Where Goldman Sachs sees value among ASX lithium stocks

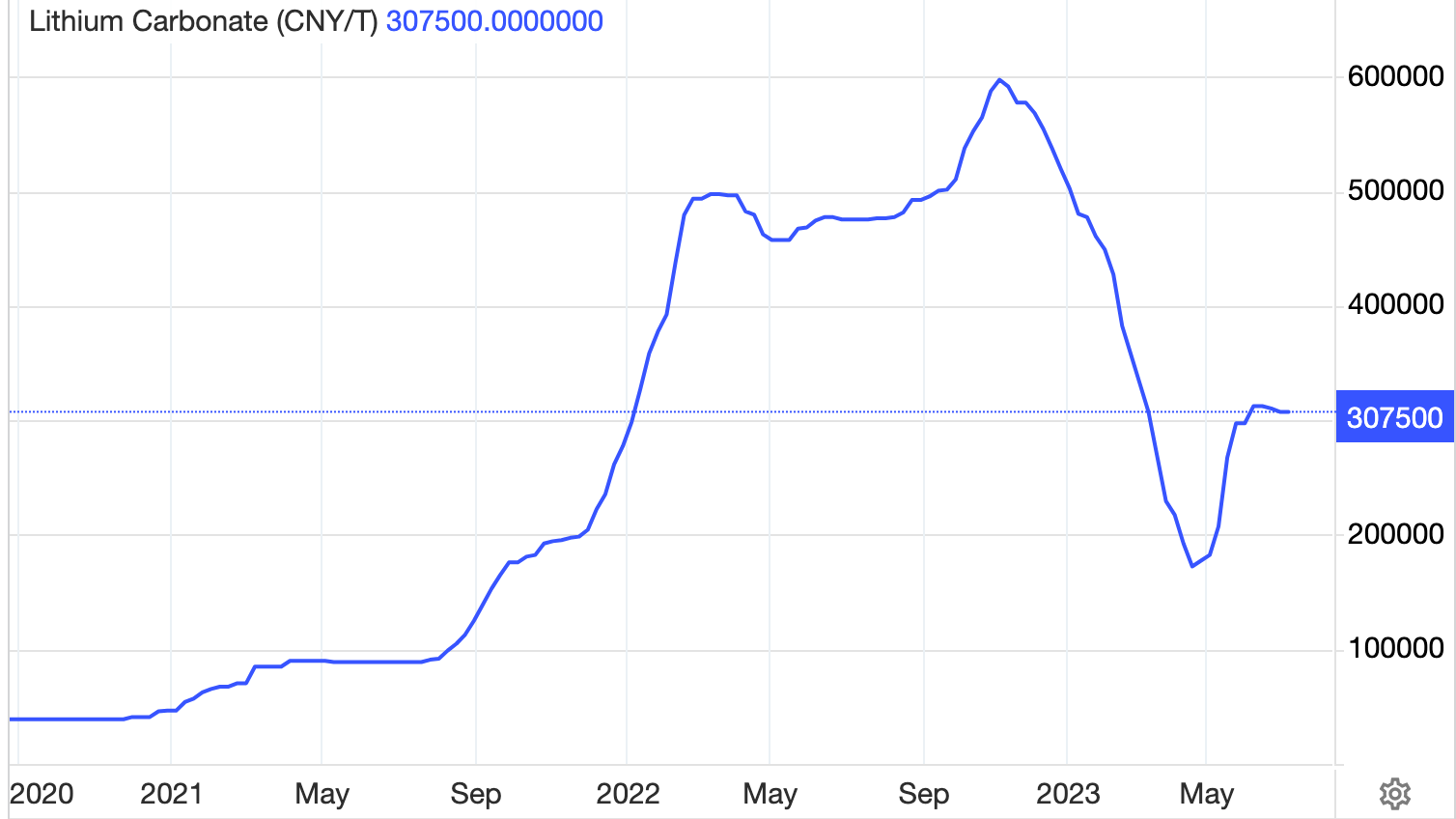

The spot price of lithium carbonate gained more than 30% in the June quarter, recovering some of the falls that resulted largely from China’s curbs on electric vehicle subsidies in January. This saw a rally in the share prices of lithium producers in both Australia and the US during the quarter but analysts at Goldman Sachs suggest it won’t last, according to broker research released this week.

Goldman analysts Hugo Nicolaci, Paul Young and Elise Bailey expect lithium prices to decline over the next 18 months and beyond – which is why they favour producers at the lower end of the cost curve, that have more diversified businesses, and greater potential to grow their output.

