Weekly S&P500 ChartStorm - 7 August 2022

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective...

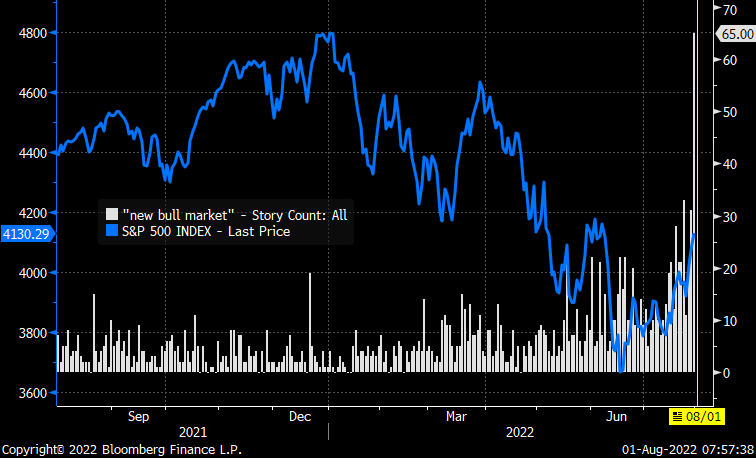

1. Resistance: There will be no new bull markets until that key resistance level is broken (and even then, astute observers will note that the next line of resistance lies at 4300 (and then there is also the 200-day moving average (so there are a few hurdles to jump))). I would say the market is particularly vulnerable to bad news or any bearish excuses at this point.

2. New Bull Market: Seems like there is a surge in news stories talking about a possible new bull market (hmm, I wonder if I just added to the count with this here article, and for that matter, I wonder if you can get an exponential increase in story count if stories start talking about stories talking about new bull markets……). Anyway, just goes to show how ready people are to jump back on the wagon.

