Where Platinum sees value as speculator smackdown looms

Semiconductors, materials and travel are key areas of focus for global fund manager Platinum over the next two to three years, while the hotter plays in e-commerce, software and payments face a drastic decline, said Platinum Asset Management CEO Andrew Clifford yesterday.

“There are good reasons to be optimistic that this recovery will continue, as vaccinations will continue to unfold across the globe, so will the opening up of economies,” Clifford said during a webinar.

- The economy will recover, just as it has from other shocks such as the GFC.

- "The speculative mania in growth stocks will end badly for those who stay too long, just as it did in the tech bubble and countless other speculative manias, and the likely cause will be rising interest rates and heightened liquidity," says Clifford.

- The longer-term outlook for rising inflation emphasises the need for some degree of investor caution.

“Yes, there will be setbacks, but over the course of 2021 sectors such as travel, leisure, restaurants, bars, events, conferences will all come back.”

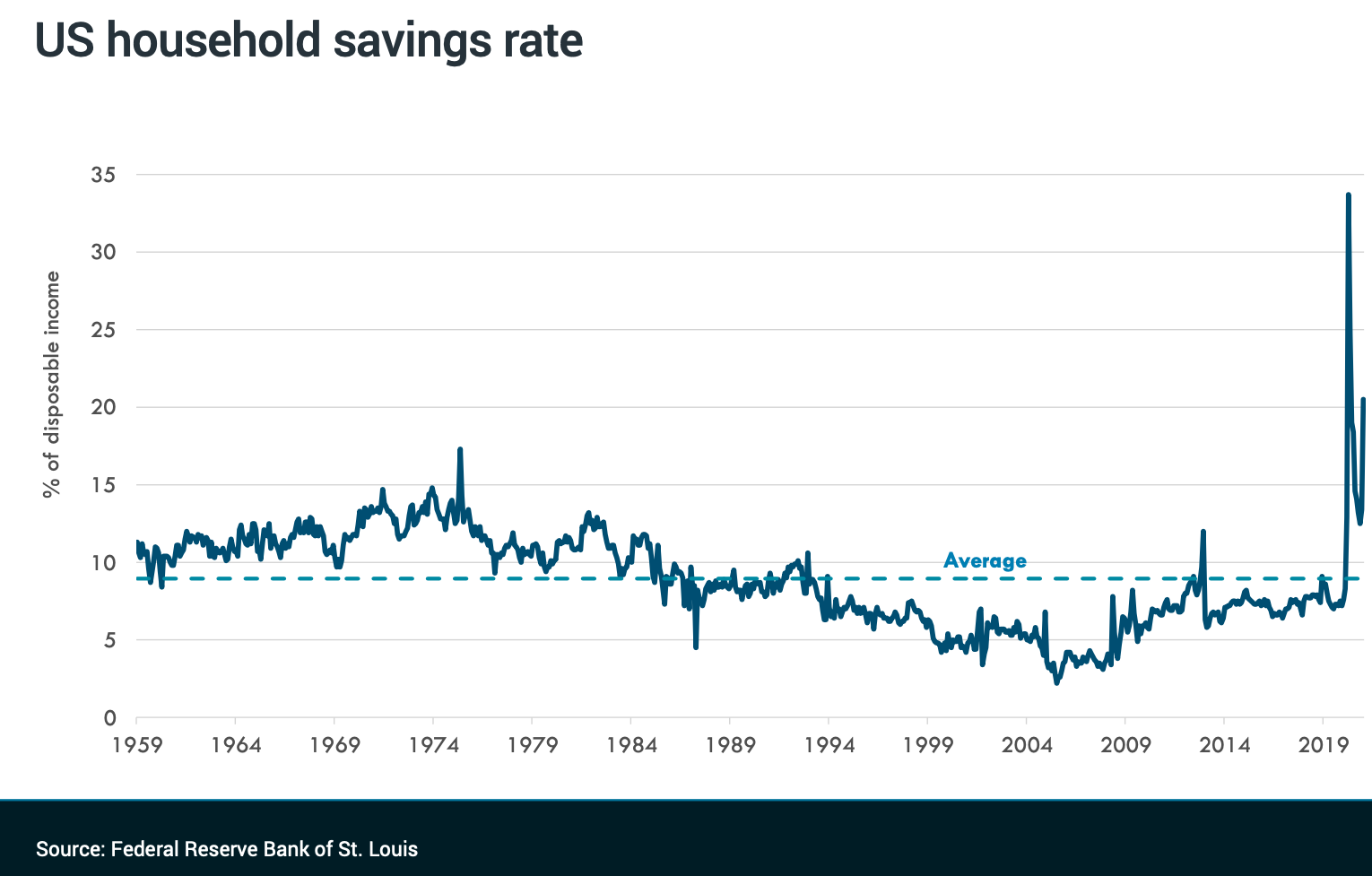

These areas will be buoyed by continued improvement in consumer confidence, along with pent-up demand for goods and services and a rise in household spending. Clifford expects households will start to spend again, after a year of building savings amid lockdowns and pandemic fears.

