Where Macquarie sees EPS growth in June (and 16 ASX stocks to watch)

It’s been an interesting year in markets. We’ve watched technology stocks continue to boom, while the Big Four banks are heading into troubled waters. The Big Australian cut its dividend at the start of the year, while Woodside Energy cut in April. Other companies have offered flat dividends or minimal increases like Commonwealth Bank.

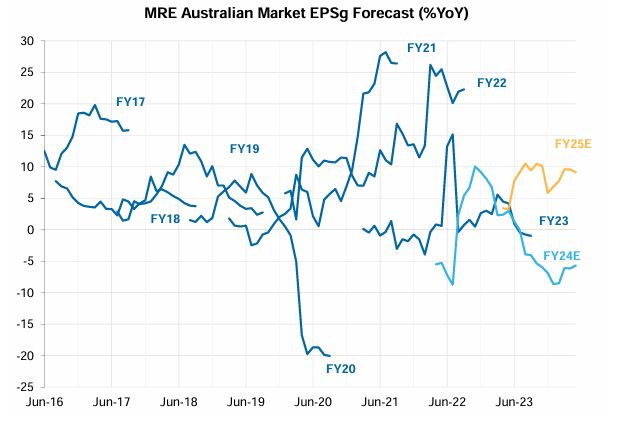

For investors relying on dividends, this is a worrying trend – and with Macquarie tipping most sectors to show negative earnings-per-share (EPS) growth for 2024 in its latest Australian Equity Strategy release, it’s certainly worth taking a closer look where the investment bank believes growth lies. Particularly at a time where its FOMO Meter measuring equity market sentiment has spiked to 1.21 indicating the risk of a market correction.

Where the growth lies – EPS growth in the coming years

The investment bank tips 2024 to be a down year for EPS growth, with the only two exceptions expected to be Industrials (8.6%) and Property Trusts (though barely at 0.5%). If the forecasts are to be believed, Resources is likely to have a particularly nasty FY24, with EPS growth down 19.8%, in no small part linked to BHP (ASX: BHP)’s cuts. The fortunes of the Banks seem unlikely to change any time soon, with Macquarie indicating that it expects a further decline in FY25 and a slight increase to flat in FY26.

Macquarie expects Resources to return to the fore in FY25 though, with EPS growth up to 21.2%, though investors shouldn’t get too comfortable given it expects FY26 to be again a tough year.

Investors should be cautious about reading too much into standard sector classifications though, with Macquarie’s classification seemingly breaking down categories to Banks, Property Trusts, Resources and Industrials. What this means is that healthcare companies like CSL (ASX: CSL) and Resmed (ASX: RMD) are noted as top contributors to EPS growth, as are energy companies like Origin Energy (ASX: ORG) and even insurers like Insurance Australia (ASX: IAG).

What looks cheap right now

June is typically a tougher month in Australian markets, with investors selling positions ahead of 30 June to manage their financial year tax positions. It can also be an opportunity for those on the hunt to pick up oversold positions – assuming quality, that is.

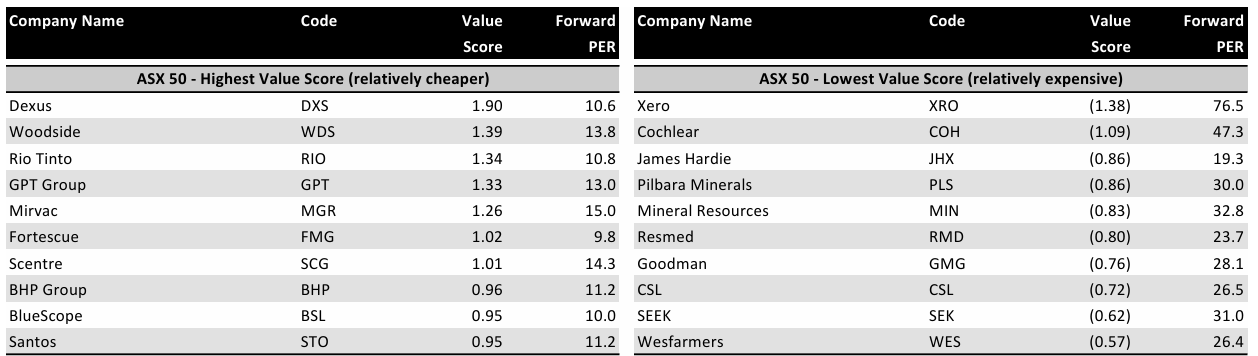

Macquarie released its analysis of the cheapest versus most expensive companies, oversold versus overbought, shorts, and EPS revisions. Below you’ll find the chart of those companies with the highest value scores versus the lowest in the ASX 50.

