Where to for credit spreads following APRA's decision to shutter $139bn Committed Liquidity Facility?

As the AFR's Cecile Lefort reports, there was quite extraordinary demand for a new bond issue (actually, dual-tranche 2026 and 2028 issues) from the NSW government on Monday hot on the heels of APRA's "shock" decision to shut-down the $139 billion Committed Liquidity Facility (CLF), which will eventually force banks to replace the CLF with Commonwealth and State government bonds.

While technically the banks can also use the cash they have on deposit at the RBA as a substitute asset for the CLF, this surplus cash will start shrinking rapidly over time as they repay the $188 billion they borrowed from the RBA under the Term Funding Facility and as bonds naturally roll-off the RBA's balance-sheet (that is, bonds that the RBA has purchased under its quantitative easing program, which will mature over time).

Brilliant NSW execution

We've been historically critical of issuance practices in the State government bond (or "semis") market, which have been opaque and not always in the best interests of taxpayers in terms of minimising their cost of capital.

As one example, the States used to do an unusually large amount of private "tapping" of big publicly-traded bonds, and would not disclose the tap for a week after they had done so. Even more remarkably, they would never disclose the price of the tap, which would be considered completely unacceptable in all other bond and equity markets. After we complained about this practice, the States moved to daily tap disclosures (albeit that prices still remain a mystery that only encourages asymmetric information disclosures). And private tapping, or issuing new bonds, to banks that have short-sold big, publicly-traded issues, and which benefit from their spreads widening (or prices declining), seems to have become a lot less fashionable of late.

But NSW could not be faulted on what was a brilliantly executed transaction. The books were only open for a few hours, and quickly soared to north of $7.4 billion, which is the largest I can recall in recent times, and possibly the largest-ever to assemble in such a short period.

The demand was explained by NSW issuing in floating-rate, rather than fixed-rate format, which is purpose built for the bank balance-sheets that are now suddenly very hungry for higher-yielding State government bonds following APRA's decision. The AFR reported that north of 90% of the interest came from banks (we also invested in both bonds). By issuing floating-rate bonds, the States help banks avoid the hedging costs that they would otherwise incur when buying fixed-rate bonds and then hedging them to floating-rate.

What was most impressive is that despite concerns regarding the volume of debt supply to be issued by NSW in light of the cost of the lockdown, TCorp, which is NSW's debt issuance and investment agency, only printed a miserly $4 billion in the context of more than $7 billion of real bidding interest from banks. There had been genuine speculation that TCorp might print $6 billion to $7 billion, yet this proved completely unwarranted.

The decision to only issue $4 billion signals both great restraint and the prospect that TCorp is relatively unphased by its future issuance requirements, which might be explained by the fact that NSW has presciently set aside what will soon be north of $25 billion in its Debt Retirement Fund. The Debt Retirement Fund currently has more than $15 billion of rainy-day savings to help restore NSW's credit rating to AAA and reduce taxpayer debt servicing costs, which will jump to over $25 billion following the sale of the second-half of WestConnex in the next week or two.

NSW can very easily tap the Debt Retirement Fund to slash its debt issuance needs simply by having the fund invest in new TCorp bond issues. This could radically reduce the amount of gross debt issuance the State needs to fund its deficits and COVID-19 costs more specifically. It would also probably be preferable to buying old TCorp bonds, which would just be reducing existing rather than future debt.

In the past, the States have generally issued bonds to fill all the demand in these deals, which means there has been very little scaling. In this transaction, TCorp's Simon Ling and Rob Kenna scaled investors very aggressively, which intensified bidding pressures in the secondary market following the deal, further reducing NSW's cost of capital. All power to them.

Bank analysts spin CLF decision

Despite bank treasury teams being without exception very surprised by APRA's truncated timetable for closing-down the $139 billion CLF by end 2022, bank analysts and researchers were busily doing their balance-sheets' bidding ex post facto with unsubstantiated claims that this decision was not a surprise, expected, and no big deal.

APRA once again demonstrated why it is one of the world's best banking regulators in resisting relentless calls from the banks for a much slower glide-path over 3-4 years or more for reducing their reliance on the CLF, which was a huge regulatory arbitrage, enabling banks to substitute higher-yielding internal loans, bank bonds, and RMBS for lower-yielding yet far safer and more liquid government bonds. (Many banks actually thought the CLF would be largely unchanged in 2022. )

What does stand the banks in terrific stead is the substantial increase in their deposit funding flows, and their reduced reliance on wholesale debt markets, which should make the task of replacing the $139 billion CLF very straightforward.

While they will have to also repay the RBA's $188 billion Term Funding Facility over the next few years, our internal analysis implies that overall wholesale bond issuance from the banks should not be materially different to what they have issued in the decade preceding the COVID-19 crisis (see our detailed modelling of this issue some time ago here).

