Who's buying and selling? ASX insider moves from the September quarter

It's that time again when we dive into the most significant insider moves of the past quarter. For anyone new to the series, you can check out previous instalments below;

-

Which ASX insiders have been buying and selling their own stock?

-

Directors went Christmas shopping: Insider moves for the December quarter

- Insiders love buying when their stock is cheap - so who has been making moves?

Today, we take a look at the following;

- Companies that have seen multiple insiders buying and selling during the period;

- Analysing which directors have been buying into weakness or momentum, and vice versa;

- Large CEO selldowns

Multiple insiders making moves

When multiple insiders buy or sell, it can tell an interesting story. Don't forget that these insiders are all sitting around the same boardroom table and responding to the same stimulus.

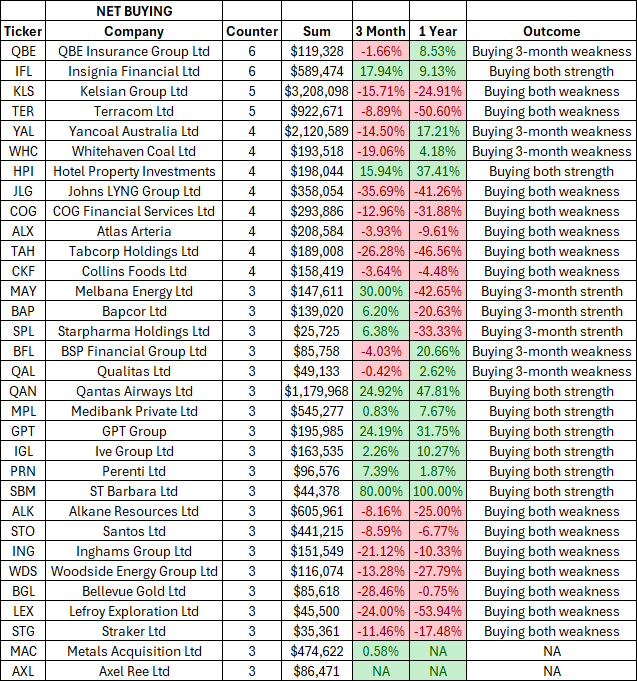

During the September quarter, 44 companies (up from 39 in the prior quarter) had three or more different insiders making moves - they are separated out below into net buying and net selling. I've also analysed under what type of circumstances the transactions occurred, based on 3-month and 1-year performance share price performance.

As explained in the first wire that introduced this series, research shows that the percentage of insider trades decreases as the share price moves from 52-week lows, towards 52-week highs. Put simply, insiders buy more when their stocks are incredibly cheap, and buy less when they are expensive (or, as will be seen below, start selling).

It should come as no surprise that the main set of conditions under which insiders in the table below were buying was "buying both weakness"—which translates to buying stock when the share price is down over both a 3-month and 1-year period.

Please note that these are simply observations based on the data. We cannot possibly know the true motives of why any director buys or sells stock in their own company.

The table below includes only what are characterised as "on-market transactions". It does not include rights issues, participation in share purchase plans, options exercised, or dividend reinvestment plans.

Transactions that involved BUYING

- Of the 32 sets of transactions that involved BUYING, 14 of them saw that buying on both 3-month and 1-year weakness - these are insiders buying when their stock is 'cheap'

- Eight instances saw insiders buying on both 3-month and 1-year strength - these are the momentum riders

- Five instances saw insiders buying on 3-month weakness (despite 1-year positive performance) - this cohort is 'buying the dip'

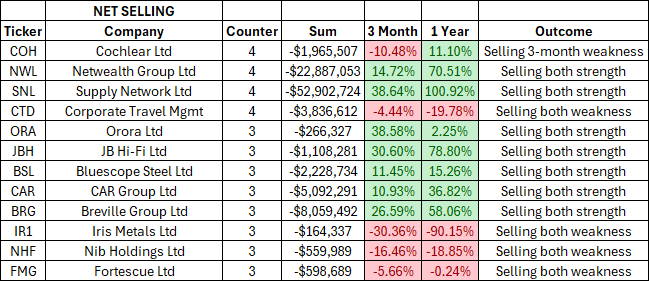

Transactions that involved SELLING

- Of the 12 sets of transactions that involved SELLING, seven instances saw insiders selling on both 3-month and 1-year strength - these are insiders selling when their stock has rallied

