What's priced in?

Key Points:

• In this insight, we outline what investment environment we think markets are currently pricing.

• Bond and cash markets are suggesting a slowdown in growth and inflation over the next year or so, which is consistent with the consensus of economists and our internal view.

• Equity markets expect a more benign outcome with consensus estimates for short term earnings far stronger than what would be expected if there was a recession. Over the longer term, equity markets are pricing relatively robust earnings growth in the US, and much weaker outcomes in Europe and Japan, consistent with the post Financial Crisis experience.

In this month’s Market Insight, we dive into market pricing versus current consensus and our own expectations, outlining what we think various markets are expecting in the year ahead and where opportunity may potentially lay.

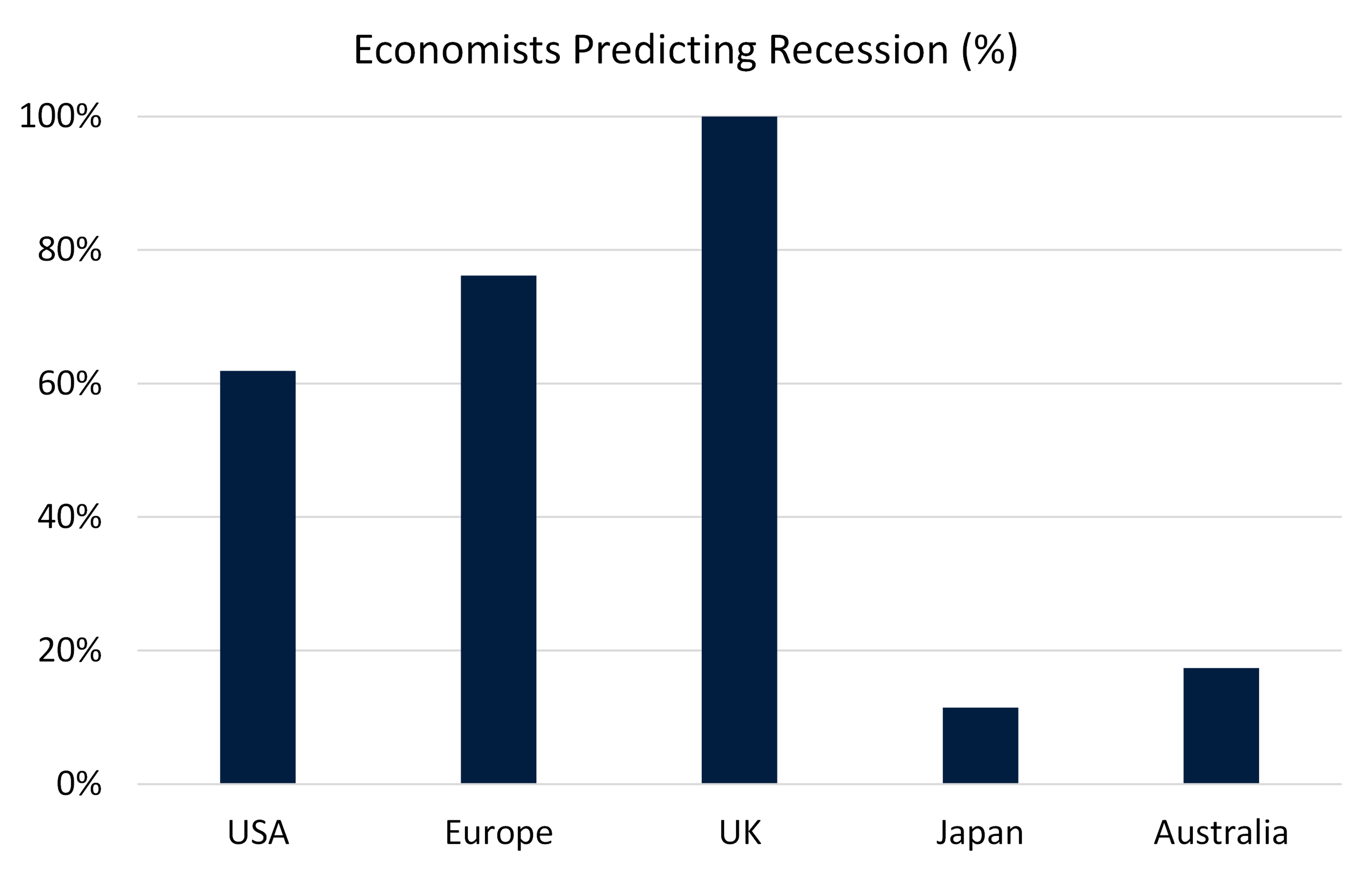

For most of last year we anticipated that the US and most other major developed economies would suffer a recession at some point this year. Over time, most economists have shifted towards this view, with around 60% of economists now forecasting a US recession according to Refinitiv. An even greater number expect a recession in Europe and the UK (see below chart). Interestingly, Australia and Japan have a relatively low forecast risk of recession. Australia’s expected resilience likely reflects strong China linkages (no economist is forecasting much pain for China’s economy this year) and a more moderate central bank tightening cycle. The Bank of Japan has yet to raise rates, likely driving its peculiar outcome - peculiar because the Japanese economy has shrunk in 19 of the 51 quarters since 2010, so the probability should be high from a baseline perspective.

