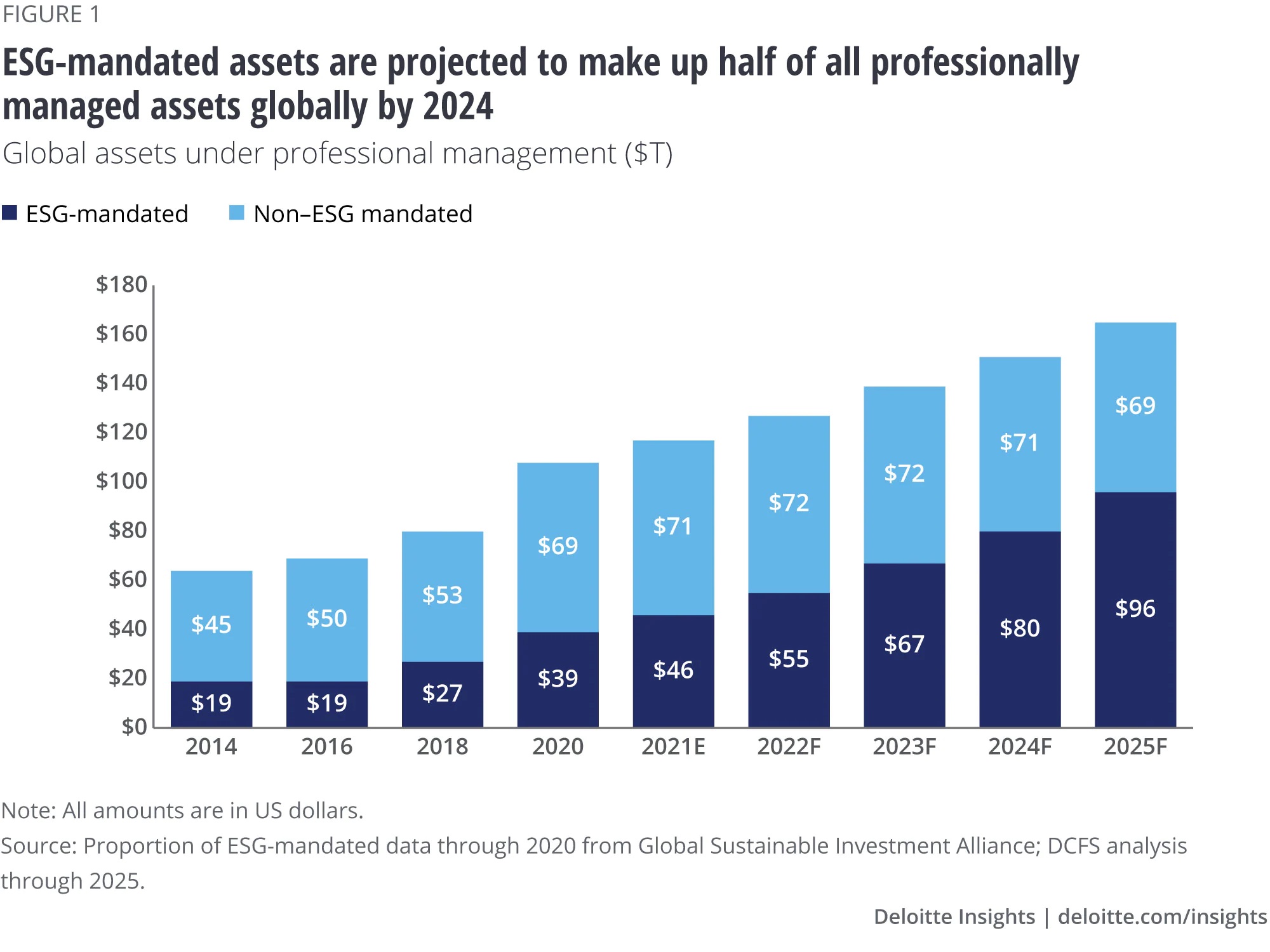

In fact, research from Deloitte out last month found that professionally managed investments with ESG mandates will surpass those without them in 2024 to reach US$80 trillion. This year alone, professionally managed assets with ESG mandates are set to reach US$55 trillion, according to Deloitte (or more than 43% of all professionally managed capital, globally).

I repeat, these are global figures. But this is nothing short of mind-blowing, right?

.jpg)

On the local front, it's not that different. For example, researcher Calastone has found that ESG funds were the major beneficiaries of Australians' capital in 2021, more than quadrupling year-on-year to $3 billion.

Unsurprisingly, investment management firms around the globe are responding to this growing interest in sustainable and ethical products by launching their own. Deloitte found there was over 1,600 new exchange-traded fund (ETF) and managed fund launches (not including the US) last year, making up 12% of all new fund floats. In the US alone, 22% of all fund launches were ESG related products.

