Where will the S&P 500 finish 2024? Some analysts are miles apart

As November turns to December and the cool breezes turn into snow storms, Wall Street analysts reflect on the year it has been, the best and worst investments, and what might come of next year.

The very top of this tradition is the S&P 500 year-end forecast, whereby analysts forecast where they believe the benchmark will be trading (on a points basis) in 12 months' time and why.

Some call it the sell-side equivalent of throwing darts at a dartboard, while others use it as a cue for where sentiment is for equities at the big-picture level.

In this wire, I'll take a closer look at the S&P 500 forecasts that are out so far - as might be expected given the macro conditions, they vary greatly and that, in itself, tells a story.

Last year's record

Last year's year-end forecasts were the widest in living memory. The Bloomberg survey had one analyst at 3,225 and the other at 4,900. Put another way, the most bearish analyst was calling for a 15% fall, while the most bullish analyst thought the S&P 500 would rise by more than 27% in just 12 months.

So, how did the S&P 500 do?

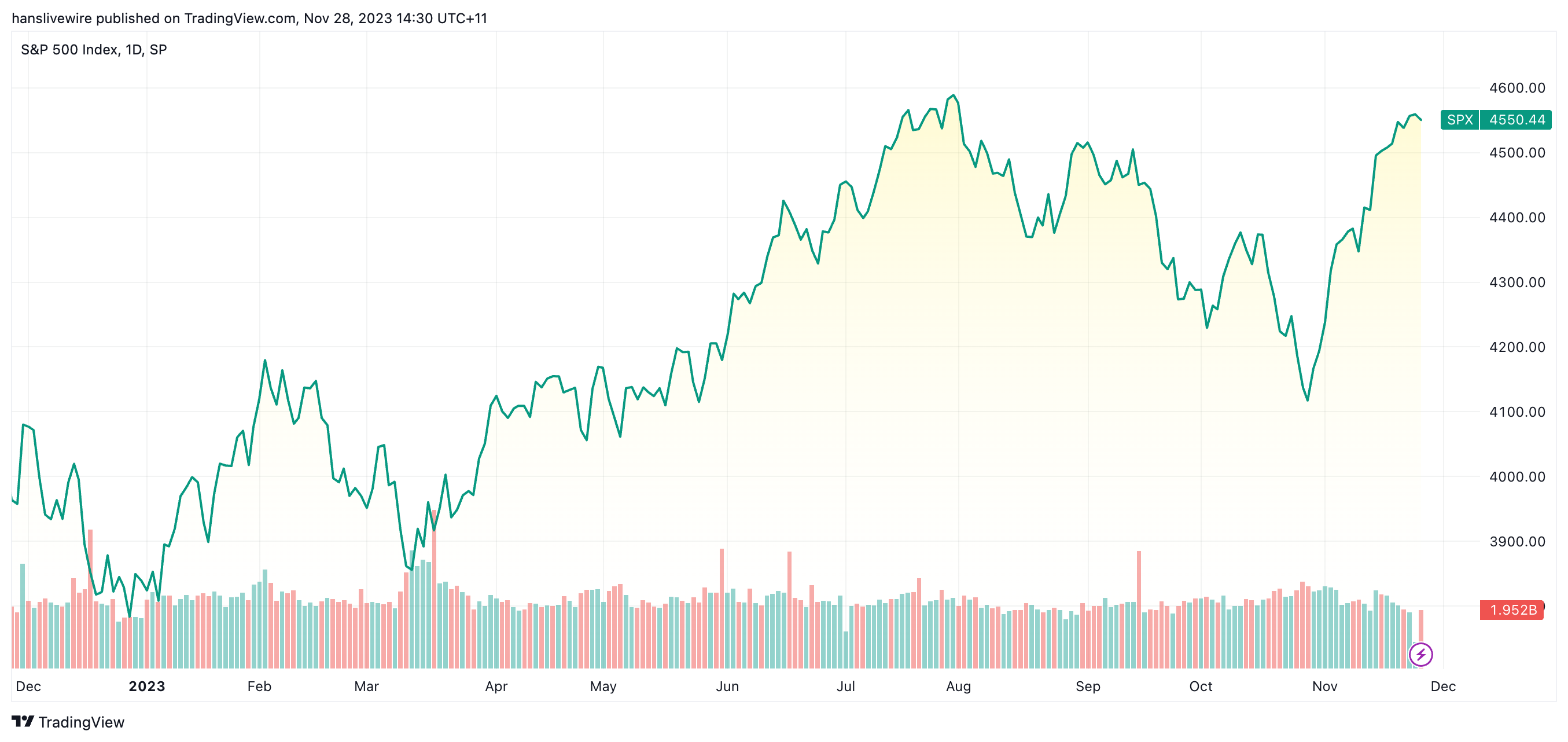

As is usually the case, the answer to this age-old question is almost never an extreme low or an extreme high but somewhere in between. But what was different about this year was that the S&P 500 continued to rally even in the face of recessionary fears, central bank rate hikes, and a massive overvaluation in mega-cap tech stocks.

