Who is to blame for Australia's housing crisis? Neither the answer nor the solution is easy

The most important thing to remember about the Australian housing debate is how nuanced the conversation is. Everyone has their vested interests and it's impossible to get a purely objective view on the situation. For instance, the writer of this piece is a renter in Sydney who has made a conscious decision to live and work in one of the world's most expensive cities. But you, dear reader, may well be in a different boat.

And there is arguably no better explanation of this situation than - and I cannot believe I'm saying this - a TikTok video featuring AMP Deputy Chief Economist Diana Mousina:

Source: AMP/TikTok

And with 120,000+ plays on TikTok (not to mention 2,000+ likes and 200+ comments on LinkedIn), it's clear this subject hits home (literally) for all of us.

But rather than attempt to work out who is solely responsible for the worsening of Australia's housing situation, which is probably non-helpful and already overdone, we've asked Mousina and CoreLogic's Eliza Owen to discuss the factors that explain how we arrived at this point. And, just for some fun, we asked them what they would do if they became federal housing ministers for a day. I think you'll enjoy what they had to say.

This wire is the second in our ongoing series looking at the broken state of Australia's housing market. The first wire can be accessed here:

Is the RBA solely responsible for the housing crisis?

Short answer: No. And far from it.

There is a common misconception among the general public that the Reserve Bank is solely responsible for the housing crisis as we have it today. But even the RBA itself has clarified this, both from the perspective of rents...

"The observation that market rents and interest rates move together appears to be a case of correlation, rather than interest rate rises causing rents to increase," RBA Chief Economist Sarah Hunter said earlier this year in an address to the REIA Centennial Congress.

And from the perspective of mortgages...

"There is some correlation between dwelling approvals and the mortgage interest rate, but it’s not perfect. So, while we are very aware of the impact cash rate changes have on the decision to proceed with a building project, there are a number of factors that determine whether or not a developer or individual goes ahead," Hunter added in that same speech.

"Over the long run, it is the fundamentals of demand and the structural build cost that ultimately dictate supply – monetary policy does not have an impact on either of these underlying drivers."

So what are the bigger issues?

This is a view that Mousina and Owen are sympathetic to. Indeed, the bigger issue, says Mousina is population growth.

"It's occurred because demand for dwellings (via population growth) has grown above the supply of dwellings," she said.

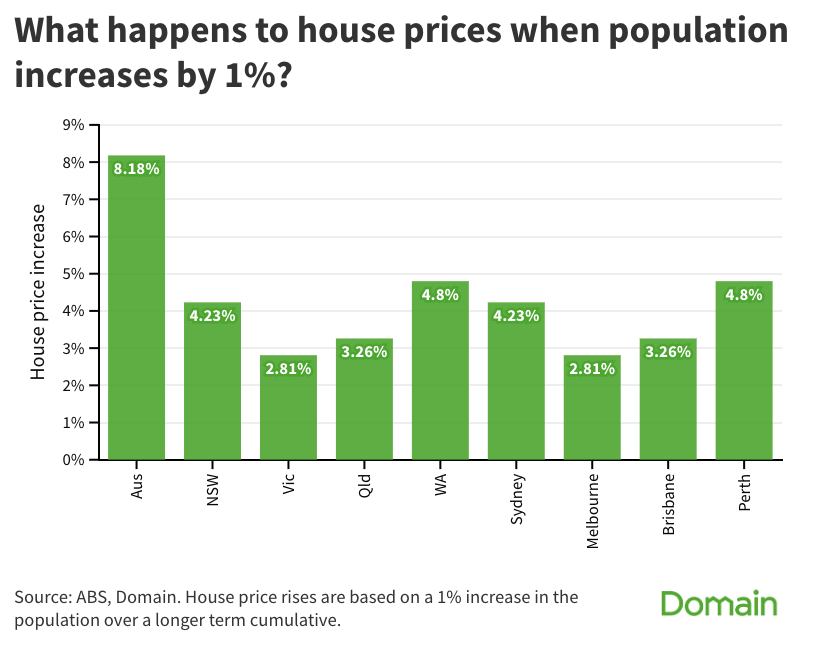

That population growth factor has a big impact on house prices. Data compiled by Domain suggests that just a 1% increase in population can increase prices nationally by over 8%. In the last year alone, the population has increased by 2.3% year-over-year.

There are two other big thorns on the supply side of the equation. One is the cost of building a home. 2023 data sourced from Rider Levett Bucknall suggests that the average cost of constructing a home in Sydney ranges from $2,350 to over $7,000 per square metre - and that's before you buy the land! But the good news is that this cost is coming down - rapidly.

"During FY24, annual costs increased 2.6%, marking the smallest annual rise in the national CCCI [CoreLogic's Cordell Construction Cost Index] since March 2002 (2.3%) and significantly below the pre-COVID decade average of 4.0%."

