What's next for exchange-traded funds?

Now the world’s largest exchange-traded fund, with nearly US$595 billion in assets under management, the SPDR S&P 500 ETF Trust marked its 30th anniversary earlier this year.

The ETF itself was born out of the Black Monday financial crisis, which saw the US stock market drop by 20%, its largest-ever single-day fall. In the post-mortem that followed, the US Securities Exchange Commission noted such a vehicle might have minimised the financial calamity. And six years later, the SPDR S&P 500 ETF Trust (ASX: SPY) was launched.

And ever since, ETFs have helped investors navigate market volatility, according to Kathleen Gallagher, State Street Global Advisors’ head of SPDR ETFs Australia and head of model portfolios EMEA and APAC. She recently sat down with me to reflect on the ETF back story while taking a stab at what the future might look like in the space.

How do ETFs help investors minimise volatility?

Gallagher emphasises that the inherent attributes of ETFs provide investors with efficient tools to implement and manage their portfolio decisions. The clue is in the name – because they’re exchange-traded, the asset price is readily available and easily tradeable daily.

“Because it’s available intra-day, you can get in easy and that’s all about the liquidity,” Gallagher says, also highlighting the availability of both primary and secondary markets for buying and selling ETFs.

.png)

And as the market has evolved, investors have also increasingly adopted ETFs as core allocations within their portfolios, recognising the cost advantages this can capture. For your individual investors, the SPDR S&P 500 ETF Trust, gave them the ability to invest in a broad market in just one trade.

How does the current economic and market environment affect ETF demand?

Gallagher has been involved in the ETF space since 2008, around the time of the Global Financial Crisis. Since then, her primary observation has been that whether it’s a bull or bear market, ETFs continue to attract investor money.

Gallagher believes demand has held up largely because of the liquidity rationale for which ETFs were first created, which allows investors to use them with higher conviction.

“It’s become investors’ go-to vehicle when markets are under stress and they need to navigate through the uncertainty,” Gallagher says.

She notes that investor inflows for ETFs are down year-on-year but emphasises they’re still positive. Globally, an additional US$200 billion poured into ETFs between January and the end of April, with Australian ETFs receiving US$2.2 billion of inflows during this period.

“More of those flows are going into what I would consider defensive asset classes, such as fixed income ETFs,” says Gallagher.

Even within equity ETFs, she has also observed a more recent preference for dividend-focused strategies and other factor-based strategies – such as Quality, Value and Minimum Volatility. Quality companies can help clients have the fortitude and resilience needed to weather market storms. Low volatility funds, meanwhile, can help reduce downside participation when markets get choppy, while Dividend yield can help provide investors with access to income when share price returns are challenged.

How has S&P 500 index evolved in the last 30 years, and how might it change in the coming decades?

