Which stocks are most at risk of tax-loss selling?

Tax-loss selling happens when investors take advantage of the looming tax year-end on the 30th of June to sell some of their losing stocks to offset any realized capital gains. Using our proprietary average cost-of-entry tool, we calculate estimates of the average investor cost basis for all stocks in the S&P/ASX 200. This can be used to surface likely losers.

Please note that this article is focused on the principles governing tax losses in relation to how investors behave. You should consult a registered tax agent for advice on your own personal circumstances since every investor has a unique tax position.

Tax-loss selling and the average cost of entry

In a previous wire, The savvy yabby (or, how I “know” when to adjust iron ore exposures), I explained how one can use estimates of the average price investors paid for their stock to judge their likely sentiment. The underlying idea is pretty simple:

Are investors going to feel good because they have paper profits, or are they going to feel bad because they have paper losses?

During most of the year, this is just a judgment of how they might be feeling.

However, once every tax year the answer to that question, what is the average condition of investor gains or losses in a stock, will have a practical impact.

You cannot make a tax loss if you only have a gain.

If most investors in a stock have paper gains they are unlikely, on average, to be choosing that stock to sell in order to generate tax losses. Of course, in stocks that have widespread losses, we should expect significant tax-loss selling. This leads us to a hidden fundamental:

The purchase price of every share issued by a given company is a real number and the stocks most at risk of tax loss selling are those where on average it is negative.

Across the market, these add up to what I call the fundamentals of sentiment.

Stocks with large unrealized losses, on average, will have poor investor sentiment, and are those most likely to be sold to harvest tax losses at the end of each tax period.

Relationship between annual losses and tax losses

Generally speaking, there is a close correlation between stocks that have fallen a lot over the past year and stocks that are likely candidates for tax-loss selling.

That is mostly right, except for some complications. For instance, there may have been stocks that did very well for many years which have only just had a significant correction. On the other hand, stocks that fell a lot over one year, but which have rallied a lot off lows may no longer have many unrealized losses. The trailing one-year return is simple, but can be skewed.

In this note, I have used the method I described in the earlier article on sentiment to calculate the bottom-up estimate of average cost basis, taking account of stock turnover. You can read the original article linked above, or just follow along here, where we just discuss results.

Our first result is to calculate the estimated average investor profit and loss by taking the closing price on 3-Jun-2022 and dividing that by our estimated cost basis on that date.

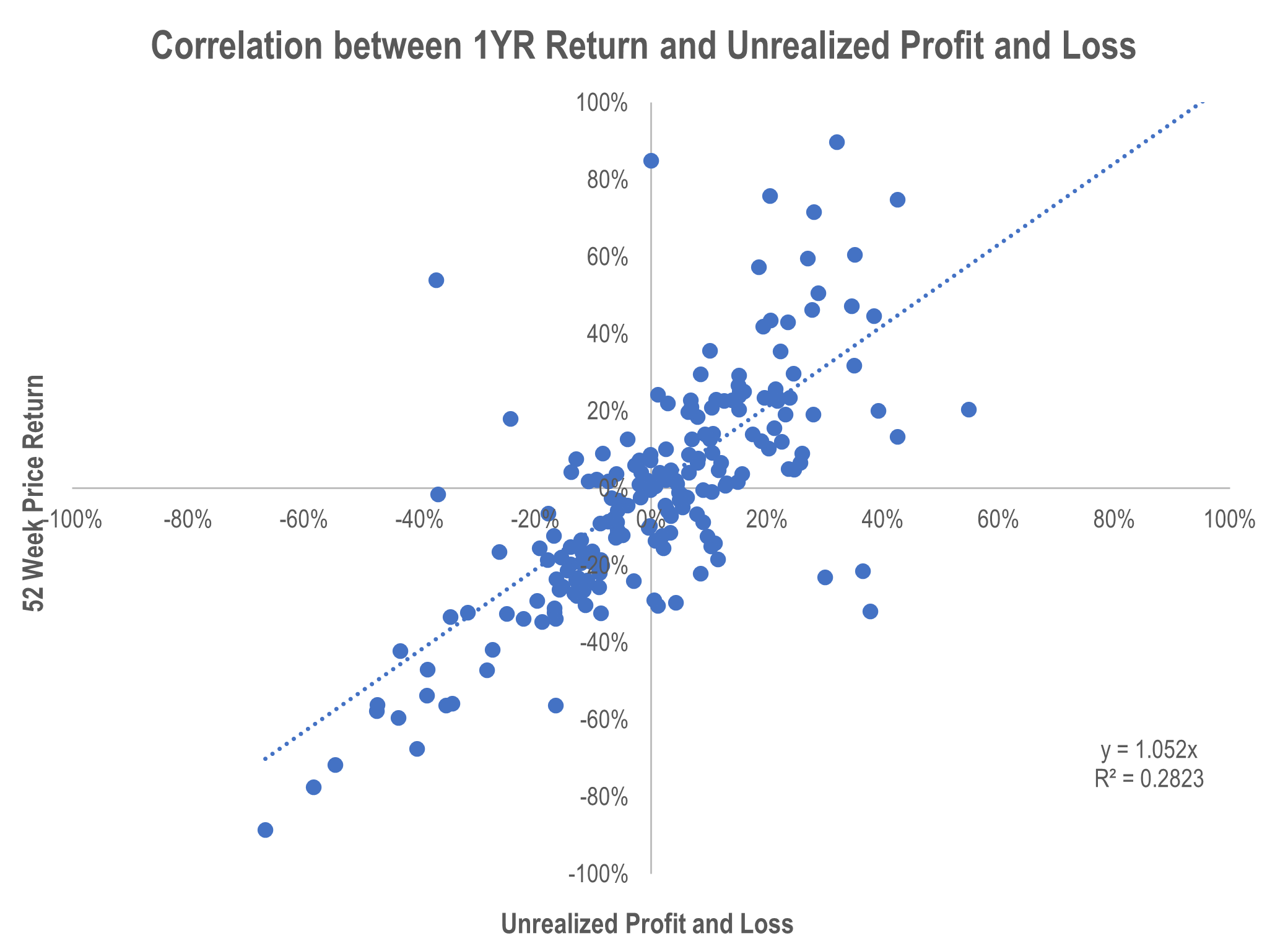

To explore the relationship between this number and the trailing one-year return we can look at a scatter plot of one variable versus the other. You can see the relationship is pretty close.

