Want CBA alternatives? Here's a new wave of dividend darlings

The strong performance of markets in 2024 has kept the issue of company valuations front of mind, particularly in the banking sector. In a recent wire titled Is CBA overvalued?, Dr Don Hamson highlighted that one of the most common concerns among Plato Investment Management's Aussie clients in 2024 was the valuation of Commonwealth Bank (ASX: CBA).

Despite this unease, many investors have loyally clung on to their CBA shares. Whether you attribute the price increase to interest rate forecasts, management, or the rise in index fund assets, that loyalty has certainly paid off.

What will 2025 bring?

As we enter the new year, many income-focused investors are evaluating where to target both yield and total return in 2025.

What’s interesting is that during this remarkable period for CBA, investors could have achieved a similar total return by diversifying into global banks, without the stock-specific risk.

Herein lies a compelling case for investing in global banks for yield.

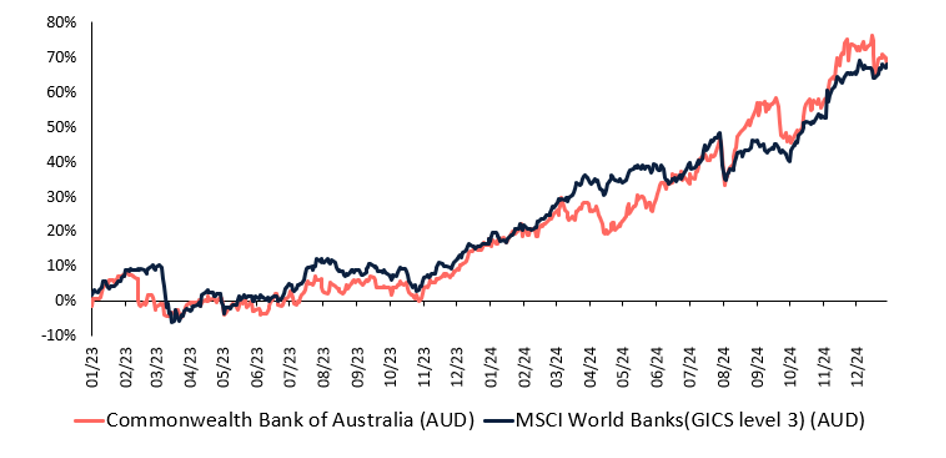

Over the last two years, in AUD, CBA has returned an impressive +67.7%, outperforming the S&P/ASX 200 Banks (+57.1%). However, the MSCI World Banks Index has risen +68.5%.

While the latter includes a notable currency boost, it also highlights the power of global diversification - a topic I’ll be exploring further in an upcoming article.

Figure 1: Total Return Chart for CBA & MSCI World Bank Index

Source: Bloomberg, Plato Investment Management

As you can see in Figure 1 above, banks have had a strong rally, but what does this mean for their valuations?

At the end of last month, CBA’s Price to Earnings (P/E) ratio was sitting at 27x, well above other domestic banks including National Australia Bank (ASX: NAB) (16.5x), Westpac (ASX: WBC) (16.1x), and ANZ Group ASX: ANZ (13.1x).

Despite impressive performance, large global banks are still valued much more conservatively in terms of both earnings and book value, which could provide more potential upside in coming years.

CBA’s P/E is around double that of leading US banks like JP Morgan Chase (NASDAQ: JPM) (13.3x) and Wells Fargo (NASDAQ: WFC) (14.6x). And when we look at Europe, the gap widens even further - CBA is trading at a staggering 3 to 4 times higher than banks like UniCredit (BIT: UCG) (6.4x), ING Groep (AMS: INGA) (7.4x), and Lloyds Banking Group (LON: LLOY) (7.5x).

Global bank earnings stack up too

In addition to a more reasonable P/E valuation, global banks have released strong earnings numbers.

While, CBA’s recent earnings have been slightly weak, reflected in a -0.7% EPS growth over the last 3 years, international peers have seen impressive earnings growth during this period, such as JP Morgan Chase (+17%), Bank of America (NYSE: BAC) (+14.7%), and HSBC Holdings (NYSE: HSBC) (+77.5%).