All in all, the market-cap-weighted S&P 500 has rallied 15% over the past 12 months. 30% of the market-cap-weighted S&P 500 is just seven stocks: Alphabet, Apple, Microsoft, Amazon, Meta, Tesla, and NVIDIA. The equal-weighted S&P 500, which treats each stock as 1/500th of the index, rose just 1% in that same time frame.

The 2024 forecast table

And now, the 2024 forecasts. Please keep in mind that this table is correct as of the end of November 2023. It does not include a couple of major players because they have not submitted their forecasts yet. Once they do, we will update this table. Some of this data is sourced from Bloomberg.

| Firm(s) | Price Target | |||

| BCA Research | 3,700 | |||

| Cantor Fitzgerald | 4,400 | |||

| Scotiabank | 4,425 | |||

| Morgan Stanley, Barclays | 4,500 (Current S&P 500 Level, as of Monday 27 Nov 2023) |

|||

| Wells Fargo | 4,600-4,800 | |||

| Raymond James | 4,650 | |||

| Goldman Sachs, UBS | 4,700 | |||

| Societe Generale* | 4,750 | |||

| Bank of America, RBC, Citi | 5,000 | |||

| Deutsche Bank, BMO | 5,100 | |||

| Yardeni Research | 5,400 |

Notes:

*Societe-Generale's team, led by Manish Kabra, sees the S&P 500 hitting 4,750 in the first quarter before dropping to 4,200 mid-year as a mild recession ensues. That 12% drop will then mark a buying opportunity.

**An honourable mention goes to Isaac Poole, Oreana Financial Services CIO and Livewire contributor. In his latest piece, he revealed that he thinks the S&P 500 may trade as low as 3,500 by Q3 2024. If it pans out, that would be quite the bear market.

***It should be noted that these are the forecasts for 2024, made at the end of 2023. Analysts often change their year-end forecasts throughout the year as earnings, macro events, and other black swans empower them to do so.

Some investable highlights from the analysts

Morgan Stanley: "2024 is shaping up to be different as U.S. equities should notch better outcomes than European or emerging market equities, particularly as central bankers globally aim for target rates. Within the U.S., healthcare is forecast to outperform, and Morgan Stanley prefers industrials relative to other cyclical sectors."

Goldman Sachs: "You’ll get slightly better returns from the seven leading stocks, but not nearly the dramatic difference that you’ve had this year. Cash, with a 5% risk-free return, will be a competitive alternative to stocks — three-month Treasury bills yield around 5.5%, similar to the earnings yield on the S&P 500 Index."

Bank of America: "A pickup in political uncertainty, plus the yield curve’s leading relationship to equity market volatility would argue for a higher quality bias come mid-2024. High-quality stocks have been a good hedge against a rising VIX."

Deutsche Bank: "If earnings growth continues to recover as we forecast, valuations will remain well supported around the top of the range as is typical on the pricing in of a pickup in earnings growth"

BMO: "We believe investors will need to own a little bit of 'everything' and not tilt too far in one direction or another from a sector, style, and size perspective - a sharp contrast to the trends that prevailed during 2023."

What does the divergence say about markets?

The 1,000-point gap between the surveyed analysts suggests that the jury is still out on whether a US-led recession will ever start, how long central bank rate hikes take to affect markets, and whether corporate earnings will crack in 2024.

We already have some data on the first and last points - and so far, it's not that bad. Economists expect the US will still grow at trend (2.1%) but that is down from the 2.3% figure in 2023. BCA Research disagrees on this - and that's a big part of why its call is just 3,700 (a long way from the consensus.)

Analysts surveyed by FactSet think the S&P 500's EPS will grow by 4.5% next year. Once again, while down from the 5.2% figure of 2023, it's hardly a crisis.