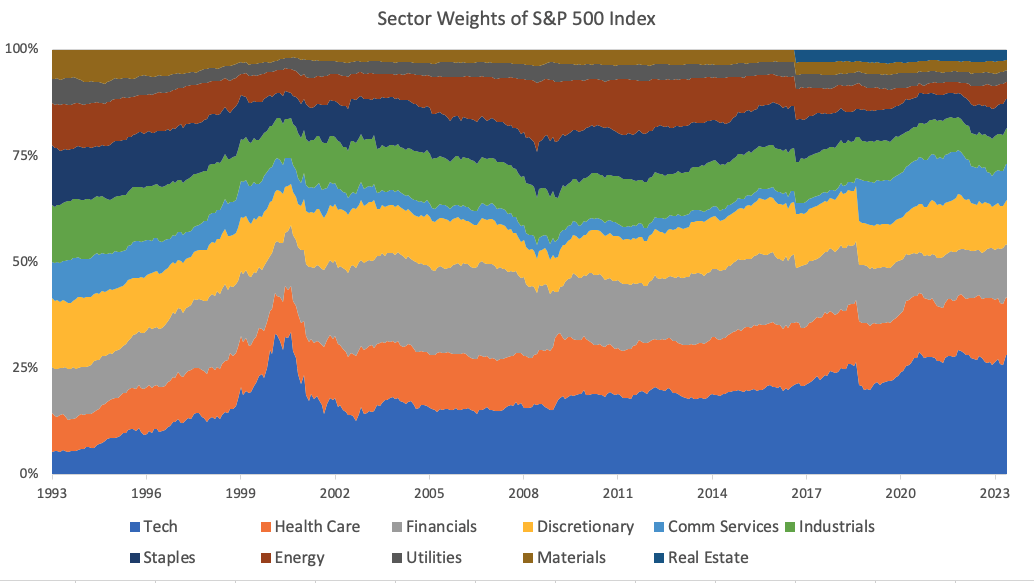

It’s probably unsurprising to learn that the Technology portion of SPY’s stock holdings has seen the biggest shift in the three decades since it launched. In 1993, tech comprised just 5% of the index, and this sector now accounts for just under 30%.

S&P 500 Index sector breakdown - then and now

“I think we’ll see the tech sector continue to grow – we’ve all seen the articles on artificial intelligence,” Gallagher says.

“And I don’t see any reason why health would decline either, based on the demographics and also what we saw during COVID.”