Source: @MichaelKantro

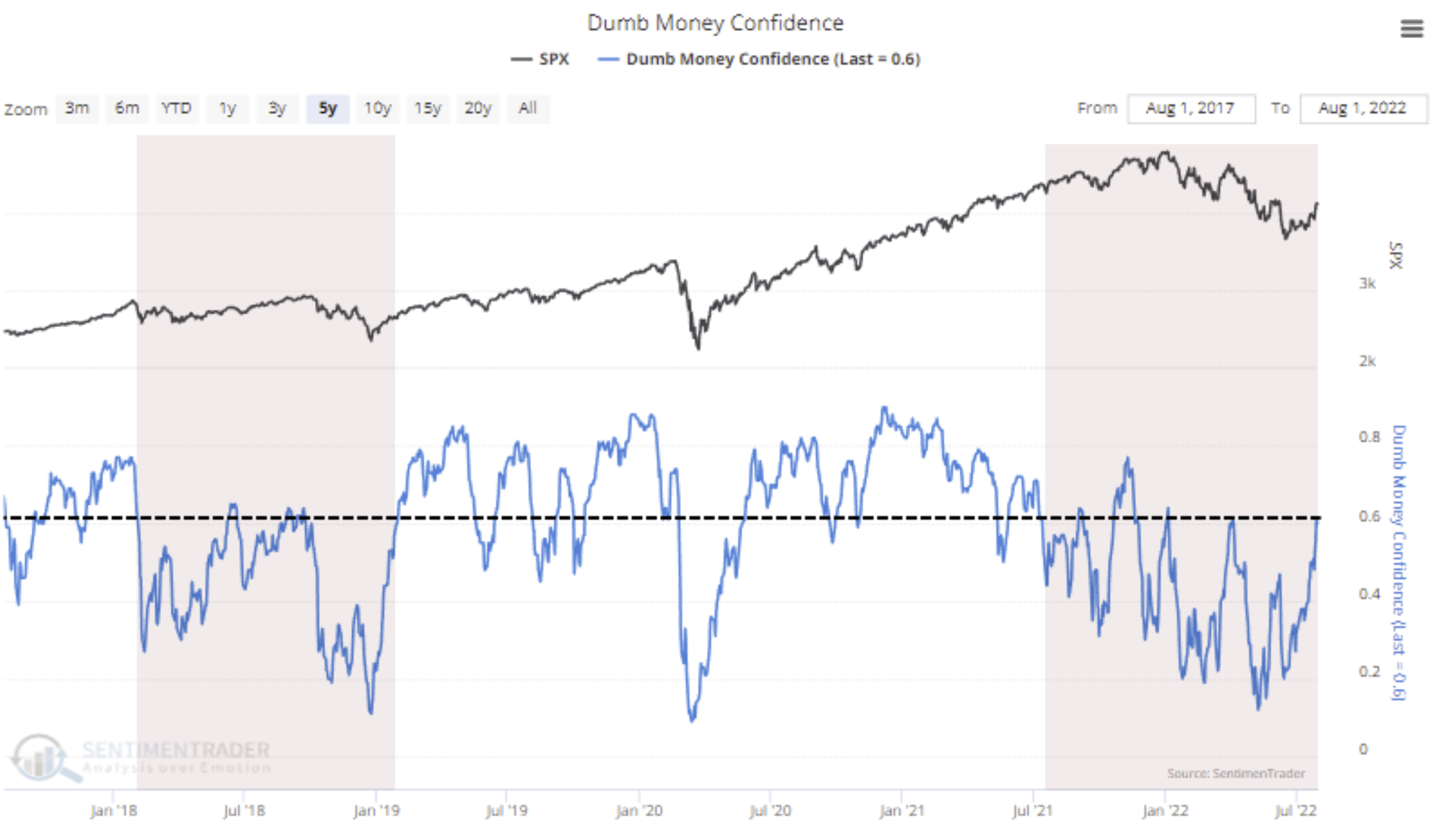

3. Dumb Money Confidence: As the market rebounds, “dumb money“ has become more bullish. Typically this is a contrarian signal, but there does seem to be some nuance to this… like many sentiment indicators, it gets more and more bullish coming out of a correction and into a new bull. But within a bear/ranging market, reaching the upper ranges like this is a tactical warning sign (folk are already back on the bus?).

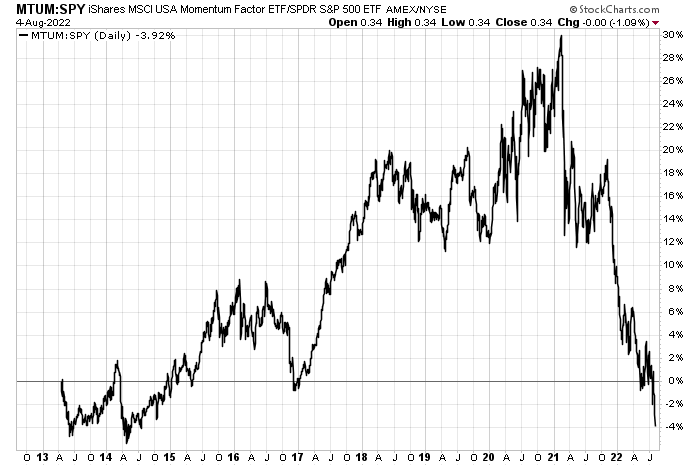

4. Momentum… (but not the momentum you were expecting!)

All “alpha“ generated by MTUM 0.24%↑ has round-tripped since inception.