And even as Australian businesses grapple with the withdrawal of the government’s JobKeeper package, the global effect of stimulus measures continues to flow through.

“A large part of these additional household savings will be spent over the next couple of years, and governments are also still stimulating. This is placing more money in the hands of consumers when they still haven’t even spent last year’s payments,” said Clifford.

“These sectors will do well”

Housing-related spending on hardware, building materials and other “do-it-yourself” items boomed during the pandemic. As the recovery rolls on and international borders start to reopen, Clifford expects this may shift into a similarly-sized bump in travel expenditures.

This segment is one of a few key areas – alongside semiconductors and commodities – that saw a sharp divergence during the pandemic. Having been the hardest hit from March 2020, they then saw stock prices quickly recover.

“We expect these sectors to continue to do well over the next two to three years as the recovery progresses,” says Clifford.

But on the other side of the ledger, he called out companies in e-commerce, software, payments, electric vehicles and parts of renewable energy as “gripped by speculative mania”. A few reasons Clifford believes pain lies ahead for speculative investors exposed here include:

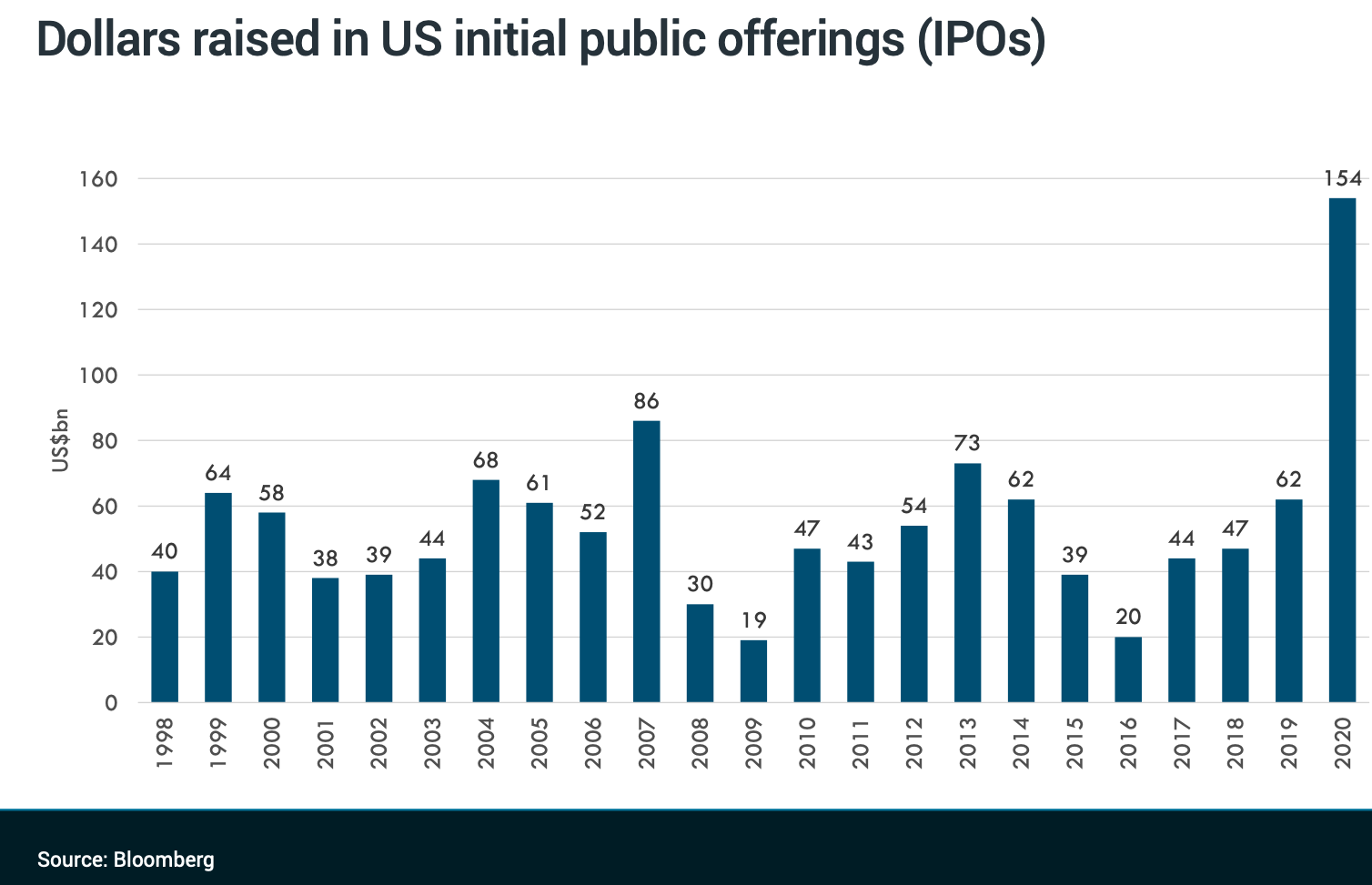

- The huge supply of IPOs in global markets

- High level of retail investor activity, for example, in the options market and as shown in the short-squeeze on US company GameStop