The fact that these are actually different quantities shows up in the slope of the line. It is not actually one, because the trailing one-year return is based on the price on 3-Jun-2022 versus that one year ago on 3-Jun-2021. If investors typically held stocks for one year, that would be about the same as the average cost of entry. However, the holding periods for stocks vary widely by stock, by investor, and by year. That is why the numbers are different.

However, they are somewhat similar, as you can see.

Estimated tax losses by sector

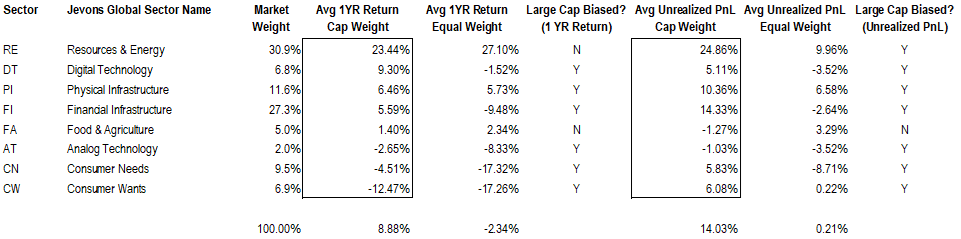

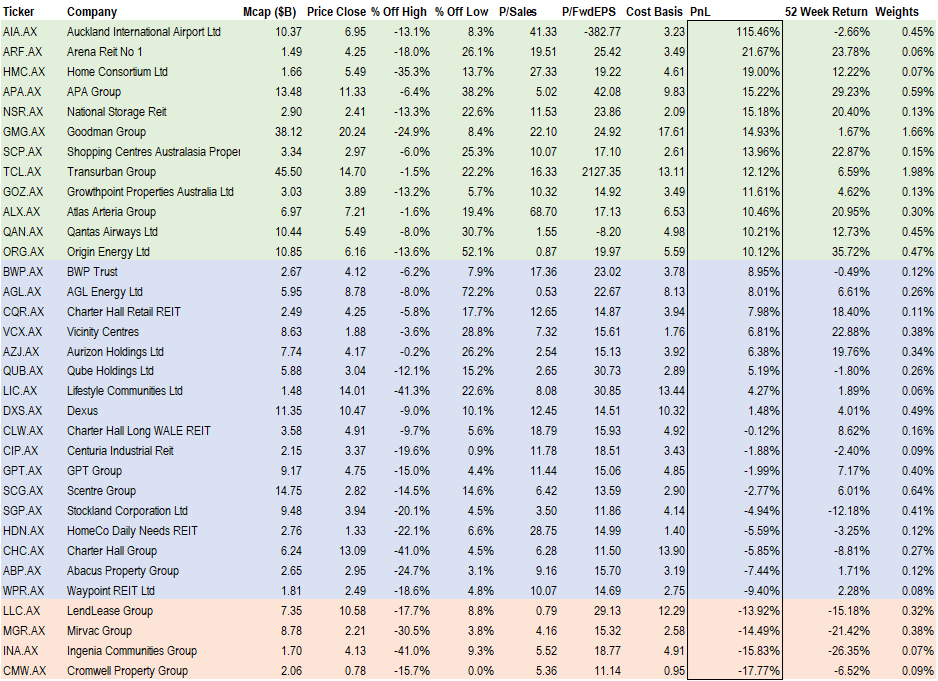

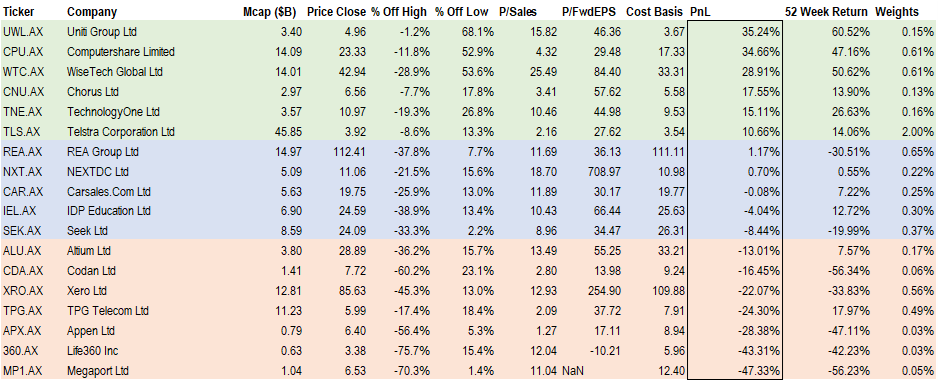

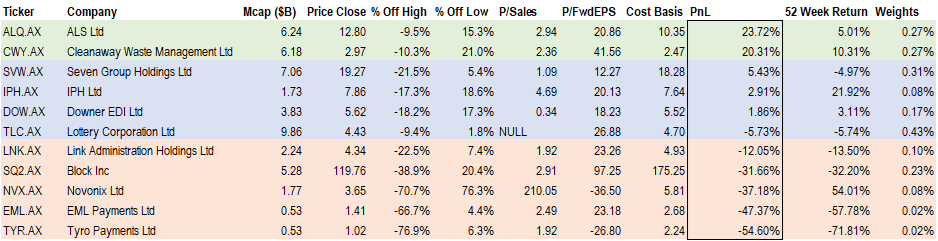

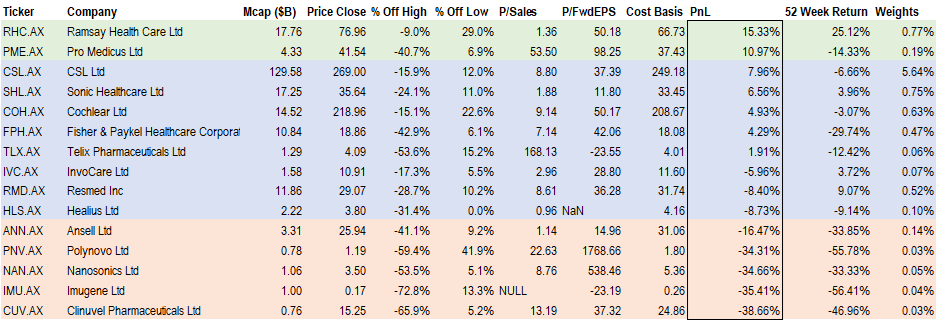

Since every stock is different, but similar stocks in similar industries experience similar market cycles, we can glean some further information by looking at sectors. The table below compares the two measures of sentiment: one-year trailing price return, and unrealized investor profit.

The sectors given are the ones I use at Jevons Global. They are fairly self-explanatory but you will see complete lists of every current stock in the S&P/ASX 200 later.

For now, look at the boxed numbers by sector. You can see that Resources & Energy has had a banner year. The average cap-weighted one-year price return was 23.44% and our estimated average unrealized investor gain is 24.86%. On the loss side, you can see that the Consumer Wants sector had negative year-on-year price gains, but shows around 6.08% profit.

These analyses help explain how tax-loss selling may appear in places we don't expect. The risk is not as simple as listing those stocks which fell a lot over one year, as we now demonstrate.

Are large annual falls always indicative of tax-loss selling?