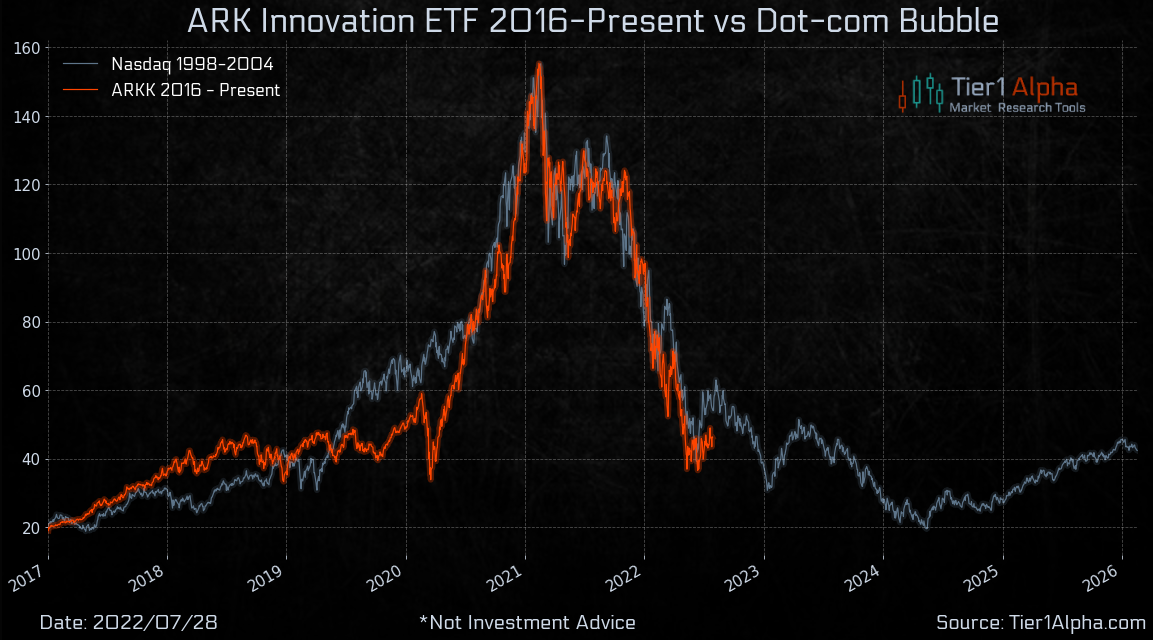

5. Arc of ARK: Past =/= Future. (but sometimes rhymes)

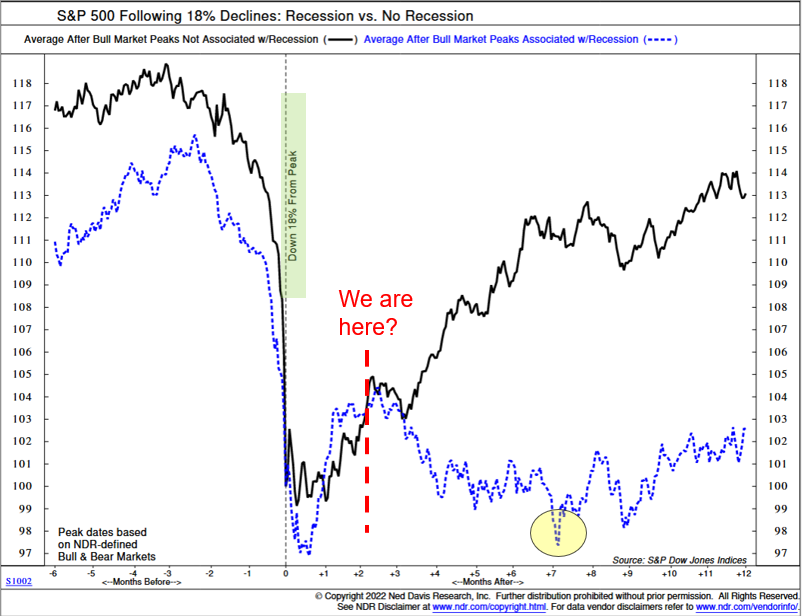

6. Choose Your Own Adventure!

<< Bear Market Edition >>

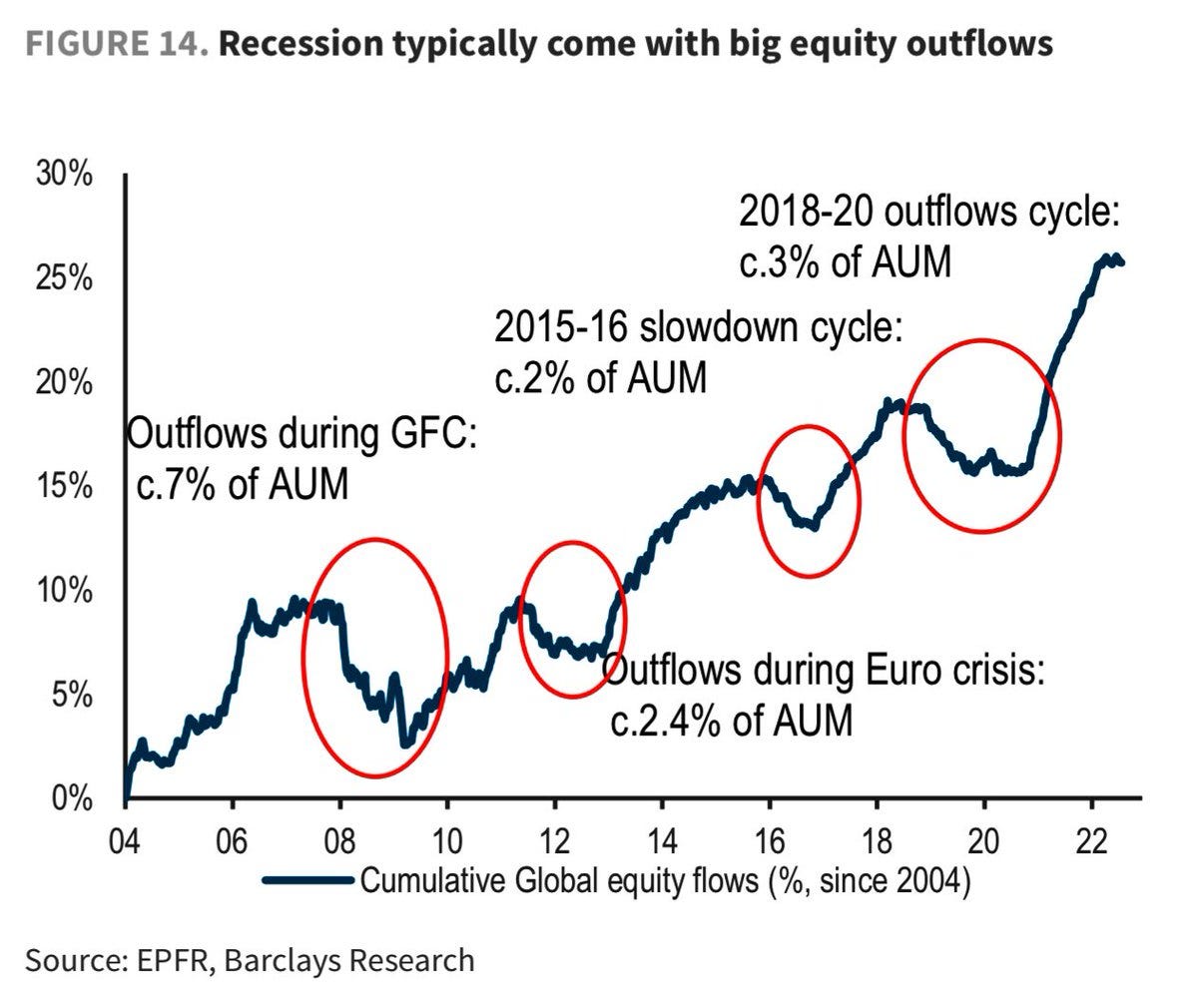

7. Recession Flows: Good follow-on from the previous chart, this one shows during recessions there tends to be substantial outflows from equities — which is probably both a cause/effect of the pattern in the previous chart (i.e. recessionary bear markets tend to see a deeper drawdown and a more drawnout recovery).

