What is the ‘Trump Trade’ for Tech?

Wow, so much can change in a fortnight.

While the market has finally begun to broaden, as I and many others predicted, what I didn’t have on my bingo card was a Trump assassination attempt!

Trump now leads the polls in all seven major swing states.

There are still four months to go, but with such a commanding lead at this point, we need to consider investments from a new perspective.

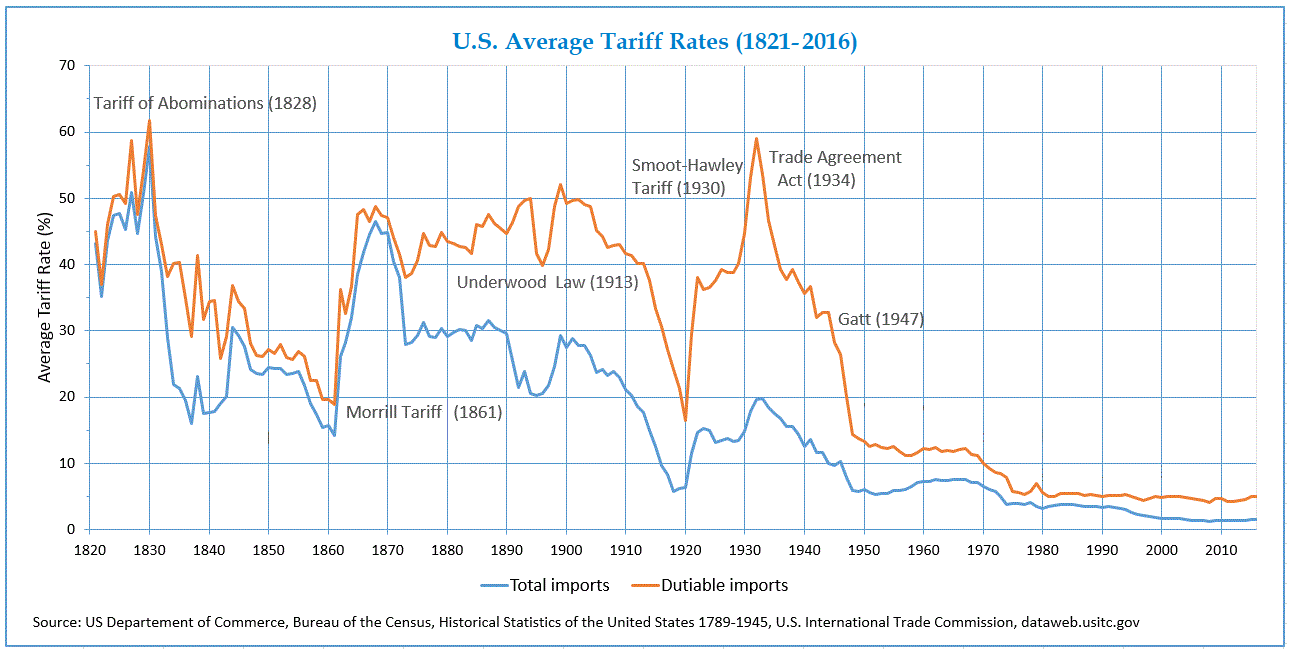

A big theme to keep in mind is protectionism.

There has been much speculation about Trump’s stance on tariffs, with some wondering if a repeat of his last presidency is likely.

Looking back at his first term in office, Trump was often fixated on US trade deficits.

They were his go-to complaint when examining trade relationships, and he felt tariffs were the tool to balance them.

While the world has generally been shifting away from tariffs, Trump is happy to ignore Republican orthodoxy and spurn the free market.

.png)

This has been a concern for many economists.

In fact, in May 2018, 1,140 economists, including 14 Nobel prize winners, sent a letter to Trump, saying:

‘In 1930, 1,028 economists urged Congress to reject the protectionist Smoot-Hawley Tariff Act,’ the authors wrote, citing a trade act that many economists argue was one of the triggers for the Great Depression.

‘Congress did not take economists’ advice in 1930, and Americans across the country paid the price. The undersigned economists and teachers of economics strongly urge you not to repeat that mistake. Much has changed since 1930 – for example, trade is now significantly more important to our economy — but the fundamental economic principles as explained at the time have not.’

Trump's first attempt at a China trade war didn’t spark the next depression, but the price of intermediate goods rose between 10–30% in the US.

Those increases mirrored the tariffs almost exactly.

So, this time around, ears had been pricked since February when Trump threatened 60% tariffs on Chinese goods.