But is cheap actually good value or simply cheap for a reason? After all, some of the ‘expensive’ picks have been exceptional performers in recent months while some of the ‘cheap’ picks have fallen for a reason.

That’s where the cross-over with other charts gives a more interesting picture attached to value.

If you look at the cross-over between the charts above with EPS revisions, you’ll see that Mineral Resources (ASX: MIN), James Hardie (ASX: JHX), BHP (ASX: BHP) and Mirvac (ASX: MGR) all had negative revisions, while ResMed had a positive revision. In that instance, you might question whether BHP’s valuation is cheap for a reason – or whether it has been punished too much for its revision. BHP had a strong run in May, but June is looking tougher following its failed takeover bid(s) for Anglo American. Market Index’s Broker Consensus Tool positions BHP as a HOLD.

When it comes to oversold versus overbought companies, Xero (ASX: XRO) and Goodman (ASX: GMG) come up as overbought while James Hardie, Mirvac, Seek (ASX: SEK) and Woodside (ASX: WDS) have been oversold. On that basis, Woodside, which fell into the cheaper valuation, may be worth a closer look. Market Index’s Broker Consensus Tool positions Woodside as a HOLD.

Shorting activity can also paint an interesting picture of market views. Pilbara Minerals (ASX: PLS), Mineral Resources, Rio Tinto (ASX: RIO), Seek and Dexus (ASX: DXS) all fall into the most shorted category, while ResMed, CSL and BHP were the least shorted. Whether they are expensive or not, there’s no doubt that CSL and ResMed are solid performers with significant market share and pipelines, and continue to be desirable to investors.

Even at an ‘expensive’ valuation, the Market Index Broker Consensus Tool positions CSL as a BUY and ResMed as a STRONG BUY.

The other consideration is momentum – 12-month returns. Fortescue (ASX: FMG) and Rio Tinto have ranked in the top 12-month returns for the ASX 50 and given they are tipped on the value end, would be worth a closer look. Investors looking for EPS growth will need to be careful though given these companies fall in the challenged Resources sector. Market Index Broker Consensus Tool ranks Fortescue as a STRONG SELL and Rio Tinto as a BUY.

On the flip side, Woodside and Dexus ranked in the lowest 12-month returns for the ASX 50 – is this a case of cheap for a reason or simply a tough year? Woodside has been hit by weakening oil and gas prices in the last year, with a further hit expected by the OPEC announcement that it would start unwinding cuts. Market Index’s Broker Consensus Tool positions Dexus as a SELL.

Broker consensus

You will have noticed the references to Market Index’s Broker Consensus Tool above – and this can also aid in which companies you may wish to research more.

Buying a company can be more than valuation when you factor in aspects like quality – particularly when you want to hold over the long term. For example, of the lowest value list, three companies are ranked as STRONG BUY: Xero, ResMed and Goodman Group, while CSL and James Hardie rank as BUY. Are they really expensive then? Or worth closer analysis.

On the flip side, Cochlear ranks as a STRONG SELL while Pilbara Minerals and Wesfarmers are both SELL so factoring value in this case might be a good indication of what not to research.

Turning to the companies in the highest value list, Rio Tinto, Scentre Group, BHP Group and BlueScope are rated BUY, perhaps meriting a closer investigation. Mineral Resources rates as a HOLD. On the other hand, Fortescue rates as a STRONG SELL and Dexus is also listed as a SELL.

It's definitely not as simple as buy the cheap companies - but what factors do you consider most important and are you planning to buy this June? Let us know in the comments.

1 topic

16 stocks mentioned