When will the pendulum finally swing for lithium prices? 2028, 2029, or 2030?

Many Aussie investors who were caught by the Lithium bug back in 2021 and 2022 are likely wondering when the lithium stocks they’ve stored safely and securely in their proverbial investing “bottom drawer” are going to finally make a comeback.

Research reports released this week from two of the biggest and most respected brokers in the business – and who follow the lithium story very closely – may hold the answer. It’s basically all about supply and demand (isn’t it always!?), and when these factors are likely to cause the lithium market to swing back to a deficit.

Cuts helpful, but not enough

In a research report released yesterday titled “DataDig: Are Li cuts enough?”, major broker Morgan Stanley had this to say about recent supply cuts from Australian and Chinese lithium minerals producers:

Around 37.7kt lithium carbonate equivalent (“LCE”) of global supply has been removed due to Australian production cuts including:

- Mineral Resources (ASX: MIN): Bald Hill placed into care and maintenance (approx. -7.5kt LCE)

- Pilbara Minerals (ASX: PLS): Announced it would slow production at Pilgangoora (approx. -27kt LCE)

- Liontown Resources (ASX: LTR): Announced a slower ramp up of production at Kathleen Valley (approx. -3.5kt LCE)

- Chinese production on the other hand continued to rise in October – despite the world’s largest EV battery manufacturer Contemporary Amperex Technology Co. Limited (CATL) announcing it would cut production at its Jiangxi Province lepidolite mines.

On that last point, it’s worth noting CATL’s announcement in September sparked a substantial rally in local and international lithium stocks. In many cases, that rally has nearly completely faded, with several ASX lithium stocks in particular hitting new bear market lows this week.

This is likely because as much as Australian producers must cut production that is borderline economic at present low prices, it appears Chinese producers don’t face the same economic realities. So much so, that Morgan Stanley now forecasts the net impact on global lithium supply for full year 2024 and forecast for 2025 is going to be negligible-to-only-modest, respectively.

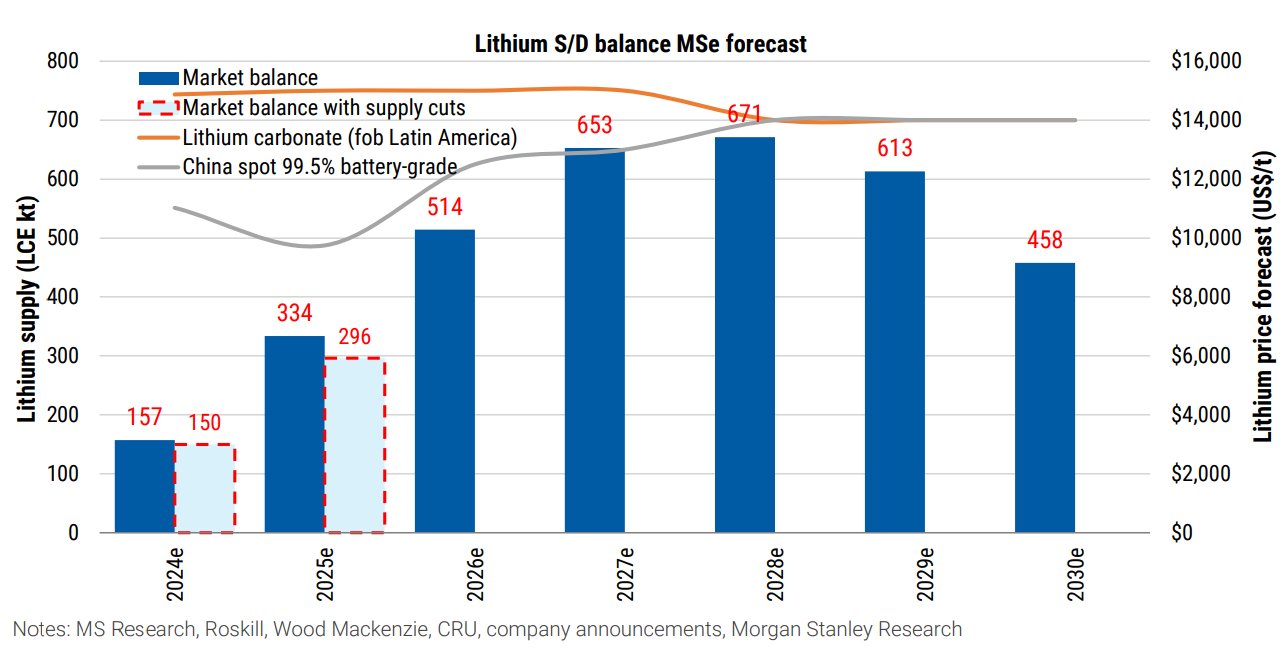

The broker forecasts the global lithium market surplus (i.e., supply will be greater than demand) will dip just 4.5% from 157kt LCE to 150kt LCE in 2024, and 11.3% from 334kt LCE to 296kt LCE in 2025. In short, Morgan Stanley is forecasting that the glut of lithium production in 2025 will be smaller as a result of Australian production cuts, but that it will still be substantially larger than it was in 2024.

