We are our own worst enemy: 3 behavioural biases and how to combat them

Aoris Investment Management

Most of us read about behavioural biases and acknowledge they exist, yet there is no evidence the financial community is any better at dealing with them. Understanding the impact of biases improves our ability to apply guardrails and combat them, leading to better decisions and investment outcomes.

With that in mind, let’s look at three of the most common biases, where we come across them in everyday life and investing, and how we can minimise their impact.

Optimism bias

It is natural to take the view that good things will happen more often than they do. While positive thinking makes life more pleasant, the evidence suggests excessive optimism can be to our detriment.

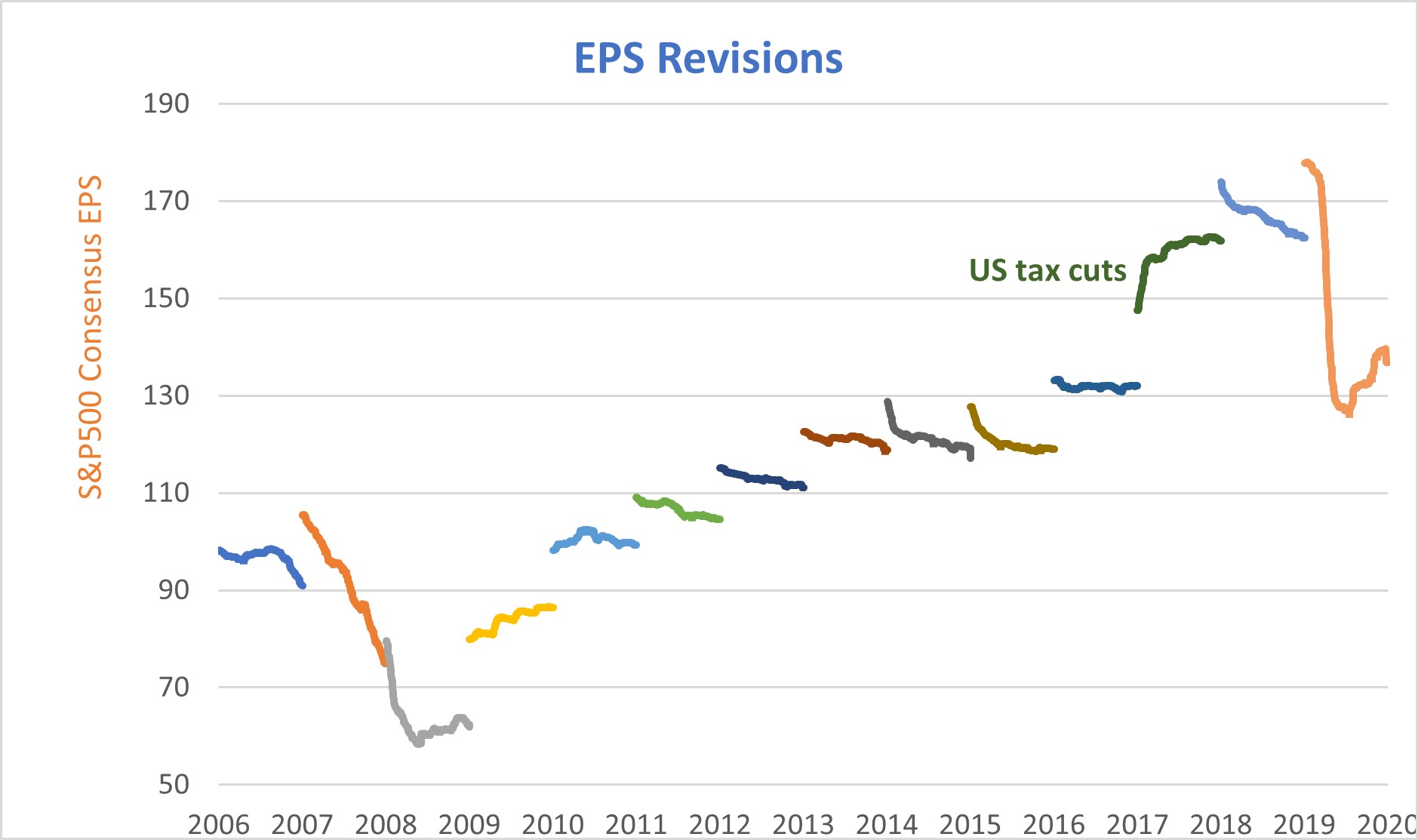

Optimism bias regularly appears in investment thinking. For example, the graph below shows the change in analyst earnings per share estimates for the S&P 500 across each calendar year from 2006–2020. Of the 14 years included, 10 showed meaningful downgrades.