In the period between 2010 and 2020, the four major banks issued about $141 billion in wholesale debt each year. Since the COVID-19 crisis, they have been able to mostly disappear debt issuance because they had borrowed $188 billion off the RBA at an incredibly attractive cost of only 0.1% pa, and because of a ramp-up in deposit flows. Over time, we should see a normalisation in bank debt issuance until the CLF and TFF are dealt with.

What this means for credit spreads

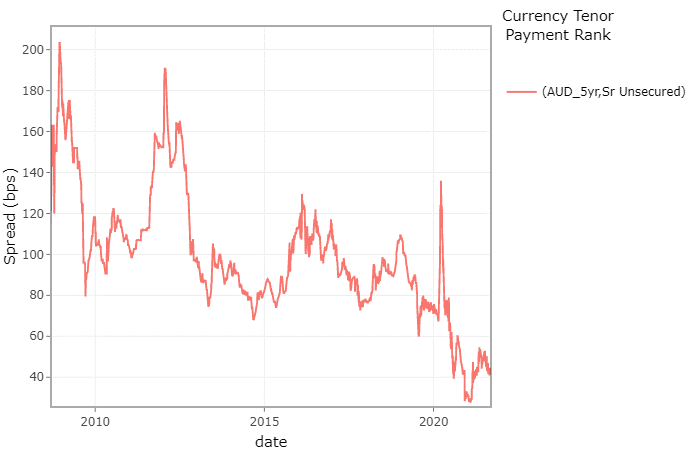

The first chart below shows Coolabah's internal, constant-maturity 5-year major bank senior bond index since 2009. Since 2013, 5-year major bank senior bond spreads have tended to trade in a range between around 60 basis points (bps) over the quarterly bank bill swap rate and 130bps, with a typical cost around 80bps.

Prior to APRA's CLF decision, bank senior spreads had been unusually compressed, although they have started drifting a little wider. Right now we have the 5-year spread at circa 45bps. This probably needs to increase by 20-40bps over time.

By far the biggest local buyer of bank senior bonds had been unusually the banks themselves, which would employ these assets as a substitute for government bonds in their CLF portfolios. Australia was the only developed country globally that allowed this practice, which had been rationalised by the absence of a big enough government bond market. But the game is now over.

While this might suggest a larger increase in bank bond spreads, there does seem to have been a structural rise in deposit funding in recent times. And there is certainly strong global demand for Aussie bank senior paper, which in contrast to most other banks overseas cannot be bailed-into equity by the regulator. The major banks' senior bonds are also very highly rated at AA- (ratings in the AA band are pretty rare in the global bank paper market).

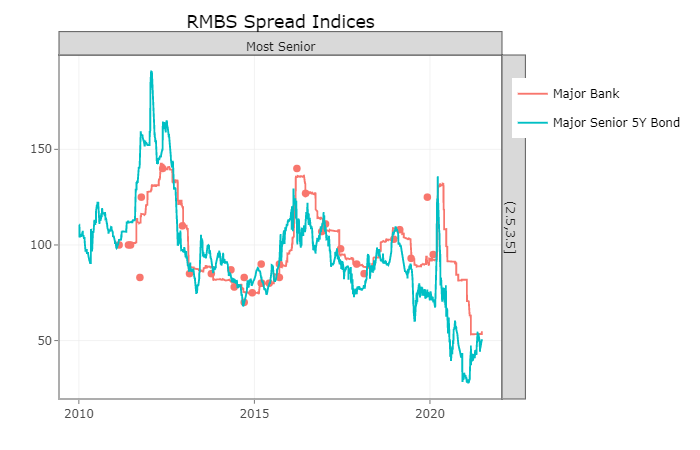

The major banks' 5-year senior bonds are treated as the benchmark asset for the pricing of most other Aussie dollar credit. One asset-class that definitely trades at a small risk premium (with a lag) to major bank senior is AAA rated, bank-issued RMBS. You can see the close correlation between these two sectors in the next chart below. While secured RMBS is more highly rated (ie, AAA) than AA- rated major bank senior unsecured paper, it comes with demonstrably inferior liquidity due to its complexity and indeterminate cash-flow profile. There is also no implicit government guarantee, which bank senior bonds do benefit from (they were explicitly guaranteed by the Commonwealth during the GFC).

RMBS does not have a fixed maturity date but rather an expected weighted-average life that may or may not be correct depending on how quickly home loan borrowers repay their mortgages, which tends to fluctuate over time. Investors are usually compensated for this illiquidity and cash-flow uncertainty with a modest risk-premium over 5-year major bank senior bonds.

