Where Auscap sees value in the unloved sectors of the ASX

Tuesday's interest rate hike by the RBA is just the latest illustration of the persistence of heightened inflation, both at home and abroad.

But Auscap Asset Management CIO Tim Carleton remains upbeat, emphasising his view that core inflation in the US has peaked and is declining. He reflected on the current global macro environment, his outlook, and what these factors mean for Australian equity investors in a recent webinar.

Carleton discussed some of the primary global inflation indicators whose effects are now starting to unwind, including:

- Soft commodities, whose prices have been rallying since mid-2020.

- Automotive prices (for both new and used vehicles) particularly in the US.

- Shipping costs, which are now back to 2020 levels.

But some big areas are still driving inflation, notably housing and employment levels. On the first of these, historic lows in residential vacancy rates in 2021 and 2022 drove up rental prices. Carleton noted that US vacancy rates, which are at 40-year lows, remain problematic.

“This is potentially the cause of ongoing inflation but currently, rents look like they have gone sideways for the last 10 months. If that remains the case, we expect inflation that’s coming from rising costs of shelter to dissipate over time,” he said.

And though the US jobs market remains at its tightest level in decades, Carleton notes this is despite the workforce participation rate gradually rising.

“The good news from an inflation perspective is that we are seeing a corresponding decline in wage growth, which will ease pressure on the Federal Reserve to continue to lift rates,” Carleton said.

What does this mean for stock markets?

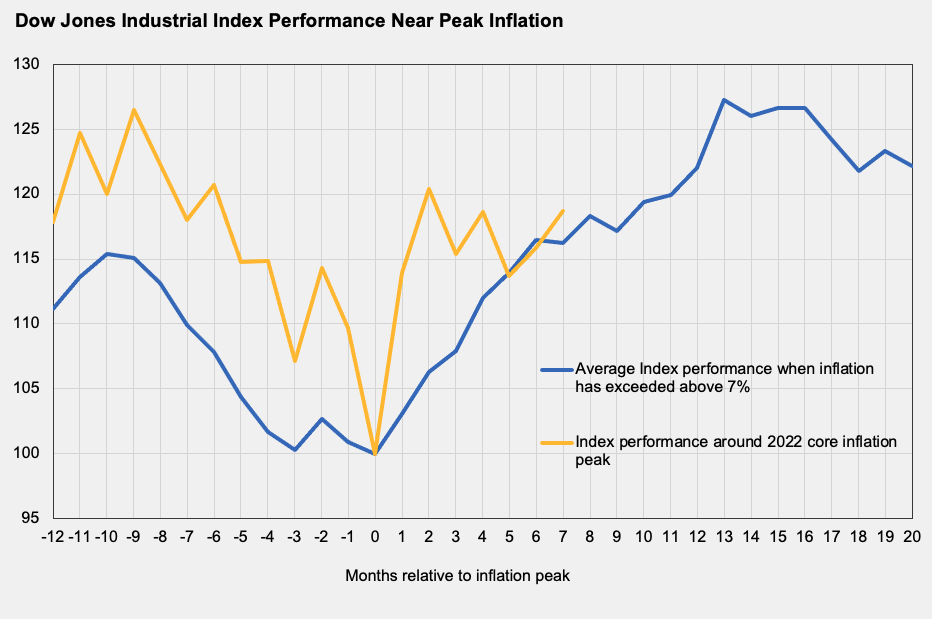

Carleton emphasised the historical correlation between poor US equity market performance and inflation of more than 7%, as shown in the chart below.

“History suggests that if inflation continues to dissipate, markets may well grind higher,” he said.

From a broader economic perspective, Carleton acknowledged that the US bond market is signalling a strong likelihood of a recession. But he emphasised the situation in Australia is more mixed.

On the local front, rental inflation is also an area of concern, with vacancy rates in our four major cities at decade lows.

