What regulation means for Big Tech in China

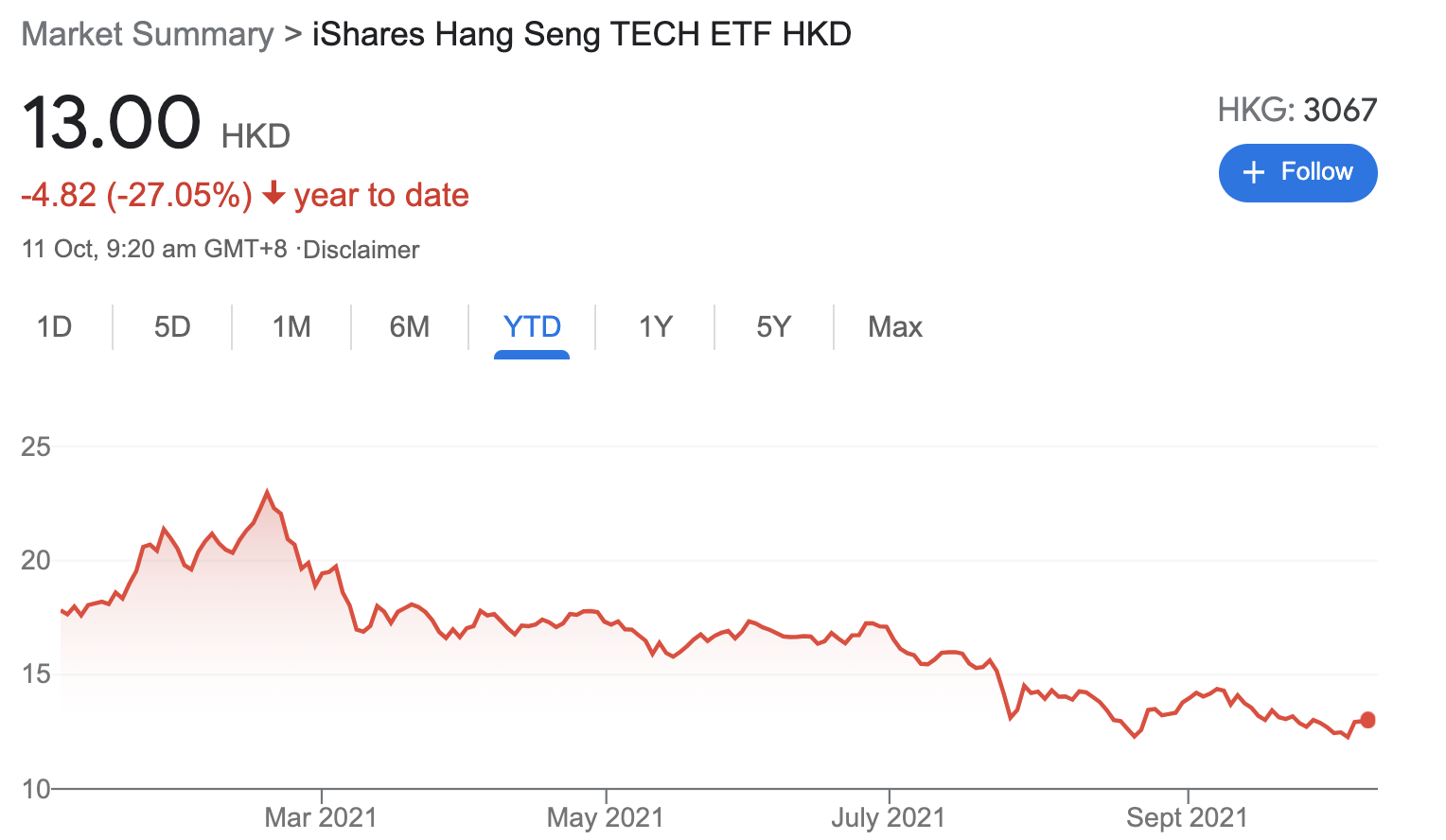

Recent regulatory crackdowns in the Chinese market have triggered selloffs across many of their largest tech names. BAT stocks (Baidu, Alibaba, Tencent) alongside the broader Hang Seng Tech Index have hit historic lows, while the FAANG stocks and NASDAQ100 continue to climb higher.

What started as antitrust and e-commerce tightening has expanded into private tutoring, data security and online content. While the worst of regulation may have come through, it looks as though these could significantly dent future growth prospects for a range of tech names. In other cases such as gaming, restrictions are unlikely to impact earnings as much as initially feared/speculated.

In this collection I reached out to fund managers to get their views into the recent crackdowns by the Chinese government, and what this means for the Chinese market.

Guest contributors:

- Sunny Bangia - Antipodes Partners

- Andrew Macken - Montaka Global Investments

Regulation welcomed by the people

The regulatory environment in China remains fluid. The country is in the process of implementing new regulations in three key areas; to restrain monopolies, govern fintech firms and protect data privacy and security.

