What does the US and China outlook mean for investors?

We now know who the next President of the United States will be. We also know more about the stimulus that China will provide its economy. Both come against the backdrop of elevated equity valuations, sticky inflation, some signs of slowing growth, and resilient investor sentiment. So where is the risk for investors? Should investors be worried? And how can investors manage portfolios through the medium-term?

The Trump trade lifted risk assets

After a highly contested campaign, Donald Trump won a resounding majority in the electoral colleges as well as the popular vote to be elected the 47th President of the United States. Stocks soared with small caps outperforming, and credit spreads tightened, on the prospect of lower taxes and less regulation.

Bitcoin surged in the hope of a friendly regulatory stance. Treasury yields had trended higher ahead of the election and jumped as the results became clear.

China delivered but disappointed

Despite high expectations, China’s policymakers failed to deliver as large a fiscal stimulus package as investors hoped. The measures announced at the National Congress in November and by the National Development and Reform Commission in October added to the considerable cumulative policy support provided over the past 18 months. But it was not significant enough to shock and awe markets. Instead, the policies could be characterised as a cautious but proactive approach to supporting key sectors and stimulating economic growth.

The fundamental backdrop matters

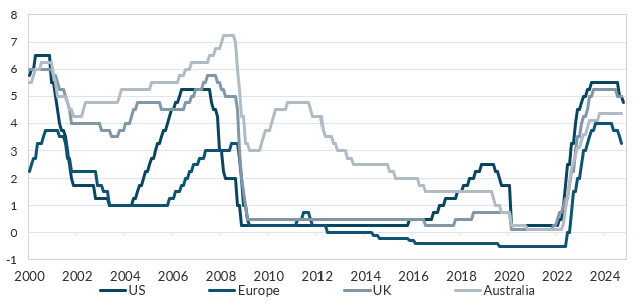

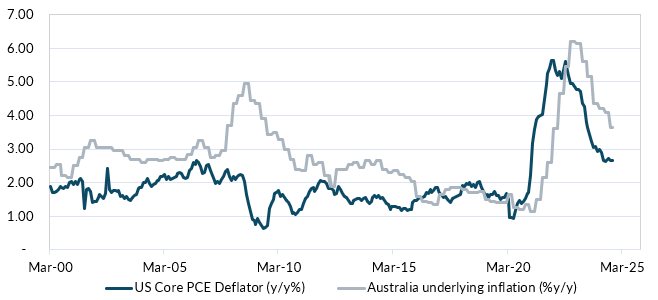

These events occurred against a challenging economic backdrop. Central banks have (mostly) started cutting rates (Chart 1), but the pace and magnitude of cuts could be constrained by sticky inflation (Chart 2). Unemployment has ticked higher in the US and Australia. But there are signs of resilience in the labour market. And that is preventing a meaningful slowdown in consumer spending.

Chart 1: Rates have mostly started to be cut

Chart 2: Inflation remains sticky

What is the catalyst for re-acceleration?

The US economy has proven resilient. That has supported risk sentiment. But the US equity market is pricing double digit earnings growth next year. That will require more than resilience. It will need global growth to reaccelerate. The re-acceleration needs to come from somewhere. US and China are obvious sources to consider. Table 1 shows some potential outcomes of the recent China announcements and the US election.

Table 1: Impact on economic fundamentals

What does it mean for Australia?

From a simple perspective, Australian equities look somewhat less overvalued. But Australia’s economy has been weaker than the US. And China’s moderate growth outlook is likely to continue to weigh on growth. The introduction of significant tariffs on China from the US could further impact China’s economy, adding to risk for Australia. On the other hand, Australia’s economy could be supported if pro-growth policies in the US outweigh the impact of tariffs on global growth.

How can investors position themselves?

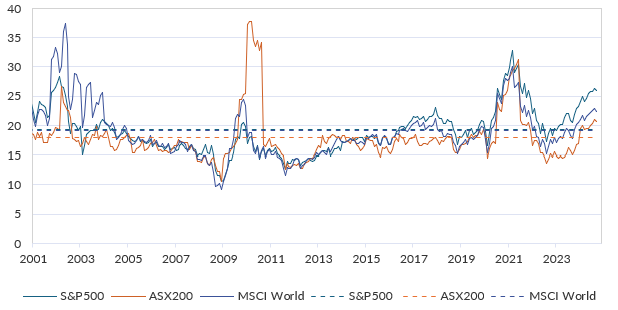

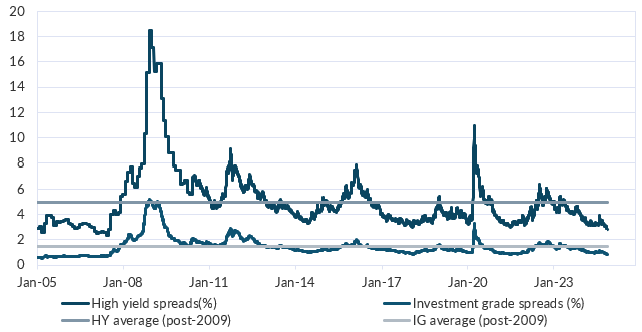

This backdrop is framed by stretched market pricing. Global equities are trading at elevated valuations relative to history (chart 3). Credit spreads are very tight relative to history (chart 4). Government bond yields have been volatile. I think there is a chance that after several years of double-digit returns for global equity investors, returns have been brought forward from the future. That could leave future returns somewhat lower than most investors have come to expect.

Chart 3: Equity valuations are elevated relative to historical averages (dashed lines).

Both China and the US matter for investors. There are a range of plausible scenarios. Uncertainty is elevated. For investors who can be more dynamic, now is a good time to take advantage of higher government bond yields. This offers reasonable income and downside protection. The risk is that inflation proves somewhat stickier.

Chart 4: Credit spreads are tight relative to history.

This allocation could be funded from either lower-quality credit (where spreads are very tight) or from global equities, where extended valuations need a material pick-up in earnings growth to be justified. If the economy does reaccelerate, this underweight will still deliver solid absolute returns. For many investors, a good alternative is to diversify across asset classes, stay invested, and rebalance through any market volatility - and keep doing so through the medium term!

3 topics