What's going on in China's property market and what does it mean for your money?

For the second time in less than two years, global financial markets are waiting with bated breath to find out if a second (and even larger) property developer in the world's second-largest economy will default on its debt.

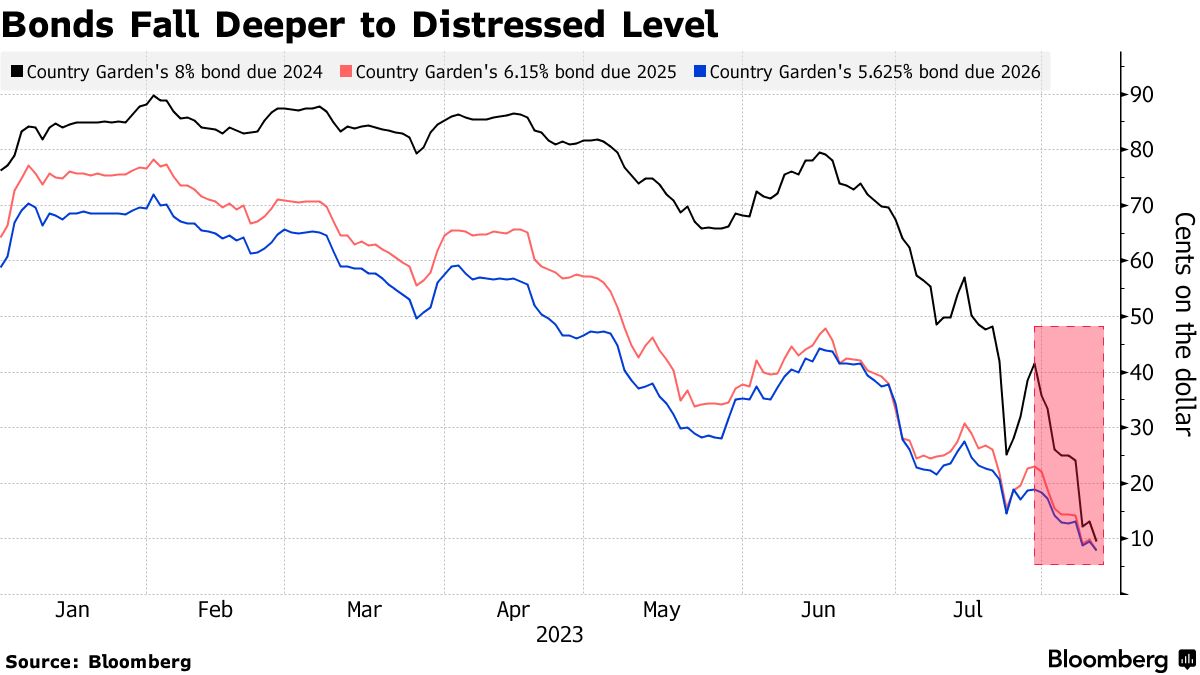

Late last week, the stock and bond prices of Country Garden Holdings crashed on news that its bondholders never received their semi-regular coupon payments by the regular deadline. Trading in its bonds has been halted while its shares are now essentially trading like a penny stock - worth just HKD80c/share as of Monday's close.

In this wire, we'll be taking a closer look at the Country Garden crisis and what it means for Australian investors.

What's actually happened?

At a macro level, the story isn't actually new. It's been a tough few years for Chinese property developers. The major names hold in excess of US$1 trillion in debt on their balance sheets, a figure that was rising for many years due to relentless expansion.

But expansion only works if there is demand. Chinese homebuyers have been putting off making purchases, putting developers into a cash crunch and, in many cases, a default situation.