- Innovative financing vehicles, for example, special purpose acquisition companies.

On the last point, Clifford said these were “extraordinary” – in the bad sense of the term – SPACs having raised $85 billion during 2020 and a similar amount again in the first two months of this year.

“Where you as an investor hand over your cash on the promise that the promoter, usually a private equity or hedge fund, who promises to find something special to buy…this is an extraordinary idea: you hand over money and don’t even know what you’ll be buying!”

This isn’t the tech wreck: it’s worse

Clifford believes the most important evidence of the unwinding due for more speculative parts of the growth universe is the nose-bleed valuations.

“Some are trading on valuations of 20-times, 30-times even 50-times sales or more, where typically there are no profits, with companies like Tesla and Afterpay good examples,” he says.

“You simply need to make heroic assumptions about their businesses over the next decade to make any sense of their stock prices.”

“There are hundreds of companies with trillions of dollars of market capitalisation, so when you hear people say, ‘this is not like the 2000 tech bubble’, I must say that I agree. This is a much bigger bubble. The question is, when does it end and what does it mean for the more reasonable part of the market that we’re invested in?”

Where is Platinum investing?

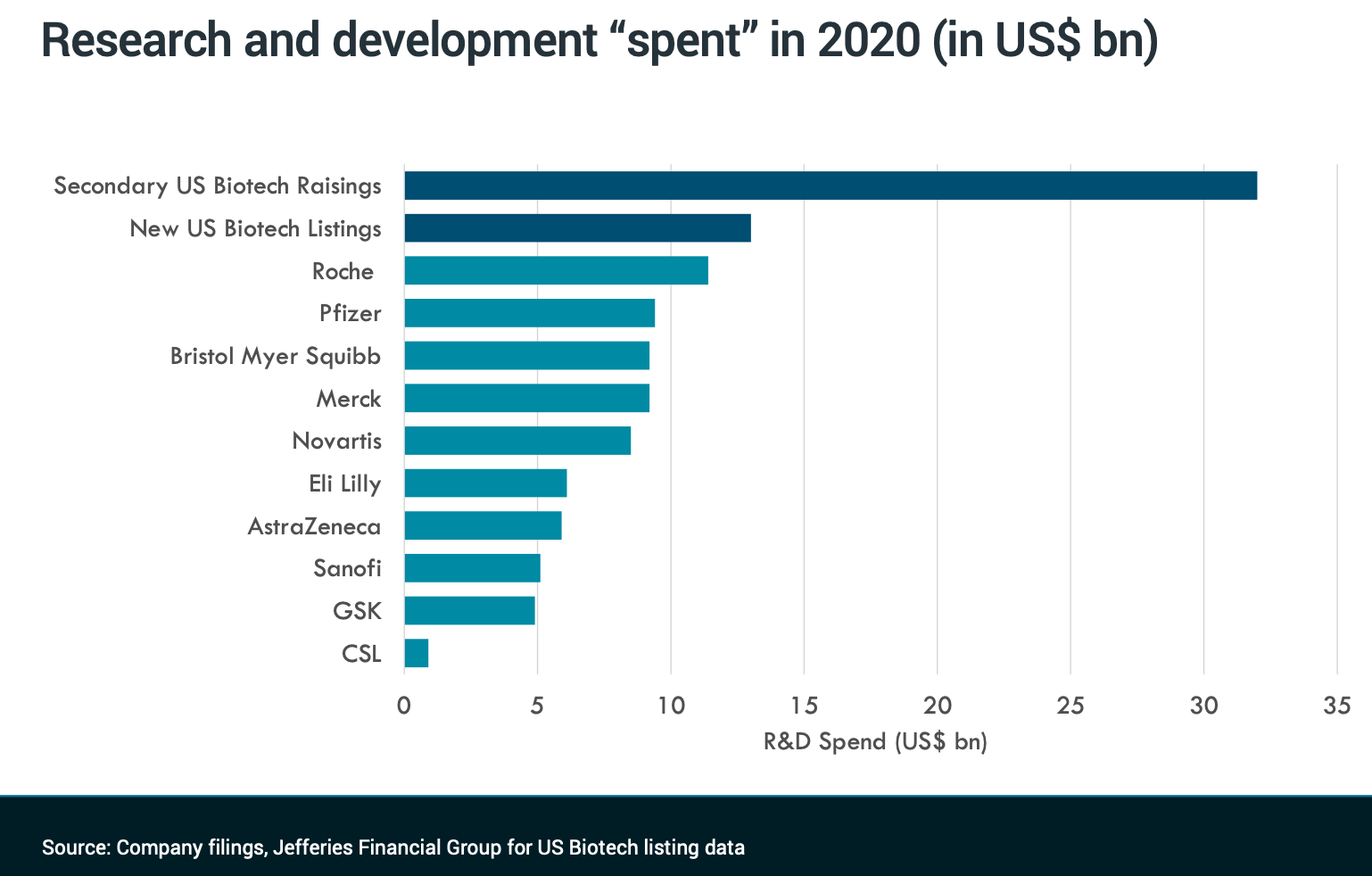

Global biotechnology is one segment that’s being closely followed by Platinum, particularly by Dr Bianca Ogden, portfolio manager of the Platinum International Health Care Fund.

Four promising biotech companies in the portfolio are:

- Moderna

- BioNTech

- NanoString

- Quanterix

Platinum invested in the first of these, Moderna, when it first listed in 2018. The company’s expertise is in expressing surface proteins, and also invests heavily in manufacturing – a rare quality in the sector. More recently, it has become synonymous with mRNA vaccines – which are genetically-based – particularly its COVID vaccine.

“The market saw a company that was very secretive, but we invested at the IPO, after extensive meetings with the CEO Stephan Bancel,” said Ogden.

Similarly, German firm BioNtech – another mRNA vaccine manufacturer – was an early-stage acquisition, added to the fund’s portfolio before the IPO in October 2019. Ogden and her team liked the husband-and-wife team and were encouraged by its mRNA developments, which were initially focused on cancer treatments.

“Though Pfizer takes the limelight, both Moderna and BioNTech have very bright futures,” said Ogden.

Nanostring is another US biotech company, which provides equipment and consumables that allow scientists to zoom in on the way genes, proteins, and cells connect with each other. The firm listed on the NASDAQ in 2013, and it was first added to the Platinum portfolio in 2016.