If 5-year senior bank spreads need to mean-revert to at least 60-80bps, one would expect that major bank RMBS spreads will do likewise into the 70-90bps ball-park. Once again, banks were among the biggest buyers of RMBS for their CLF portfolios, and this demand will no longer exist. This should reinforce the need for a mean-reversion in RMBS spreads back to at least their historical heuristics.

Inevitable mean-reversion

Bank senior bonds and RMBS are core holdings in many fixed-income portfolios. There will, therefore, likely be attempts to talk-down or explain-away these risks to their outlook (everyone is long with few if any shorts). But the mean-reversion in spreads will be both inevitable and healthy, and offer very attractive future entry points.

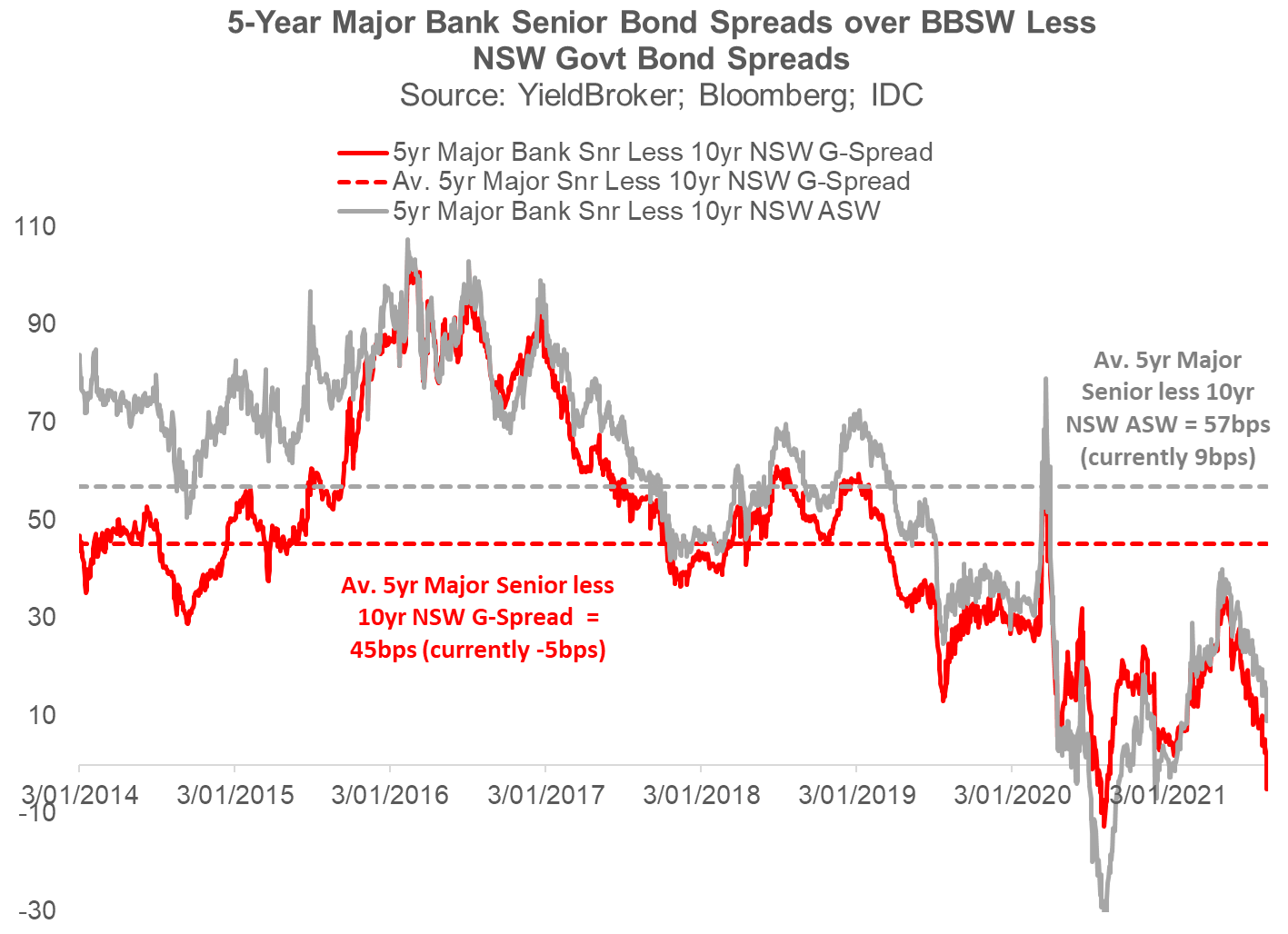

We had previously highlighted that for effectively the first time in history, 5-year major bank senior bond spreads were lower than the equivalent spreads on 10-year State government bonds, as the chart below shows. It was only a matter of time before this anomaly was corrected.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

3 topics