Where investors' smart money is going as recession looms

Analysts are now revising the probability of a recession in the US. Last week, Goldman Sachs' Jan Hatzius upped the stakes - saying there is a 35% chance of a significant downturn between now and the end of calendar 2023.

So where to from here? Deutsche Bank's global head of research David Folkerts-Landau noted it's all about the "tremendous war chest of excess savings".

Given this and the global supply shock which hasn't improved, DB were one of the first teams to call for a recession in the states earlier this month.

As for the path forward, Australian chief economist Phil O'Donaghoe says it's all about the messaging. "I think the path from here depends on how successful central banks are at containing the inflation spike," Phil says.

With those views setting the stage, we asked three of Australia's best investors to describe their future game plan.

The fund manager: Alastair Macleod, Wheelhouse Partners

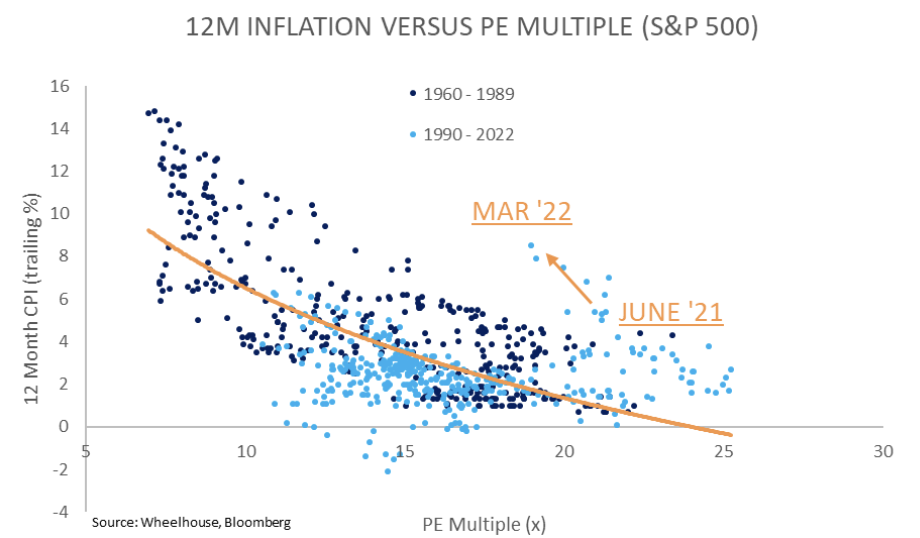

In July last year, Alastair wrote a wire saying inflation must fall – or that markets will. He later followed that up with another wire when US inflation hit 7.5% in February this year. It's well past that point now.

Alastair says the market will continue to de-rate, only offset by relatively strong corporate earnings prints. The best example of that is in this chart - which he first drew to our attention last year.

Alastair says the best place to be is in companies with pricing power given inflation has now gapped higher.

"Typically these sort of wide moat businesses are very well placed to preserve their pricing power during prolonged periods of higher inflation. Consumer staples and many diversified industrials would be included in this list," Alastair says, adding that technology investments will require more careful selection.

The portfolio manager: Isaac Poole, Oreana Financial Services CIO

Isaac has been on the record saying a soft economic landing from the Federal Reserve will be – to put it politely - difficult. He also says the market is primed for disappointment – with expectations for multiple, aggressive rate hikes a sign of wishful thinking. Inflation, in his view, will start to slow down sooner rather than later.

"We expect it to settle somewhere in the lower half of central bank targets. Nothing has changed the starting point of high debt levels and weak demographics," Isaac says.

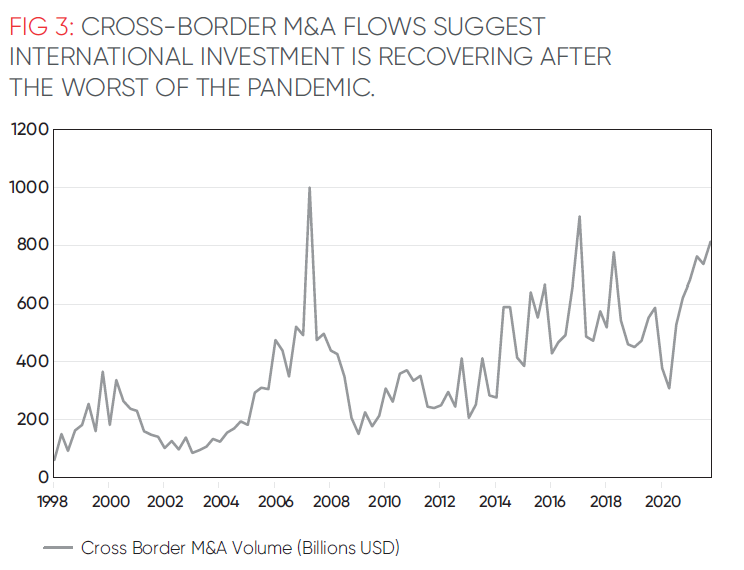

Speaking of demographics – Isaac points to this chart which he thinks may have some bearing on the trajectory of inflation.

