Where Australian house prices could go in 2025

The Australian economic year has kicked off with two key reads on the housing landscape. The headlines have already been splashed across the front pages of the news websites:

But rather than repeat what's in the headlines, I'm digging deeper into two key releases to get a more granular view of Australia's housing market and where it could go in 2025.

Firstly, property investors need not panic

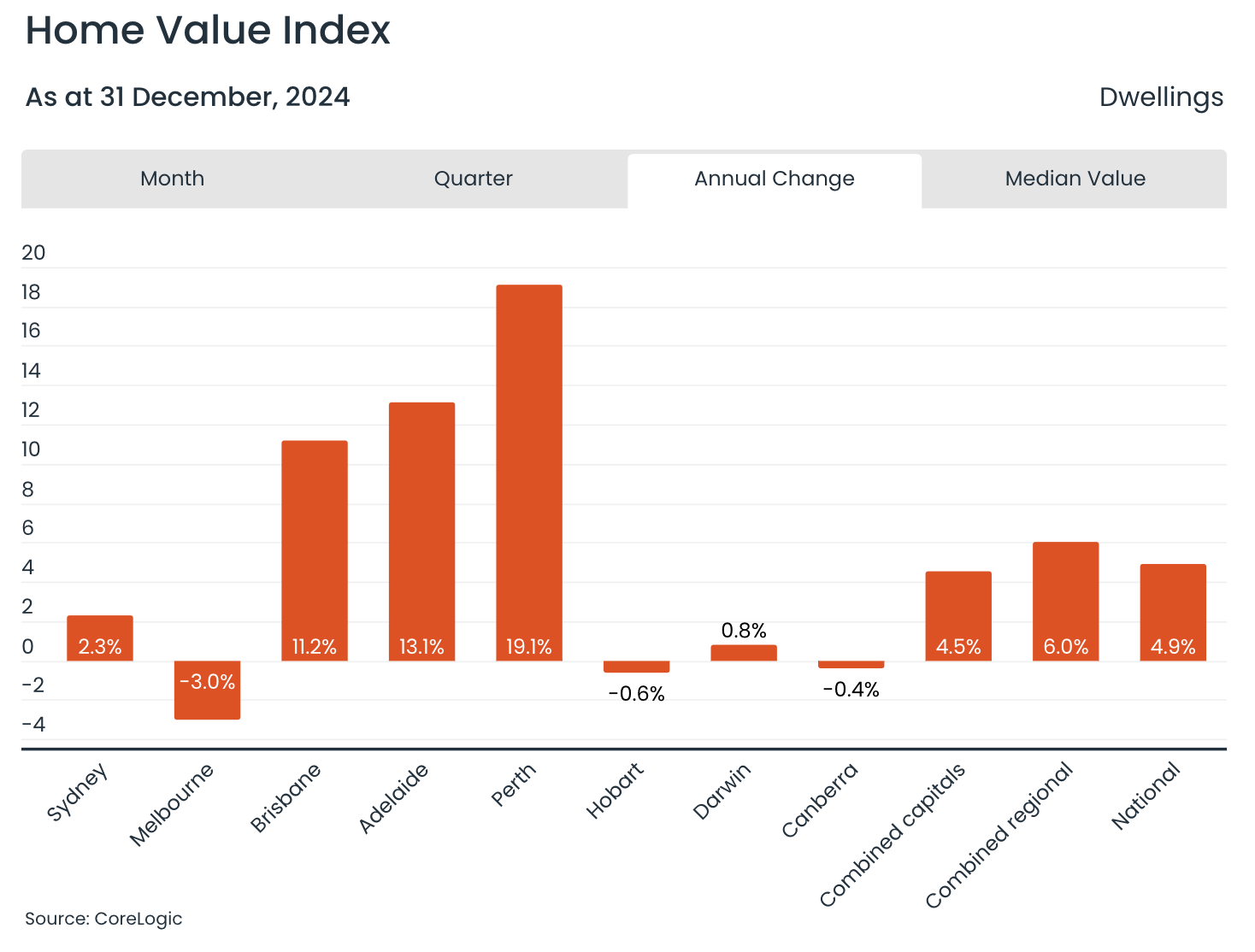

House prices, according to the CoreLogic Home Value Index, fell 0.1% in December. The headlines will portray this as the first monthly fall in 22 months.

But it's also all of the following:

- A 0.1% fall following a 4.9% increase in house prices throughout 2024.

- Between February 2023 and October 2024, house prices across the five major capital cities increased 16.3% while unit prices increased 10.2% according to data sourced directly from CoreLogic's Eliza Owen.

- The median house price across the major capital cities is still a shade under $900,000.

- If you sold your property last year, you made a median profit of $295,000. Oh - and given 95% of property sales were made at a profit - the odds are that if you did sell, you cleaned up.

In other words, the headlines don't reflect what came beforehand - very chunky and resilient growth during a period when house prices should have been on the downside.

