What’s next for Liontown?

After a year-long pursuit, lithium giant Albemarle has terminated its plans to acquire Liontown Resources (ASX: LTR), citing the “growing complexities” with progressing the transaction.

As for billionaire Gina Rinehart – It’s mission accomplished. And it only cost her a cool $1.3 billion to amass a blocking 19.9% stake in the company.

The withdrawal prompted Liontown shares to enter a trading halt on Monday to “allow for the finalisation of funding associated with the Kathleen Valley Project.”

In this wire – I’ll recap everything you need to know about Liontown now that Albemarle is out of the picture.

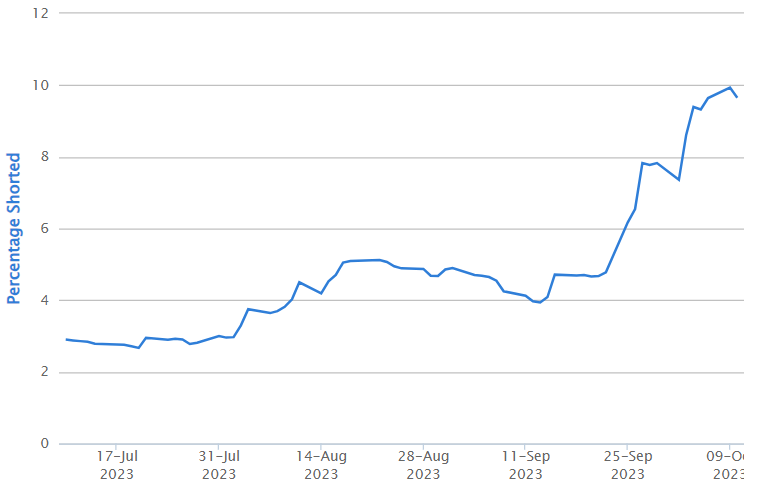

The shorters were right

With Liontown shares hovering around $3.00 throughout September and early October, the growing risk of the takeover collapsing due to Rinehart’s controlling stake presented an attractive opportunity for short sellers.

Short interest in Liontown aggressively climbed to 9.9% last week from around 3.0% in August.

Liontown short interest history (Source: Shortman)

