Why 140% growth in NPAT may not satisfy this stock's investors

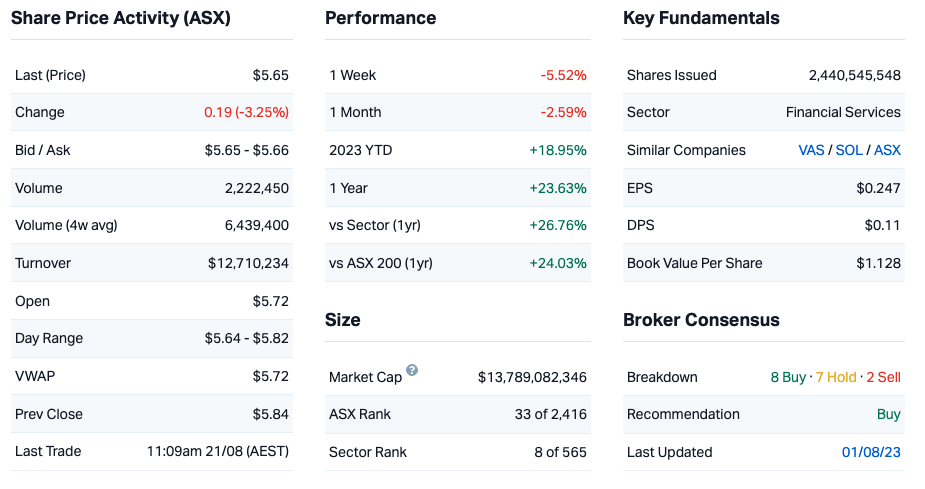

The past year has been undeniably strong for Australian insurers. The shares of major players in the industry have appreciated by as much as 20% with the help of rising premiums. Insurance Australia Group (ASX: IAG) has been a pack leader, netting investors nearly 25% since September.

Today, management reported a net profit after tax of $832 million (up 140% from FY22), a gross written premium of $14.73 billion, (up 10.7%), an insurance business profit of $803 million with a margin of 12.6%, and an FY23 final, partially franked dividend of 9 cents per share.

And yet, this has not been enough to impress investors, with the FY23 final dividend missing the consensus expectation, and pushing down share prices.

But according to Perpetual Limited's Nathan Hughes, there are some strong signals from IAG that the underlying business still has room to grow.

"IAG's current target for the commercial division is a profit of $250 million in the next financial year. and it looks like it's well on track to achieve that".

"Results are showing really good momentum, and there appear to be tailwinds for the insurance business".

In this wire, Hughes outlines some of the biggest surprises from IAG's latest result as well as his outlook on the insurer and its sector over the year ahead. Plus, he shares why investors may be over-reacting to the report.

Note: This interview took place on 21 August 2023. Perpetual's ESG Australian Shares Fund holds an overweight position in IAG.

Insurance Australia Group FY23 Key Results

- Net profit after tax (NPAT) of $832 million, up 140%

- Total claims paid of $10.2 billion, which is up 20%

- FY24 natural perils allowance up by 26% to $1.15 billion

- Gross Written Premium (GWP) $14.73 billion, up 10.7% from $13.32 billion in FY22

- FY23 final dividend of 9 cents per share, franked to 30%.

- Insurance profit of $803 million at an underlying insurance margin of 12.6%

Key company data for Insurance Australia Group

1. In one sentence, what was the key takeaway from this result?

The key takeaway was the continued growth in gross written premium, and the acceleration of that growth ahead of claims inflation.

2. What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

The stock is down 3% off the back of these results. At the moment, I think the focus from the market was on a miss to the insurance margin in the second half, and a slight miss to the dividend, which was one cent below consensus expectations.

In my view, the early stock price move is probably a slight overreaction and is not too meaningful. I think the result demonstrated good momentum in the underlying business approaching FY24. All in all, there's nothing to be particularly alarmed about in the result.

3. Were there any major surprises in this result that you think investors should be aware of?

There aren't any major surprises to investors. One thing that did catch my eye though, was the improved performance of the commercial division. That division is also showing high premium growth, and so the profitability really picked up in the second half of the year.

IAG's current target for the commercial division is a profit of $250 million in the next financial year. and it looks like it's well on track to achieve that.

It was also pleasing that they were able to lift prices pretty materially in some of their personal lines businesses that go through a third party.

This did cost IAG some clients, as when you push prices quite aggressively, retention will typically drop off. Altogether, however, this contributed meaningfully to an uplift in the profitability that is set to continue.

4. Would you buy, hold or sell IAG on the back of these results?

Rating: HOLD

We do already have a big position in IAG, and we are more than willing to hold on to it. Results are showing really good momentum, and there appear to be tailwinds for the insurance business. As an additional kicker, the heightened interest rates we are seeing at the moment appear to be really supportive of profitability.

I think there was some concern surrounding whether or not there might be more capital management from IAG. That hasn't been the case today, but we still believe the cap position is sound given that there are more business interruption provisions to be released over the coming years.

5. What’s your outlook on IAG and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

The biggest risk to IAG and the domestic personal insurance sector is the weather. We've seen elevated "natural perils", or weather events claims over the last couple of years and they can be a big detriment to profitability.

So far this year looks pretty benign, but it's early days. IAG has also made much bigger allowances for weather events in FY24, with the natural perils allowance raised by 26%. This will place it in pretty good stead.

One risk the sector as a whole must contend with is affordability constraints, as in some pockets of the country premiums may begin to eclipse what residents are able to afford. One way in which insurers can meet this challenge is by working alongside the government to try to change where, and how new houses are constructed.

Looking more broadly, however, pricing and retention appear to be quite promising and that will drive profitability over the coming years.

IAG and Suncorp (ASX: SUN) are very similar in that regard, so the outlook for the sector is quite positive for the coming 18 months.

6. From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 3

Broadly speaking, as a result of the movement of bond yields, as well as some of the prevailing dividend yields and multiples on the market it's hard to say that there are widespread bargains.

With the heightened volatility and the recent pullback, there are, however, definitely selective opportunities.

A lot of opportunities we are seeing are stock-specific. Often these ideas centre around themes that have fallen a little bit out of favour, or perhaps where earnings have been a bit slow to recover post-COVID.

Altogether, there is still selective value at the moment. Not everything in the market is currently a buy, but there are certainly enough good opportunities to go around at the moment.

Reporting season in particular has introduced some extra volatility based on annual results, and this is providing more opportunities out there on the market.

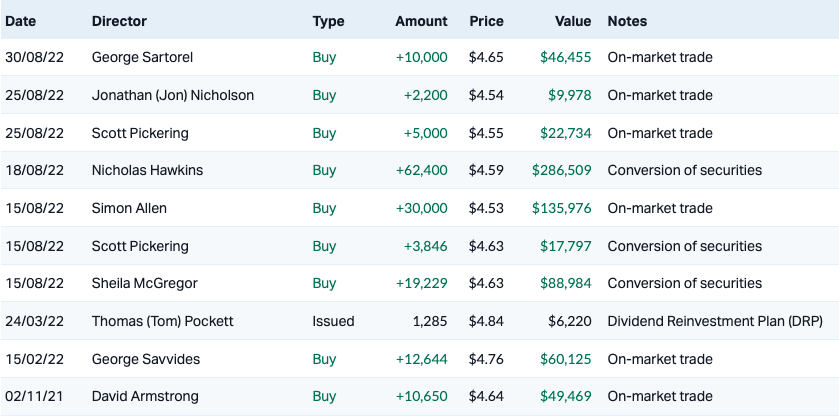

10 most recent director transactions

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

5 topics

2 stocks mentioned

1 contributor mentioned