The broker believes that even deeper production cuts are required to balance the market. However, it also suggests that even if prices do recover due to smaller surpluses, there remains the risk that mothballed supply “could easily restart” and kill such a rally. Morgan Stanley also flags concerns about the potential for softer Chinese EV production as a result of new tariffs introduced by the USA.

When will the global lithium market swing back to a deficit?

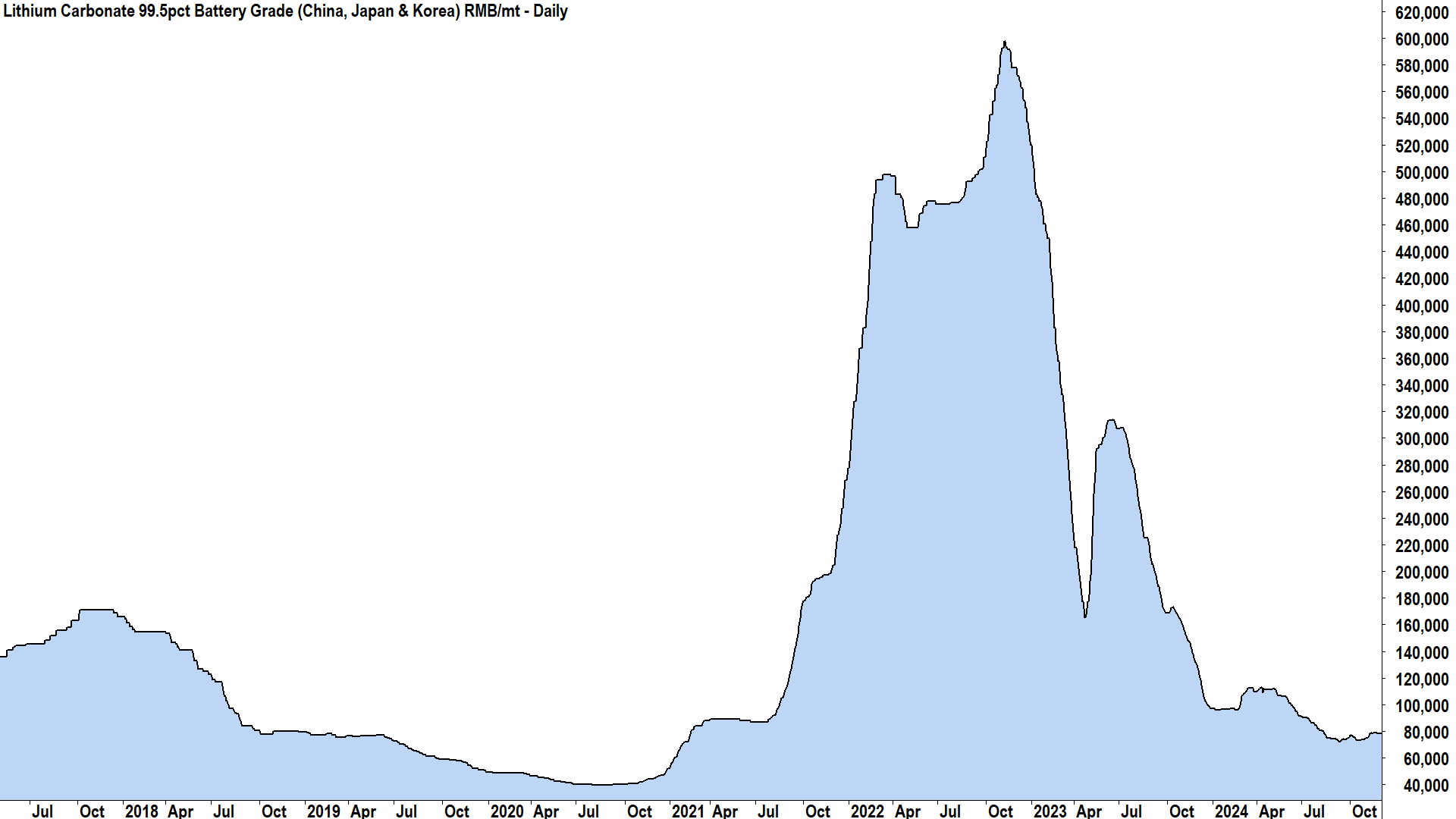

This is the million-dollar question for lithium bulls! History suggests there’s a direct relationship between global lithium market deficits and bull markets in lithium minerals prices. Similarly, it also shows that during global lithium market surpluses, lithium minerals prices generally experienced withering bear markets.