Source: Drummond Capital Partners, Refinitiv DataStream

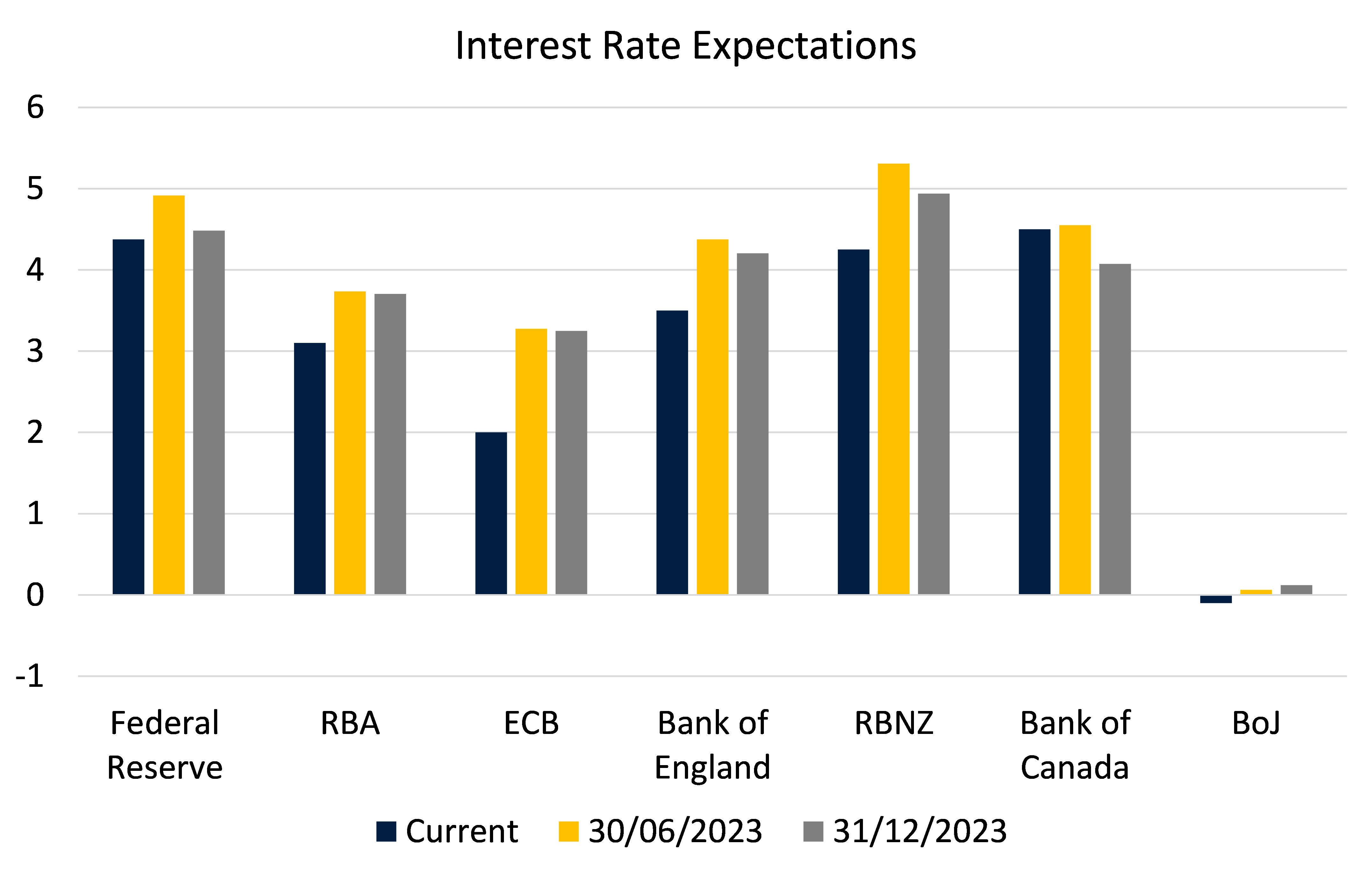

Interest Rates

With apparently better than even odds of a recession, most would expect markets to be pricing cuts to policy interest rates in the year ahead. However, derivative markets are pricing only minor cuts in central bank interest rates in 2023. More meaningful cuts are expected in 2024, with the Atlanta Fed’s market probability tracker showing a central estimate of a Fed Funds Rate below 3% by the end of that year. This gap between interest rate hikes and eventual cuts isn’t unusual, normally central banks will leave policy rates elevated for a while before the slowdown in growth is apparent enough to warrant policy easing.

Source: Drummond Capital Partners, Refinitiv DataStream

Long term bond markets are effectively flagging a very high chance of a recession. The yield curve (the difference between two and ten year bond yields) in the US and other major economies is heavily inverted – meaning that longer term bonds have a lower yield than shorter term bonds. Historically, this has been a very effective predictor of a recession as it implies the market believes that central banks will cut interest rates and/or inflation and growth will fall. This is consistent with the medium term estimated pricing of cash rates mentioned above.

The relative yield between inflation protected bonds and nominal bonds also indicates the bond market’s implied expectation for future inflation. After rising to multi-decade levels in early last year, the market’s expectation of future inflation has become much more benign, falling towards the post Financial Crisis average. We think this is probably a little optimistic. While inflation looks to have peaked, this is largely based on falling goods prices. The services side of inflation remains quite elevated.

