What a future blue chip looks like and 4 companies that fit the bill

The word blue chip comes with a few associations. Enduring quality, stability of earnings and growth, amongst others. And in Australia, consistency and growth of dividend earnings are usually also a factor. While the term suggests a company that has been around for decades, the truth is that what we identify as a blue chip investment has changed over time.

Thirty years ago, CSL (ASX: CSL) would barely have rated a mention as a potential blue chip and yet today, it’s a certified inclusion. Similarly, the likes of Apple (NASDAQ: AAPL) would have been a riskier growth investment and stands today as a solid blue chip choice.

By the same token, there have been companies to drop off the list. General Electric (NYSE: GE) was once considered the ‘bluest of blue chips’ and has struggled in the past decade. Or the likes of Babcock and Brown and ABC Learning.

As Yarra Capital Managements’ Dion Hershan puts it, “there’s a graveyard full of companies who were once deemed to be blue chips and they proved not to be.”

So, which companies will be tomorrow’s blue chips and who will fade from the stage?

I asked three fund managers for their views:

- Dion Hershan, executive chairman and head of Australian equities for Yarra Capital Management

- Maroun Younes, portfolio manager for Fidelity Global Future Leaders Fund

- Nathan Hughes, portfolio manager at Perpetual Asset Management

.png)

The characteristics of a blue chip investment

Market capitalisation and dividends are often used as a proxy for identifying blue chips. These can be helpful – after all, the ability to pay dividends can indicate the generation of cash above what is needed to fund operations while business size in theory can speak to market dominance – but are not perfect measures. You can think of this in two ways.

Firstly, the size of a company doesn’t necessarily guarantee that it has the other characteristics of a blue-chip, such as solid balance sheet going forward. And past dividends might not reflect the future – a company that has built up in the past decade, for example, may only now be reaching a point of paying consistent dividends in the future.

It’s also worth considering that while dividends are incentivised in Australia, this is not the same case internationally. Companies with global revenue streams may be less likely to pay large dividends (and certainly won’t be able to offer fully franked dividends), while many foreign companies will use buybacks rather than dividends.

Size and dividends are more of a reflection of the past, rather than the future prospects of the company – so you generally need to look deeper.

“The label blue chip conveys a sense of quality – a favourable industry position, an established track record of profitability and robust balance sheets,” says Hughes, adding that these need to be consistently displayed over time.

Younes similarly points to industry position, noting a competitive advantage can assist companies in becoming entrenched and ensuring that the business is relatively predictable and reliable in performance. This becomes evident in strong balance sheets and free cash flow.

“These companies usually have a long-standing reputation of using the cash generated from business operations to fund dividends, share buybacks, as well as investing in the business to generate growth,” says Younes.

What should a future blue chip look like?

Buying blue chips is not the set-and-forget strategy you might think it is.

“There’s no such thing as a permanent blue chip. Industries, businesses and management change and thinking can’t be static,” says Hershan.

He argues you need to be dynamic in assessing businesses and the industries they operate in.

When it comes to looking to the options of the future, Hershan believes a high degree of visibility in terms of industry structure and business revenue streams is important.

When it comes down to it, the qualities that will make a company a blue chip in the future, should apply now – even if the company is emerging.

“A company should have favourable industry dynamics, a long-term growth runway, and importantly, a capable management team to ensure that the growth potential is achieved without significant use of external capital,” says Hughes.

He also adds that, just because a company is ‘out of favour’ now, doesn’t mean it can’t return to blue chip status later. Hughes gives the example of Woolworths which halved in value between 2013 and 2016 but has since returned to strength due to the competitive position of its underlying assets.

That may or may not be reassuring to concerned Qantas (ASX: QAN) investors who may be watching the litany of court cases and reputation damage and wondering if the airline could possibly recover from the hits.

Blue chip today, gone tomorrow?

A company doesn’t lose its status overnight – but you could say there are warning signs along the way.

According to Hershan, there are a few characteristics that could see a company fall:

- A breakdown in industry structure, for example, a new and significant entrant in what was a duopoly like domestic airlines.

- Technological innovation and megatrends which can create disruption and obsolescence, such as decarbonisation or the development of artificial intelligence.

- Changes in drivers, for example, China’s multiple decade ascent has seen many companies dependent on it, but its future looks different to the past and companies will need to broaden their revenue streams.

Looking more specifically at today’s lists, you can be sure some names today will not necessarily be there in the future.

Younes believes that businesses with negative ESG issues for society will struggle to maintain blue chip status.

“This could include any business that has coal operations, large carbon emissions (such as steel making), engages in controversial weapons, or even has supply chains that source labour using non-ethical methods (such as children, or working in poor conditions,” he says.

This has some interesting implications for the likes of big Australian miners like BHP (ASX: BHP), Woodside (ASX: WDS) and Rio Tinto (ASX: RIO) which have featured heavily in blue chip portfolios so far.

Will these mining stocks still be blue chips in the future?

The short answer is that mining could easily still feature heavily in blue chip lists – but it might not be the names we currently nominate. We still require mining to support the energy transition, both to maintain energy supply until we can completely transition and to develop required infrastructure.

Hughes points to Australia’s cost advantages in certain metals, which he expects to endure – particularly on the front of lithium and copper which will be dominant in the energy transition. This could see miners in these areas reaching blue chip status down the track.

Hershan believes miners will need to be diversified to survive – and coal companies are on notice. It’s a sunset industry and the big names will have to act quickly to stay relevant.

“Frankly, I can’t think of an Australian coal company that’s trying to diversify outside. They’ve effectively recognised their pure place,” he says.

Another industry that should consider itself on watch is the banking sector.

Both Hughes and Hershan think the best times for the big four are over.