In Australia and New Zealand, Morningstar has identified 154 sustainable funds as of the fourth quarter of 2021. Interestingly, active strategies are favoured over passive within this arena, receiving 63% of fund flows in 2021.

But how many of these funds are actually "true to label"?

Around 10, according to Evergreen Consultants' Angela Ashton. And as Credit Suisse Australia's Andrew McAuley notes, it's not exactly easy for investors to identify greenwash (companies and investment teams have become spectacularly good at it).

So in this roundtable discussion, you'll hear how Ashton - one of Australia's top investment consultants, and McAuley - one of the country's top wealth managers, are putting clients' money to work in a bid to generate sustainable, long-term returns and also help decarbonise the planet.

They also identify 12 different funds across a variety of asset classes that investors can use to get exposure to this compelling thematic.

Note: This panel session was filmed on April 26th, 2022. You can watch the video or read the summary below.

A short summary

The main challenges investors, like you, are facing

When asked what challenges investors are facing when trying to get exposure to decarbonisation, Ashton replied "a lot".

"At the core, there aren't a lot of pure decarbonisation opportunities available," she said.

"There are a lot of companies that are doing stuff around adaption, or they are starting to change the way that they approach climate change as an issue, but it depends on what people want from decarbonisation and what they are looking for. The reality is, the number of funds and maybe stocks that are really actively looking to positively change what's going on, isn't actually that great."

So when investors try to put together funds or even portfolios of these decarbonisation players (the ones there are), diversification immediately becomes a problem, Ashton adds.

For McAuley, the major issues Credit Suisse has been encountering surround the consistency and validity of funds (and stocks) measuring carbon intensity and capture.

"Who is measuring it? How are they measuring it? We all quote tonnes of carbon produced, or CO2 produced, and how much of it is captured, but you really have to wonder about the accuracy of those measurements," he said.

"The universe of investible options is still not great."

Top tips for identifying the good from the ugly in sustainable funds

McAuley believes there are two things that investors can focus on at the outset of their sustainable investment journey:

- Have an idea of how much carbon your portfolio is producing, and have a goal to improve that.

- Consider whether you want to eliminate carbon in your portfolio, or reduce carbon in your portfolio (by investing in companies that are transitioning to better practices or through investor activism).

"To create a sensible, diversified portfolio with an 'elimination' strategy - a net-zero strategy - is still, very, very difficult," McAuley said.

There are typically two leagues of investors when it comes to sustainable investing: those who want to eliminate exposure to carbon-intensive companies, and those that want to engage with fossil fuel companies and reward these companies if they make measurable steps to decarbonise, he said.

That aside, the first thing investors should look at when assessing a "sustainable" or "decarbonisation" fund is "people, process and performance, McAuley said. After this, investors should:

- Look at the carbon intensity of the portfolio and how it compares to the benchmark.

- Can the fund evidence "swapping out" - meaning, is it investing in companies that are shifting to more sustainable practices over those that aren't.

- Assess whether the fund incorporated the UN's Sustainable Development Goals into its process.

- Measure whether the fund is actually having an impact - by investing in technologies or solutions that address climate change.

- Ask how long an investment manager has been doing this - what is their pedigree, and do they have a well-known brand name in this area?

Meanwhile, Ashton recommends investors look out for funds that are signatories of UNPRI and the Responsible Investment Association Australasia (RIIA) member - those that have committed to invest sustainably across all their products (not just one fund).

Other factors Ashton recommends investors look out for include:

- Specialist talent or systems so that a manager can deliver on decarbonisation.

- Investment managers that are dedicating their resources to sustainable investing - rather than just having a single token sustainable fund.

- To identify greenwash: Look underneath the hood at a portfolio's top 10 holdings - are they what you expected or not?

- Just because a fund says it is sustainable, that doesn't mean it is. Equally, just because a fund doesn't say sustainable in its name, doesn't mean that the investment manager itself doesn't have rigorous processes in place.

"Some of the great fund managers that are committed to this, don't have sustainable in the name, they are sustainable across the board," Ashton added.

