What to expect from the Fed this financial year

Despite reduced Fed rate cut expectations for this year, the outlook for risk assets remains positive. The same economic strength that is delaying rate cuts should drive robust earnings growth, securing a still solid backdrop for equities, while macro resilience should ensure fixed income credit spreads do not widen meaningfully from their historically tight levels. Provided the economic backdrop remains robust, investors do not need to fear a delayed and modest rate cutting cycle.

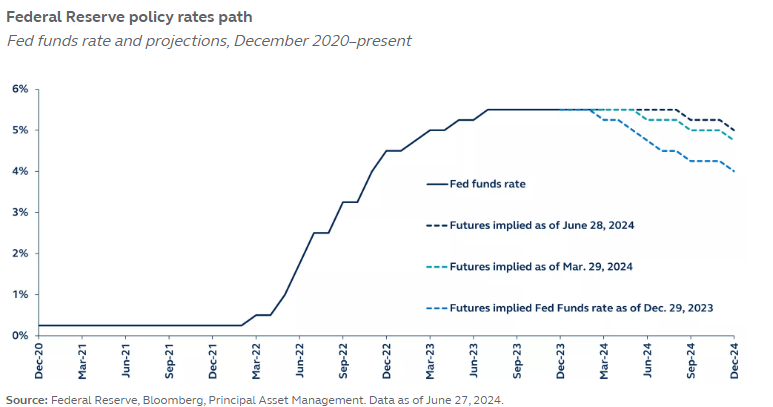

Central banks fueled the market rally earlier this year as they embraced optimism that inflation could decelerate without sacrificing growth. Now, as the Fed confronts the harsh reality that resilient economic activity has cultivated sticky, stubborn inflation, reducing rate cut expectations, what lies in store for markets?

The Fed's decision to hold off on rate cuts is supported by resilient economic growth keeping inflation above the 2% target. That same economic strength that has delayed Fed cuts should support a positive backdrop for corporate earnings, ensuring that the set-up for equities remains constructive. Indeed, Historically, extended periods without rate changes, such as the 1995-1996 Fed pause, have been positive for stocks. In the current cycle, solid economic growth should support earnings growth and broaden risk appetite, creating opportunities beyond the U.S. tech sector.

Similarly, fixed income has performed strongly despite significant repricing in rate expectations in 2024. Credit spreads are near historic lows, yet macro resilience should ensure a gradual rise in defaults rather than a sudden spike, meaning spreads are unlikely to widen significantly from their current levels. Furthermore, as the yield generated from fixed income today is markedly higher than a few years ago, investor interest in fixed income is unlikely to diminish quickly.

Markets may have lost some of their gleam and unrestrained optimism has faded. Yet, the still robust macro backdrop, even without imminent rate cuts, should provide an almost perfect set-up for a risk-on environment.

For more insights on the setup for markets in the second half of the year, and the risks to the outlook, read Shifting sands: The economy, the Fed, and market dynamics in 2024.