Prior to reviewing the stocks we believe are most at risk of further tax-loss selling, it may be helpful to dig a little deeper into the difference between a large annual price fall and the tax issue of whether investors are sitting on large unrealized losses.

As it happens, these are not necessarily as closely correlated as our scatter plot suggests. The reason has to do with the level of liquidity in the marketplace for the stock. The simple fact is that stocks that trade very little tend to have a much slower moving average cost basis.

The math of this can be a little complicated but the idea is actually pretty intuitive.

Imagine a stock that was listed at $1 but traded very little until it reached $10. The average investor would have bought at an average price close to $1. If the stock then plummeted from $10 to $5 it might look like a high conviction candidate for tax loss selling, but most investors have gains around $4.

The moral of the story is that we have to look closely at the rate of turnover. Low turnover stocks with high drawdowns can oftentimes be stocks that are still in profitable territory.

To illustrate, I have picked out a few current examples from our S&P/ASX 200 database.

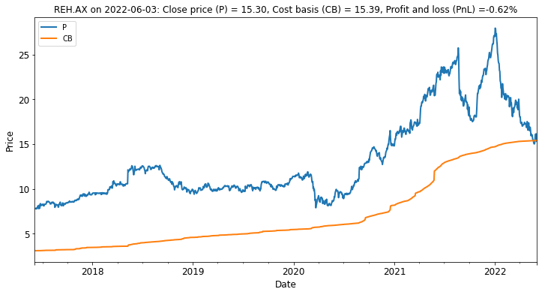

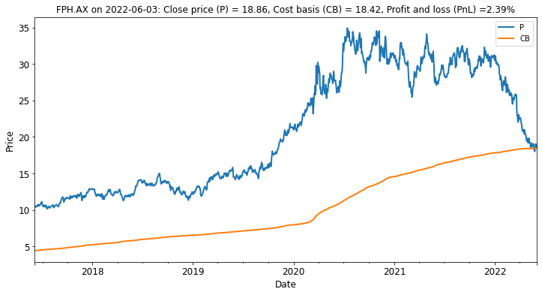

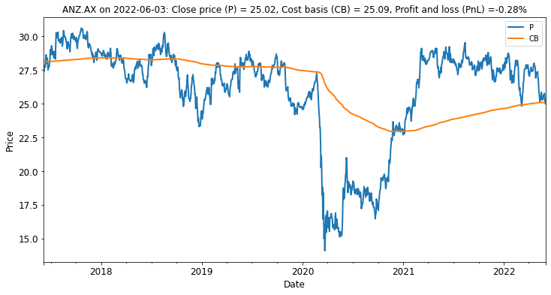

The chart below is for Reece (ASX: REH) , a plumbing supplies firm. The blue line shows the recent price history using the closing price from the Australian Stock Exchange. The gold line shows an estimate of the average cost basis of investors. This is the same as the price they paid, on average, when buying the stock over time. The number changes on a daily basis.

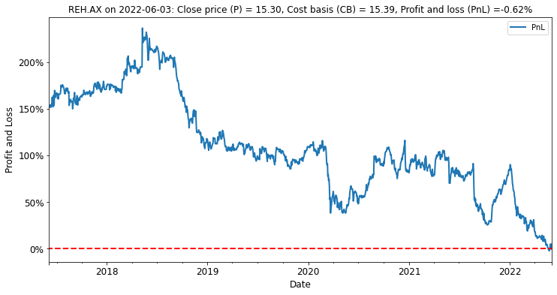

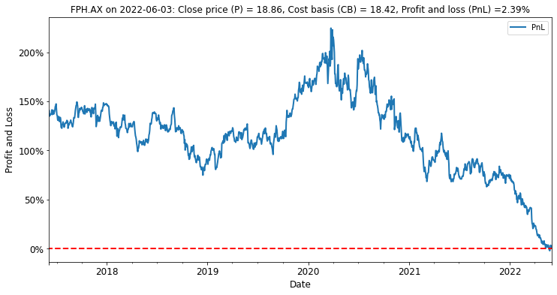

When the blue line is above the gold line, the typical investor is in profit. When it is below, the typical investor is in loss. This is easiest to see if we plot the average unrealized profit and loss at each point in time by dividing the price on a given day by the cost basis on that day.

