Where Big Four dividends stand heading into ASX Reporting Season

Who doesn't love a dividend? In most cases, payouts are regular and larger in a world where the fight for income is more pronounced than in recent years. But buying any stock - income-paying or not - requires judicious timing. And right now, many defensive stocks are trading at lofty valuations.

For defence and dividends, they don't come much more popular among everyday investors than the Big Four banks. And while all of the Big Four have dividend yields above 4%, two of them are also trading at near-all time highs. That's despite the sector being up only 3% in the last 12 months.

So how does an investor reconcile these high entry points and the payouts the Big Banks offer? In this wire, I will collate the views of both Macquarie and Morgan Stanley ahead of what will be an interesting and important reporting season for these companies.

Are the Banks too expensive?

They are, if you believe Macquarie's view. Their recent analysis suggests that not only are Australian banks relatively expensive when compared against market history, they are also comparatively more expensive than their global peers.

"We see limited scope for banks to re-rate from current levels and believe the risk to bank multiples remains skewed to the downside while investors remain concerned with potential credit quality issues stemming from economic slowdown," analysts recently wrote.

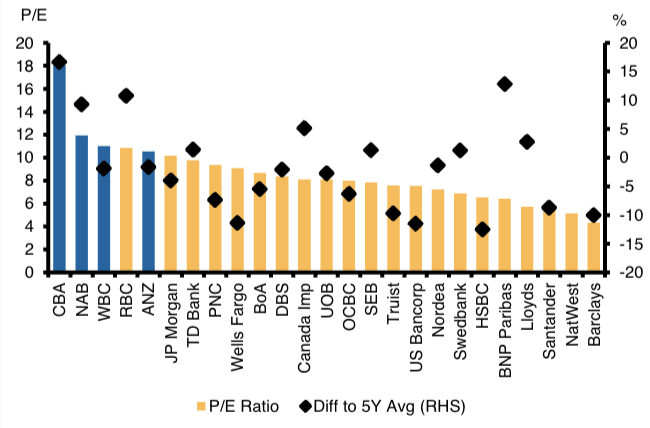

To illustrate this point further, they use this chart. In comparison to our global peers, Australian bank valuations have remained a lot more resilient. In addition, Australian banks carry a premium with them given the structure of our banking and financial system served us well through recent crises overseas. But the premia, as you can see here, is fairly hefty.

For those who haven't gotten in yet, you may want to hope for a recession. That's because bank multiples tend to contract by as much as 35% during severe downturns. Some offshore banks are already trading in that "worst-case" scenario but our banks haven't adjusted just yet.

Does that make the Big Four a value trap?

The definition of a value trap is a company that is trading at extremely low levels and extremely low multiples. They look like bargains, talk like bargains, but act like anything but a bargain. We talked more about value traps recently in this piece with Talaria Asset Management.

Ironically, one of the tell-tale signs of a value trap is whether companies continue to see their market share eroded. Another is whether companies tend to over-rely on one particular offering or product. Both are issues that the Australian banks have to deal with - in the form of structurally falling net interest margins and their heavy reliance on respective mortgage books.

For Macquarie's part, it has this to say:

"In the medium term, while banks appear cheap on an absolute basis and compared to their recent history relative to the broader market, we expect discounted valuations to persist until there is more clarity on the economic outlook. We are NEUTRAL on the banks sector and our order of preference is NAB (ASX: NAB), Westpac (ASX: WBC), ANZ (ASX: ANZ) and Commonwealth Bank (ASX: CBA) amongst the majors, and Bendigo and Adelaide Bank (ASX: BEN) over Bank of Queensland (ASX: BOQ) amongst regionals."

What about dividends?