“We see more limited upside in the lithium space on a 12-month view,” the analysts said in a research update released on Thursday.

“While we expect recovering demand to support lithium prices in the near-term, we continue to see a supply-led correction over 2H 2023.”

The analysts estimate that Australian lithium stocks are trading at an average of around 1.3 times their net asset values and are pricing in an average spodumene price of approximately US$1,350 a tonne. Leaving Goldman’s long-term outlook on share prices unchanged, this suggests the market is anticipating current spot prices will persist for more than 1.5 years.

The volume of spodumene – a primary source material for lithium carbonate – remains the key driver of supply growth. Goldman believes this will add another 500,000 metric tonnes of lithium supply during 2023 and 2024, with an additional 200,000 metric tonnes per year anticipated from China’s lepidolite capacity (another source of lithium) by the end of next year.

Further supply increases are likely to keep a lid on lithium prices in the medium- to long-term, including Latin American projects and Direct Lithium Extraction, as also noted by the GS analysts.

What does this mean for lithium stocks?

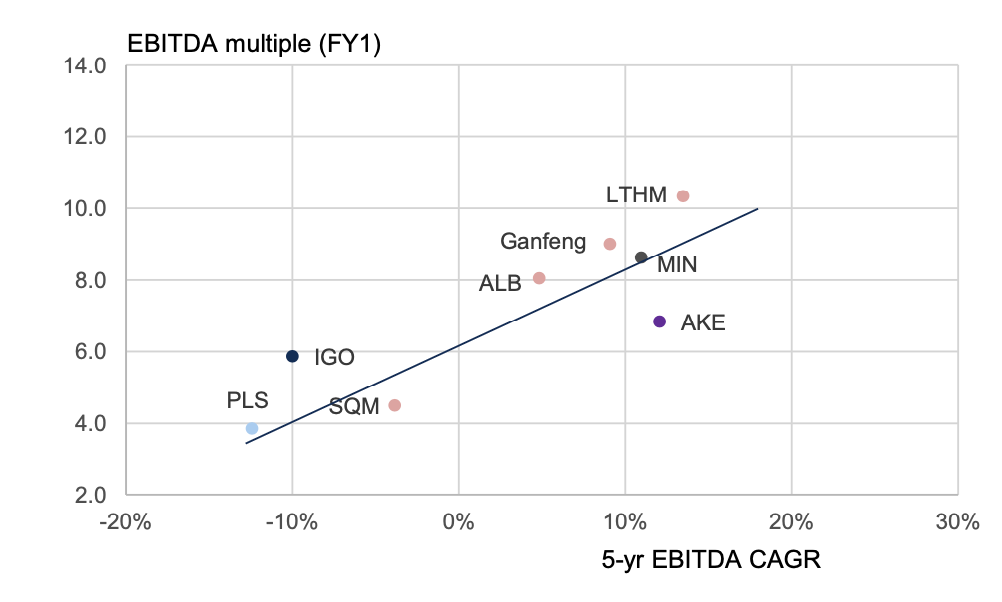

“Despite recent price volatility, the Australian lithium sector has continued to outperform global peers, with a narrowing multiple discount,” said the Goldman Sachs analysts.

But they emphasise that the valuations of Australian lithium stocks are becoming more aligned with global counterparts, and expectations for lithium prices in Australia and globally are also becoming more similar.

The Australian stocks are now less cheap on EBITDA growth

EV/EBITDA multiple (x) vs. 5-yr EBITDA CAGR FY23-28E (%) Source: FactSet, Visible Alpha Consensus Data, Data compiled by Goldman Sachs Global Investment Research

The Goldman Sachs analysts believe the following ASX lithium stocks show the widest discrepancy in share price valuation versus global peers. But they also emphasise that the greater levels of vertical integration and exposure to longer-life brine assets of global lithium stocks might also contribute to their higher valuations.

Allkem (ASX: AKE)

Rating: BUY

Market cap: US$7 billion

12-month price target: $17.10

At AKE’s latest closing price of $16.22 on Thursday, this suggests a potential upside of 5.4%.

IGO Limited (ASX: IGO)

Rating: BUY

Market cap: US$7.8 billion

12-month price target: $16.10

With IGO shares closing at $15.50 on Thursday, Goldman’s suggests a potential 3.9% upside.

Pilbara Minerals (ASX: PLS)

Rating: BUY

Market cap: US$10.1 billion

12-month price target: $5

Pilbara shares closed at $5.07 on Thursday, suggesting 1.4% downside potential.

This article was originally published on marketindex.com.au on Thursday 6 July 2023.

2 topics

3 stocks mentioned