This second type of chart has just one line which shows the unrealized profit and loss on each day, measured as a percent gain or loss. It changes each day, as the price fluctuates.

Reece saw good conditions during the pandemic lockdown as many homeowners renovated. While it is down 32% over one year, and significantly more from the recent highs, our estimate of the average investor cost basis shows the typical investor as being pretty close to break even. There are few tax losses to take now!

Reece has shown a very good history of positive unrealized gains and is now at break even.

Stocks like Reece are prime candidates to be bought in the new tax year as investors go back to their models, re-do their valuations for the new environment, and judge their entry price.

Fisher and Paykel Healthcare (ASX: FPH) is another excellent example of this factor at work. The stock has typically low rates of turnover, and is now back at break-even for the first time in more than five years. It will likely as not be bought in the new tax year.

Situations like the above are comparatively rare, but can help the more fundamentally oriented investor make some sense of the price action in their favored growth stock that is sold down!

The other situations of interest relate to when stocks with modest profit and loss history may be sold down at this time of year until such point as they hit break even.

Investors who are seeking yield may well step up to buy ANZ (ASX: ANZ) in the new tax year as they see the falling stock price stabilize. The average estimated tax losses are now close to zero.

Which stocks are most likely to show further tax-loss selling?

Clearly, the estimated cost of entry for investors is only one factor that determines whether investors will buy or sell a given stock. Valuation is also critical, along with the recent firm performance, and the condition of markets, in general.

However, since tax losses are mathematically determined by the entry price of investors, we should expect that, other things being equal, those stocks with the worst estimated tax losses will see the most tax loss selling.

You may take that or leave that as a statement about what a particular stock might do.

These are tools that can guide us to the typical, or average, behavior, and we should not expect them to work, in an ideal fashion, for each individual circumstance.

Nonetheless, we know how to interpret the cost-basis in the context of tax losses and gains and so it can be helpful to tabulate those stocks with the largest estimated tax losses.

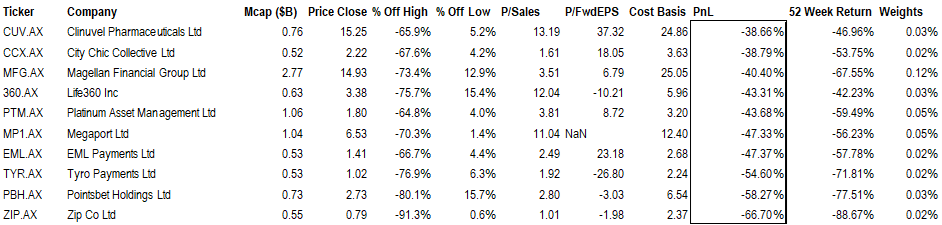

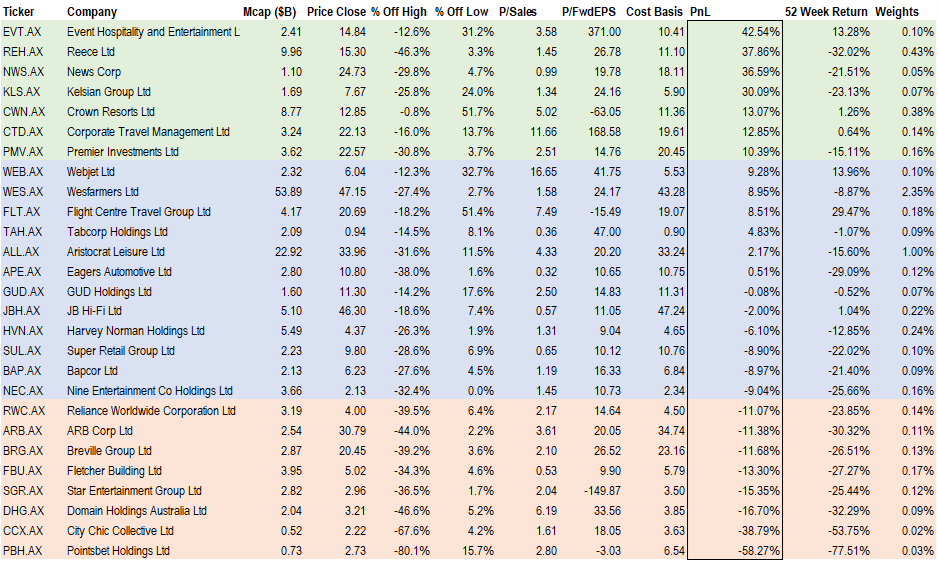

The above table gives the ten stocks in the S&P/ASX 200 with the largest estimated losses as at a calculation date of 3-Jun-2022. Note that these estimates change with each trading day as the calculation takes account of how much volume is traded, and at what price.

When stocks trade at levels above the cost of entry the average cost basis must rise.

When stocks trade at levels below the cost of entry the average cost basis must fall.

In order to calculate the numbers in the table we have taken all 200 stocks and applied a rule to combine all previous days' trade in the stock to come up with a current estimate.

Here is our countdown of the ten stocks with the worst estimated unrealized losses.