“There is quite meaningful evidence that parts of their businesses have already been disrupted and some could be further disrupted into the future,” Hershan says, noting that they’ve already lost market share and seen returns on equity dip from high to low teens in the last decade.

Hughes agrees, adding that new players are starting to encroach on bank profit pools in payments and mortgages.

“The highly leveraged nature of bank equity means these companies can be more risky than recent history suggests,” Hughes says.

The sectors to watch for future blue chips

The changing nature of the world means some sectors may lend themselves better to blue chip status than others.

Younes points to technology and healthcare as holding promise for investors.

“Technology permeates our lives, even in ways we don’t see. As a result, dominant companies in this space are likely to continue to grow their revenues and profits going forward,” he says.

Healthcare on the other hand benefits from structural trends – the aging demographic profile requiring more healthcare and health-related services. Lets just say the likes of CSL and ResMed (ASX: RMD) should continue to do well unless things dramatically change.

For Hershan, infrastructure is an essential sector which investors shouldn’t ignore when it comes to blue chips.

“A lot of infrastructure companies lend themselves to blue chip status. They’ve got long-term concessions, long-term visibility on their income and their industry structures tend to be solid. We would put data centres in that camp as well,” Hershan says.

3 Australian and 1 global company that could be blue chips of tomorrow

I asked the three fund managers to name a top pick for the future and here’s the companies they suggested.

The Australian name

1. NextDC (ASX: NXT)

Though many view NextDC and other data centres as being technology, Hershan argues they are truly infrastructure companies.

“You can see the growth potential they have, the returns they are generating and their ability to scale. It’s absolutely got the ability to be a blue chip company in the future,” he says.

It’s not a dividend pick, but as Hershan notes, “we’re not there for the income, we’re there for the growth and capital appreciation.”

You can read an interview from my colleague Ally Selby with NextDC CEO Craig Scroggie here.

2. Medibank (ASX: MPL)

While Medibank took a hit last year off the back of the hacking scandal, Hughes believes it is set up for success.

“Already of meaningful size, Medibank can continue to grow steadily through population growth, private health insurance participation, market share gains from competitors and premium pricing. This can be augmented by targeted investment into adjacent health services,” he says.

He also expects that Medibank will be able to pay consistent, and growing dividends over time.

%20Share%20Price%20-%20Market%20Index.png)

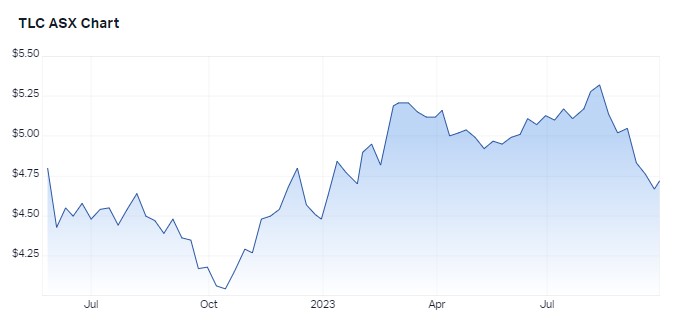

3. The Lottery Corporation (ASX: TLC)

This one may come as a surprise to investors but Hershan views it as solid compared to previous owner Tabcorp (ASX: TAH).

“It is almost infrastructure-like in nature. They’ve got long-term licenses for the lotteries on average north of a decade. They’ve got a platform that’s built, actually have a high degree of pricing power and demand for lottery tickets is not as volatile or cyclical as you would expect,” says Hershan. In essence, it’s “a local monopoly with pricing power and long term licences.”

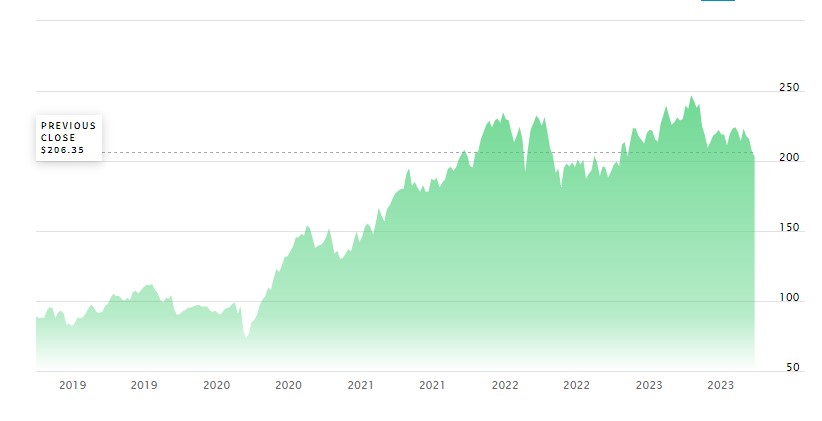

The global name: Tractor Supply Company (NASDAQ: TSCO).

The equivalent of an American Bunnings for recreational farmers and ranchers, Tractor Supply is a retailer of farm and ranch products and operates almost 2200 stores. It’s been listed since 1959.

“Over the last 30 years, the company has grown sales each and every single year, even during the GFC, with a compound annual growth rate of over 14% pa. Earnings per share have grown by almost 19% pa in the same time,” says Younes.

He also notes Tractor Supply has grown its dividends over 31% pa in the last 12 years. Tractor Supply is targeting further store expansion and has continued growth in sales in existing stores, generating substantial free cashflow.

“Given the type of activity the business engages in, it’s a steady and relatively stable business with below average levels of cyclicality,” he says.

Over to you, what do you think will be the blue chips of the future? Let us know in the comments.

5 topics

15 stocks mentioned

3 funds mentioned

4 contributors mentioned