Where Harley Grosser is finding value in micro-cap stocks

The age-old (and perhaps contentious) saying “time in the market beats timing the market” shouldn't just apply to returns: the experience from being invested at a young age can be instrumental.

This was certainly the case with Harley Grosser who launched Capital H Management at just 23 years of age, having written extensive stock research reports through university and invested successfully in these formative years. In that time, he has developed a blooming fund with a focus on understanding the value on offer and pouncing when those opportunities arise.

"I work off the goal of wanting to understand this business better than anybody who could be selling us the stock... It often can be just somebody who's owned the stock for 10 years and wants to sell it, so they sell it at any price. If you've done your work and you're ready, you can be buying it at a silly price."

In this week's episode of The Rules of Investing, my colleague Patrick Poke spoke to Harley about his entrance into the investing world, his value-conscious mentality and how to know when your investment thesis is breaking before it is broken.

.png)

An early bloomer in the world of investments

Capital H was initially launched as a trust with 2 parties making up the inaugural $100,000: Grosser and his grandparents. He went on to turn this into $800,000 within 4 years, before expanding into a managed fund. He launched Capital H Management with $5 million under management and hasn't looked back, growing FUM to $40 million in 3 years.

But this wasn't an industry Grosser just stumbled into.

Through university, he had written equity research reports, published across his own website as well as Roger Montgomery's blog. He caught the attention of some more fundies and soon moved to New Zealand to work for Pie Funds. This was a transformational experience as he learnt about the processes they put in place to succeed.

"They were a very entrepreneurial, fast-moving group, but much more structure and systems than what I had been doing by myself ...

Making this ambition obvious and acting on it set Grosser apart, and this sheer commitment has been a core element of his investment approach

But I think in general, it's just about trying as hard as you can, doing, learning as you go, and then finding those people who respect that you're putting in a lot of effort, and they're willing to help out, and then give advice and point you in the right direction.

Defining the strategy

After trying the smorgasbord of assets including currency, commodities, international stocks, Grosser's attention kept falling onto the same topic: value on offer

"We're not deep value investors by any means, but we want to buy things for less than we think they're worth. And hopefully, they're growing. That just intuitively worked for me, that made sense. And in micro-caps, you get bigger value discrepancies in terms of what the stock is trading at, and what you think the company is worth."

The value presented by micro-caps at the time meant that was where the focus naturally fell, but the fund is not tied to a micro mandate by any means

It's about, it's about valuations, about good quality business, it's about what the opportunities are.

This means that at times they have certainly bought into mid-caps, such as in the aftermath of the COVID-19 crash where smashed valuations were just too expensive to ignore. Overall, the most consistent value discrepancies appear at the smaller end of the market - and thus that is where their time and energy has been focused.

The next consideration, and a unique factor of how they operate, is considering what they can do for the company they're invested in.

"We can't go into the BHP office and add much value to those guys, but we can meet with the management team of a micro-cap and there might be some things that we can help out with ... Often the management teams own a lot of stock, which is one of the criteria for investment and if we can come to them with a sound, well thought out plan of how we add value to their company, then nine times out of 10, they're very happy to listen."

Let your scars define you

A pending crash is the biggest fear of any investor. But the immediate aftermath presents a meaningful opportunity to establish yourself.

A lot of fund managers did an excellent job out of the GFC. And then they just smashed it out of the park for a few years, and that out-performance carries through so many years. You can build up your reputation and your career off of how you responded to a relatively short period.

Two major lessons came about from commencing an investing journey during the GFC:

- Maintain a lot of cash all the time because prices can just keep going lower and lower; but also

- Pay attention to the types of opportunities that this sort of crisis creates.

Grosser notes that while he couldn't fully capitalise on it at the time, it prepared him for when the inevitable opportunity arose.

"I didn't have anywhere near enough cash in the GFC to really get rich out of it, but I was always thinking if we ever have another thing like this, I needed to have enough cash ... It took until 12 years later before that came. And luckily I'd done a lot of work and we'd built up a capital base... I thought when we get our GFC type market collapse moment, that's when we need to not be scared and hopefully we have an investor base supporting us that thinks the same way."

Managing risk in a small town

Investing is a high-risk sport by nature - you are never going to have complete information. You can always lose 50% of your investment whether it's a micro or large-cap, but the risk with the smaller end of the market often comes from singular revenue sources and weak balance sheets. What they do have on their side are growth and accessibility.

"A lot of CEOs are more willing to chat directly to shareholders than many shareholders might expect. They're not being swamped by analysts from all the big investment banks to talk to them like they would for a large-cap."

