Where to invest if the RBA does or doesn’t cut interest rates

2024 is being quickly characterised as the year of the rate cut. It's also turning out to be the year of the split - strategists are divided on when those rate cuts start and how many of them we get this year. So much so that we recently discussed it on the brand new episode of Signal or Noise (if you haven't seen it, you can click here):

.jpg)

Most think the Federal Reserve, the world's most consequential central bank, will start cutting interest rates in June. But some think it may come later - or if you believe the view of Torsten Slok, Chief Economist at Apollo, none at all. And that's before we get to predictions around the RBA (one or none seems to be the split here) and in Europe.

In this wire, we will attempt to distil the noise into actionable insights with the help of an asset class matrix and two leading multi-asset investors: Oreana Financial Services Chief Investment Officer Isaac Poole and Schroders Australia's Head of Multi-Asset Sebastian Mullins.

The inspiration for this piece

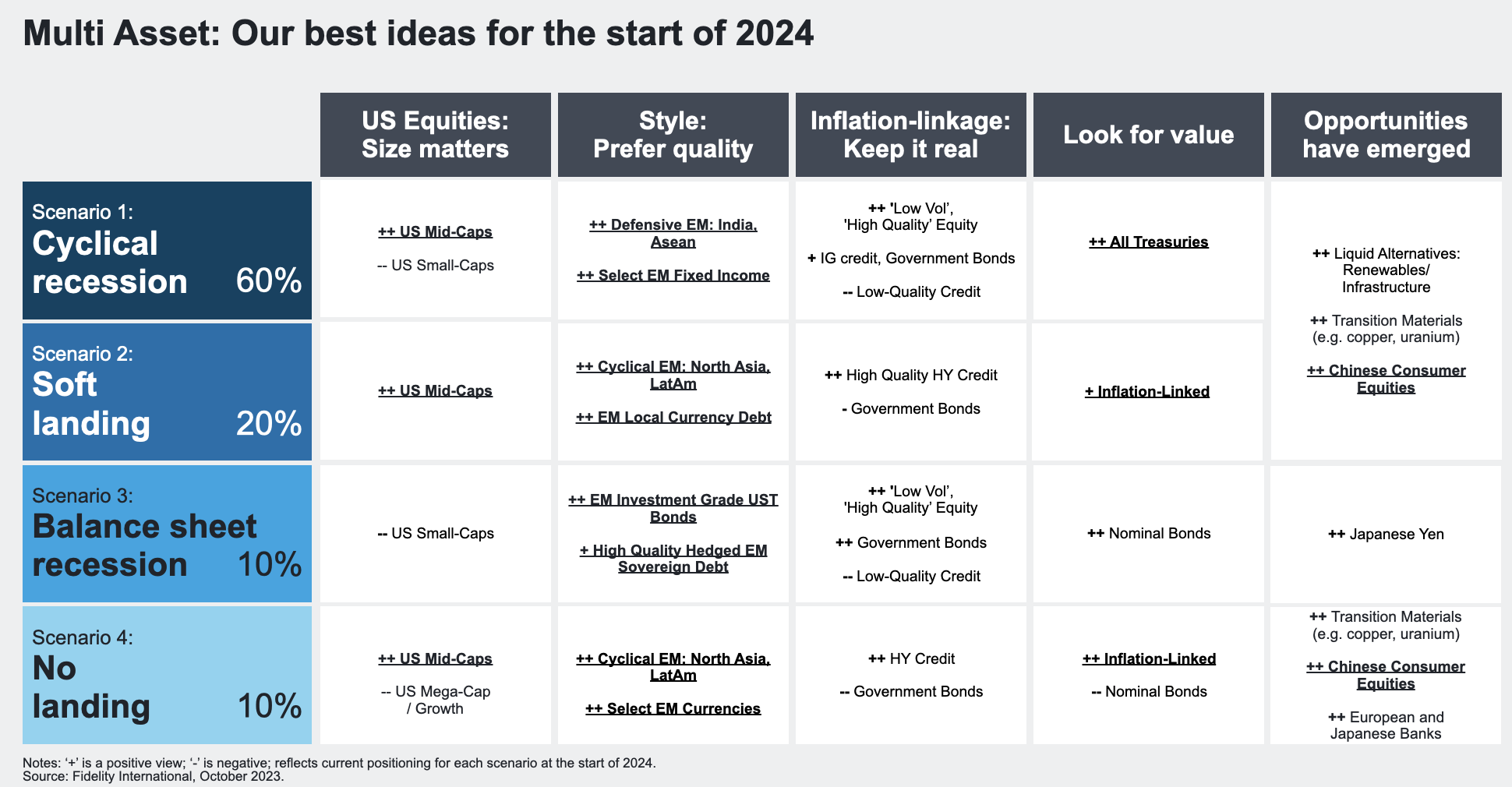

Incidentally, the inspiration for this piece came from a recent interview I conducted with Fidelity International Global Chief Investment Officer Andrew McCaffery. McCaffery and his team produce a matrix of different economic scenarios, the probabilities they assign for each, and the asset classes they would most favour in each specific scenario.

For reference, this was their version of that table as of the end of 2023.

