What's going on with Gold?

Global X ETFs

War in Ukraine has set volatility alight. Investors have flown to safety, as stock and bond markets have fallen. Inflation has rocketed to 50-year highs, causing fiat currency debasement. China is suffering an economic slowdown, hurting global growth.

This environment – while containing more than one element of human tragedy – has all the elements that have historically supported gold. And yet, to the surprise of asset allocators and gold bulls alike, gold has traded sideways throughout the year.

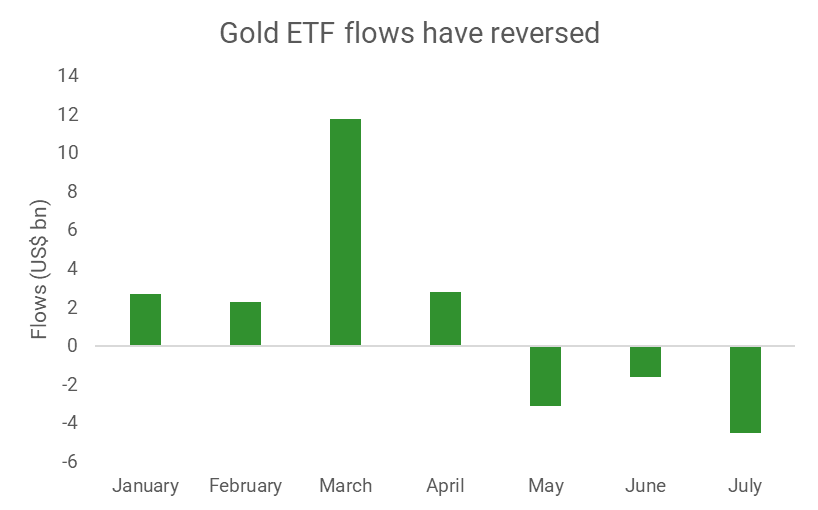

There was a moment in March when gold hit US$2,000 an ounce. As investors panicked at the onset of the Russia-Ukraine war, gold ETFs sucked up record inflows. But since its March peak, gold is down almost 14%. ETF flows have reversed, with global gold ETFs losing US$1.7bn in June and US$4.5bn in July, according to data from the World Gold Council.

So what’s going on?

A rising dollar and the Russian horde

The main answer appears to be that war and inflation are taking a back seat to fears about the Fed raising interest rates. Rising interest rates tend to hurt gold for two main reasons.

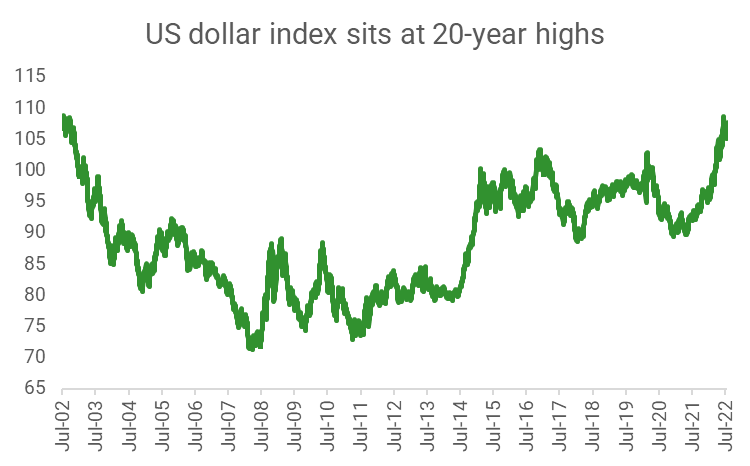

First, when the Fed raises rates, the US dollar gets stronger. Gold, like other commodities, is priced in US dollars. When the US dollar becomes more valuable, it requires fewer dollars to buy gold (i.e. the gold price falls). As of August, the US dollar index sits near 20-year highs.

Second, rising rates increase the appeal of income-paying assets, especially cash. When interest rates rise, investors holding cash get a better deal while taking no risk. As gold pays no income, investors tend to prefer it at times when interest rates go to zero and cash pays no income either – such as during the 2020 COVID-19 pandemic and after the 2008 financial crisis.

Questions about what Russia will do to the gold market are likely another reason for caution. The Russian government sits on one of the world’s largest gold piles. And given that the Russian government has been frozen out of capital markets, some fear that Russia could dump its gold – believed to be worth US$140 billion – to try and raise money.

Finally, inflation expectations are falling in the US, the most important market. The NY Fed’s inflation expectation gauge, which is based on extensive consumer surveys, fell quite substantially in July. Market measures of inflation expectations are falling too, with two-year inflation breakevens – among the most popular measures of near-term inflation – heading down in July and August. Inflation, which causes government-backed currencies to be less valuable, has historically been good for gold.

