Who will benefit from Australia's housing shortage?

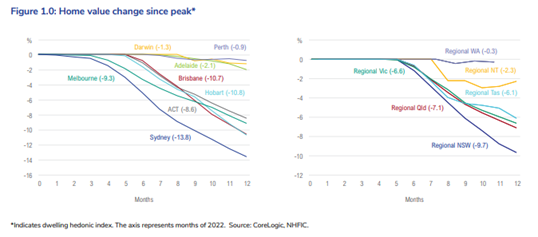

Over the last 12 months Australia has experienced 10 consecutive RBA interest rate rises which has driven a sharp decline in house prices. At the same time, a COVID-19 driven building products production backlog, clogged supply chain and accelerated demand has resulted in an explosion in construction costs. This has forced many builders and subcontractors into receivership which is creating a domestic housing shortfall. Porter Davis the most recent high-profile business to crumble.

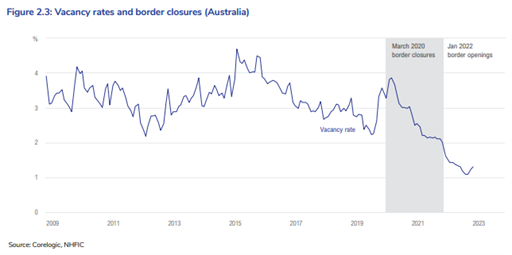

As a result of these circumstances, affordability has become a big issue. We have seen a significant increase in rental costs driven by record-low vacancies, whilst buyer demand remains constrained by affordability and lower borrowing capacity following rapid interest rate increases.

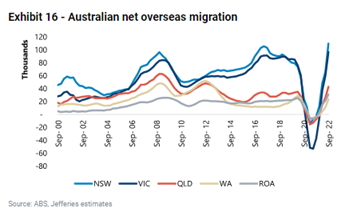

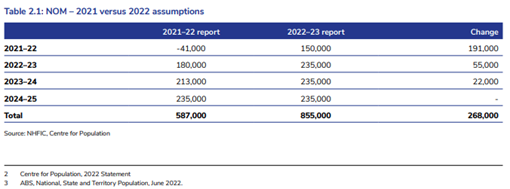

The opening of Australia’s borders in early 2022 has seen a stronger-than-anticipated immigration recovery with the Centre for Population expecting net overseas migration to be 268,000 higher by the end of 2025 than initially forecast. All these factors are creating a perfect storm for a significant housing shortage in Australia.

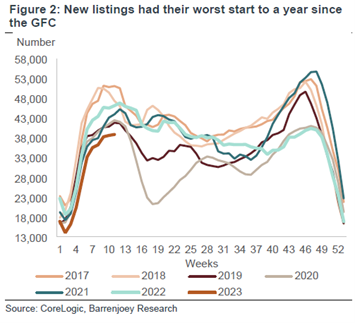

Housing turnover, measured by new listings and total stock on market, has had its weakest start to a year since the GFC, however with higher interest rates now impacting homeowners, we expect vendors will start to trade and housing turnover will pick up from record low volume levels as we move through 2023.

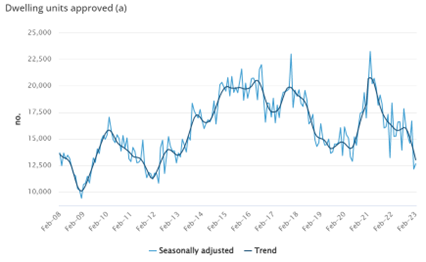

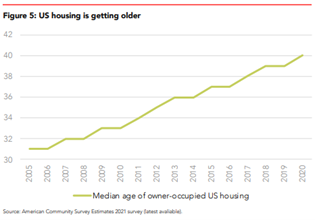

Dwelling approvals are at 10-year lows after the spike in 2021 and we expect this to improve in the months ahead, providing an improved outlook for the sector as we head into 2024. The chronic underbuild of housing which is playing out across Australia and the United States has major social implications. The gap between home construction and household formation in the US is estimated to be in excess of 2m homes. While this dynamic should lead to significant catch-up construction in the years ahead, it has also pushed the average age of a home since the GFC from ~30 to ~40 years.

Historically, when housing sentiment is this poor, future stock returns are very strong. So how should investors position for this outlook and take advantage of companies that will benefit over the medium to long term? We think building companies that successfully navigate the next 3-6 months will have an excellent runway in the years ahead given there will be fewer competitors, improved pricing power, less cost inflation and strong demand. There is also the prospect of Government support across the housing sector to help address this housing shortage crisis.

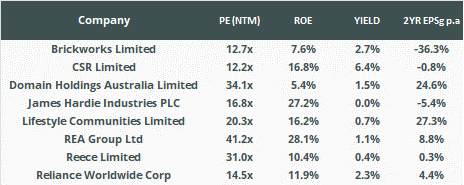

CSR Limited (ASX: CSR) and Brickworks Limited (ASX: BKW) are two of the oldest and financially strongest building businesses that are well-placed to benefit over the years ahead. Both companies have extremely experienced management teams, modest debt levels and significant land banks. CSR’s building products business is vertically integrated with pricing power, excellent earnings visibility and generates great cash flow. We expect a strong result when they report in early May. Domain Holdings (ASX: DHG) and REA Group (ASX: REA) are in good shape for a recovery in residential listing volumes as we move through 2023. James Hardie Industries (ASX: JHX), Reliance Worldwide Corporation (ASX: RWC) and Reece (ASX: REH) are all poised to benefit from their exposure to the US catch-up construction cycle and growing resilient repair and remodel market. Lifestyle Communities (ASX: LIC) has a significant portfolio of affordable housing and is expected to benefit as an ageing demographic look to downsize over the coming years.