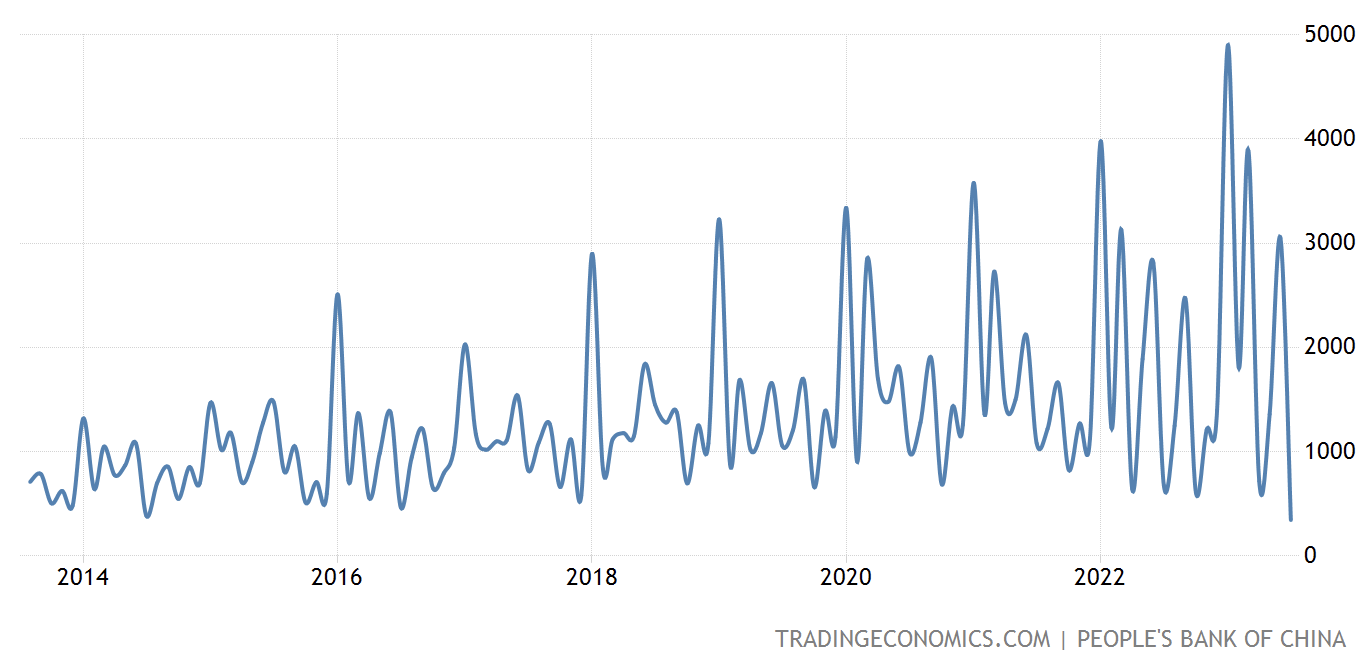

New loans, a closely watched data point, tumbled along with other key credit gauges last month to levels not seen since the depths of the Global Financial Crisis in 2008/2009.

At the micro level, Country Garden is reportedly looking to undertake a debt restructuring which may even involve delaying the maturity of some of its corporate bonds and notes. More immediately, it now has less than 30 days to avoid a default and become the second major headache in this sector in just two years.

It comes after the company guided for earnings to swing from an H1 2022 profit of CNY1.9 billion ($403 million) to an H1 2023 loss of CNY55 billion ($11 billion). Industry peer Evergrande, which already defaulted two years ago, also reported massive losses recently.

Is Country Garden the next Evergrande?

While this potential default smells a lot like the Evergrande crisis of two years ago, Morningstar associate equity analyst, Jeff Zhang, says it's very different in some key ways.

"We think Country Garden’s financial position is not as dire as Evergrande’s," Zhang said. Zhang's list of reasons includes:

- Country Garden has less debt than Evergrande did when it was facing default.

- Country Garden's (40%) net gearing (debt-to-equity) ratio is nowhere near as high as Evergrande's (90%).

- Country Garden was more profitable in the year before its potential default than Evergrande was. Its corporate debt also garnered a higher rating from the major research houses, suggesting its balance sheet was in a better state before all these concerns cropped up.