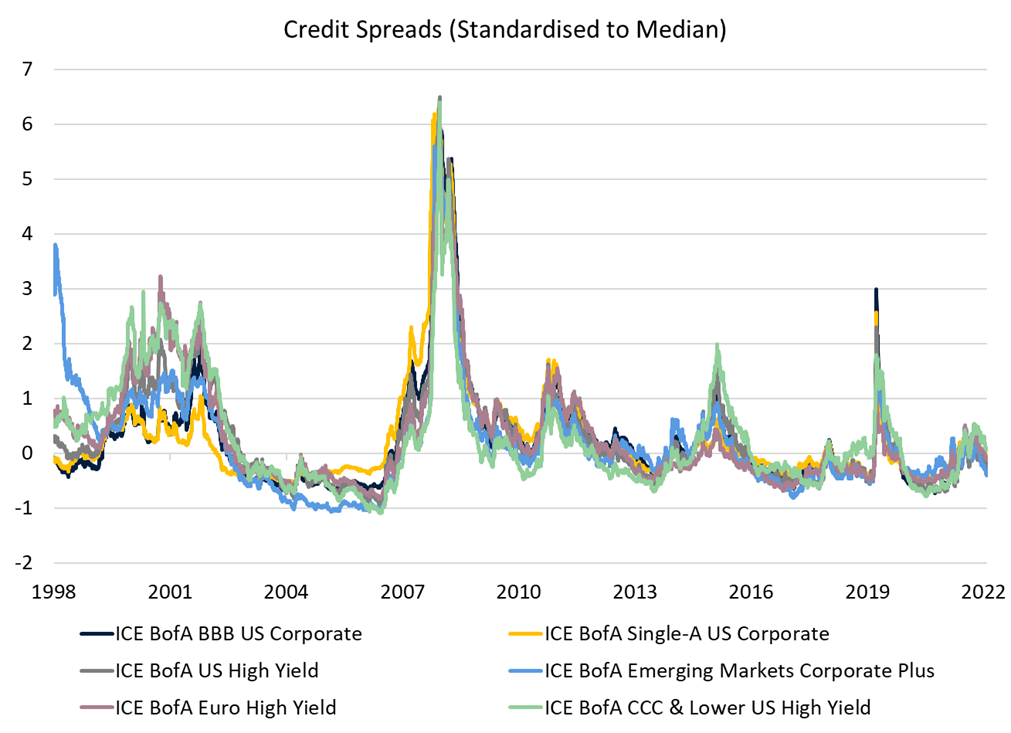

Credit

Conversely, credit markets seem to be signalling a relatively benign outlook. Credit spreads (the spread corporates need to pay over government bond yields to finance themselves in public markets), are very close to long run median levels. Historically during recessions they have spiked meaningfully (see below). Assuming a 35% recovery rate, the implied default rate in the US high yield market is around 6.5% - above the long-term actual average default rate of around 4% (meaning investors will be compensated by a “normal” amount if defaults remain “normal”), but below the ~10% level seen in recent recessions.

Source: Drummond Capital Partners, FRED

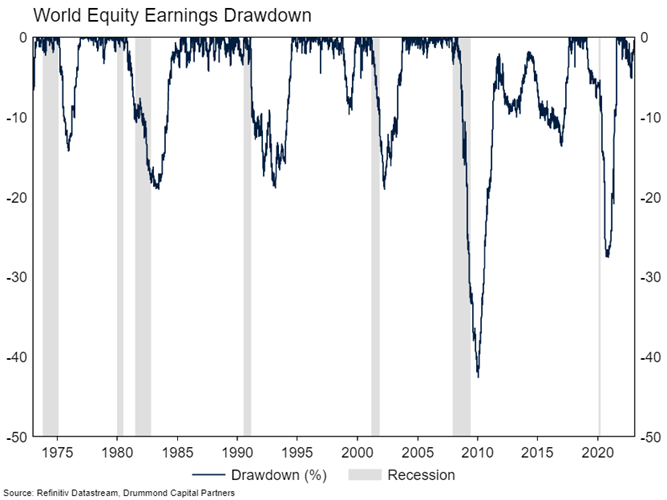

Equities

Recessions tend to feature a decline in corporate earnings as sales fall (see below), normally in the order of 15% to 30%. The Financial Crisis was much larger due to the drag from an overleveraged financial sector. Currently, consensus expects global earnings to grow around 2% this year and 9% next year - noting that often reported earnings fall late or after the recession has officially ended. This year’s estimate is certainly low by historic standards, but nowhere near pricing a recession. Next year’s estimate is above the historic average and is likely optimistic even if central banks achieve a soft landing.

