What’s ahead for Aussie tech, and 3 small-cap stocks on Goldman’s radar

You may have noticed an uptick in commentary about small-cap stocks lately, spurred on by (hopeful) signs that inflation has flattened.

Since the end of May, the Russell 2000 – a major US market small-cap index – is up more than 10%. Our local equivalent (if you can call it that, given the massive discrepancy), the Small Ords, is up 3%. But Roger Montgomery thinks now’s the time to buy ASX small caps, as he pointed out in his recent article.

Russell 2000 Index - year to date

On the other side of the coin, Chris Leithner recently penned a strongly-worded – and academically rigorous – assessment of ASX small caps titled, The myth of small-cap outperformance.

Both articles are worth a read. And if you happen to land on Montgomery’s side of the debate (his article drew some 7,000 clicks), Goldman Sachs' view on the following companies is especially interesting.

How does the tech landscape look?

Put simply, it’s “challenged” but some parts are more compelling than others.

“Generative AI has driven a surge in investor interest across the tech sector offshore, as well as upstream data centre player NextDC in Australia,” write Goldman Sachs analysts Chris Gawler, CFA, Kane Hannan, CFA, and Benjamin Rada Martin.

They expect AI to create a third wave of demand for the services of companies such as NextDC (ASX: NXT) – not covered by Goldman – and other data centre providers that are, one of which is named below.

On the demand side, Goldman expects spending on technology will continue to rise across the board but will differ sharply across different segments. That’s why these analysts favour “cleaner exposures toward the downstream end of the IT value chain”. In English, that means they prefer Aussie tech companies that are less, rather than more, diversified and that focus mostly on selling rather than building stuff.

Of the three companies named below, there are two standouts for Goldman. That’s largely because it likes their cash flows and balance sheets – one is running a “net cash operating model,” the other having recently completed a $160 million capital raise to fund a new data centre.

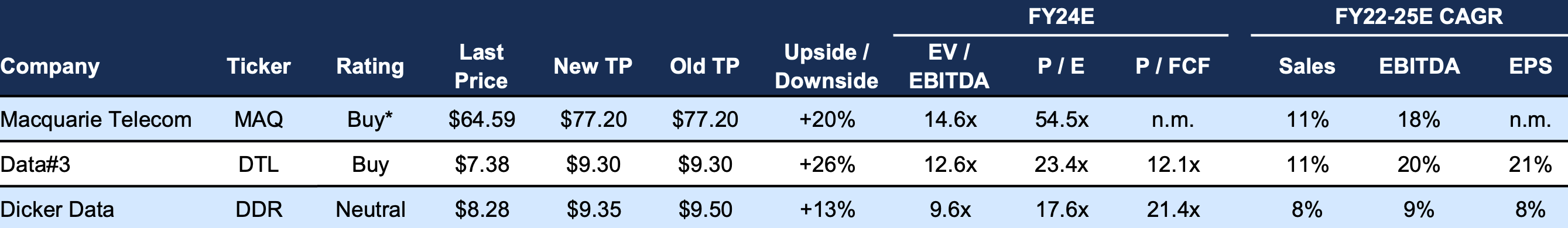

ASX technology service providers, by the numbers

Macquarie Technology Group (ASX: MAQ)

- Market cap: $1.61 billion

- Rating: BUY

- Price target: $77.20

- Latest closing price: $66.39

MAQ is a provider of cloud and IT services, with a focus on customers in the enterprise and government areas of the Australian market.

“It is strategically positioned across the growing categories of cloud infrastructure and managed services, backed by its portfolio of data centre assets including its 50MW campus in Macquarie Park,” say the Goldman analysts.

The company tapped investors for $160 million in mid-June. Somewhat remarkably for a tech company of this size, this is MAQ's first such capital management initiative since its 1999 IPO.

They expect “robust earnings growth” through to at least 2025 driven by large deployments of cloud technology and continued growth in managed services. This is underpinned by, “attractive returns on data centre investments and debt/sale-and-leaseback funding,” say the analysts.

On a holistic view of the company, they describe MAQ as undervalued, with high-quality businesses across the company’s IT stack – from data centre and infrastructure to managed services and cybersecurity.

“We are positive on management’s strategy and long history of successful execution, and believe MAQ is on track to building an enduring vertically-integrated cloud franchise,” say Goldman’s Gawler, Hannan and Martin.

They also cite the key risks:

- Execution risk on data centre development plans;

- Lower-than-expected segment growth; and

- Funding risk.

Data#3 (ASX: DTL)

- Market cap: $1.14 billion

- Rating: BUY

- Price target: $9.30

- Latest closing price: $7.35

An Australian reseller and provider of IT services to both companies and the government, Goldman’s thesis for DTL hinges on:

- Public cloud adoption;

- Digital transformation spending; and

- Managed IT services.

Key callouts are the company’s capital-light and self-funding attributes – put simply, it doesn’t chew up tonnes of capital to operate.

The Goldman analysts also applaud management’s “cost discipline during the current inflationary period.”

“We are Buy rated on DTL based on attractive valuation relative to DTL’s growth outlook, long-term structural growth drivers, high-returning business model and underappreciated profit growth potential,” they say.

Dicker Data (ASX: DDR)

- Market cap: $1.44 billion

- Rating: NEUTRAL

- Price target: $9.35

- Latest closing price: $7.98

This company is a top three distributor of IT hardware and software in Australia and New Zealand, with an increasing focus on software. This segment comprises around 25% of total revenue today, a figure which is tipped to grow to 34% by the end of FY2025.

The Goldman analysts believe DDR’s diversified product and vendor portfolio offers protection in the event of a slowdown, "although we see it as cyclically exposed, given 75% of revenue is from non-recurring hardware sales."

“DDR’s robust sales outlook underwrites a high single-digit FY22-25E EBITDA CAGR. However, the company appears fairly valued compared to peers and its cash flow generation potential. Hence, we are Neutral-rated on DDR.”

This article was first published for Market Index on Tuesday 18 July 2023.

2 topics

4 stocks mentioned

2 contributors mentioned