- Country Garden plays in a different part of the Chinese property market to Evergrande. Without getting too into the weeds, Country Garden focuses most of its operations in smaller and less prosperous cities than its rival.

"Country Garden’s issue is more timing related but this does not diminish the challenge to resolve the problem as a lack of homebuyer confidence in the tier 3 & 4 (smaller) cities are likely to persist in the absence of more direct and specific government policies," Zhang added.

Will Beijing step in?

For now, all we have heard is that Beijing is willing to institute looser policies for the property market. Looser policy includes the continued cutting of interest rates by the People's Bank of China and speeding up the issuance of infrastructure bonds.

Both measures are intended to add more liquidity into the market - and would theoretically give these companies more money to ensure debts are repaid.

Update: The People’s Bank of China (PBoC) made a surprise cut to the 7-day reverse repo rate by 10bps to 1.80% and the 1-year medium-term lending facility rate by 15bps to 2.5% on Tuesday 15 August. The reverse repo rate is the benchmark rate for money markets and the medium-term lending facility rate is the benchmark rate for mortgages.

Speculators are betting that the Chinese government will indeed announce stimulus measures given, as Commerzbank economist Tommy Wu has put it, "the failure of another major Chinese developer would pose tremendous pressure on the already slowing economy.”

Bank of America China Economist Helen Qiao feels that there will be some stimulus eventually but investors may be disappointed with how much they get.

"We believe more pro-growth policies are warranted to support economic growth, and further easing in monetary policy can be expected. That said, as

policymakers vowed to “ensure the exchange rate is basically stable at a reasonable and

balanced level” during the July Politburo meeting, we see limited space for significant

monetary easing in the near term," Qiao wrote to clients last week.

Zhang agrees with Qiao, arguing Beijing will release a suite of stimulus measures including changes to property types to help keep market valuations afloat.

"Our house view is that there will be more policies in addressing excess property inventory through encouraging sales of existing houses and converting unsold units to leasing apartments. We also expect ongoing credit support for project completion, coupled with more relaxation on purchase restrictions and down payment ratios," he said.

Are there any implications for Australian investors?

If Beijing did announce more stimulus measures, the impact on markets would also be immediate. Stocks would rise (although whether they would rally is another question) and bond yields would come down in a normal environment. Zhang said that state-owned firms like China Overseas Land and Investment (HKG: 0688) and China Resources Land (HKG: 1109), which have heavy exposure to those larger cities will perform better in the long run.

A rising Chinese stock market would also have positive implications for Australia's stock market given we are widely perceived by international investors to be a proxy for China. And of course, local investors would be buying materials stocks like BHP (ASX: BHP), Rio Tinto (ASX: RIO), Fortescue Metals (ASX: FMG), and Mineral Resources (ASX: MIN) in such a scenario.

Our commodity prices will also naturally gain a boost from any stimulus. Speculators in the iron ore market will look very closely to see if Beijing wants to inject some cash into the economy.

The onset of the Evergrande Crisis triggered a 60% selloff in iron ore prices from US$214 a tonne in mid-July 2021 to a low of US$86/tonne by mid-November 2021. It's worth noting that the selloff occurred when iron ore was trading at all-time highs of more than US$200 a tonne due to the closure of mines in Brazil due to safety concerns and strong demand from China.

Country Garden has caused some unease across commodity markets but not full-blown panic. Iron ore prices are down around 13% in August to a 2-month low of US$100 a tonne. Likewise, copper experienced a brief breakout to US$4.0/lb on 31 July, only to whipsaw back to a 6-week low of US$3.72/lb.