“And we do expect to see upward pressure on wages, which is inflationary, so there are two meaningful positive contributors to the inflation figure at the moment, as much as there are things that will be pushing it lower,” Carleton said.

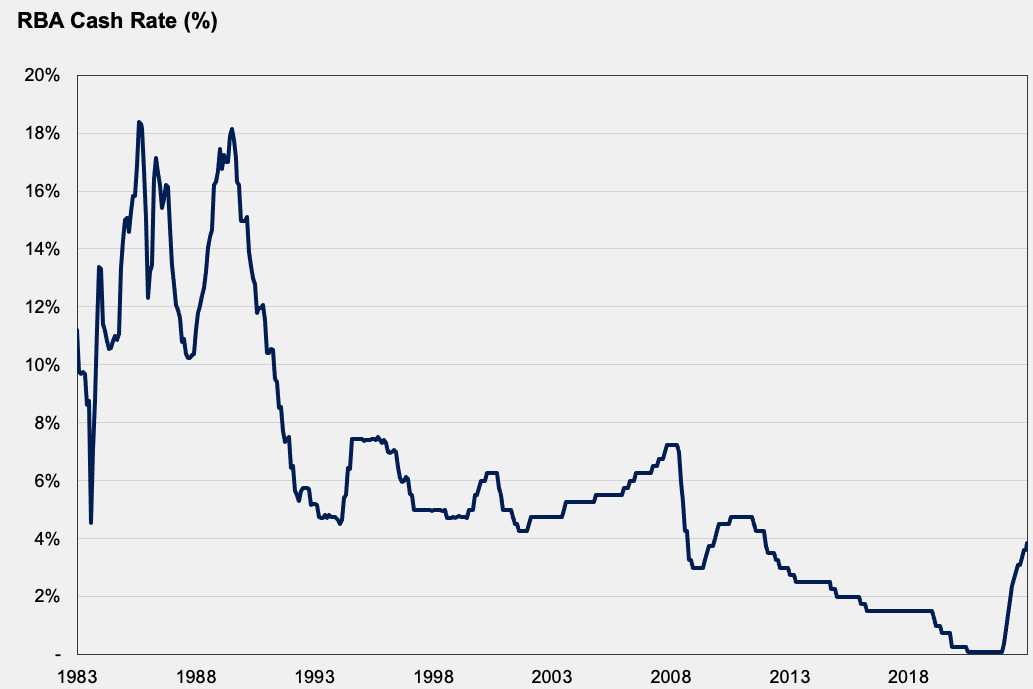

Even in the context of the latest rate rise, which sees our 4.1% cash rate at its highest point in a decade, it remains low in historical terms.