10. Clinuvel Pharmaceuticals

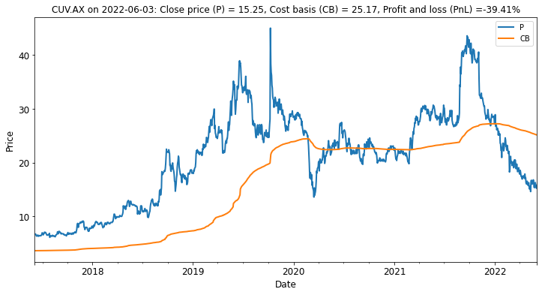

Clinuvel Pharmaceuticals (ASX: CUV) is a pharmaceuticals firm focused on a range of innovative treatment targets using melanocortins. The bear market development in this stock started around the start of this year when the price broke below the cost of entry.

These considerations alone cannot provide much guidance on where the stock would be in clear value, since biotechnology firm valuations are very much driven by the pipeline and clinical prospects for treatments that they have under development.

Stocks with a high component of speculative value are best treated on their own fundamental merit in respect of their research and development programs. However, in conditions like now it would be unsurprising to see tax-loss selling in June. Long-term holders who are familiar with the state of the R&D pipeline might best consider entering the market after the tax year-end.

9. City Chic Collective

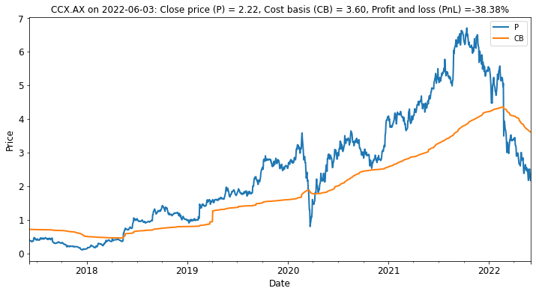

City Chic Collective (ASX: CCX) has been a good story for most investors until the onset of the recent bear market. The firm is a multichannel retailer with an innovative marketing strategy.

The situation described is not uncommon for high-growth names that hit rough waters due to a change in market sentiment. In this case, there likely will be a tax-loss selling this season, but investors who are long-term holders may want to go back and check their valuations. Since there is an underlying real category retailing business, it makes sense to work out where it presents value to the unjaundiced eye. In our view, investors who actively work on stressing their valuation numbers will likely find confidence to perhaps buy in the new tax year.

8. Magellan Financial Group

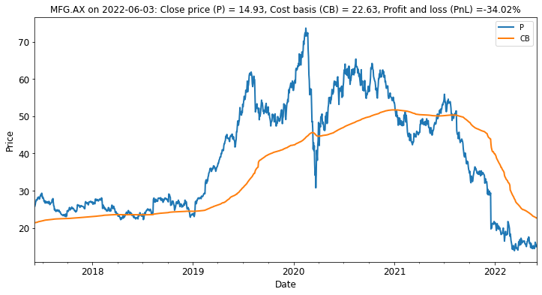

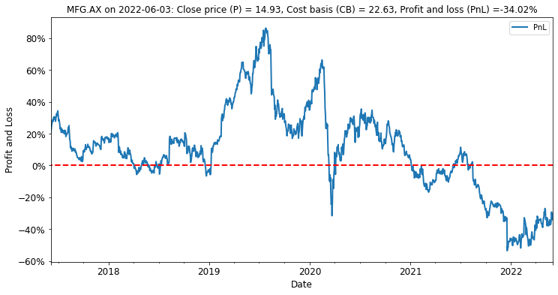

Magellan Financial Group (ASX: MFG) is one of several listed Australian funds management businesses racking up unrealized losses for investors who bought the stock.

The bear market for Magellan appears set to continue for the time-being.

Since there are significantly changed fundamentals in play, Magellan seems caught in a bind until the new management are able to win back investor confidence to stem outflows. This stock seems likely to be sold in the tax-loss selling season as value investors stand aside.

7. Life 360 Inc

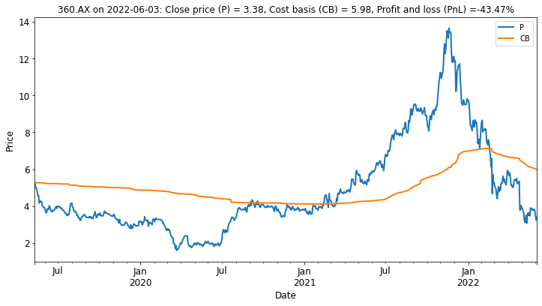

Life 360 Inc (ASX: 360) provides location based services to assist family members in tracking each other, for security, convenience, and peace of mind. Like many high growth concept stocks it has been punished in the current global technology stock correction.

Since the stock is estimated to have significant investor unrealized losses it will likely continue to be sold down going into the tax year-end. Investors who believe in the long-term potential of the business may find more attractive entry points past the end of this tax year.

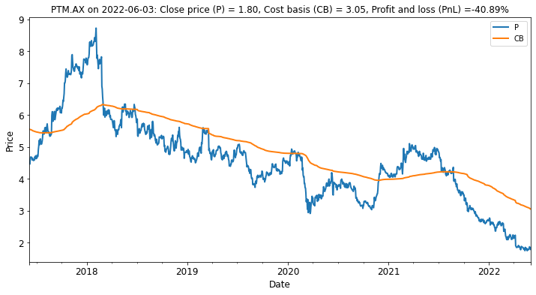

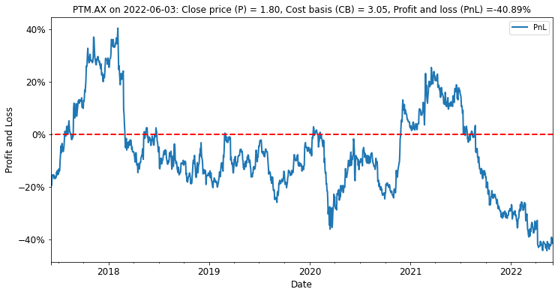

6. Platinum Asset Management

Platinum Asset Management (ASX: PTM) is yet another funds management business that has been racking up unrealized losses for investors who bought the stock.