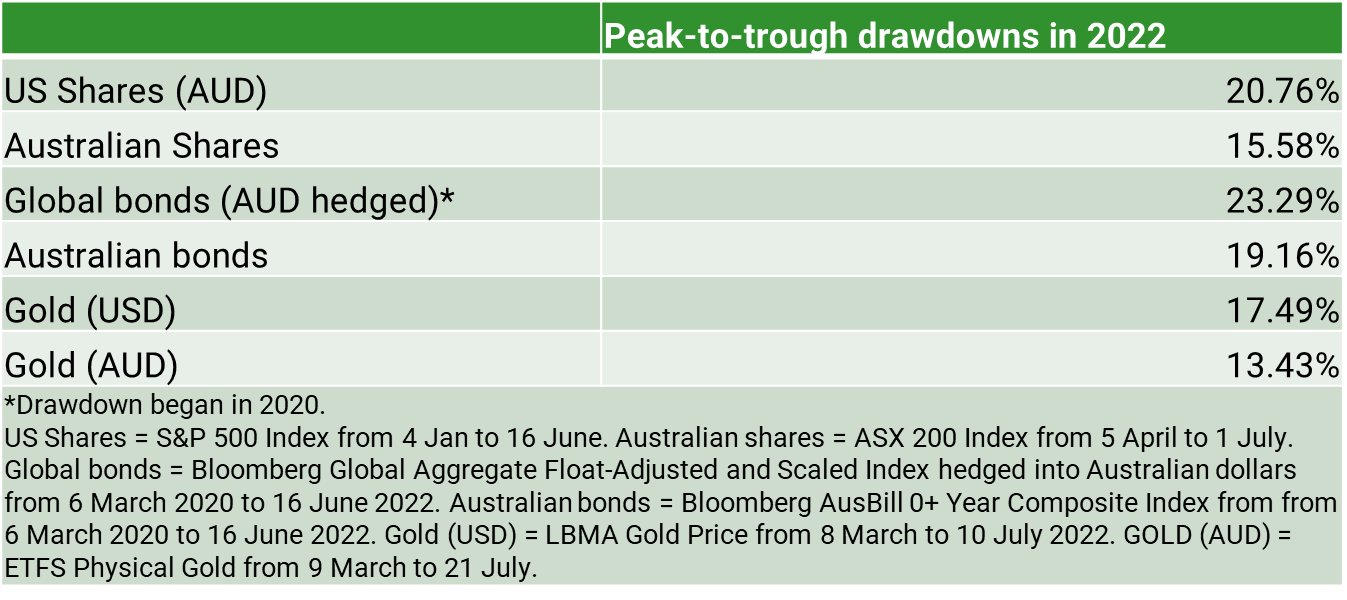

The bull thesis: falling supply and bitcoin volatility

In this setting, gold investors may wonder what the good news is. A major piece is that gold has outperformed other asset classes year-to-date. Headlines have focussed on gold’s 17% peak-to-trough drop from March to August in US dollars. Yet peak-to-troughs for other asset classes important to Australians have been worse or broadly in line with gold’s drop this year. A correction of sorts is not unique to gold.

Some comfort may be taken from the fact that bitcoin has tracked a volatile path. There was a suggestion in some quarters in late 2021 that bitcoin could be replacing gold as an alternative currency and store of value. Mohamed El-Erian, chief economic adviser to Allianz, told the Financial Times in October 2021: “Bitcoin has attracted money away from gold.”

Yet this year’s experience will likely put to bed such fears. Rather than looking like “digital gold”, bitcoin’s rise and fall, rise again and fall again look suspiciously similar to an early-stage technology company. And indeed, bitcoin advocates themselves would argue that a still early-stage technology is precisely what bitcoin is.

Other price support could also come from fundamentals. Mining companies are feeling the squeeze, with the average cost of mining gold – all-in-sustaining costs (AISC) – hitting record highs thanks to rising consumer prices, diesel, and wages. Some miners – such as Newmont – have announced production cuts.

Gold is different to other precious metals like platinum and silver in that its price is less determined by fundamentals. Other factors, such as interest rates and speculation, have a much bigger impact on gold. But supply still affects gold prices, even if to a much lesser extent than other commodities in the short term.

Conclusion: gold may need more time

What this all may mean is that gold may need more time. Poor returns from bonds – and their failure to provide diversification against share market declines this year – have shone a light on commodities like gold.

It’s also worth remembering that gold is one of the only – perhaps the only – assets with a proven track record in times of crisis that does not underperform long term. There are strategies that can outperform gold when stock markets tank, such as exotic derivatives strategies. However these strategies – unlike gold – come with blow-up risks and can sustain long bleeds if held over extended periods.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

1 stock mentioned

Expertise