What's driving the global equity bear market - and what you should buy instead

Markets are shattering records all over the world and in every asset class. Although the decline in US equities is not near the long-run average for bear markets yet, global bonds are in their first bear market for 70 years. And that bear market comes on the heels of a 30+ year bull run which kept yields depressed even during the height of the Global Financial Crisis of 2008. The US 2s/10s yield curve spread has not been this inverted since 2000 and the US Dollar Index continues to shatter its own records in a bull run like no other.

No wonder analysts all call 2022 the "year of the rate reset"!

But bets on a global recession are always bubbling away in the background - and opinions still differ on which regions will take the biggest hit. Enter JP Morgan Asset Management global markets strategist Kerry Craig and fixed income portfolio manager Arjun Vij, who argue that a European recession is all but locked in. The US, however, is a different story.

Does that mean assets from these regions are now way cheaper than first thought? And does the cheap price make for fair value? In this wire, I'll share Craig and Vij's insights from the latest JP Morgan Asset Management markets briefing across equities, bonds, and currencies. By the end of the wire, there will be an answer one way or another.

A non-pivot sets the scene

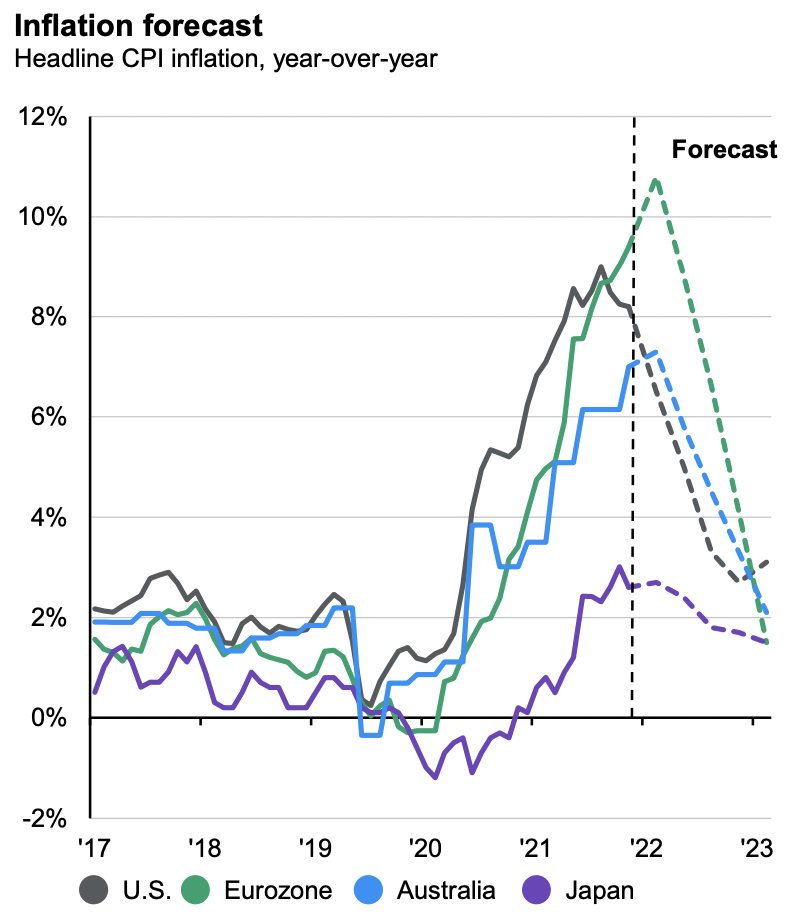

Let's start with some good news and bad news. The good news is that headline inflation will, in Craig's view, peak at the end of this year before coming down slowly to target across the major economic regions.

"A lot of those inflation pressures (supply chains, COVID, energy) will start to fade out next year," Craig says. Having said this, core inflation (inflation minus energy and food prices) has elements that are likely to remain sticky for some time and that's likely because the jobs market remains tight all around the world.

That leads us to the bad news - anybody hoping for a pivot should get off their high horse. Put bluntly, it isn't coming. The lack of weak economic data suggests rate cuts still can't be priced in for next year. But Craig reminds us we shouldn't ever discount the unexpected positives that have come from the COVID-19 experience.

"It's been remarkable how resilient these economies have been to those shocks. We are starting from a relative position in strength - think about corporate balance sheets and household balance sheets and savings rates in Australia providing a cushion," Craig says.

But it's the reality that these high savings will only last for so long that makes these positives just a "cushion" rather than an actual offset in the event of a global recession.

It also doesn't take away the fact that inflation is still public enemy number one - and the race for central banks to crush it is, in their view, the top driver of this equity bear market.

List of positions in summary

- Underweight global equities, some credit assets

- Australia's income bias will serve us well

- Japanese equities are "more favourable", but long-standing US bias remains

- More value in government bonds, but choose your fighter carefully

- The US Dollar's gains are more important than other currencies' losses

Explaining the underweight equities call

Let's get this out of the way - JP Morgan Asset Management's team is underweight global equities despite Chinese and European stocks looking very cheap. So why is cheap, not good enough in this market? It's the economy, stupid!