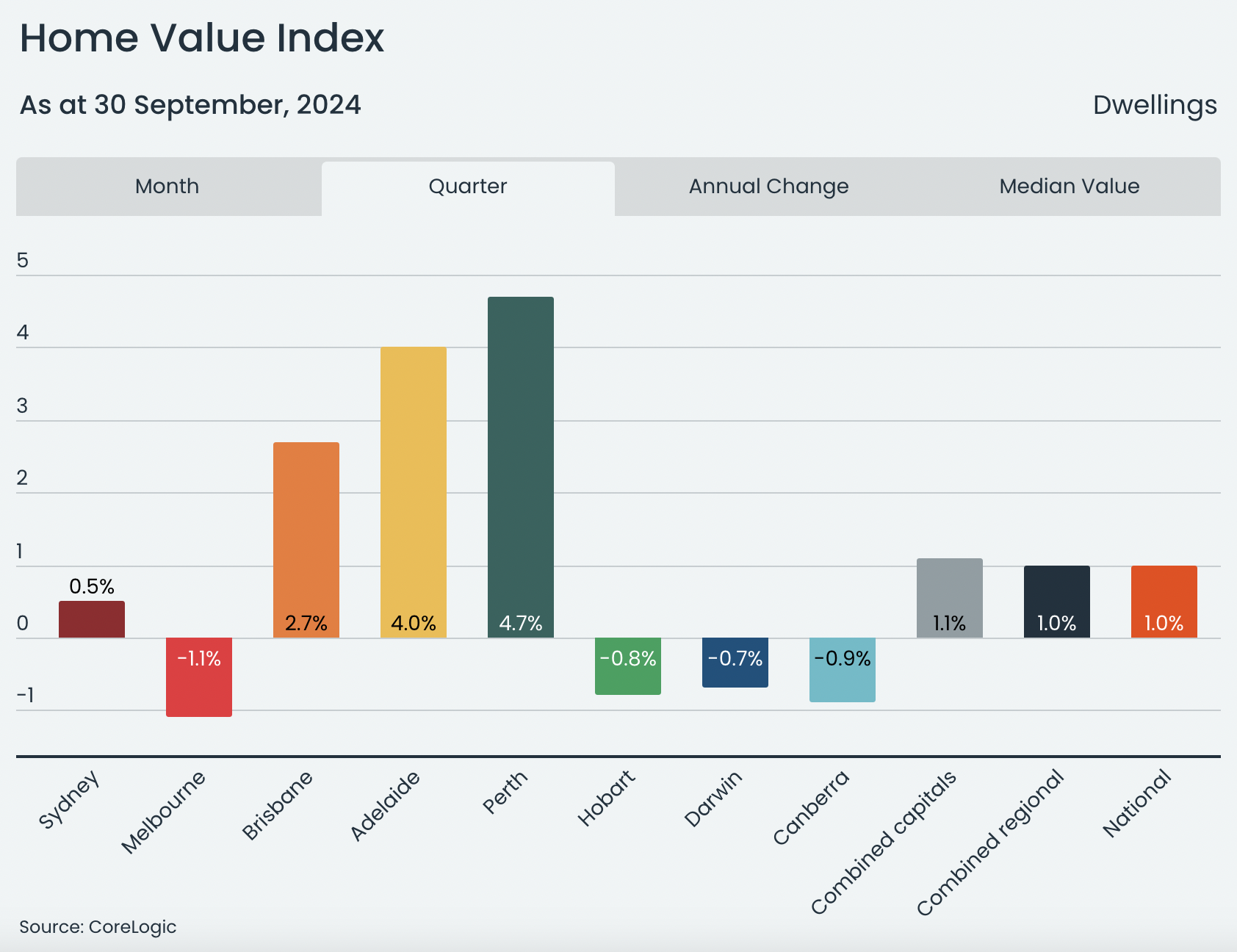

The other is where prospective homebuyers are wanting to live. After all, if you are adamant about having that beach lifestyle, you're going to have to pay for it! However, what's interesting is that CoreLogic's data suggests that demand has been concentrated in the "cheaper" end of the market, driven in turn by high-income buyers with larger deposits.

But the good news, for some at least, is that this demand is now fading.

How long will it take for the balance to be rectified?

While it will likely take decades for the imbalance to be rectified, the first step policymakers can take right now is to break up the inertia.

So what is the first piece of policy inertia to break up? Mousina has her ideas:

"We really need to be building more especially if we want to run such high immigration numbers, so this was a policy error on behalf of the government but it has been difficult to do in the current high-cost environment," she offered.

"More construction of homes is desperately needed. This needs to be a coordinated effort by all levels of government and involves more greenfield land development, releasing land and suburb densification, speeding up approval processes and potentially getting more investment into the housing sector through the superannuation funds," Mousina added.

If you were Housing Minister for a day, what solutions would you offer to make the Great Australian Dream more structurally affordable again?

Mousina's policy offering is three-fold:

- Build 240,000+ new homes a year

- Cut net overseas immigration back to around 250K (for now) and

- Do a broad-scale tax review

She describes a potential review as such:

"We need to look at whether the negative gearing and capital gains tax is still appropriate for Australia’s situation but they can’t be looked at in isolation so that’s why we need to look at all taxes – personal, corporate, GST and investment taxes to see what the right path is for Australia. Some minor changes to negative gearing and capital gains tax may make housing seem like less of an “investment” and may put some downward pressure on prices in the long run," Mousina said.

Owen's policy offering is similar to Mousina's but is even more comprehensive, even though she reminds us that CoreLogic is a data provider and not a think tank:

"The construction industry has a lot waiting in the pipeline to be delivered, so boosting the productive capacity of the sector would help to deliver housing faster, and boosting government funding for development-ready land could help with faster and cheaper delivery of new homes."

"Tax reform can also play a crucial part in making the housing system more efficient, with many economists arguing that swapping out stamp duty for a broad-based land tax could make it easier, and provide more incentive, to move into the right-sized home."

"I am also not opposed to some reforms around negative gearing and the capital gains discount, such as swapping out a 50% discount for an adjustment to CPI or the long-term inflation target. But given this last one is so politically unpopular, my career as treasurer may truly then only last the day!"

This concludes Part 2 of the Housing Series. We want to sincerely thank Eliza and Diana for taking part. If you've missed the earlier edition of this series, you can read that here.

Next time, financial adviser Ben Nash will join us to discuss a question a lot of people may have asked at one time or another in today's investing climate: Is buying a first home really the best investment you can still make in today's economy?

2 topics

1 contributor mentioned