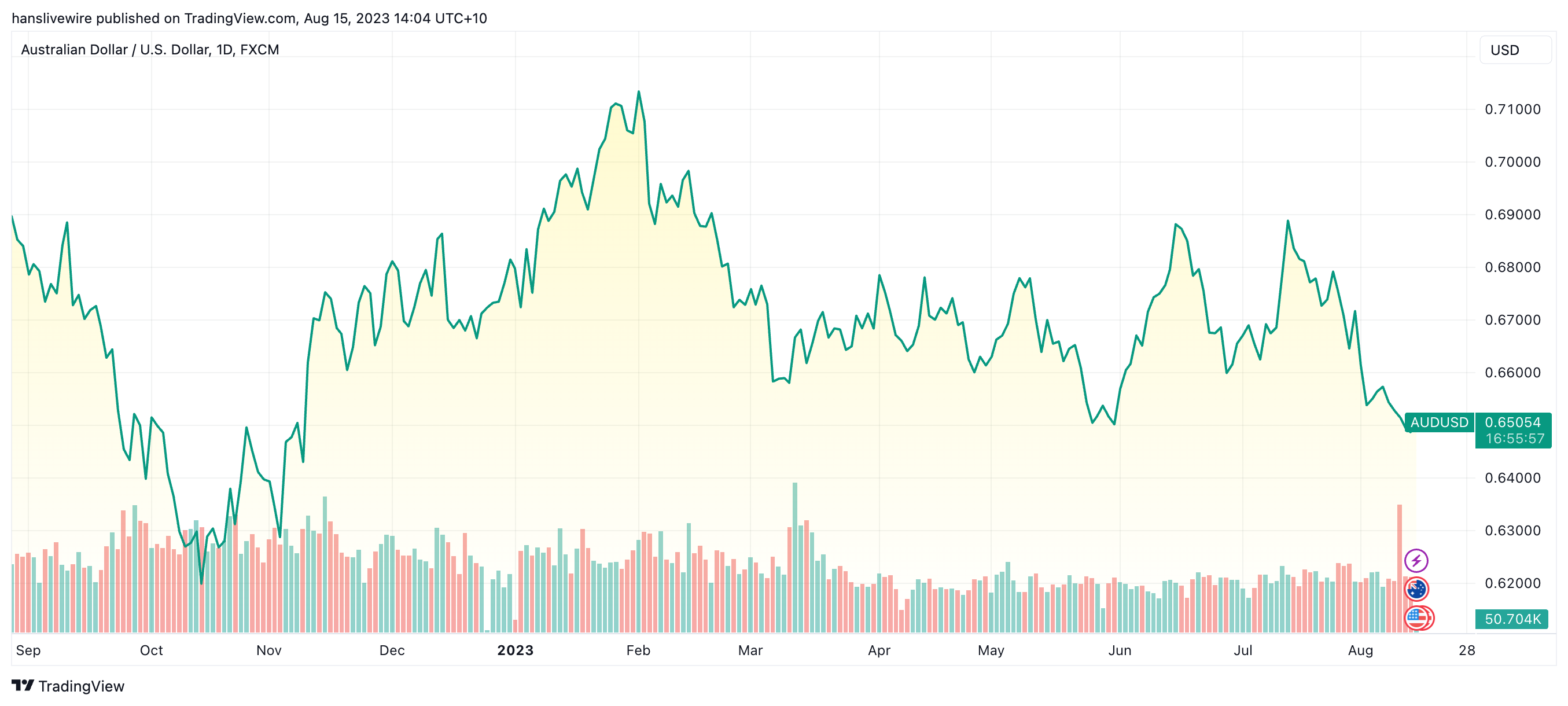

The other major beneficiary would be the Australian dollar.

With the RBA not looking to hike rates any further and a risk-off sentiment creeping back into markets, the local currency's value has cratered in recent months. A boost in stimulus from Beijing would create increased (if only temporary) buying in the local currency.

"China’s steps to support its ailing property market appear to be an attempt to stem bleeding rather than to stoke broader economic growth that would support the Australian dollar," Sean Callow, senior currency strategist at Westpac said.

Ultimately, all the signs point to a slowing Chinese economy and a lot of the blame will be put on the property sector, which is more than one-fifth of its total GDP. Just as an underweight position in Japanese assets has been an easy call for analysts for the last 30 years, an underweight China call may be about to get a whole lot easier.

4 topics

4 stocks mentioned