His recent interview with Bloomberg was his first chance to clarify his vision of ‘Trumponomics 2.0.’

And it showed he’s doubling down.

It’s clear that he intends to raise tariffs on China and the EU, too, seeing tariffs as a political cudgel.

‘I can’t believe how many people are negative on tariffs that are actually smart,’ Trump said.

‘Man, is it good for negotiation. I’ve had guys, I’ve had countries that were potentially extremely hostile coming to me and saying, “Sir, please stop with the tariff stuff.”’

If those words weren’t enough to ruffle feathers, Trump's comments on Taiwan have also reverberated across markets.

When asked about Taiwan's defence, he quipped that the relationship should look more like a protection racket.

‘They did take about 100% of our chip business,’ Trump told Bloomberg, ‘Taiwan should pay us for defence.’

‘You know, we're no different than an insurance company. Taiwan doesn’t give us anything.’

Beyond the mafia-like rhetoric of these comments lies a much darker one that could embolden China.

The Taiwanese certainly see it; they’ve already announced unplanned invasion drills in three days' time.

On the markets, Taiwan Semiconductor Manufacturing (TSMC) stock plummeted nearly -8% in a session, while Taipei-listed shares fell -2.37%.

Other chip stocks also fell: Nvidia fell 6.62%, AMD was down 10.21%, Qualcomm fell 6.7%, and Broadcom fell 7.91%.

All these moves can’t simply be attributed to Mr Trump. Biden is also toughening trade with China across major chip players.

Beyond that, markets are rotating out of big tech stocks into smaller players, and overall, the market will be healthier for it.

A lot is going on, and that’s for sure. But the same old question for investors remains…

Where should you be looking to invest now?

Onshore or Friendshore?

The practice of ‘friendshoring’ is the relocation of supply chains to allied countries.

If tariffs become a reality, these aging Western supply chains will again be in the spotlight.

From an Aussie perspective, this could mean shifts away from Chinese-focused trade that could benefit some industries and hurt others.

For my subscribers, I’m looking at rare earth elements and critical minerals as growth sectors in a world of new, tighter supply chains.

The recent saga of Northern Minerals [ASX:NTU] attempted boardroom coup by Chinese investors was telling.

The company aims to be the first major producer of dysprosium outside China — a key component in EVs and advanced weaponry.

But the company had been in the throws of backcourt board tussles between its local management and Chinese conglomerates.

The Federal government eventually stepped in to block the quiet takeover and force the sale of the Chinese stakes.

But this isn’t the end of the story here.

If markets split into regional trading partners, we’ll likely see more moves like this.

Interest in Rare Earth Elements (REE) outside China could become far more valuable in this kind of world.

Onshoring will also be a strong theme in a potential Trump second term.

Tariffs and lower regulation could spur local manufacturers as they become price competitive.

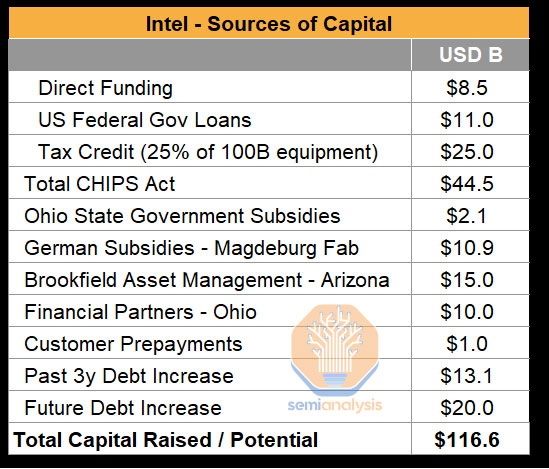

From a tech perspective, the standout beneficiary will likely be Intel [NASDAQ:INTC].

With the US spending roughly $280 billion on the CHIPS and Science Act to bring R&D and manufacturing back to its shores, intel’s pivot to a chip foundry model could be well-timed.

Intel is investing heavily in manufacturing thanks to CHIPS loans and grants. So far, it has been awarded US$8.5 billion and has the potential for $11 billion more in loans.

But that is not all; here’s an estimate by Dylan Patel on its sources of capital:

With this mountain of cash, it’s shooting for the rafters.

It’s building two new factories in Ohio for US$28 billion, updated one in New Mexico for US$4 billion, and spending US$36 billion on expanding its site in Oregon.

That’s not to mention a €17 billion plant in Ireland, €30 billion on two sites in Germany, and a US$25 billion chip plant in Southern Israel.