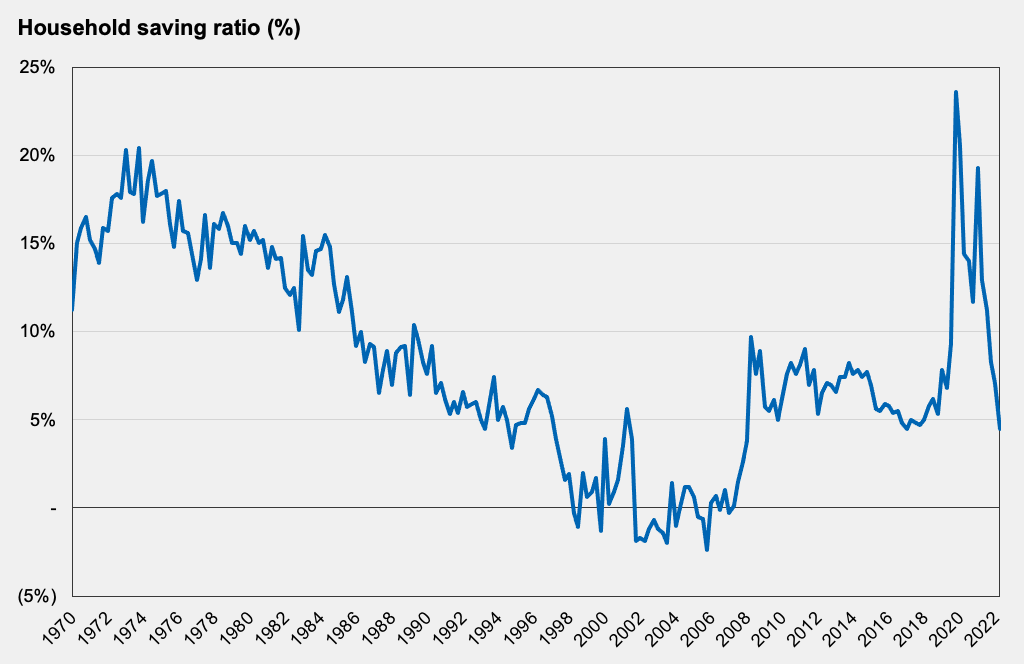

Carleton believes Australia’s economy is in far better shape than many others, attributing this largely to the “remarkable job of saving” done by our citizens since the GFC and again during the COVID downturn.

“Households are still earning more than they are consuming and have a positive savings ratio...yes, it’s come down from elevated levels, but it remains positive,” he said.

Carleton also noted the financial press’s preoccupation with Australian household debt, which remains elevated relative to historical levels.

“But that doesn’t take into account what’s happened to household deposits over time or the fact that many mortgage holders today have an offset account, whereas historically they may have just paid down the gross level of debt,” he said.

“Australian households today have net leverage that was last seen back in 2003 when interest rates were significantly higher than where they are today. So, the outlook from a leverage perspective is perhaps less negative than many people would assume.”

He also emphasised the importance of recognising that 65% of Australian households don’t have a mortgage and are benefiting as interest rates increase.

Rising levels of migration are another positive contributor Carleton believes will improve the inflation outlook. Net migration is already ahead of pre-COVID levels and is tipped to exceed 400,000 immigrants in FY2023.

“That adds to demand and consumption in the broader market and will be playing a part in reducing the effects of rising interest rates on overall consumption,” he said.