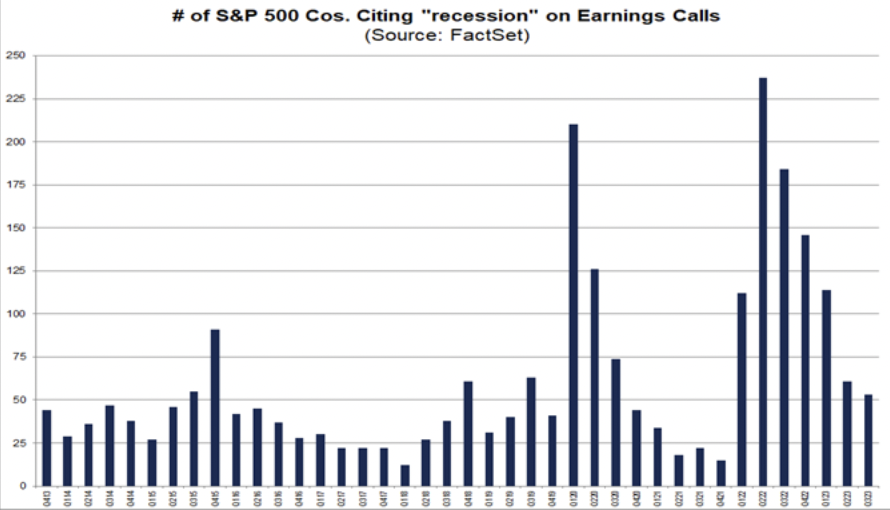

FactSet analysis also suggests that fewer companies are discussing a recession. After peaking in Q2 2022, the number of S&P 500 companies citing “recession” and "inflation" on earnings calls has declined for five straight quarters.

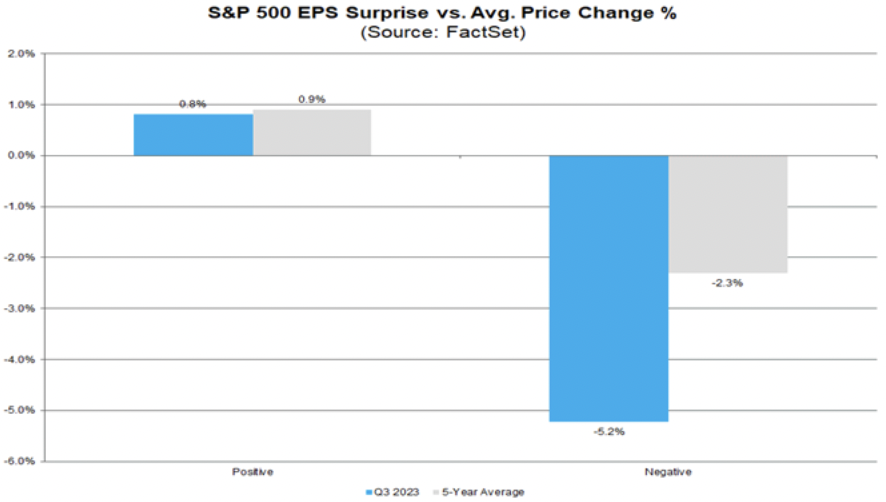

There are, however, two important trends still playing out. Disappointing earnings - or worse, misses against analyst expectations - are being punished hard. Negative share price reactions to earnings misses in the most recent US reporting season were the most savage since 2011. And naturally, savage share price falls will affect the S&P 500's price as an index.

The second point around central bank rate hikes is the other relative unknown. Corporate earnings have remained resilient because net interest expenses and reliance on short-term loans are far lower than they were in 2008. But just because it's good now does not mean it's going to remain this good - as Franklin Templeton's Stephen Dover wrote in Barron's a few months ago:

"At some point, new borrowings are required, and maturing debt must be rolled over. If borrowing costs remain elevated, the good times will go away."

Rate hikes also tend to take anywhere between 12 and 18 months to feed through the economy. According to S&P Global's data - there have been more bankruptcy filings in the US this year than in 2021 and 2022. Corporate defaults (by number) are also 13% higher in 2023 than the five-year average - and that's before you consider that individual debt is at an all-time high in the US.

That's why investors like Christopher Joye believe there is still more to come. The Fed only finished hiking recently - and it will take another 12 to 18 months for those to feed through.

Speaking of divergence

Finally, just because you have a bullish view of the economy does not necessarily mean you have a bullish view of markets. For instance, Goldman Sachs has had a long-held view that the US can nail a soft landing. But its year-end target of 4,700 implies the S&P 500 will rise by only 3% next year, suggesting limited upside after the year 2023 has been.

In contrast, the same research house can have a bearish view of the economy and a bullish view of markets at the same time. The perfect example of this is Deutsche Bank - which was the first major Wall Street firm to argue that the US would end up in a recession. But chief global strategist Binky Chadha believes the S&P 500 can rise to 5,100 next year. If it pans out, that would be a 12% increase on top of this year's 18% rise.

But generally, the two go together. BCA Research's 3,700 call is a cocktail of a typical US recession plus an earnings drawdown of anywhere between 5 and 15%. If that call comes true, then it's going to get very ugly.

I wrote recently about the Bank of America 5000 call here:

I also wrote recently about the VIX, which is referenced in that Bank of America quote. You can read that here:

3 topics

3 contributors mentioned