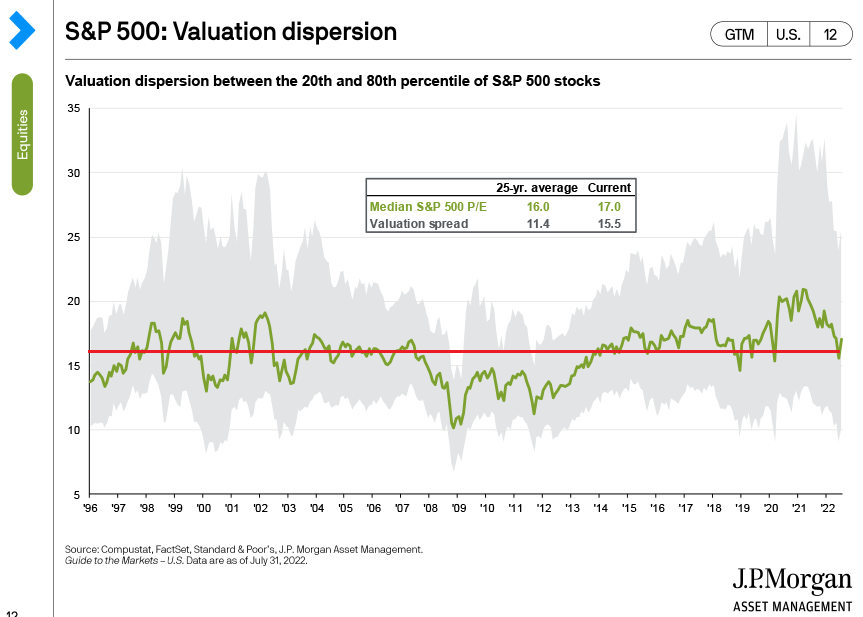

8. Valuation Dispersion: The Median PE ratio has come down to long-term average, but interestingly there is still significant "dispersion" (i.e. some relatively cheap and relatively expensive stocks out there).

Also of note: the Median PE = no longer expensive (but not cheap as such yet either).

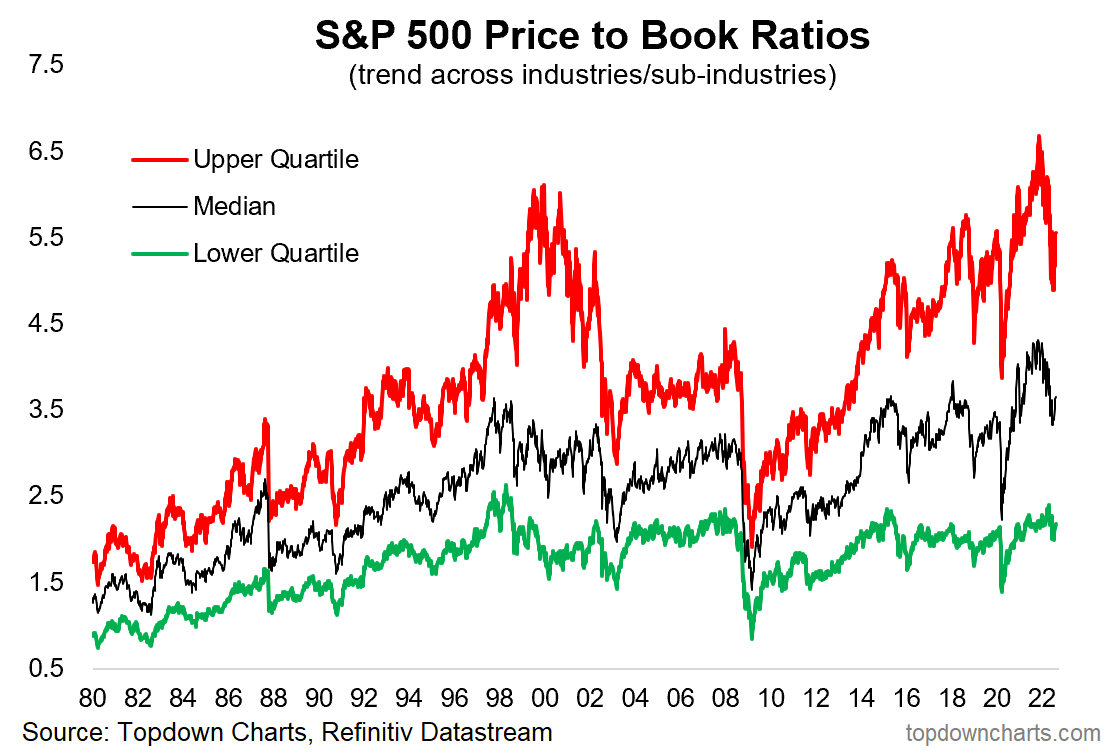

9. Price to Book Ratio Trends: Another one on valuations — that old price to book ratio chart of mine updated. This one echoes the points from the previous chart, i.e. there is still a big gap between the cheapest vs most expensive parts of the market, and P/B ratios are generally still elevated vs history (no big overshoot to the downside like in previous major market bottoms).