- Four instances saw insiders selling on both 3-month and 1-year weakness - perhaps getting out whilst they still can

The big counts

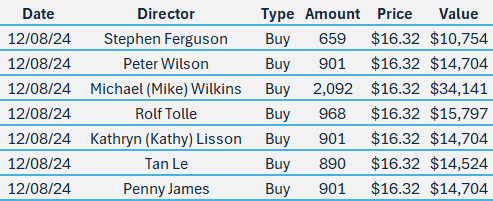

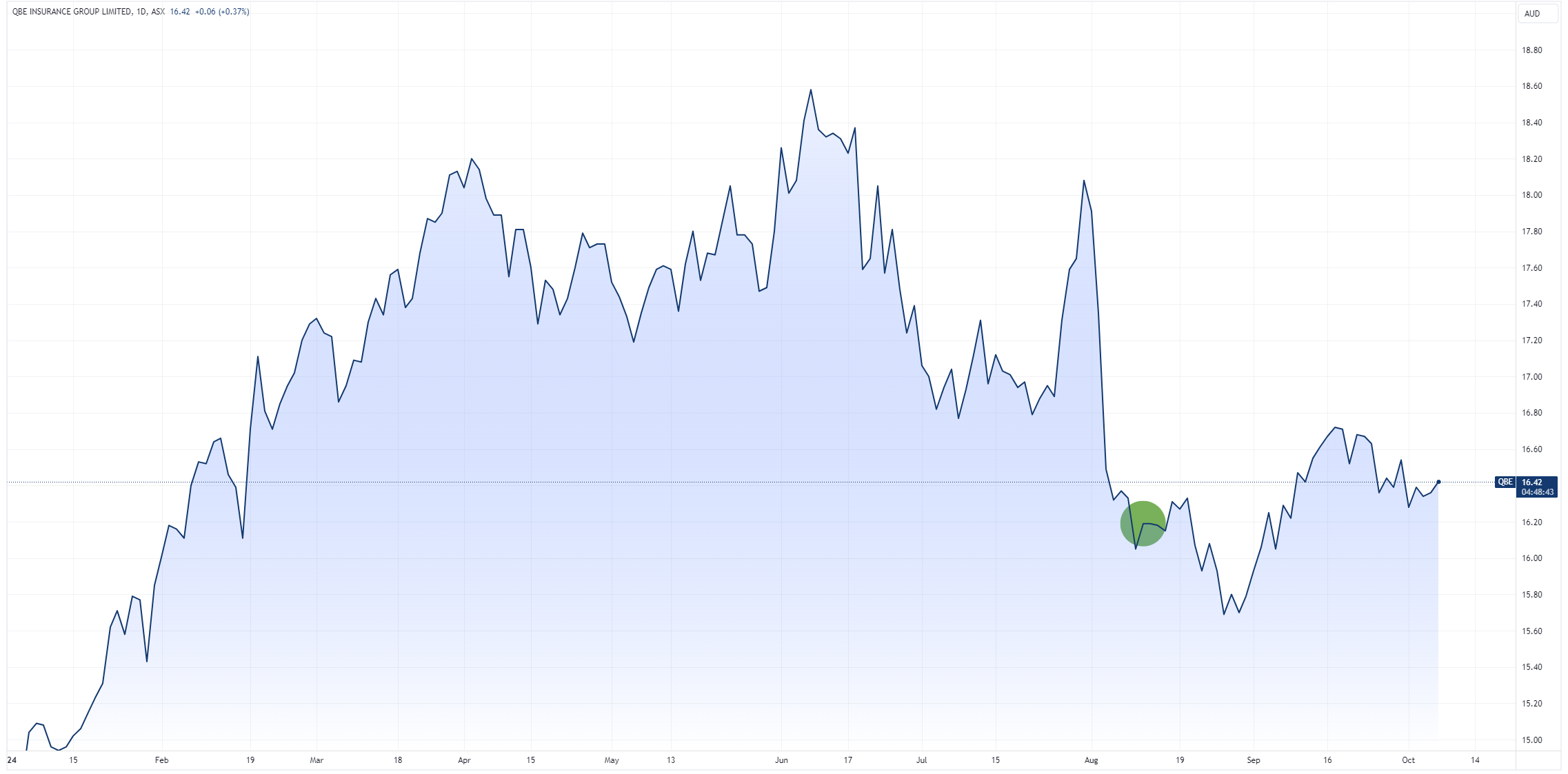

QBE Insurance (ASX: QBE)

In the June quarter, we saw seven directors buying QBE. The sum of the trades was $119,258. In the September quarter, we saw six directors buying. The sum of the trades was $119,328. These transactions seem to be part of QBE's Director Share Acquisition Plan.