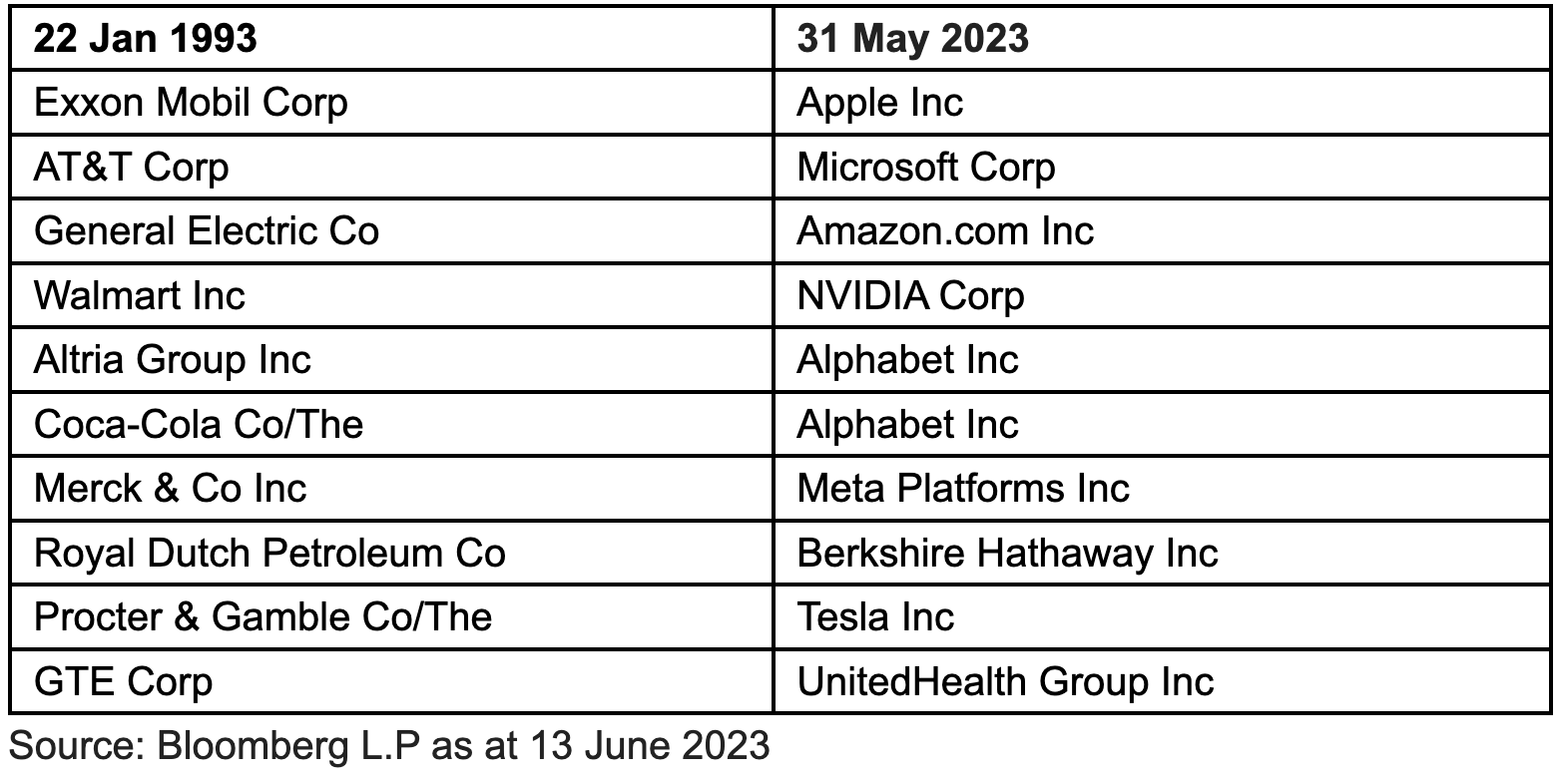

Gallagher also provides a snapshot of how the largest constituents of the index have shifted in the 30 years since SPY launched.

This information should not be considered a recommendation to invest in a particular sector or to buy or sell any security shown. It is not known whether the sectors or securities shown will be profitable in the future.

How has the role of ETFs in retail investor portfolios evolved?

Most investors initially use ETFs for specific tactical exposures, often on the back of professional advice from a financial planner, to invest in harder-to-access areas such as emerging markets.

“But as they learn more about ETFs – and also as the Australian regulatory environment changes – we’ve seen them used more as core allocations and long-term positions,” Gallagher says.

“And as you have more asset classes represented and the funds grow in size, it makes it easier for advisers to select them too.”

What does the future look like for ETF investing?

Gallagher regards the distribution of ETFs – particularly in the online, digital channel – as one of the most prominent areas of disruption in the space.

“Since the launch our SPDR S&P/ASX 200 Fund (STW) and SPDR S&P/ASX 50 Fund (SFY), ETFs in Australia have become one of the most popular ways to invest. Better financial education and improvements in technology have helped make ETFs become more accessible to a broader range of investors including younger Australians who are using digital platforms to invest, ” she says.

And within the products themselves, Gallagher expects to see growing demand for fixed-income ETFs, which comprise only around 12% of the total Australian ETF market. They’ve claimed around half of the total flows into Australian ETFs this year so far, with a similar trend observed in the US.

“I think we’ll see more development in fixed income ETFs, now that the market's changing and there's more yield out there. Investors will want to see more within that range and what they can do with it,” Gallagher says.

She also anticipates continuing investor demand for products slanted toward the environmental, social and governance theme – something that’s also being driven by regulatory changes.

Another area where Gallagher expects to see more development is in "smart beta" – which refers to passive investment strategies that use measures other than market capitalisation to determine weightings in a portfolio. She notes that most smart beta strategies currently focus on providing exposure to one factor or multiple factors, without taking into account changing market conditions.

"The next generation of smart beta multi-factor strategies will likely focus on targeting different factors more dynamically, adapting accordingly to prevailing market conditions,” Gallagher says.

“We could also see more ETFs with multi-asset strategies, that are in effect 'ETFs of ETFs' covering both equity and fixed income asset classes. These are targeted at delivering particular investment outcomes that are suitable for retirement investing.”

The biggest ideas inspire new ones

30 years ago, one ETF inspired the world to invest differently. It still does. Keep innovating with the ETF that started it all. To learn more, visit the State Street Global Advisor website.

1 topic

1 stock mentioned