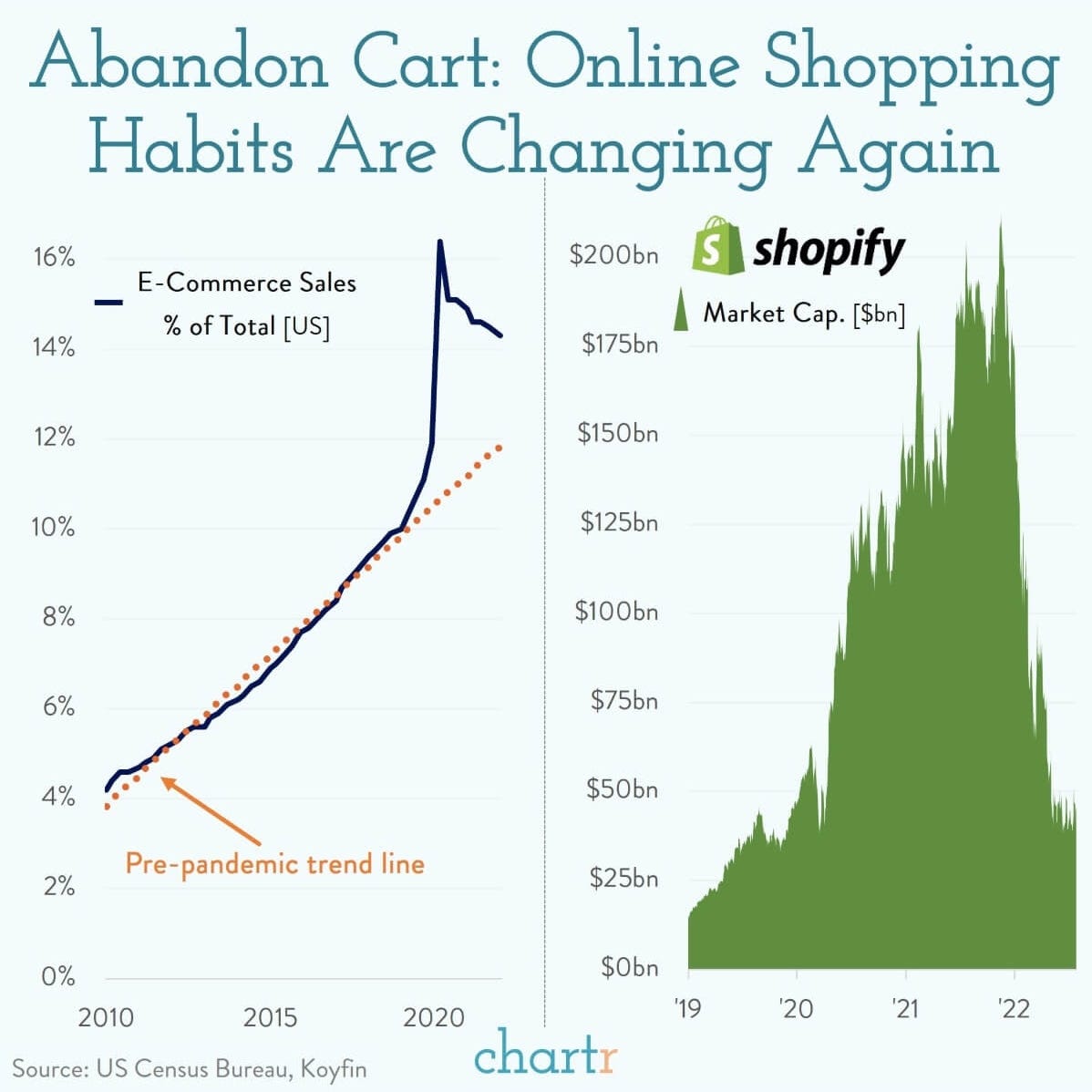

10. Peak E-Commerce?

Almost certainly not in absolute terms, but almost certainly so relative to trend. This is one reason I was bearish tech/growth last year — as a group they got this big fat one-off pulling forward of growth (even if it was part of a structural trend) that was never going to be replicated any time soon. Reminds me of one of my own macro/market lessons or observations: know the trend, but also know the cycle around the trend…

Thanks for reading!

Callum Thomas, founder and head of research at Topdown Charts.

Any feedback, questions, and views are welcome in the comment section below.

4 topics