Goodbye anchor

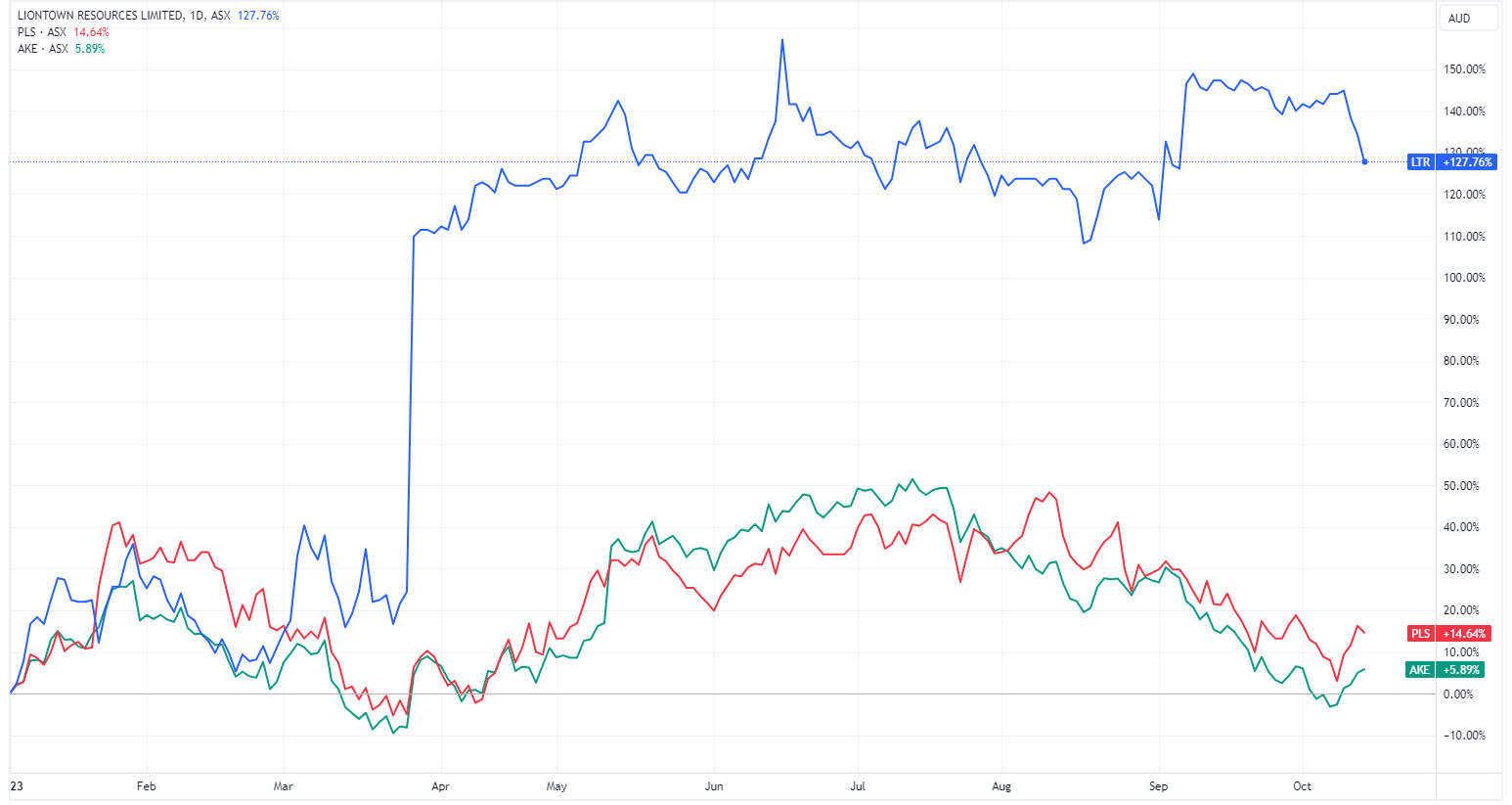

Liontown shares have remained resilient amid broader lithium market weakness, hovering around the $3.00 thanks to Albemarle’s takeover offer. However, with the bid withdrawn, the stock now faces significant uncertainty.

Goldman Sachs downgraded the stock on Monday to a Sell rating with a $1.85 target price (from $1.35). The new target price reflects a downside of 33.7% from Friday’s close of $2.79.

Finalisation of funding

Liontown shares will remain halted until Wednesday, 18 October to “allow for the finalisation of funding associated with the Kathleen Valley Project.”

The company is expected to raise both debt and equity to fund its development, according to the Financial Review.

A Kathleen Valley project update from 29 September noted the following key estimates:

- Timing: On schedule to commence first production of spodumene by mid-2024

- Cost: All major construction and mining contracts has enabled finalised estimates of Project capital costs to first production of $951 million, up 6% from the $895 million estimate in January 2023

- Cost per tonne: An average cash cost expected to be $651 per SC6 tonne over the initial 10-years of production

- Funding: “Well advanced in discussions with a syndicate of commercial banks and government credit agencies to obtain the funding … The size of the debt package is yet to be finally determined but, at a minimum, it is anticipated to cover the $450 million required to fund the capital costs …”

It’s worth noting that back in January, Liontown said it had spent $73 million on the Project to date, with $685 million of remaining funds comprising $385 million in existing cash reserves and $300 million via a debt facility.

Food for thought

Here are a few factors to think about as Liontown works towards new funding and a potential capital raise.

Who's next: What does Albemarle do now? Are there any other names on its shopping list? The company wanted Liontown’s Kathleen Valley as feedstock for its downstream lithium hydroxide processing plant in Kemerton, Western Australia. Will it continue to look for hard rock plays around the area?

What’s Gina up to: On 11 October, Rinehart's Hancock Prospecting said it was seeking a “prominent influence in Liontown’s future.” Will she buy the whole thing? Play a major role in project funding or development? Or maybe the plan was to help keep the assets in Australian hands?

Blowout costs and operational headwinds: I’d go as far as calling 2023 a ‘cost of mining crisis’. There’s been no shortage of capex revisions in the resource sector. Could Liontown face more challenges in bringing Kathleen Valley online?

Mind the gap: The $3.00 offer has kept Liontown shares relatively sheltered from broader market volatility and falling lithium prices. So what happens when the offer disappears?

Liontown vs. Allkem and Pilbara Minerals year-to-date chart (Source: TradingView)

Intraday volatility: Liontown is the fourth most shorted stock on the ASX. So what happens if the stock faces substantial downward pressure when it resumes trading on Wednesday? Could it rally from session lows as short covering and dip buying dominates the tape? Brace for a volatile Wednesday.

2 topics

1 stock mentioned