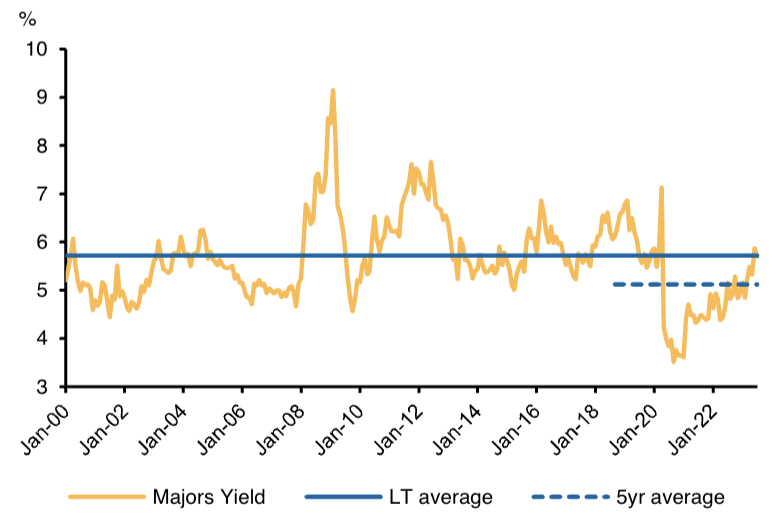

Between them, the Banks have a current dividend yield of around 5.7%, which is in-line with long-term averages and above the 5-year average. Yields since COVID have recovered driven by an uplift in earnings, but also more recently, by a pullback in share price performance. as this chart from Macquarie shows.

Morgan Stanley has also done some number-crunching on what it expects for the Banks' dividend and buyback plans. The crux of the story is that dividend payouts may actually end up flat year-on-year after all the hopes of rising interest rates positively affecting its margins and thus, its payouts. But if you think of it another way, it's a miracle that these payouts will stay flat.

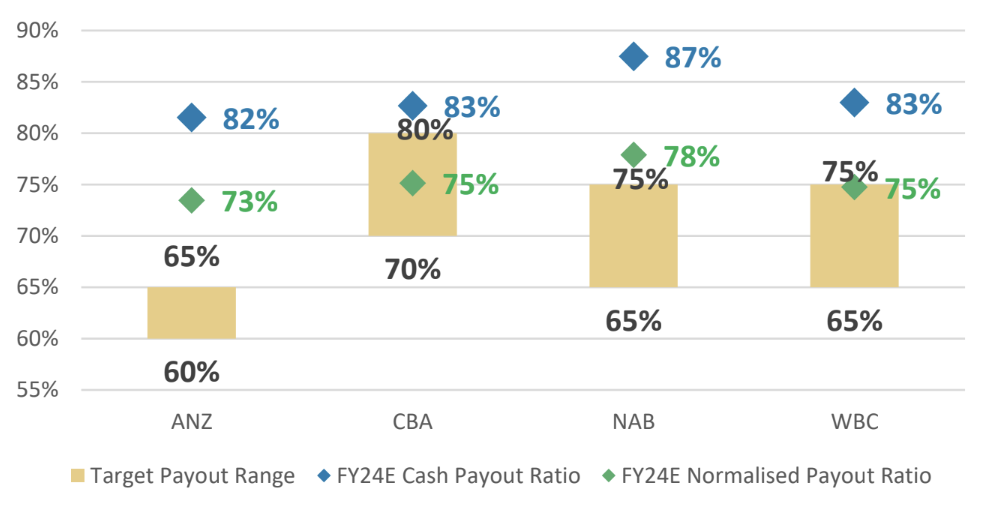

The chart below shows the analysts' calculations in graphical form. As you can easily see, ANZ has the lowest target payout range. But it may also find itself paying out the biggest surprise over the next fiscal year.

For investors in Commonwealth Bank, analysts expect the full-year dividend will come out to about $2.35/share, or a full-year payout ratio of around 73%.

For investors in NAB, analysts expect that the dividend for FY23 will turn out to be the same as FY19 (83 cents per share). If borne out, that would make for a full-year payout ratio of 71% which is inside its target. They also expect a $2 billion buyback to start at its FY23 result which comes in November this year.

Westpac has previously hinted a buyback may come as soon as its FY23 result but Morgan Stanley argues this will not come until FY24. For its part, analysts expect the second-half final dividend to come in at around 70 cents. That is well below both the 2019 and pre-COVID peaks.

Finally, ANZ's buyback hopes will likely depend on whether regulators approve the group's acquisition of Suncorp. If it goes ahead, don't expect one. If it doesn't, analysts say the buyback could be as large as $4 billion. For now, it's expecting a final dividend of 81 cents per share, which would be in line with the interim dividend and above 2019 levels (albeit marginally).

4 topics

6 stocks mentioned