But don't get too comfortable

As CoreLogic's Tim Lawless points out, the long and variable lags of a steep interest rate hiking cycle may only just be turning up now in the housing market.

“This result represents the housing market catching up with the reality of market dynamics," Lawless said.

“Growth in housing values has been consistently weakening through the second half of the year, as affordability constraints weighed on buyer demand and advertised supply levels trended higher.”

New supply is coming - but it won't likely be enough to offset price rises

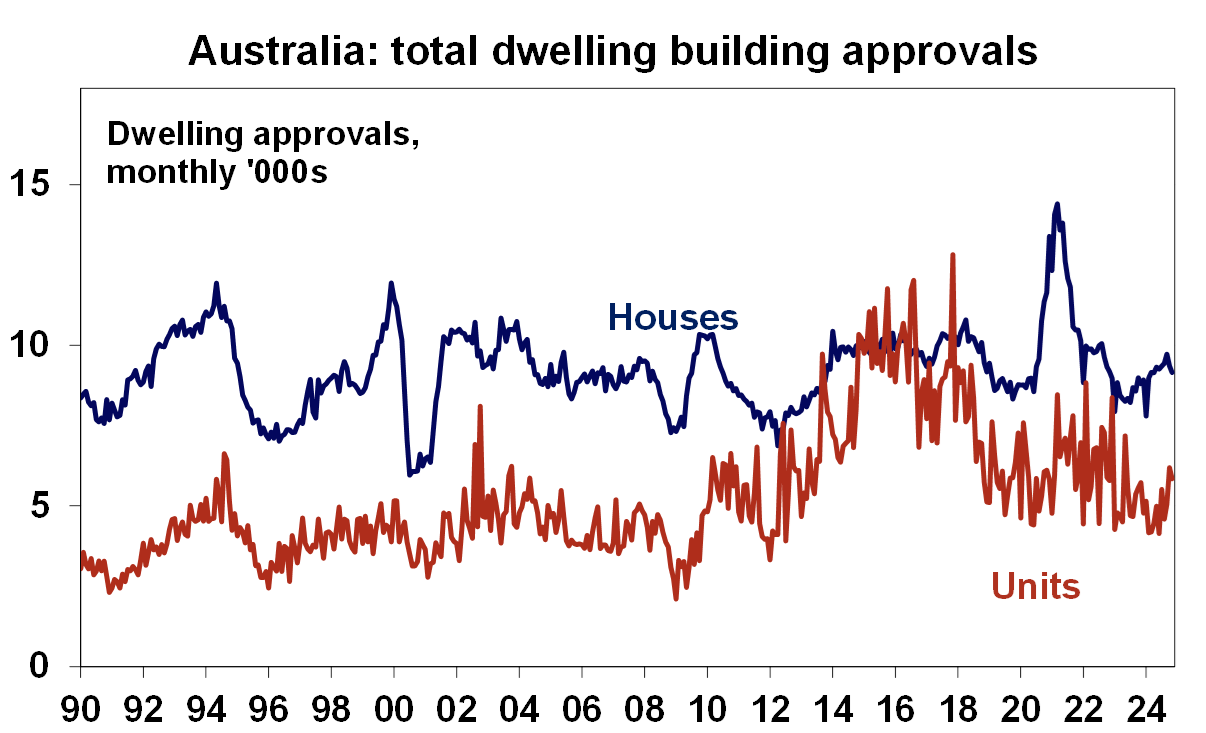

In more timely news, Australian building approvals data hit the wires this morning. While it showed a meaningful decline on first glance (down 3.6% in November and far more than economist expectations), the one-month number negates a couple of notes.

- The 3.6% fall came on the back of an upward revision in October of +5.2%.

- Throughout 2024, building approvals have trended up, similar to the trajectory of new home sales, reflecting stronger market confidence following the end of rate hikes.

- In the past 3 months, the pace of approval is clocking at 181k per annum. The current growth pace is faster than population growth, according to analysis completed by AMP's My Bui.

In other words, the big picture view also remains the same. The number of projects getting the green light is going up but not by enough to alleviate the housing crisis or get close to where the Albanese government wants them to be.

"We continue to see the housing shortfall to continue throughout this financial year, which will put a floor on house price depreciation in the first few months 2025 before the RBA starts cutting," Bui wrote in a note to clients.

ANZ agree.

"We expect capital city housing prices to grow 2.7% in 2025 and 4.1% in 2026. The market is likely to remain soggy in coming months before rate cuts come into effect. We expect the first RBA cut in May 2025," ANZ economists Madeline Dunk and Adelaide Timbrell forecast.

CBA are even more bullish, forecasting a 5% rise this year buoyed by three cities seeing huge gains - Brisbane, Perth, and Adelaide. You can find out more about why these cities are seeing such big tailwinds in the recent property edition of Signal or Noise:

2 topics