"Given the headwinds in the economy - so much depends on the fiscal responses now," Craig says. Part of that call is centred around the crude oil price. Craig believes there are reasons why crude oil may not come down much further over the near term due to strategic releases and seasonality factors.

"There is also the unknown quantity about price caps countries are trying to transfer to insurance options," Craig adds.

If you have to be in equities at this time, the rule is to trust companies with quality earnings. Craig says there should be a sustained focus with persistent revenues. And for all of you asking whether you should buy back into growth stocks, he has a simple answer.

"Not when there is this volatility in the bond market. As long as it persists, it's hard to see growth outperforming," Craig says.

There are three exceptions to this broad rule. The first is a long-standing bias toward US large caps (on valuation grounds). The second is a contrarian play in itself - Japanese equities (given the weakness of the Japanese Yen). The third is Australian income-oriented equities.

"I think Australia has a bit of a benefit there because income is defensive. It's a high-income market, and it could do quite well. But quality has to be the most important bias right now. And until we see economic and earnings data really bottom, we don't see material upside in the equity market in the short term," Craig says.

Not all fixed income opportunities are equal

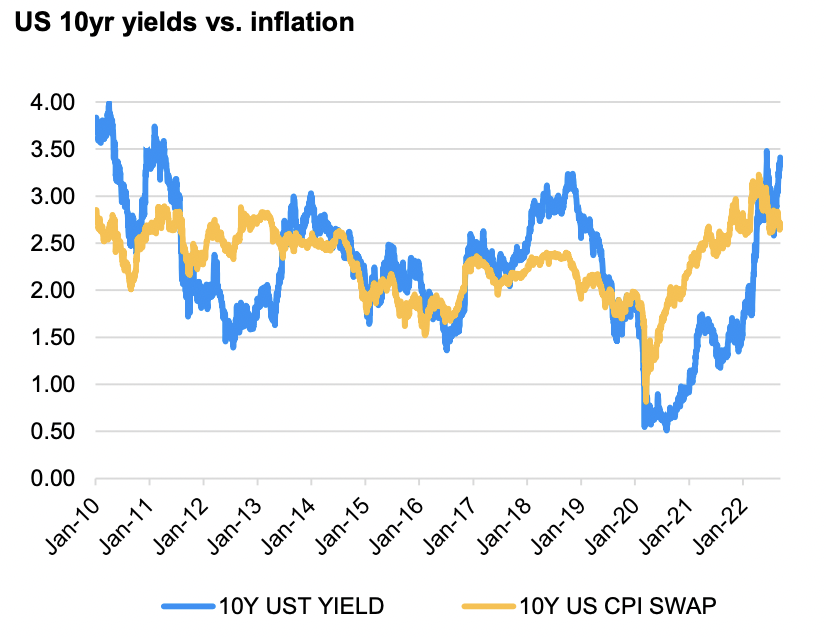

While bond prices have had their worst year in decades, higher rates (and yields) have created a value the fixed income market hasn't seen in many years. If you want any proof of that, look at the next chart. The fact that the blue line is, once again, above the gold line, is a big clue to why Vij and his team are starting to buy fixed-income assets.

But just like stocks, there's a litany of fixed-income assets to choose from. And like every investment, it's all about the timing. Vij says the time to start accumulating is now, but the time to go all-in is not here just yet.

"We're moving to what feels like a different regime," Vij says. "On our side, we're not as sanguine. We think markets will price in a recession within the next three to six months. This is quite fast for us," Vij adds.

This is all a long way of saying the prices of short-dated bonds (i.e. multi-month notes or bonds that won't mature for up to two years) may have more to fall. On the other hand, long-dated bonds (bonds with five years or more to run) are looking a little more appetising than they have been for a decade. While this deepens the yield curve inversion we referred to earlier, it is the base case for the team.

"Our sense is that there's been a decent value created in the long end," Vij adds. "If you had to start adding bonds today, we'd like to buy the longer end."