Earlier this month US markets posted solid returns (S&P 500 +1.8% in a single-day rally), driven in-part by outstanding full-year results from leading US banks, which reported their second most profitable year ever. They’ve benefited from the higher interest rate environment fuelled by inflation over the past few years.

JPMorgan, for example, became the first bank in US history to surpass US$50bn in annual profits, with net income soaring 50% in Q4, clearly outpacing market expectations. Wells Fargo also saw a 62% revenue boost.

Investing in these global banks, which are priced at more attractive valuations, offers greater potential for future returns. This potential is often backed by more diversified earnings streams, including global trading across various markets.

Todd Gillespie (Bloomberg; January 17, 2025) highlighted the bumper 2024 for US banks, with the 6 largest returning over US$100b to shareholders via dividends and buybacks. Looking ahead to 2025, he points to a strong likelihood of even higher payouts, driven by increased profitability and potential regulatory changes.

“The Trump administration is likely to bring a wave of relief by reducing or cancelling plans to force banks to hold more capital on their books,” which could lead to significant income for investors."

A new wave of dividend darlings?

One key attraction of CBA has been its generous franked dividends, which have offered strong yields for income-focused investors.

Just a few years ago, CBA was yielding 6% (net of franking), but it no longer stands out as a top dividend pick.

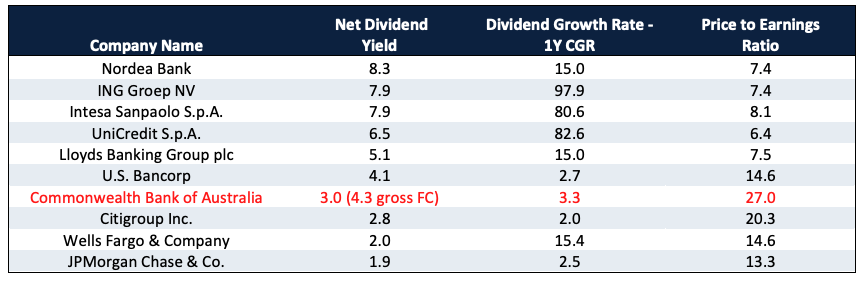

By the end of 2024, its yield had dropped to just over 3%, with a 1-year dividend growth rate of +3.3%. When we compare this to numerous global banks, as shown in Figure 2, it becomes clear that there are now more appealing dividend opportunities out there.

Figure 2: Bank dividend and P/E characteristics (January 2025)

Source: FactSet, Bloomberg, Plato Investment Management

Although US yields are generally lower than those in Australia, the gap between CBA and global banks is shrinking.

In fact, for some banks like US Bancorp (NYSE: USB) (+4.1%), investors can actually achieve a higher net yield by investing overseas compared to CBA. While CBA does offer franking credits, its gross franked yield only rises to 4.3%.

Looking across the Atlantic to Europe, the yield story becomes even more compelling. Banks like Intesa Sanpaolo (BIT: ISP) (7.9%), Nordea Bank (HEL: NDA-FI) (8.3%), Lloyds Banking Group (5.1%), and UniCredit (6.5%) offer significantly higher income, along with much some stronger recent dividend growth rates, as highlighted in Figure 2 above.

Time to cast your dividend net wider?

CBA has certainly been a strong performer for both yield and total return. However, as we’ve shown, you can reduce single-stock risk by diversifying into global banks, and still enjoying solid income and positive returns.

Retail investors have understandably stuck with CBA and been rewarded, but in 2025 long-term investors should begin to feel more comfortable taking a more diversified approach to equity income by gaining exposure to global bank stocks.

Diversify your equity income exposure with the Plato Global Shares Income Fund

The Plato Global Shares Income Fund, rated “Recommended” by both Lonsec and Zenith, has consistently distributed ~6% p.a. yield since inception, more than 4% p.a. above the index, and outperformed it’s index in total return space over the last 3 years, highlighting the benefit of active management for income generation.

Click here to view the Fund's portfolio, performance, and information on how to invest.

You can also read Plato's latest quarterly global income report here. In this update, Daniel outlines the key market drivers of 2024 and provides insights into potential risks in the years ahead.

3 topics

8 stocks mentioned

1 contributor mentioned