Platinum has suffered bear conditions now for around a year on deep estimated losses.

5. Megaport

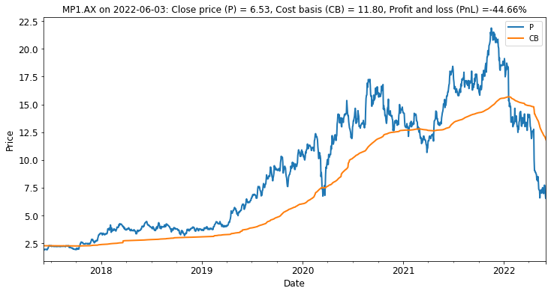

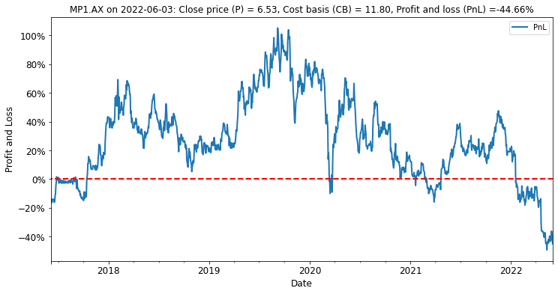

Megaport (ASX: MP1) provides connectivity solutions between public and private cloud services. This is a growth business that appears to have been caught up in the correction.

Megaport has had a solid history of providing a good experience to investors through generally high unrealized investor profits. This situation began to change last year as interest rates were rising offshore. The stock entered a bear market at the start of this year.

While the present state of the market is bearish for Megaport, the correction underway seems to be more driven by valuation than by any change to growth fundamentals. Investors who hold the stock may wish to review the Australian Taxation Office (ATO) wash sale rules.

In a nutshell, if one were to sell Megaport now, with the intention of harvesting a tax loss, and then buying it back at the start of the next tax year, then the tax loss is disallowed.

Since Megaport seems to be a good business exposed to a general technology correction, it may be more sensible to continue to hold the name, and perhaps buy more at the lows.

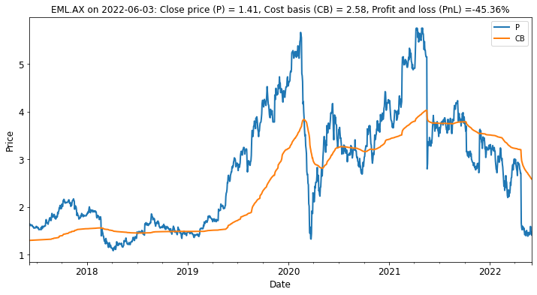

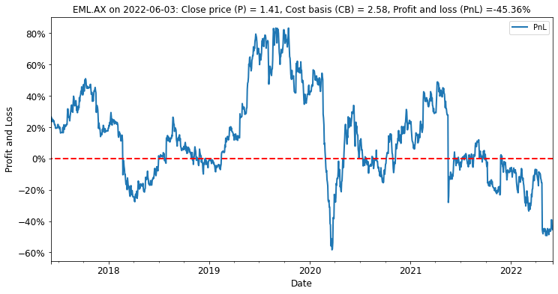

4. EML Payments

EML Payments (ASX: EML) is a global payments solutions platform. The company has been sold down heavily since around the merger of Afterpay and Block.

The estimated level of EML Payments investor unrealized losses is around -40%

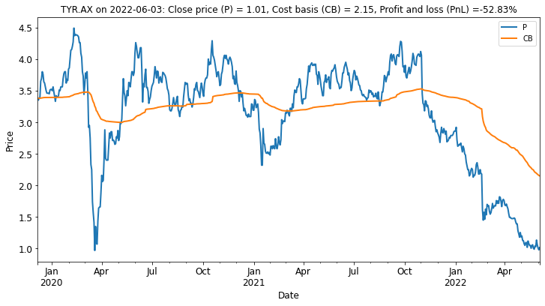

3. Tyro Payments

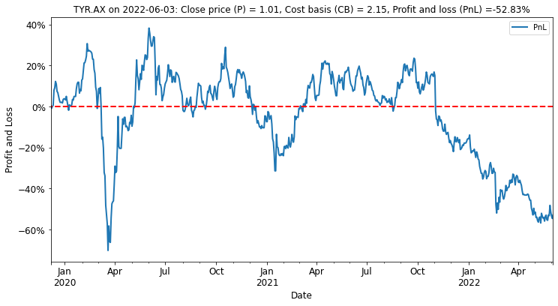

Tyro Payments (ASX: TYR) has been in a bear market since late 2021 due to operational issues with its payment terminals. Investors appear to remain wary of the company.

Tyro remains under heavy pressure as the estimated unrealized losses have not abated.

2. Pointsbet Holdings

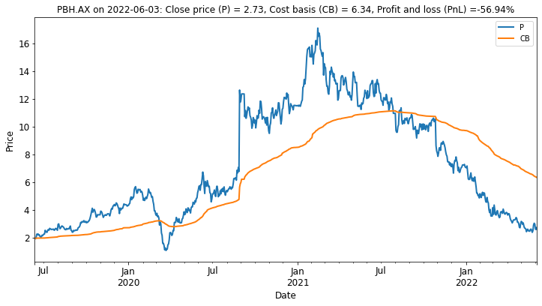

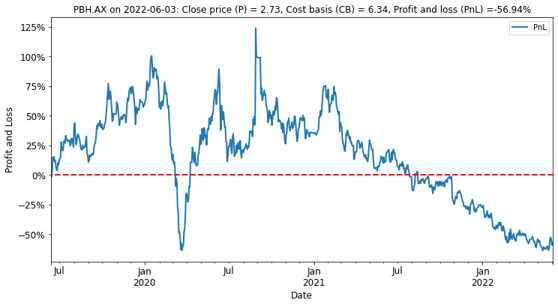

Pointsbet (ASX: PBH) is a sports-betting company that did great for investors until mid-last year.