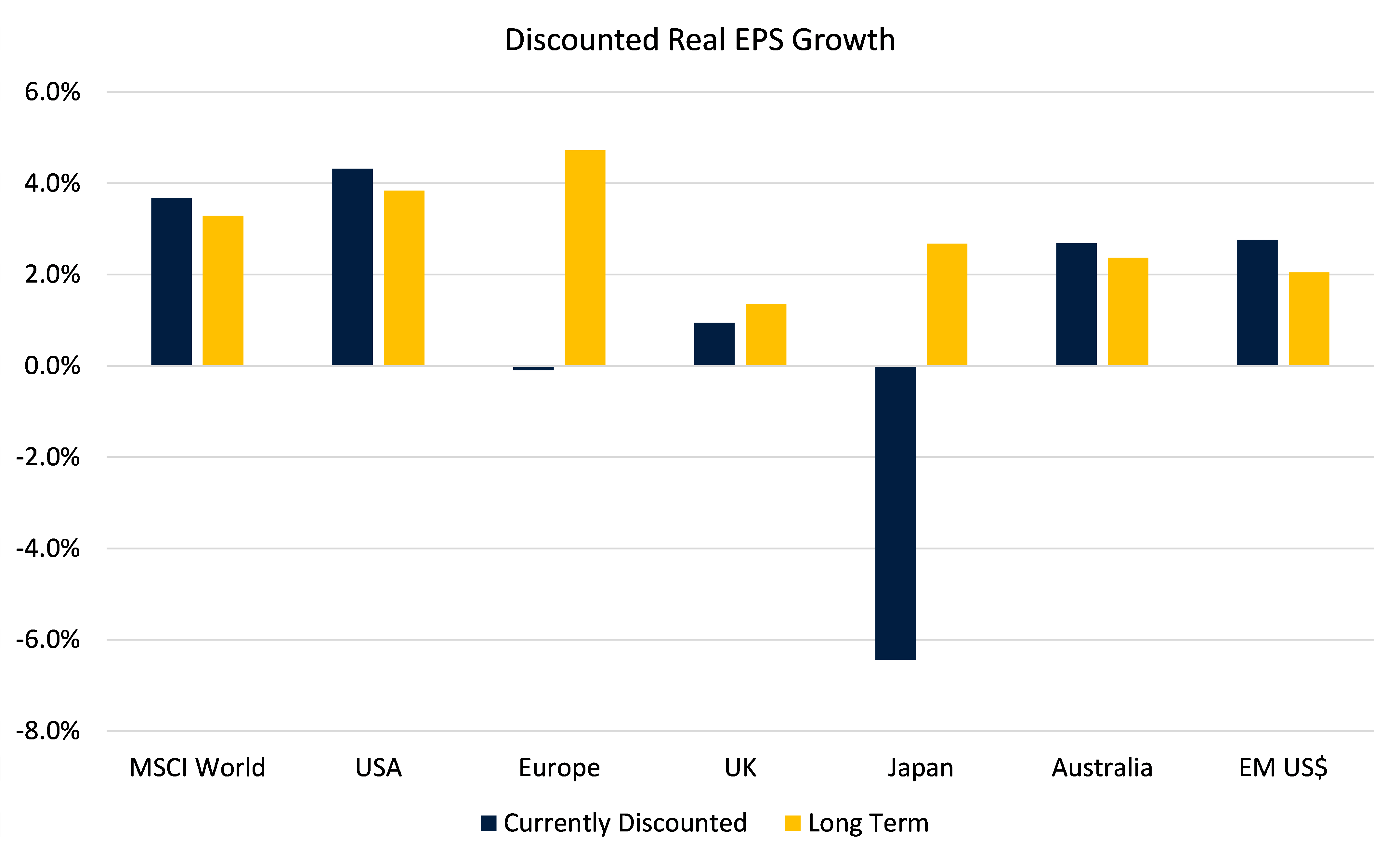

It is also possible to back out what earnings growth is implied by current valuations by building a discount cash flow model which assumes long term interest rates are fair value and then solving for what rate of earnings growth makes the model “add up”. The figure below shows the outcome of that model and compares the forward-looking estimate with the long term (post 1973 DM and post 1995 EM) realised real earnings for each major market.

The biggest standout from the analysis is the expected persistence in the post Financial Crisis gap between earnings growth in the US and Europe, UK and Japan. Real implied earnings growth in the USA, Australia and emerging markets is higher than the long-term average, which seems improbable given the slowdown in potential economic growth in these regions due to aging populations and weak productivity growth.

Source: Drummond Capital Partners, Refinitiv DataStream

The net of the above suggests at face value that equity markets are not pricing a recession. Alternatively, they may simply react differently this time around given how well flagged the recession actually is. Perhaps the market is looking through a forthcoming short period of pain on the expectation that central banks will be able to quickly and easily reverse course later this year, a similar outcome to the 2015-2018 Fed hiking cycle. Given the starting point of inflation, weakness in growth already evident, and the larger magnitude of the tightening cycle, we think this scenario is unlikely, but it isn’t impossible.