The unusual opportunity: Chinese bonds

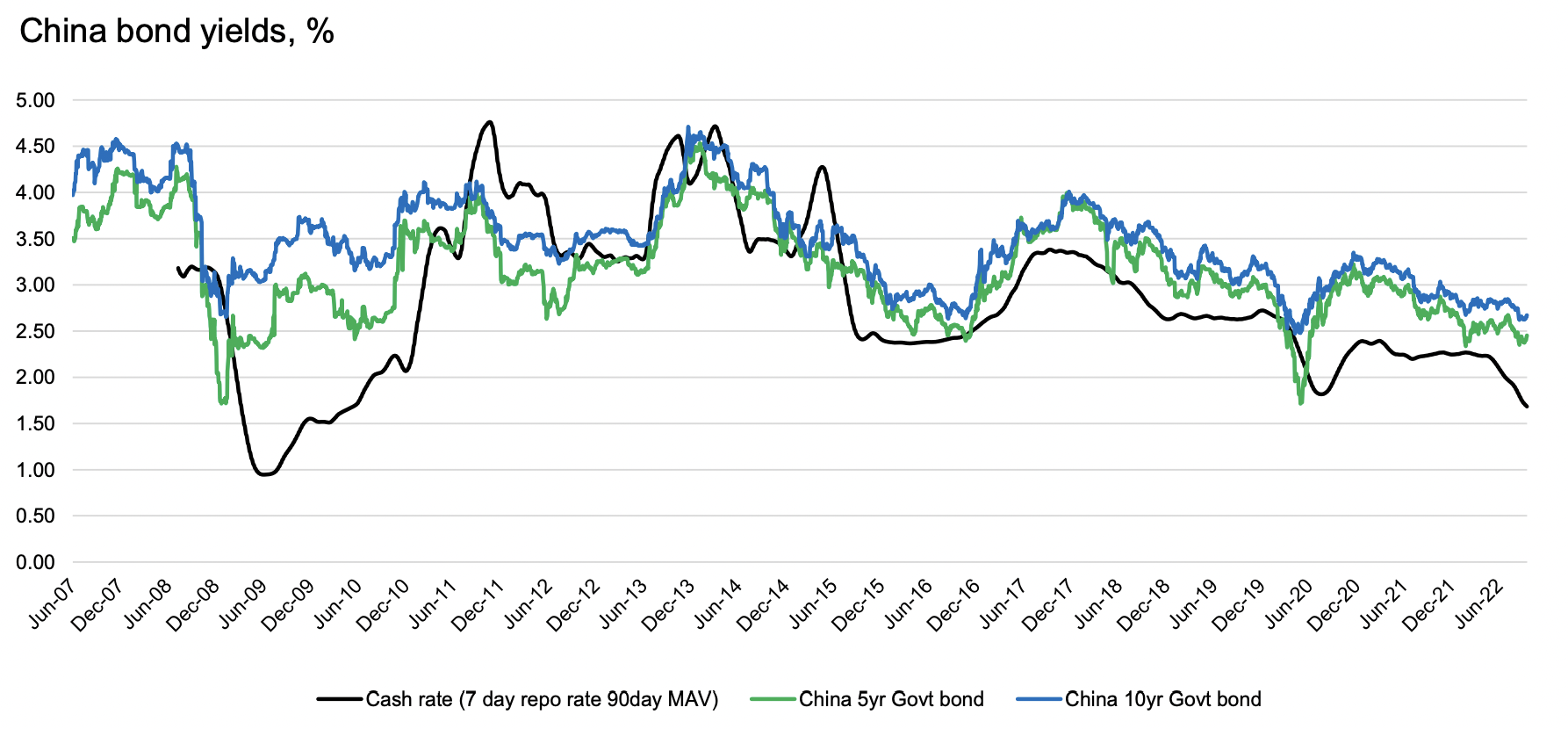

So far, we've talked mainly about government bonds from around the world - but there is one unusual opportunity the team has spotted. It also happens to be one of their top calls in the fixed income portfolios that JPMAM runs: Chinese (Yuan-denominated) bonds. Vij says there are three reasons to buy this opportunity - and the fundamentals of this chart is the first of them:

Second, the yield on these two instruments has been nearly the same (despite the extra five years you would have to hold a 10-year instrument) since mid-2012. As China acts more like a developed economy (with higher debt-to-GDP ratios), interest rates have to move lower. But - one eyeball of this chart shows that hasn't happened yet.)

"Rates haven't come down enough. That's a structural reason," Vij says.

Finally, they argue that China provides a safeguard against a recession in developed markets, should a global recession start in the West and spread. The People's Bank of China (and for that matter, the Bank of Japan) are still pumping stimulus into their respective economies despite the risks of a serious growth slowdown or worse.

Concluding on currencies

There is one other elephant in the room that we haven't addressed - the US Dollar. As of writing, the (fixed) Chinese Yuan was inches away from matching a level not seen against the US Dollar since the depths of the GFC. So is there any reason for that to stop? No, in short.

"It's very hard to find something that will get in the way of US Dollar continued strength for our mind," Craig says.

For the British Pound, which has had a wild week, to say the least, Vij views the Bank of England's non-action as a sign of excess supply in the UK gilts market. But the bigger issue is the credibility of the United Kingdom's financial stability.

"There's a little bit of institutional credibility at risk because the central bank and the government are pulling in different directions. It introduces a risk premium on these assets. If it persists, you have to remain underweight UK assets," Vij says.

One final point worth mentioning is cash holdings across the major JPMAM portfolios are averaging 8-10%. That's high by their own standards and suggests there is still reason to be risk averse in this market. Even the constructive analysts have their reasons to raise eyebrows.

You can read about all things cash - and the US Dollar in particular - in an outstanding piece written recently by my colleague David Thornton:

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics

2 contributors mentioned