Pointsbet has been under steady selling pressure for most of the past financial year.

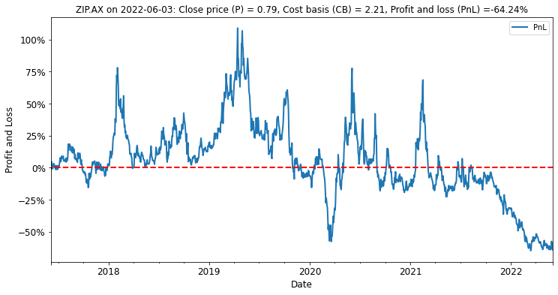

1. Zip Co

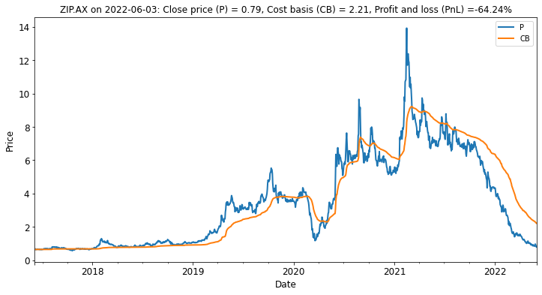

Zip Co (ASX: ZIP) is a Buy Now Pay Later stock that soared up until the merger of Afterpay with Square which later was renamed Block. The entire sector seems to be under a cloud, at this time.

Zip boomed in the early adoption wave for Buy Now Pay Later solutions, but now seems to be mired in the general downdraft for technology stocks, and its larger cousins like Block.

Due to the uncertain regulatory environment for Buy Now Pay Later stocks, we expect ZIP.AX to remain very weak, and under significant tax-loss selling pressure this season.

Summary Results for the S&P/ASX 200

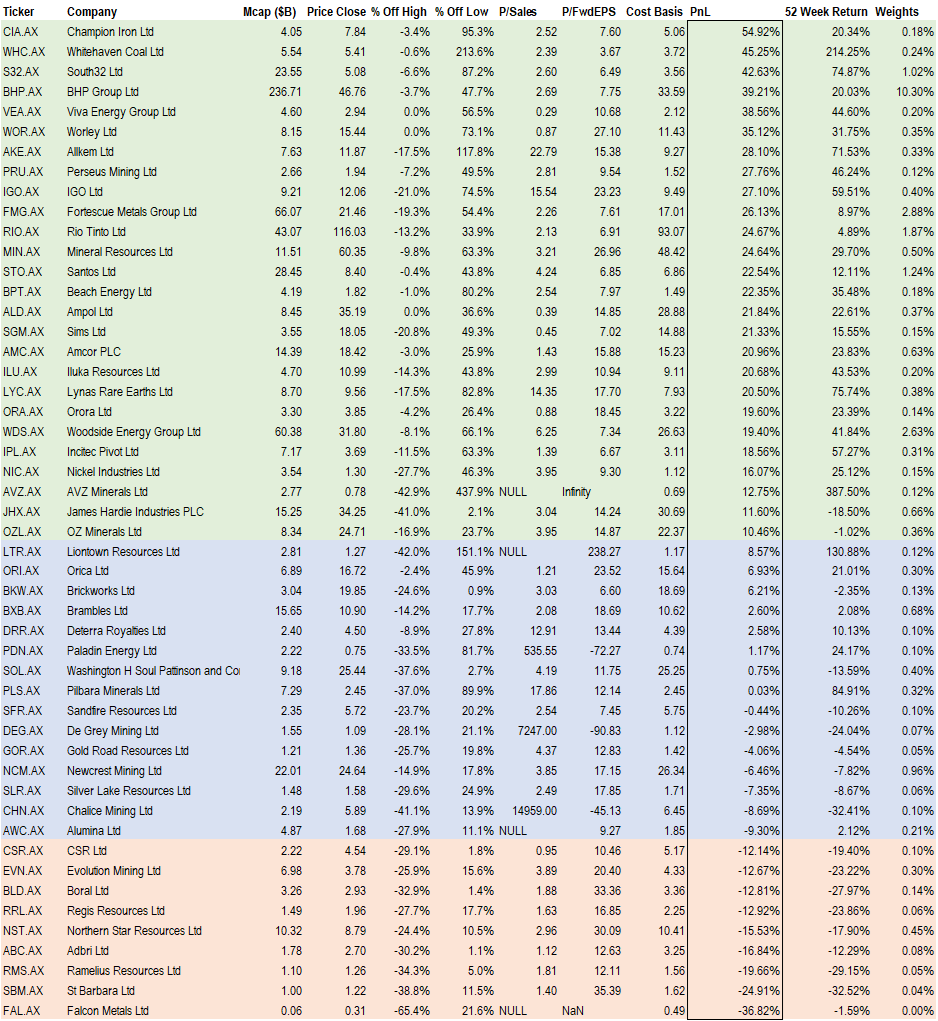

Resources and Energy was the strongest sector this financial year to date. Our two measures of sentiment, the estimated unrealized profit and loss, and the 52-week price return were positive on average. The table below shows all such stocks ranked by estimated unrealized profit and loss with gainers above 10% in the green, losers below -10% in red, and the middle in blue.

The gold sector was the biggest loser last year and may well have a flurry of tax loss sales.