After the Ant Financial saga at the end of last year, it was events regarding Didi earlier this year that marked a tipping point for investors who were growing concerned about regulation. Two days after Didi executed the second-largest US IPO by a Chinese company, the Cyberspace Administration of China launched a probe into Didi’s data security, resulting in the company’s apps being removed from app stores in China.

We can be sure that there will be greater supervision over Chinese companies listed overseas and rules for overseas listings may be revised.

Ultimately China wants its leading companies to be accessible to Chinese domestic investors via listings in the mainland or Hong Kong. To me, this seems reasonable and positive at most levels and has actually been happening for some time, initially in response to US legislative threats.

Since the Didi saga, there have been more moves aimed at bolstering the regulation around consumer-facing tech companies in areas such as e-commerce, gaming and online education. At the heart of these moves is the social good and protecting consumers from being exploited by technology (preventing online gaming addiction and excessive after-school tutoring, for example). While for western investors these may seem extreme, in mainland China these moves have been largely welcomed by the people.

The assumption that all these moves are aimed at destroying the private sector is wrong.

China knows its technology companies are vital to a prosperous economy and we’ve even seen recent moves by senior party officials who have spoken publicly to ease the nerves of investors.

The question you must ask yourself is, is it unusual for regulators to regulate lenders, protect consumers from anti-monopolistic behaviour or have concerns around data security?

Long term implications?

The fundamentals of China’s leading tech companies, which benefit consumers, remain unencumbered and we think in the long-term their earnings will continue to increase in line with rising domestic consumption trends in China, which is an undeniable story of growth.

What’s also interesting for investors is how the crackdown on anti-competitive corporate behaviour could open opportunities for smaller competitors to tech giants such as Alibaba.

Past regulatory oversight drives overcorrection

Andrew Macken - Montaka Global InvestmentsOfficially, the Chinese tech sector is facing a range of new regulations relating to competition, privacy and national security. Given the size and importance of this industry, as well as the somewhat lax rules that have been in place to date, it is perhaps not entirely surprising that regulations would be strengthened. Indeed, this is a trend we are seeing all over the world, not just in China. That said, the speed and severity of the changes clearly took the market by surprise – and even the companies themselves are scrambling to get on top of all the new requirements that are coming out.

Unofficially, there is a view that the internal Chinese pecking order needed to be reinforced.

The Jack Ma saga of late last year demonstrated how quickly one can fall out of favour with the Chinese leadership – even with a net worth of billions of dollars.

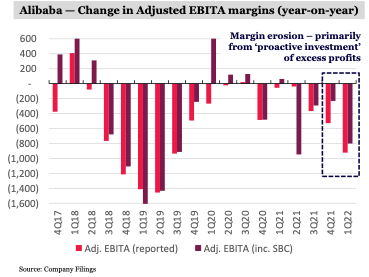

In recent quarters, we have observed Alibaba management committing to the investment of the company’s “excess profits” into “strategic areas” to support merchants. There is a sense this transfer of wealth from Alibaba shareholders to Chinese merchants reflects Alibaba’s renewed commitment to the objectives of the Chinese leadership.

The questions for investors, of course, are:

- For how long will these punitive measures remain in place?

- How will shareholders benefit longer-term from today’s strategic investments?

Long-term implications?

These new regulations are already impacting the earnings of many of China’s important tech businesses. This can be observed most clearly in the profit margins of Alibaba who is ‘proactively reinvesting’ the company’s “excess profits” into “strategic areas” to support merchants.

In the most recent quarter, Alibaba’s profit margins were down by around 8% from the same time last year. This rate of margin decline has not been seen since 2018 during which the company was investing heavily in New Retail (i.e. the digital combination of online and offline shopping experiences), fulfillment and distribution logistics, and Lazada, Alibaba’s South-East Asian e-commerce business.

The longer-term implications of these regulations are likely multifaceted and different for different players.

Perversely, one side-effect we typically observe when new, large-scale tech regulations are introduced is that incumbents are strengthened. Dealing effectively with regulations is costly and often creates new barriers to entry, thereby protecting and even strengthening the positioning of large incumbent players.

Furthermore, as concerns around privacy and data-sharing intensify, the multi-company digital ecosystems tend to converge more towards single-company ecosystems. Through this lens, it is possible that leading Chinese digital platform businesses, such as Tencent and Alibaba, emerge from this period in even stronger positions.

Conclusion

Overall, our contributors are view this government powerplay as a demonstration of their strength. This is unlikely to have severe long-term implications on established names given their importance to the continually developing country.

So what is their stance on investing in China and where are the opportunities? Make sure to stay tuned for the next editions of this collection to find out.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series.

If you enjoyed this wire, please click like and comment below if you are looking to exploit this sell-off.

4 topics

1 contributor mentioned