Supply versus demand equals price. It’s the first tenet of economics, and therefore it’s no surprise what’s playing out in the lithium market right now.

%20RMB-t%20daily%20chart.%20Source%20Carl%20Capolingua%20&%20SMM.png)

In a research report released on Monday titled “Critical Minerals Chronicle Lithium producers musical chairs” Macquarie also considered the situation in the global lithium market. I have more detailed analysis on their views about market pricing and their ASX lithium stock coverage here.

One item not covered in my last article that's more consistent with Morgan Stanley’s report, is the topic of when the global lithium market will again return to deficit – and therefore potentially finally provide some relief to long suffering ASX lithium investors.

Macquarie is also modelling a surplus in the global lithium minerals market in 2024 and 2025, to the tune of 62kt LCE and 120kt LCE respectively. These numbers are significantly lower than Morgan Stanley’s forecasts, but confirm a likely surplus nonetheless.

If we look at each brokers’ longer term forecast of surplus-deficits, we can begin to understand when the lithium minerals market might finally rebalance, and therefore perhaps when lithium minerals prices might finally turn around.

Macquarie’s Global Lithium Market Balance Forecast

This comprehensive schedule of lithium supply and demand factors including reuse and recycling, provides investors with an excellent insight into the global lithium market past, present, and future. I have added some colour to Macquarie’s original Figure to highlight how global lithium market surpluses correlated to bear markets in lithium minerals prices in 2018-2020 and more recently in 2023-2024, and how deficits correlated with the 2021-2022 bull market (compare with the long term chart of lithium carbonate I provided above).

The bad news for lithium bulls is that Macquarie is forecasting a growing surplus in 2025 (120kt LCE). The good news is that 2025 is likely to be a peak surplus year, with surpluses forecast to diminish steadily to just 1kt LCE by 2028. That’s as far out as the broker’s estimates go, unfortunately, but I suggest the trend is likely one’s friend from there.

Morgan Stanley’s Global Lithium Market Balance Forecast

This one is only bad news lithium bulls, I'm afraid. Morgan Stanley’s modelling is clearly far more bearish for lithium prices as it proposes much larger global lithium minerals surpluses generally, but also that those surpluses will likely persist into the next decade.

Ultimately this is what makes a market. Different analysts/investors with different views. They vote with their capital on those views and the demand and supply of capital this creates is what moves global asset prices. It’s up to you which view you choose to believe, and how to allocate your capital accordingly.

Macquarie and Morgan Stanley’s top ASX lithium picks

On that last point, how to allocate your capital accordingly, it might interest you to note Morgan Stanley’s and Macquarie’s preferred ASX lithium stocks. Given current circumstances, perhaps it's no surprise that there’s a very narrow range to choose from.

Morgan Stanley prefers Mineral Resources as its only OVERWEIGHT rated lithium stock. The broker notes current weak lithium prices and outlook are already “priced in” to MIN’s share price. Also, that the company’s balance sheet risk has been alleviated by the recent sale of its gas assets and it has an attractive forecast free cash flow yield of 13% for FY26. Morgan Stanley’s price target for MIN is $58 which implies around 72% upside from yesterday’s closing price of $33.57.

(Note: Morgan Stanley is currently EQUAL-WEIGHT on Pilbara Minerals, price target $3, and UNDERWEIGHT on IGO (ASX: IGO), price target $5)

Macquarie on the other hand, prefers Patriot Battery Metals (ASX: PMT) as its only OUTPERFORM rate lithium stock. The broker believes the company’s Shaakichiuwaanaan Project has the potential to be the fourth largest hard-rock lithium mine globally, and this likely makes the company a prime takeover target. Macquarie presently has a price target for PMT of $0.90 which implies around 275% upside from yesterday’s closing price of $0.24

(Note: Macquarie is currently NEUTRAL on Pilbara Minerals, price target $2.80; NEUTRAL on IGO, price target $5.60; and UNDERPERFORM on Liontown Resources, price target $0.60)

This article first appeared on Market Index on Thursday 28 November 2024.

5 topics

5 stocks mentioned