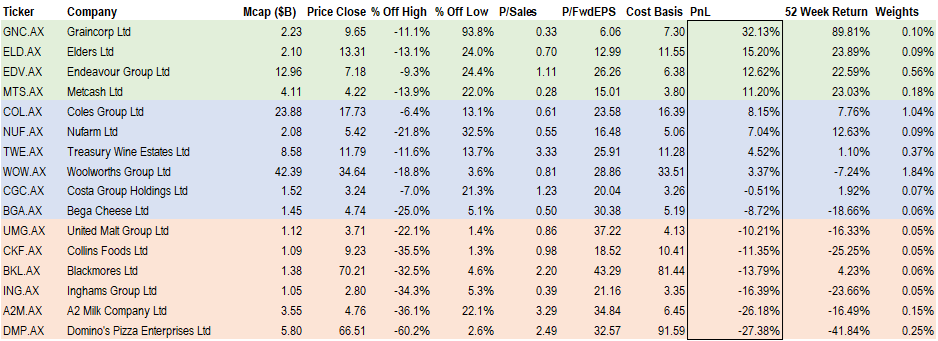

Food and Agriculture was broadly flat although it is noteworthy that primary producers were largely in the green, while restaurants and food processors did less well. This reflects difficult fundamentals from rising input costs for everyone downstream of primary production.

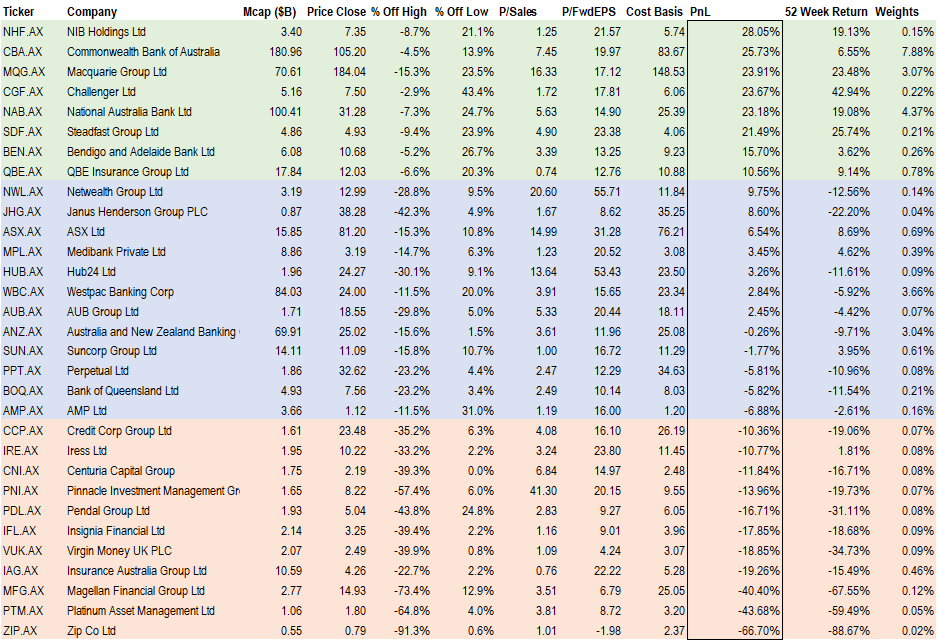

Financials were mixed although large-cap banks did okay. Since these are widely held among retail investors we do not expect heavy tax-loss selling in the financials. The exceptions are funds management companies, which have been under heavy pressure, and some fintech.

Physical infrastructure held up well in the larger capitalization Real-Estate Investment Trust sector offset by weakness in developers that are exposed to higher building costs.

Digital Technology was a wash, with larger cap names doing well as the former stock market darlings in the WAAX group were sold off. The exception has been WiseTech Global.

Analog Technology is our catch-all sector for industrials not captured elsewhere. Some of the Buy Now Pay Later (BPNL) stocks show up in this area, along with other fintech. These stocks are prime candidates for tax-loss selling due to large estimated unrealized losses.

Consumer Needs contains defensive consumer stocks with a mix of healthcare and biotech. The more speculative biotechnology and pharmaceutical names show the largest estimated unrealized losses. Further tax-loss selling is anticipated in this group. Overall, the sector has typically higher sensitivity to rising interest rates which was reflected in performance.

Consumer Wants captures the more cyclical consumer business in retail, leisure and media. The sector has shown a mixed performance reflecting significant volatility in sales and earnings as the pandemic waxed and waned.

Conclusion

Generally speaking, the Australian stock market has held up pretty well in spite of the rising interest rate environment. This likely reflects sound valuations, significant support from high dividend yields in large-cap banking and resource stocks, plus the tail wind of inflation, as it supports high selling prices for Australian commodity exports.

In our view, the Australian market is unlikely to suffer any deep distress at the larger end of street. The large capitalization stocks may be boring, but they have firm valuation support. Where the tax-loss selling season seems set to inflict the most damage is:

- Gold miners with significant investor paper losses

- Speculative biotech and technology stocks caught up in the US bear market

- Stressed areas of financials such as funds management firms

- Real estate developers and others exposed to rising input costs and slowing housing

The large retail banks are travelling well, so far, but clearly, investors must actively monitor the situation in the housing market. Although housing prices are falling in some markets, and the clearance rates are weak, unemployment is historically low. The possibility of bad debts is somewhat mitigated by this combination of factors.

Those investors who take advantage of the tax-loss selling season can always wait before redeploying capital. This may be prudent given the uncertain global situation.

In relation to your own personal tax affairs, be sure to consult with a registered tax advisor concerning your own unique tax position.

Tax laws are complex, and your trading actions will alter your likely taxable income.

Photo by Markus Winkler on Unsplash

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

13 stocks mentioned