We are talking about serious investments, over US$100 billion in total.

If anyone could take advantage of a disruption to East Asian chip manufacturing, it’s Intel.

The next disruption idea is a little out of left field, but it’s related to powering the AI boom.

‘Drill baby drill’

‘Trumponomics 2.0’s final flourish is broad deregulation — especially in oil and gas.

He has brushed off any concerns of inflation reemerging from tariffs by pointing to energy as the tool to keep inflation down.

‘Energy prices remain high because we keep supply in the ground,’ he told Republican Senators recently.

‘We are going to – I used this expression, now everyone else is using it so I hate to use it, but – drill, baby, drill,’ he told Fox News in a recent Interview.

This starkly contrasts with the Biden Administration, which just lost in the courts over its ongoing suspension of all approvals for LNG exports this year.

Five LNG projects with a combined capacity of ~50 MTPA lacked Department of Energy approvals.

While many others have been waiting until November 6th to move forward with development.

A Trump presidency will free these projects and others and unleash a new wave of natural gas from the US.

In fact, he directly promised it in May when he met the country's top oil and gas executives after demanding his dues:

‘You all are wealthy enough, that you should raise $1 billion to return me to the White House.'

At the dinner, he reportedly vowed to immediately reverse dozens of Biden’s environmental rules and policies and stop new ones, according to WSJ and people with knowledge of the meeting.

Cheniere Energy [NYSE:LNG] was among the CEOs in that room whose stocks soared after the June 27 debate and the recent assassination attempt.

The ‘Trump-trade’ has clearly favoured fossil fuels and large financials so far.

But before you go following the trade, what could the longer-term outlook of LNG be from all of this, and why even consider LNG?

In the world of AI, the growing need for data centres has been on everyone’s radar recently.

Natural gas could be a strong contender for meeting our immediate energy demands.

Morgan Stanley estimates energy demand from AI data centres could be 8–15% of the Australian grid by 2030.

That’s a big variation, but I would probably bet in the middle.

To fill this demand, gas-peaker plants could be seen as a great bridging technology on the road to renewables.

Their flexibility and ability to easily scale power generation up and down make them a reliable option.

Grid-scale batteries would be an ideal long-term solution, but they are still ramping up.

For now, grid batteries are focused on grid stability rather than seasonal or time-shifting power for demand.

Most lithium-based grid batteries have storage of around 4 hours, which is still too short for our needs.

This will eventually change, but there is a clear gap in the market to fill energy seasonal lulls, heavy industry, and grid stability.

Gas-peakers could fill all those gaps in the short term. The other reason to consider LNG could be cost.