The terms of trade boom

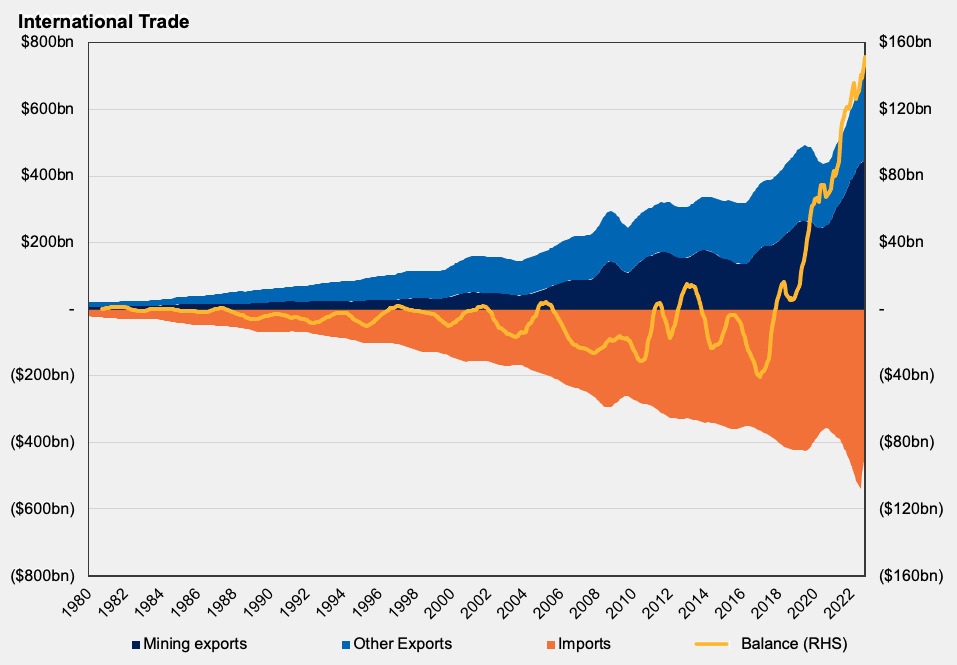

Though the financial press focused heavily on some parts of the commodities space amid strong iron ore and lithium prices, the “unprecedented terms of trade boom” we’re currently experiencing is largely ignored.

“To put this in context, the boom we saw in the immediate aftermath of the GFC peaked with our terms of trade producing about a $15 billion terms of trade surplus,” Carleton said.

“At the moment, we are running north of $150 billion per annum – more than 10 times the size of that previous boom, so it’s very significant.”

This is just one of several reasons Carleton believes Australia will avoid a recession – alongside the Federal Government’s ongoing fiscal expansion and our bond market that is vastly different to that of the US.

Are stocks expensive?

At current levels, Carleton described the cyclically adjusted price-to-earnings ratio of Australian equities as fairly valued, contrasting with the expensive and cheap valuations in the US and UK, respectively.

How is Auscap positioned?

With its value conscious approach, Auscap seeks to take advantage of situations where market sentiment is exceptionally bearish. In line with this, the Consumer Discretionary sector is one that Carleton emphasises, noting the fund holds several “decent positions” in retail.

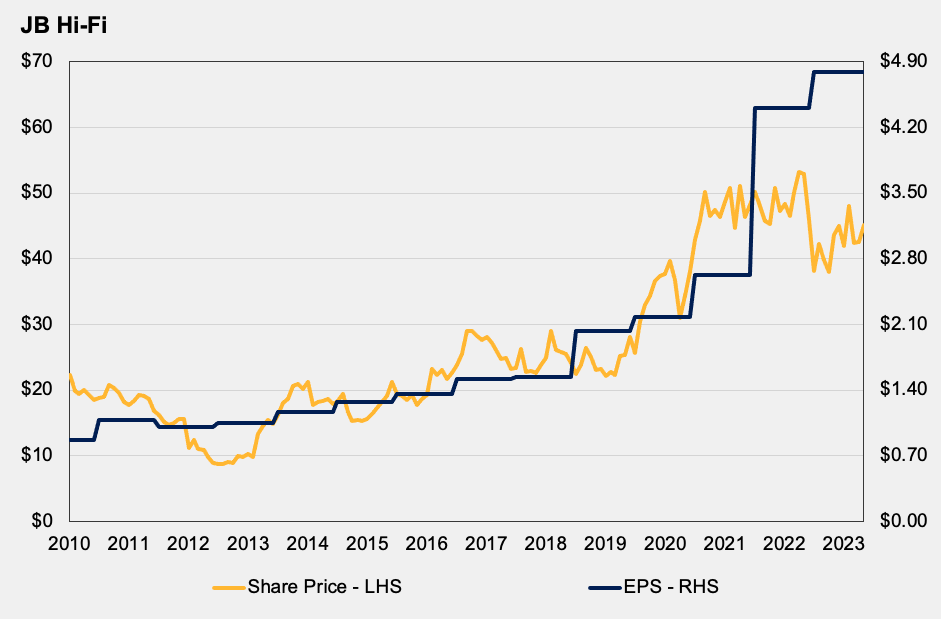

JB HiFi (ASX: JBH)

Describing this as “one of the best quality retailers in the market,” Carleton pointed to JBH as an example of a stock that has been underestimated by many investors.

“Analysts have a material decline in earnings for this company on a go-forward basis, but we are more positive than the broader analyst community,” Carleton said.

Though he accepts a pullback from current earnings is almost certain, he emphasised that this is already reflected in the current share price.