When it comes to putting precautions in place, Grosser's preferred strategy comes far before any capital has been deployed:

"I work off the goal of wanting to understand this business better than anybody who could be selling us the stock ... It often can be just somebody who's owned the stock for 10 years and wants to sell it, so they sell it at any price. If you've done your work and you're ready, you can be buying it at a silly price."

Some red flags that investors best be wary of:

- Balance sheet: If they're running out of cash or just not strong enough, and you know there's a capital raise coming, it's very easy just to pass or wait for that capital raise if you do like the business.

- Management: I've been here 12 years and I know a fair amount of people, and you can ask them about a CEO or a certain person and get feedback. And are they the type of person you want to be backing? So that's a huge yes or no decision as well.

- Industry: If they're in a tough industry or you know that there's another competitor coming in there that's just going to eat their lunch, then you just avoid that too.

- Valuation: Sometimes you can just look at a company and say, well, that's a really good company. You look at the stock and it's 50 times revenue and you go, that's not for me.

This doesn't mean you abandon the company forever, but instead put it on ice. Such companies are growing and often they can actually backfill their valuation over a couple of years.

For the companies that pass the screen, however, after understanding it intimately and making an investment, Grosser's focus turns to manic monitoring.

"Understanding the company is not just about buying, it's about knowing when your thesis is breaking. And we always try to be selling as a thesis breaking, not once the thesis is broken"

Identifying when a thesis is breaking is much easier said than done, but knowing the buy catalyst and monitoring its progress fervently is at the heart.

"When we come in, we set out a timeline of things that we're expecting the management to do over a certain time period. And if that doesn't happen or they downgrade their expectations or there's any change in that sentiment, then we will start selling. It doesn't mean we just exit position straight away.

You have to balance being a disciplined seller with also knowing that it takes time to build a real business and for market caps to grow, and you want to be there for the journey because the returns can be so good. But we also want to manage the position sizes relative to the company's execution and performance."

An early 10-bagger: Wisr

The non-bank lender was one of the fund's first purchases at around 2.7 cents, and fully sold out at 27 cents. A consistent theme around good management and unrealised value rings true in this case.

"The main thing that we saw there was management. Anthony (Nantes) is just a really impressive CEO ... sometimes you meet CEOs that you just want to back them. It's really rare ... but as long as the price is good enough, I'm happy to back this team. The other pieces to it was that it was completely unknown. There was no volume in the stock. "

The other tailwind was the rise of fintechs through 2018. Afterpay and Zip were rising and that fuelled interest in the sector. And Wisr was able to keep performing and growing as a result.

"Open banking was making it easier for a company like Wisr to pick and choose the good and bad borrowers.

Before it was very binary, yes or no, I'm going to lend to you, whereas now you could adjust your pricing by digging into the data.

So that was obviously good for our investment thesis and would drive capital flows into companies like Wisr. And we were able to get there before that capital flows caught up to Wisr being a very fast growing fintech."

Would Grosser buy back in if the valuation calmed down?

"Of course. Once a company gets bigger like Wisr has ...they tend to not trade at the types of valuations that we're looking for in micro caps. But if the price is right, then of course we'd want to get involved again, because it does fit all the criteria that we look for."