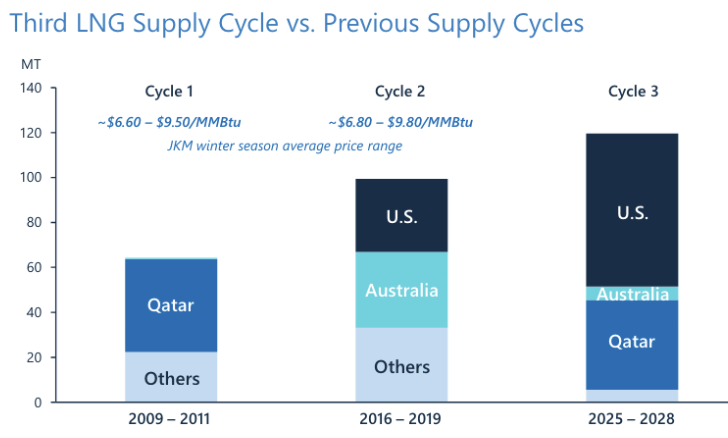

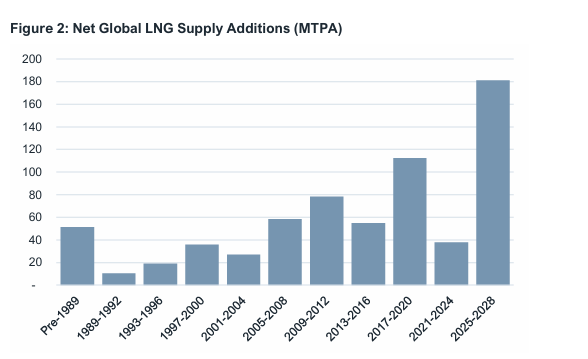

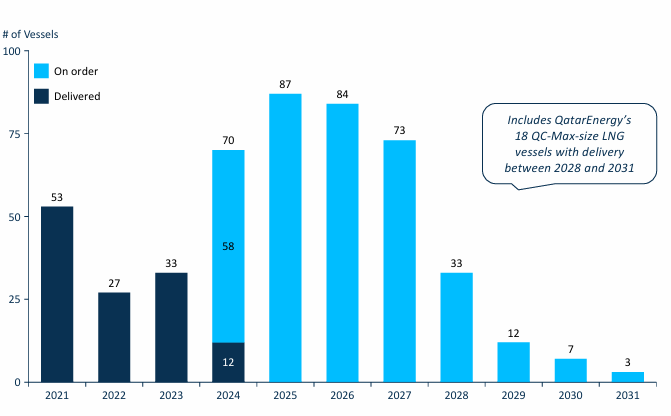

LNG supply capacity is set to increase by an incredible 40% from 2025 to 2028. With the US and Qatar leading this ‘third wave’.

While the intended home for much of this new LNG supply was emerging markets, that reality is still iffy in the short term.

Developing markets have matured their renewable policies faster than many thought, and they face similar approval roadblocks to the West.

Vietnam and the Philippines, for example, both completed major LNG terminals. However, both have seen demand lag due to persistent issues with the approval of new gas generators.

Meanwhile, serious purchase agreements for LNG-to-power have repeatedly failed in the region. Much of this is probably due to unease about long-term pricing.

The consequence has been further delays in the region's commissioning of new gas generation.

This all comes as many major long-term LNG contracts are set to be renewed in the next few years.

The Institute for Energy Economics and Financial Analysis (IEEFA) thinks this could push the market into a glut, saying:

‘LNG markets are likely to soon be awash with uncontracted LNG, particularly from lowest-cost producer Qatar. By 2030, Qatar could potentially have up to 59MTPA of uncontracted LNG capacity.’

Some may take issue with the IEEFA, but it's not only them saying this. Morgan Stanley analysts made a similar conclusion, saying:

‘We expect this [increase in LNG supply] to represent the net cyclical downturn in global gas and spot LNG prices, which favour downstream gas companies over upstream suppliers.’

This wave of cheap LNG could take on a new face if we imagine a world split through trade wars or conflict in the South China Sea.

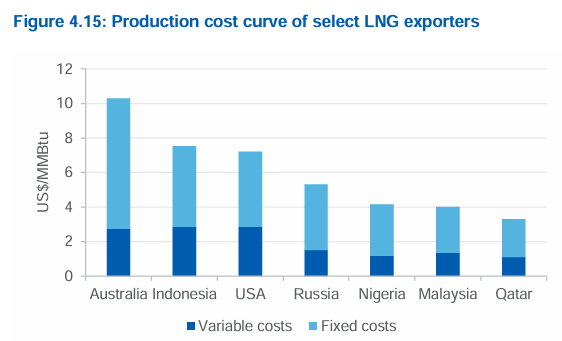

This oversupply could be a challenge for new Australian projects, which typically have much higher capital costs.

Santos’s Barossa development, for example, was estimated at around US$5.5/MMBtu before its project delays and carbon offset schemes.

Qatar’s average, on the other hand, is closer to US$2/MMBtu. That doesn’t include shipping, but those costs are projected to shrink as a new wave of LNG ships is due soon.

New LNG Vessels

Where is all of this going?

If a wave of LNG comes sooner than the market expects, countries like Australia and the US could struggle to fill international contracts, squeezing prices.

This could dramatically lower our traditionally high domestic LNG prices and open up local gas use in generation or peaker plants both here and in the US.

Strike Energy’s [ASX:STX] recent strategy pivot towards gas-peaking plants could be one to watch.

For a safer pair of hands, I like the look of AGL Energy [ASX:AGL] and Origin Energy [ASX:ORG] as investments in this kind of market.

There are still a lot of unknowns here, however.

What all of these investments have in common is a sense that things are changing.

With or without Trump in the White House, the potential for a ‘Trump trade’ could be wise, as global markets tend towards more regional ties.

Being adaptable will be essential for investors looking to capitalise on any shifts from here.

My colleague here at Fat Tail, Brian Chu, has also been writing about these changes, but from a Chinese perspective.

He believes China is building a new Doomsday Vault to protect its markets from these shifts.

Click here to read more about China’s bold new strategy, or subscribe to Fat Tail Daily here to read more ideas like this.

3 topics

4 stocks mentioned

%20cropped.png)

%20cropped.png)