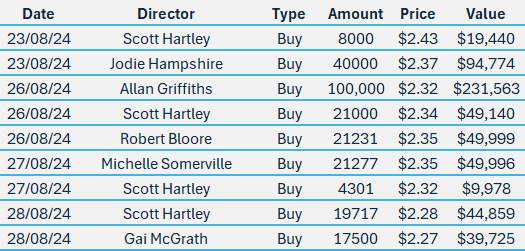

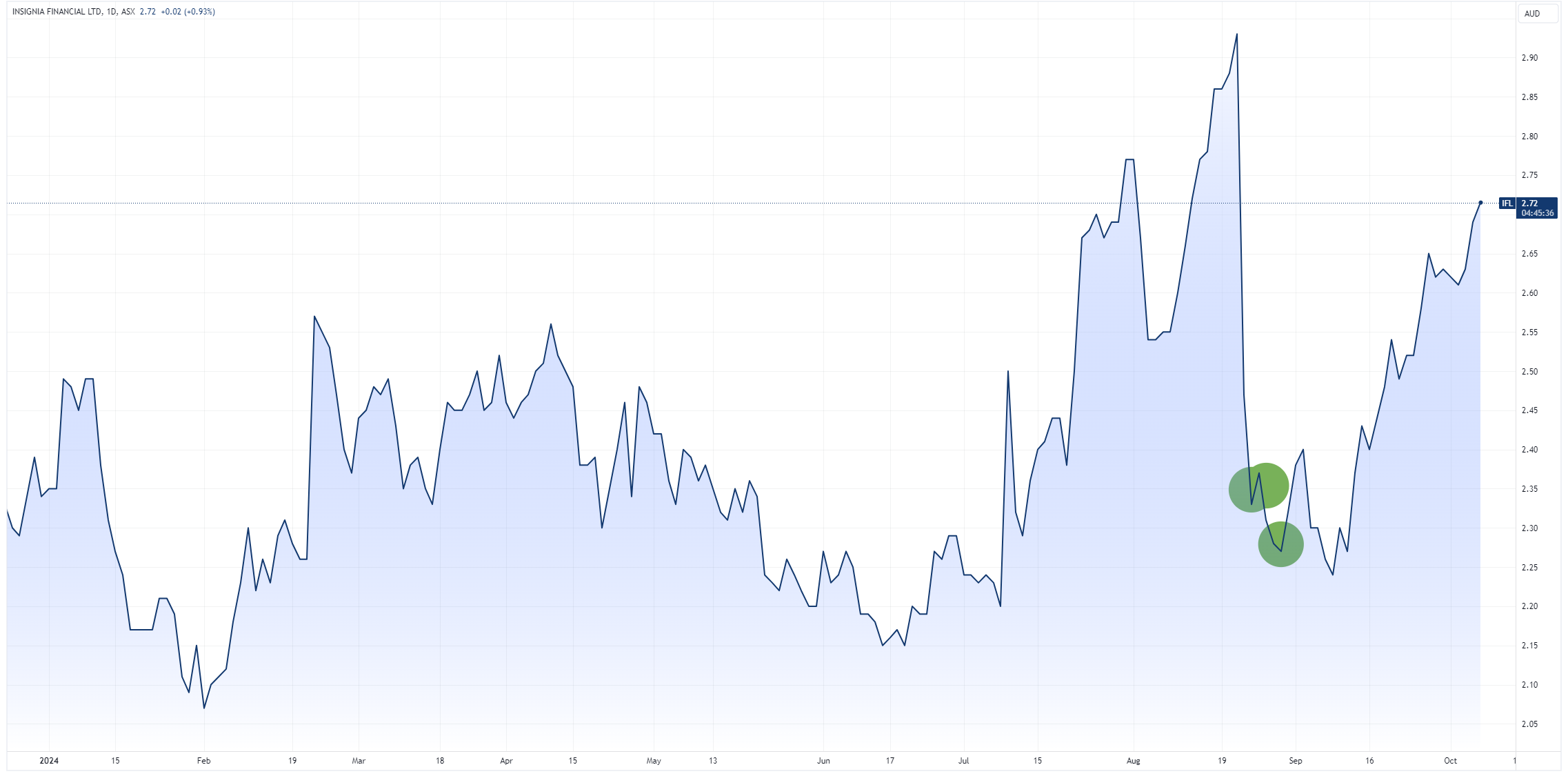

Insignia Financial (ASX: IFL)

In the September quarter, we saw six unique directors buying. The sum of the trades was $589,474.

Insignia shares plummeted by 23% following its FY24 results announcement on 22 August. The company's earnings fell short of analyst expectations, primarily due to increased business transformation costs and remediation payments. In response to mounting pressure on free cash flow, the Board suspended dividend payments, contrary to forecasts of a 10.5 cents per share final dividend. Despite these setbacks, analysts remain cautiously optimistic, forecasting modest earnings growth for Insignia over the next three years.

Kelsian Group (ASX: KLS)

In the September quarter, we saw five unique directors buying. The sum of the trades was $3,209,098

Kelsian shares experienced a one-day selloff of 23% on 26 August after its full-year result flagged an elevated capex outlook for FY25. This reinforced concerns about the business's capital intensity and was seen as a burden that would delay the company's deleveraging efforts. Several brokers, including UBS and Macquarie, noted that while long-term contracts and recurring revenue streams remain strong, the market is likely to remain cautious until there is clearer evidence of improved ROIC (return on invested capital).

Seasonal Selldowns

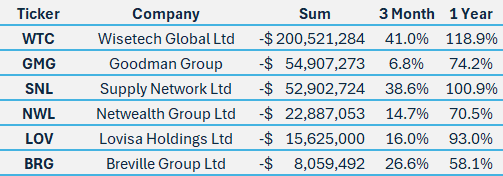

Last quarter, founders and CEOs from several large-cap companies, including Wisetech, Goodman Group, and Supply Network, sold millions of dollars worth of shares. While such large sell-offs might initially raise red flags, a closer look reveals a more nuanced picture.

Most of these directors have shown the tendency to offload shares post-reporting season, suggesting a seasonal selldown rather than a reaction to something negative. Interestingly, all six of these stocks have performed incredibly well over the past twelve months, up an average 85.9%.

Among these transactions, Wisetech CEO Richard White's selldown stands out as particularly noteworthy. In FY24, White sold approximately $304 million worth of shares, his largest selldown in any financial year to date.

In an interview with Livewire Markets, he said these transactions were taking place daily. "Making a small daily trade, in a very orderly way and reporting it every week ... means that people can see that liquidity is coming to the market."

"The alternative would be to not sell the stock. We get a lot of complaints about the inability to get stock, in enough size, to make a substantial holding."

"I've been selling small amounts of stock, about the same percentage, every day, for probably the last three years (excluding blackout periods of course)," he said.

While Mr White’s ownership of the company has fallen from 51% in April 2016 to 35% in June 2024, the value of his stake has grown from approximately $497 million to $14.1 billion over the same period.

4 topics