On average, analysts overestimated EPS growth by about two times. The high proportion of downgrades illustrates analysts repeatedly overestimating business prospects at the beginning of each period, demonstrating optimism bias in practice.

Optimism bias can be exaggerated when investing in companies with a wide range of outcomes, where little past information is relied on for the basis of bold future assumptions.

By focusing attention on the large potential gains, it can be difficult for investors to visualise potential losses. For example, the electric vehicle market is in its early stages, and it is difficult to gauge how stable the market will be and which manufacturers will ultimately succeed.

How can we combat our natural optimism bias without turning ourselves into killjoys? Paying attention to history will help keep our expectations grounded.

Social proof bias

Social proof is a phenomenon that involves people copying the actions of others in situations of uncertainty. Humans naturally believe there is safety in numbers and want to fit in with the crowd. We also avoid confrontation, so going along with what others think provides the path of least resistance.

Humans feel there is safety in numbers. Investors can panic amid a sell-off and follow the crowd, even if selling is contrary to the information they have on hand. In contrast, at the peak of an economic cycle investors can flock to well-performing stocks in an attempt to ride the momentum wave and avoid the dreaded feeling of FOMO (fear of missing out).

FOMO and the impact of herding behaviour can have very real consequences. For example, in Singapore in the 1980s an unexpected bus strike had created an abnormally large crowd at a bus stop outside a bank.

Local customers mistook the gathering as people waiting to make a withdrawal, so they too lined up thinking the bank must be in financial trouble if there were so many customers waiting. The bank was forced to shut its doors to prevent an actual bank run.

How do we counter social proof? A simple (but not easy) way to combat this behaviour involves developing independent thoughts and conclusions, with reference to objective reasoning and facts and not the "sway" of the herd.