Ashton's top fund managers for exposure to decarbonisation, sustainability and ESG:

- Robeco: Robeco Global Developed Sustainable Enhanced Index Fund

- AllianceBernstein: AB Managed Volatility Equities Fund

- Regnan: Regnan Global Equity Impact Solutions Fund

- Pendal Group: Pendal Sustainable Australian Share Fund

- Artesian: Artesian Green & Sustainable Bond Fund

- Affirmative Investment Management: Affirmative Global Impact Bond Fund

- Impax Asset Management: Impax Sustainable Leaders Fund

- Munro Partners: Munro Climate Change Leaders Fund

- State Street Global Advisors: State Street Climate ESG International Equity Fund

- Inspire Impact: Inspire Australian Equities Fund

McAuley's top funds and stocks for exposure to decarbonisation, sustainability and ESG:

For McAuley, whether a fund or stock is suitable for a portfolio depends on the objectives of the portfolio, the investor’s circumstances and the point in the cycle. But the funds he believes do a good job articulating the incorporation of decarbonisation, sustainability and ESG in their strategy are:

- FP WHEB Sustainable Impact Fund

- Rockefeller Ocean Engagement Fund

A stat you can't ignore

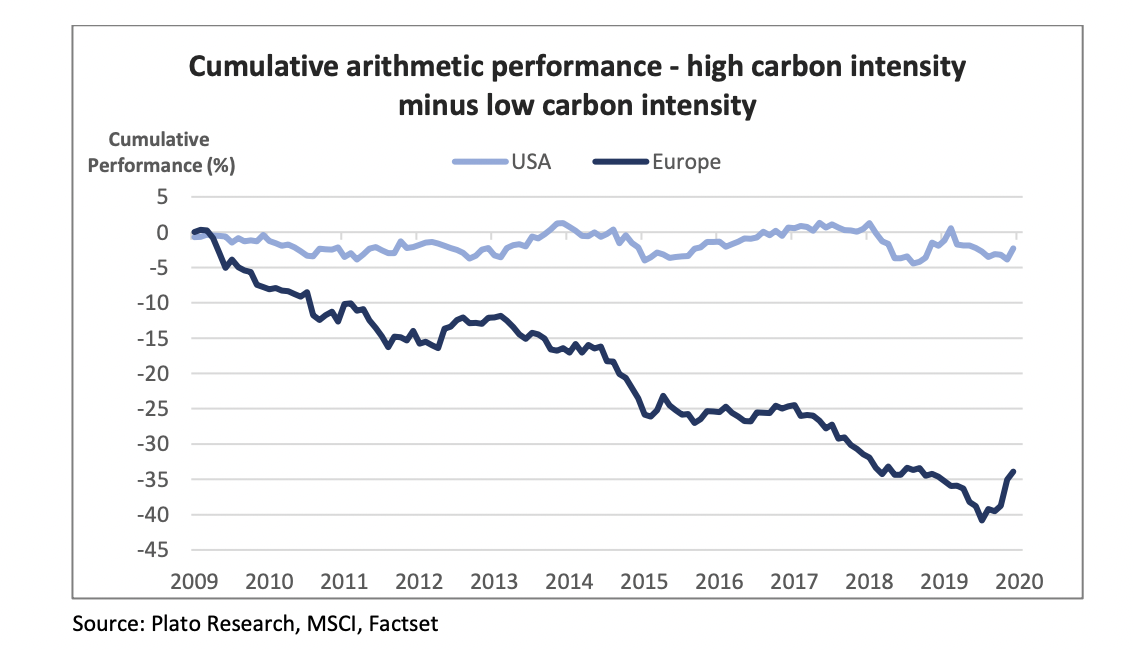

Ashton called on recent research out of Plato Investment Management, which measured the performance of carbon-intensive stocks against those that are low in carbon intensity.

"The difference in performance over the last 10 years is -40%. So those carbon-intensive stocks have underperformed by 40%," she said.

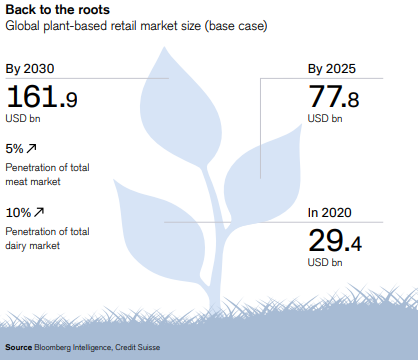

Meanwhile, McAuley's stunning stat surrounded the rise of non-meat products in response to the greenhouse gas emissions released by cattle (and meat processing).

"We estimate that 25% of all greenhouse gas emissions come from the production of animal-derived foods such as meat and dairy," he said.

"There's a lot of fuss, and a lot of noise, about the production of plant-based meats... You might blow it off as a fad. It's not a fad. There will still be a lot of focus, and a lot of investment and technology applied to reducing that big 25%."

.png)

Want to learn more about Decarbonisation?

Livewire's Decarbonisation Megatrend Series brings you feature articles that go deep on carbon-neutral investing, alongside special episodes of Buy Hold Sell, a megatrend investing podcast and interactive panel sessions with leading fund managers. To visit our Series page, please click the link below.

4 topics

1 stock mentioned

5 funds mentioned

2 contributors mentioned