Volatility

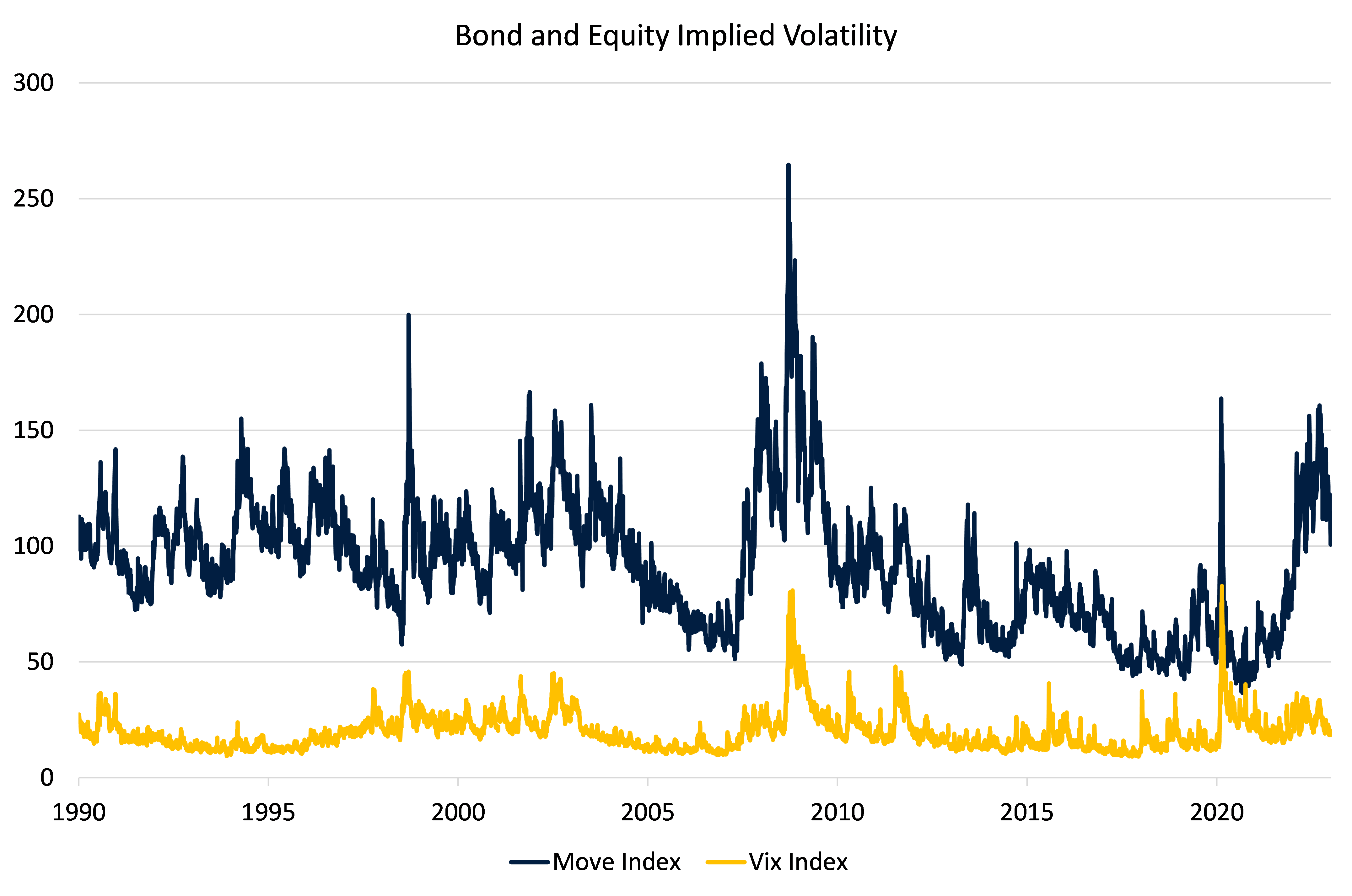

In line with their respective underlying markets, options markets are also showing quite a dispersion between implied outcomes. Implied equity volatility is slightly below average, meaning the cost to insure an equity portfolio over the very short term isn’t particularly high by historic standards. Interestingly, the cost to buy protection (or calls, to participate in market upside for that matter) over longer horizons is much closer to the long term average, implying that while equity option markets are not particularly worried about the next month or so, the level of worry about the next year is roughly normal. Implied bond volatility remains elevated by post Financial Crisis standards (where central banks have been more active in manipulating longer term interest rates via quantitative easing), though has fallen sharply from late last year. This is entirely consistent with the underlying bond market having faced the largest sell off in many decades over this period.

Source: Drummond Capital Partners, Refinitiv DataStream

Summary

Based on the above, it seems clear that equity and cash/bond markets are expecting pretty different outcomes. In our view, equity markets are underappreciating the risk of a recession and are pricing an outcome that involves a normalisation in inflation, a reduction in interest rates and very little pain (from an earnings perspective). Bond markets seem more worried about the future, though one could argue that their pricing could be consistent with a soft landing where central banks solve the inflation problem which then allows them to cut interest rates (even if there is no economic pain).

Consistent with our expectation of a recession this year, our portfolios remain significantly underweight equities. Despite the rally in equity markets through January, little has changed from a fundamental perspective to change that view. As always, we will monitor the outlook in case that changes and adjust the portfolios if appropriate.

1 topic