Anchoring bias

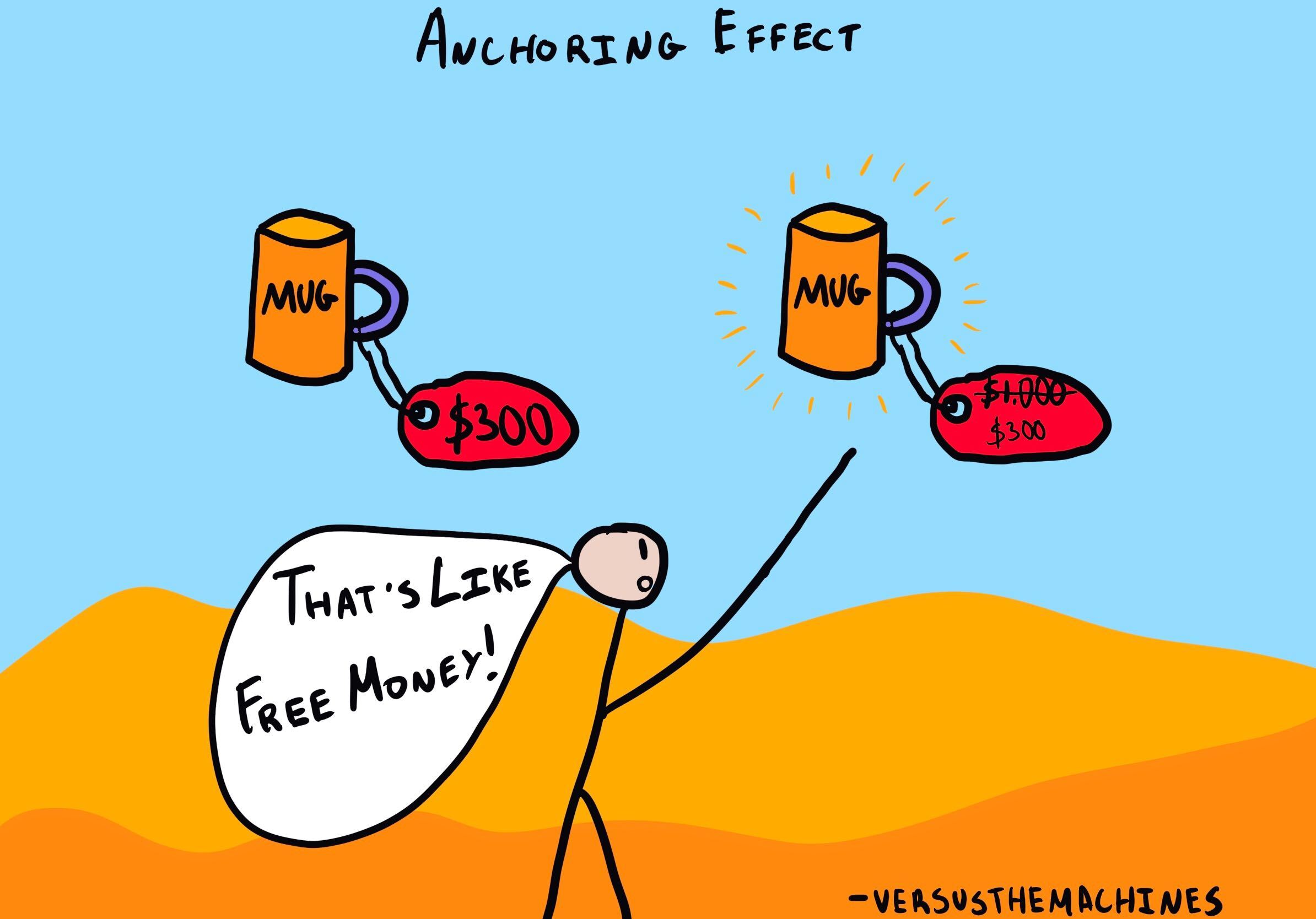

Anchoring bias causes us to rely too heavily on the first piece of information we are given about a topic. We then typically adjust slightly away from the original anchor point when making decisions, even if it has little relevance to the problem we are trying to solve.

Anchors are used in negotiations every day. Take the used car salesperson for example, who will always give you their best price upfront. They have now dropped an anchor, and any price you can get below that will seem like a better deal to you when it could still be a price well above the car’s value.

This will now play a larger role in your decision, rather than more relevant indicators of value such as the age of the car and its current condition.

Similar behaviour regularly occurs in equity markets. Investors have a tendency to anchor on the current stock price and use that as a gauge on where the stock will go in the future, or use current multiples compared to historical values.

Like the car salesperson example above, this single indicator has little relevance and offers no insight into the value of the underlying business.

How do we deal with anchoring? Dropping your own anchor is an effective way to combat this. Thinking about the value of a business independent of the current price or purchase price can keep the focus on business fundamentals.

Key takeaways

In conclusion, let’s reinforce the key considerations for investors when dealing with the three behavioural biases mentioned above.

Optimism bias: If we participate in parts of the market characterised by narrower ranges of outcomes, it mitigates the chances of excessive optimism. Exciting themes, emergent markets and unproven technologies are fertile grounds for optimism bias.

Social proof bias: Maintain independent thoughts and conclusions. Be wary of herd following behaviour and think carefully about the reasons for a purchase or sale.

Anchoring bias: Delay decisions and drop your own anchor. Slowing down our decisions allows us to develop a more holistic view of the problem we are facing and can avoid anchoring off that first piece of information we receive. We can make more informed transaction decisions if we focus on the value of the underlying business, without reference to the current price or our original purchase price.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

Born and raised in the New England region of NSW, Ty is a proud Kamilaroi man. As an analyst at Aoris, he researches market leading and high-quality global businesses.

Expertise

Born and raised in the New England region of NSW, Ty is a proud Kamilaroi man. As an analyst at Aoris, he researches market leading and high-quality global businesses.