While some analysts think there is an anti-globalisation side effect which is being felt from the COVID-19 pandemic, Isaac is more skeptical.

"Cross-border M&A activity has surged and that suggests to us that forecasts of de-globalisation may be overdone," Isaac says.

Despite all this, Isaac is overweight Australian and Asian EM equities but underweight fixed income. While some risks are skewed to the upside, he notes the scope for upside surprise (particularly in Chinese assets) is far more appealing.

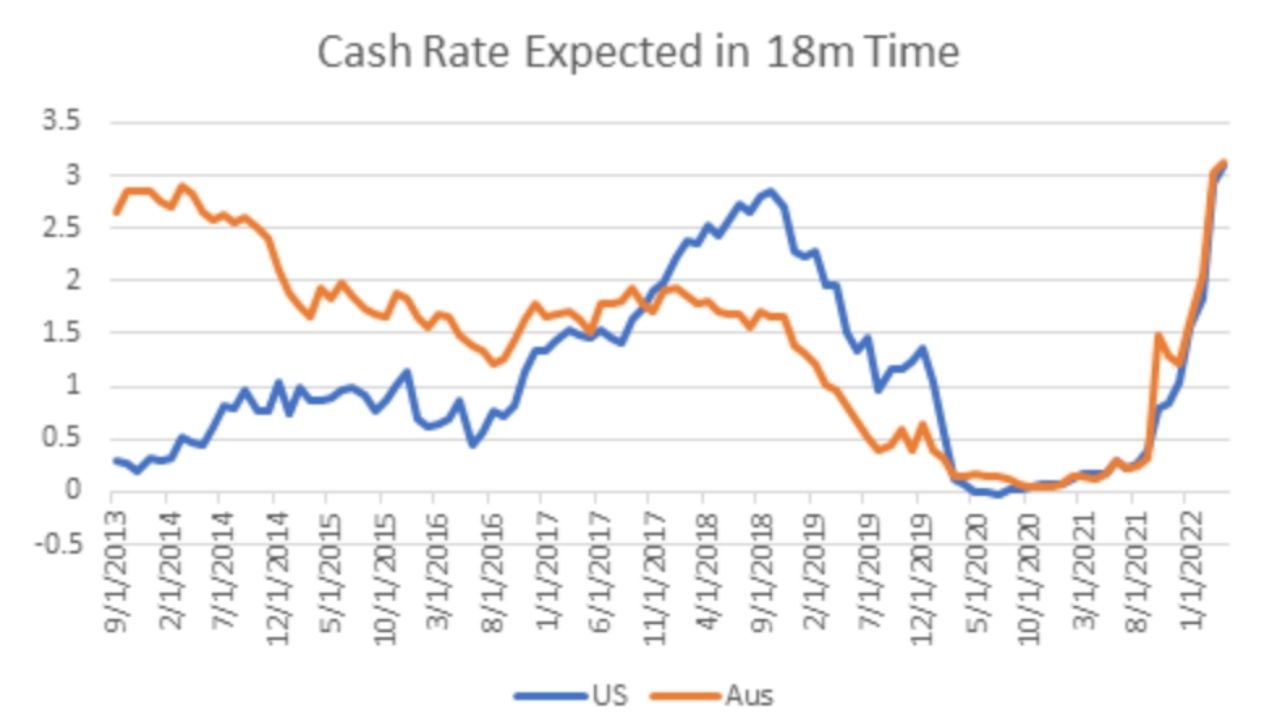

While commodity prices have been soaring and equity markets in a tailspin, the real action has been in the bond market. In the last year, a local government 10 year yield has nearly tripled as some traders think the RBA could hike multiple times in 2022.

.jpg)

Chris Rands, co-portfolio manager of the Yarra Australian Bond Fund thinks markets will be left wanting more. However, that's not necessarily a bad thing.

"If Australia is slower than the US in moving the cash rate, Australian bonds should eventually outperform the US," Chris says.

As for where he is investing, Chris says the money will be made in shorter duration and widening credit spreads.

"The 3-year bond has already priced most of the high inflation environment in. As the long end has been flattening, there is not as much value in owning long-dated bonds," he adds.

The watching brief

In short, there is no one magic formula in this market. While some of our experts agree that the market is primed for disappointment, all agree it will be much harder to make fast cash in this volatile market.

Finally, returning to the recession comments made at the beginning, we note that Wall Street's brightest are starting to make predictions about when the downturn will hit in the world's largest economy. However, no one (seems) to be including a prediction on how long the recession will last. That's fodder for another piece at another time.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best macro strategists, economists and fixed income fund managers. If you have questions of your own or guests we should chat to, flick us an email: content@livewiremarkets.com.

2 topics

2 contributors mentioned