“From this point, if the news is incrementally positive, we think you’re getting a very attractive opportunity to buy into one of the best quality retailers in the market.”

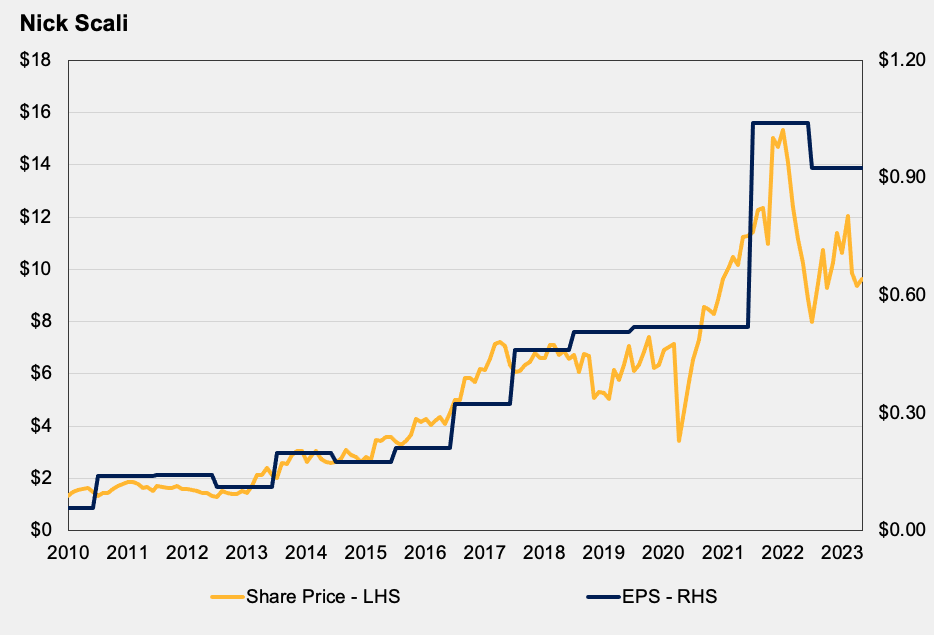

Nick Scali (ASX: NCK)

Another consumer discretionary stock, Carleton said he expects the 2023 financial year will see the furniture retailer produce another earnings record. And again, he believes this is being largely overlooked by the broader market.

Mineral Resources (ASX: MIN)

The Materials company is favoured by Auscap primarily because of its lithium business, with Carleton and his team visiting several of its West Australian mine sites late last year, including its Wodgina and Mt Marion operations.

Underpinned by EV market fundamentals, “We expect lithium demand to continue to explode for the next decade,” Carlton said.

“It’s hard to see where the world will find sufficient lithium to satisfy demand on a go-forward basis, which places Mineral Resources in a reasonably enviable position as a top five producer at the bottom of the cost curve.”

Some other names from various sectors were called out by Auscap’s newly appointed deputy portfolio manager, Will Mumford.