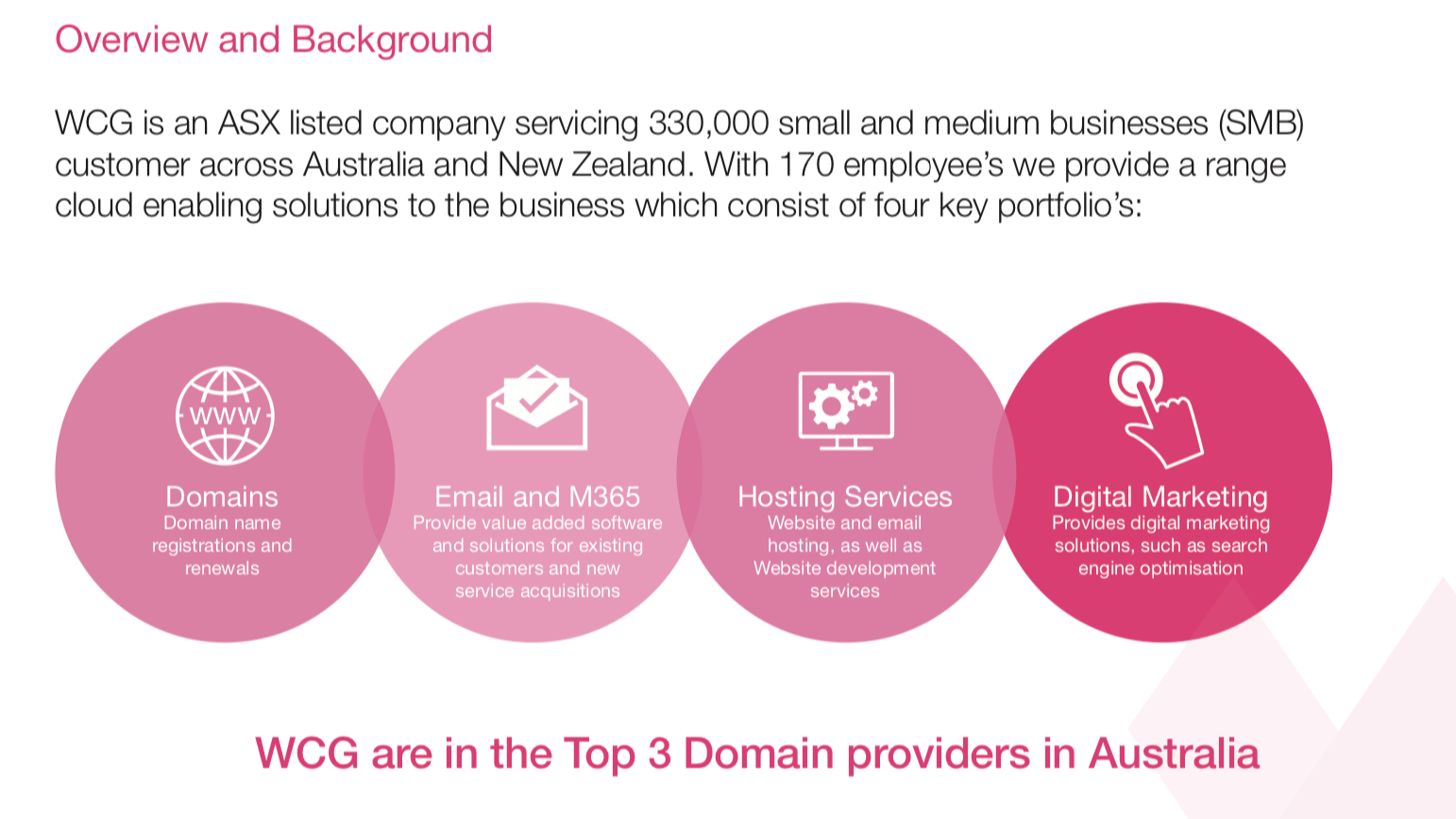

WebCentral: A company that ticks all Harley's boxes

A company he has written about on Livewire before, the domain business is set to ride the wave of corporate activity we are seeing, while simultaneously being a stand-out performer.

We have seen complex negotiations where 5G Networks (ASX:5GN) made a bid for WebCentral (ASX:WCG), and now they've gone the other way and Webcentral's made a bid for 5G Networks. Ultimately it is a merger of the two.

"It's a super predictable domain registration and hosting business now with data centres as well in the 5G business. Once that merger completes, assuming it does complete*, I think, 7 to 8 times EBITDA, with a strong balance sheet and an aggressive acquisition strategy by the management, is too cheap.

The telco sector itself trades probably from 11-16 times. This is a bit of a mix of a telco and a tech, so you could argue 11- 16 times EBITDA is at least fair.

As the entity grows, it will likely attract the attention of analysts, brokers and other funds. More attention means the likelihood of more capital flows which Grosser cannot wait for.

That'll start to attract more funds and bigger funds than us, to buy the stock and there'll be broker coverage and all the rest. So I think there's value there because there's been so much news and corporate activity happen, that the market's missed how cheap it's trading.

*Editor's note: Since recording, the merger between the 2 entities was completed and they have recently launched a bid for Cirrus Networks (ASX:CNW)

Motivation drives ambition

"The main thing that I think has helped me get to where I am, was just the motivation to keep going. And so my favourite books have been books that encourage me just to keep going. So for me, that's biographies of people that I would admire."

It hasn't been smooth sailing at all. One of his first and most sizeable investments was in Energy Action (ASX:EAX), which soon dropped 50-60% after a surprise downgrade. But maintaining internal confidence and the ability to learn from such events has pushed the fund into the stratosphere. Accompanied as well perhaps by a bit of Disney magic (which was also his long-term stock of choice)

Listen to the interview on the Rules of Investing podcast

.jpg)

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

3 contributors mentioned