But instead of economic scenarios, our scenarios will focus on the number of rate cuts. Our apologies in advance but you will need to scroll across the page to read the full table.

Scenario |

Equities |

Bonds |

Credit |

Alternatives |

No rate cuts |

|

|

|

|

1-3 rate cuts |

|

|

|

|

4+ rate cuts |

|

|

|

|

And now, here is Sebastian's version - far more succinct but equally insightful.

Equities |

Bonds |

Credit |

Alternatives |

|

No rate cuts |

US quality |

Inflation-linked Bonds |

Private Debt |

Commodities (Best) |

1 to 3 cuts |

Ex-US (Best) |

3-7 year bonds |

High Yield |

ILS (Insurance-linked securities) |

4+ cuts |

Small Caps |

2-5 year notes (Best) |

Investment Grade |

Gold |

Now they have shared with us their tables for how they would invest, we asked them a few more questions about their views on the state of the markets.

LW: How many rate cuts are you expecting this year from the RBA and how do you expect that to affect market returns?

Poole: We expect the RBA will cut rates twice. They are likely to hold rates at current levels for too long, resulting in growth slowing sharply in H2 2024. We think the unemployment rate will move higher and could have a 5% handle by end-2024.

That will require significant rate cuts in 2025. Equity markets may perform OK through H1 2024, but the first cuts could be a catalyst for the market to question the durability of the growth outlook.

Mullins: We believe the RBA will remain cautious with cutting rates while uncertainty about the path for inflation remains high. While progress on inflation remains encouraging, the labour market remains tight which places upward pressure on wages. The RBA is optimistic that labour productivity will improve which allows for a lower impact of higher wage growth into inflation, but the jury is still out here.

With fiscal stimulus around the corner in the May budget and the July tax cuts, we think the earliest timing for a rate cut is late in the year after the September quarter CPI and third-quarter activity data can be assessed. This points potentially to only one 25 basis point easing in 2024 if inflation remains on track. This expectation is broadly in line with market pricing. The market has been trading between one and two 25 basis point cuts for most of this year, so expect little impact on broad asset class returns if the RBA delivers on this expectation.

LW: What excites you most about today’s opportunity set in markets? Conversely, what excites you the least in today’s opportunity set?

Poole: The backup in government bond yields has provided more interesting entrance levels for investors who missed out on 10-year yields above 5%. Shorter-dated bonds are still attractive, but for investors with the appropriate risk tolerance, moving out the curve will provide a very important risk hedge against a fall in equity prices.

I’m least excited about equities in general. Valuations are discounting a re-acceleration in growth, and that just doesn’t look likely right now. That means prices need to move significantly lower to normalise P/E ratios.

Mullins: Within fixed income markets, one of the key differences now to the last 10 years is dispersion in valuations across different regions and sectors of the market. We manage highly flexible strategies with a very broad investment universe and we have access to active strategies across different regions (US, Europe and Asia) and sectors (IG, HY, hybrids and securitised) of the market. This allows us to take advantage of the dispersion in valuations by focusing the fund’s asset allocation to the most attractive region or sector based on our assessment of valuation and our business cycle outlook.

For example, we have been selling US investment grade exposures (where spread levels are in their most expensive quintile) and allocating them to an active securitised asset strategy managed by a specialist team based in New York. This strategy has exposure mostly to US mortgage-backed securities and other asset-backed securities with diversified exposure to US consumer loans backed by collateral. These assets are paying 1% pa over US investment grade bonds but have higher credit ratings.

Our outlook for US growth is above consensus and the US consumer has displayed surprising resilience to higher borrowing costs and is capturing real wage gains – with attractive valuations and strong fundamentals, we prefer the risk-reward payoff from securitised assets relative to US investment grade.

LW: Nominate one ‘wild card’ (an event that is unlikely but not impossible to happen) that could upset your base case - and what you would do in that scenario.

Poole: A genuine housing market correction in Australia.

This is unlikely because the RBA and the government would likely step in to prevent the risk of contagion throughout the rest of the economy. But it is not impossible – households are over-leveraged and the full impact of the roll-off of fixed to variable-rate mortgages has not flown through the economy yet. A couple of big implications would be falling equity prices, a sharp collapse in the Australian Dollar and rates being cut aggressively.

So underweight Australian equities in favour of international, reduce the hedge ratios as the Australian Dollar falls sharply, and overweight government bonds versus corporate credit. And of course, look to buy property as it collapses in price!

Mullins: Our main concern remains progress on lower inflation is potentially stalling (ie sticky inflation), so we are building in inflation protection into our portfolios. We are doing this in a few ways.

Firstly, in both our fixed income and multi-asset portfolios we have made allocations to US inflation-linked securities where the semi-annual coupon is variable based on the level of inflation, so we receive higher cash flows if inflation is higher.

Secondly, we have tilted our Australian investment grade exposures to issuers that have their pricing linked to the inflation rate, such as utility companies and infrastructure assets.

Within our multi-asset portfolios, we have been increasing allocations to commodities, which have very attractive valuations and inflation linkages and within equities, we have made direct allocations to global energy companies.

For more great asset allocation insights like this, tune into Livewire's Signal or Noise! Both Poole and Mullins have been guests on previous editions of the show.

5 topics

2 contributors mentioned