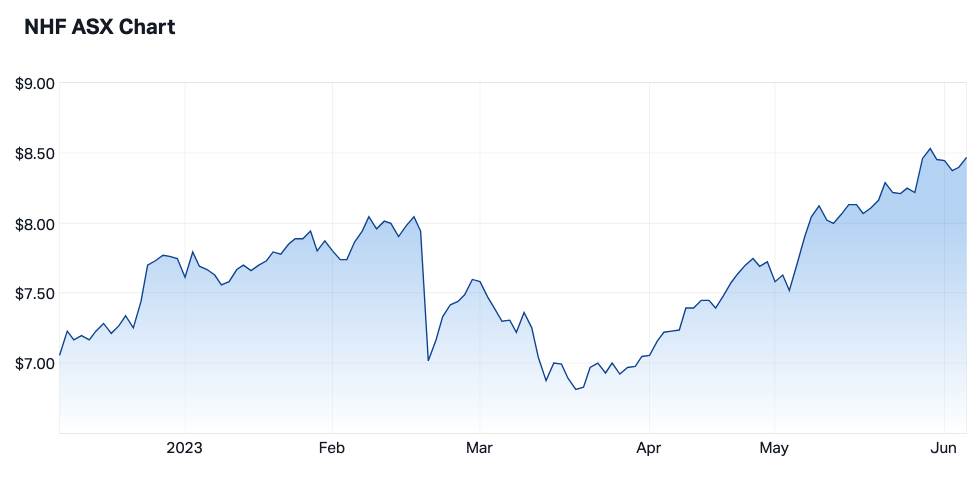

Nib Holdings (ASX: NHF)

Mumford believes the investment community’s outlook for declining profitability from the health insurer is “overly pessimistic.”

Against the consensus, he’s bullish on the firm’s private health insurance businesses in Australia and New Zealand into FY2024, “given the incredible net migration Australia’s currently seeing and the strong outlook for travel and tourism.”

Auscap’s confidence in the stock is also supported by NIB’s position as one of the few publicly listed health insurers that are actively participating in the National Disability Insurance Scheme.

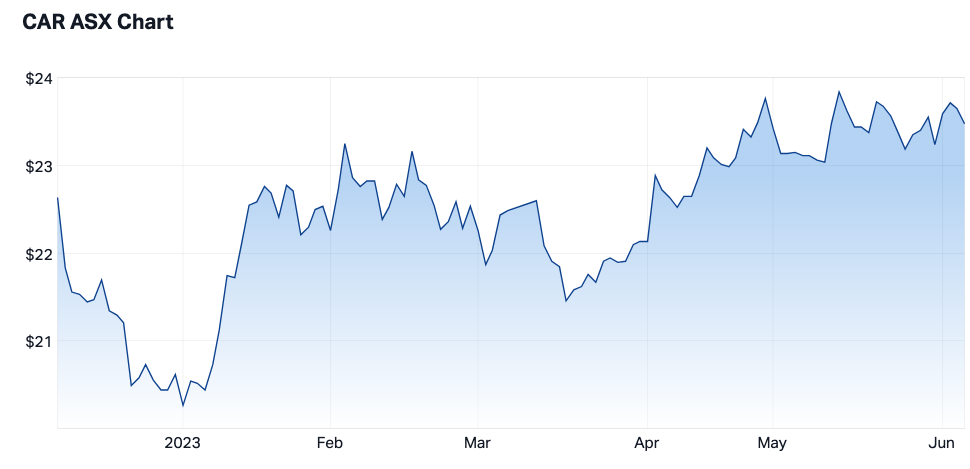

Carsales.com (ASX: CAR)

The online automotive marketplace has increased its average advertising yield to $148 from $68 in the last seven years. But far from being tapped out, Mumford believes there’s still significant room for further growth, given the firm is still only taking a 0.4% cut of the total value of each vehicle sold in the platform.

He also emphasised Carsales’ dynamic pricing model will bring further benefits as it is rolled out across the firm’s international businesses – Trader Interactive in the US and Brazil’s Webmotors.

“Currently more than half of Carsales’ revenue comes from offshore, with significant room to grow,” said Mumford.

Eagers Automotive (ASX: APE)

A global automotive retailer, Eagers owns 11% of the local market and is a long-time holding of the Auscap fund.

Mumford believes only part of the post-COVID boom in vehicle sales is reflected in the firm’s revenue figures. “So, we think the downside risk to profitability is quite low in the coming years.”

He singles out Eagers’ recently inked partnership with China’s BYD as one of its most exciting developments. The nation's largest EV manufacturer, BYD recently surpassed Volkswagen in topping the nation's overall automotive sales.

For all the insights from Tim Carleton and Will Mumford, click here to access the full webinar.

1 topic

6 stocks mentioned

1 fund mentioned

2 contributors mentioned