Quanterix is a biotechnology “tool company” in the US that Ogden says “pushes the limits of protein detection”.

“Previously it was a technology without clinical applications, so commercially wasn’t that exciting,” said Ogden. But having followed the prior success of the company’s now CEO, Kevin Hrusovsky, in bringing together scientific development and commercial opportunities, Ogden invested in 2017.

4 principles, 2 stocks

And finally, Clay Smolinski, co-CIO and co-portfolio manager of the Platinum International Fund revealed the underpinning principles of the investment team.

- The price you pay heavily influences the ultimate return you’ll make on an investment. “Over the long run, price matters,” Smolinski says.

- Comfort: truly great investments carry a seed of discomfort

- Crowd: we look in areas that sit outside the spotlight

- Perception of value: stock mispricing is heavily influenced by cognitive biases

Focusing on more economically sensitive areas of the market. Smolinski and his team, have priced-in the likelihood that rises in both interest rates and inflation will see economically sensitive areas thrive. “But this is going to hurt the very hot stocks,” he says.

He singled out two companies in very distinct areas:

- UPM a paper pulp and forestry company

- IndiGo a domestic airline in India

UPM produces a range of specialty packaging and labelling products. “What’s really exciting is the new wave of regulatory and environmental change that’s helping the company,” says Smolinski. “This is allowing it to dramatically increase the size of its renewable diesel and renewable plastics businesses.”

He emphasises commitments to use renewable sources of materials by airline KLM, courier and packaging firm FedEx and soft drink manufacturer Pepsi as key to the outlook for UPM: “Demand for its products is completely outstripping supply."

Platinum bought the stock when it was trading on an earnings multiple of 14-times, and Smolinski believes this figure could double over the next three years.

A monopoly airline

The fund added IndiGo, which now controls around 60% of India’s domestic air travel market, to its portfolio at the height of COVID fears in mid-2020.

“Since then, the intensity of competition in its main market, and for IndiGo, has been dramatically reduced,” he says.

“Kingfisher and Jet Airways have gone bust, so airfares are likely to go up from here.”

Having bought the stock when it was trading on recovered earnings of 6-times, Smolinski draws comparisons with Chinese airlines as a ballpark indicator of potential growth: “If you’d bought a China airline at this sort of multiple, you’d have made 6-times your money as that market grew from 140 million to 600 million passengers.”

Access the full webinar

The above wire is a summary from Platinum's recent investor update. You can listen to a full replay here.

1 topic

1 stock mentioned

1 fund mentioned

4 contributors mentioned