Why ASIC is determined to provide a fair go for Australian investors

A fair go. It's as Australian as lamingtons, koalas, and Hills Hoist.

It encapsulates our sense of fairness - which includes equality of economic opportunity, universal political rights, and the provision of a safety net for all citizens.

A fair go also means a level playing field for those having a go - something that is critically important to all investors.

Investing is hard enough. None of us want matters complicated by nefarious activities from bad actors.

Fortunately, we have one of the cleanest stock markets in the entire world, according to ASIC's most recent Market Cleanliness Report.

Released on Wednesday, the report is available at the bottom of this wire.

Below are some of the key highlights, as well as commentary from ASIC Executive Director, Calissa Aldridge.

Report highlights

Key findings include:

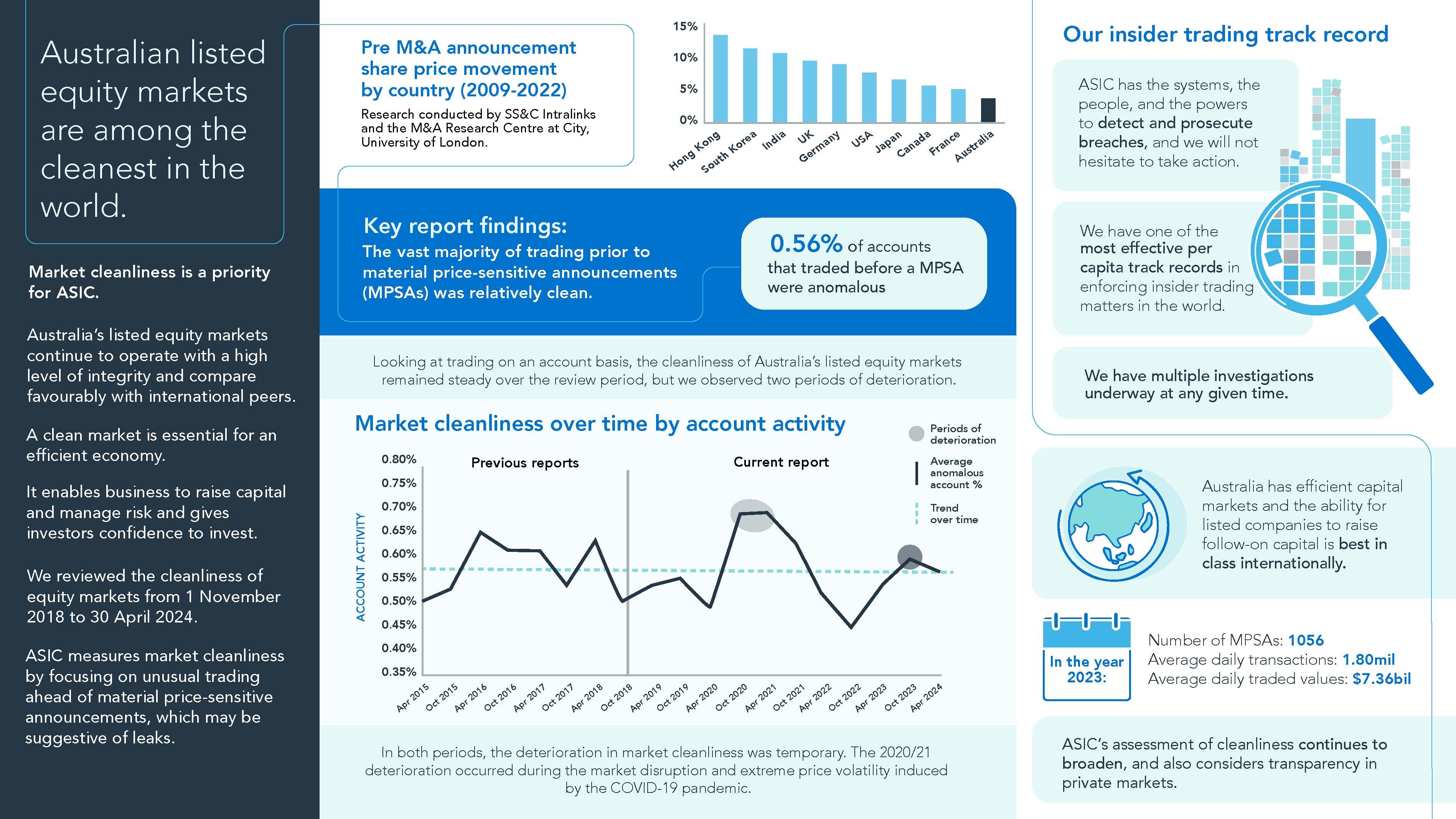

- Compared to global peers, we have less than half the amount of unusual trading ahead of merger and acquisition announcements

- The two periods of deterioration were during the COVID-19 pandemic when global markets experienced high market volatility and trading, and again in late 2023 as corporate activity increased

- Nearly 5% (4.75%) of trading volume ahead of material price sensitive announcements was anomalous/abnormal

- Telcos were the ‘cleanest’ sector, real estate was the ‘least clean’ sector

- Australia’s markets had 55% less price ‘run ups’/spikes ahead of M&A than our global peers

The article below was written by Calissa Aldridge, Executive Director – Markets, ASIC

ASIC remains vigilant to maintain market cleanliness

Australia’s equity markets remain among the cleanest in the world – but as markets shift we remain vigilant, explains ASIC Executive Director, Markets, Calissa Aldridge

The cleanliness of Australian financial markets is critical to a strong economy. It builds investor confidence to participate in markets, which in turn directly impacts the wellbeing of many Australians.

The latest ASIC review of market cleanliness found Australian listed equity markets remain clean, and continue to be among the cleanest in the world.

Between 1 November 2018 and 30 April 2024, the proportion of accounts engaged in unusual trading ahead of material price-sensitive announcements was 0.56%, remaining steady even after the disruption of the pandemic.

Research by SS&C Intralinks and the City, University of London’s M&A Research Centre found that from 2009 to 2022, Australia had, on average, 55% less share price run-ups ahead of M&A deal announcements than its global peers.

This shows our efforts to uphold market integrity in Australia are working. Nevertheless, ASIC must remain vigilant.

ASIC’s response to a shifting investment landscape

As with our international peers, Australia has seen a recent decline in the total number of listed companies. The number of de-listings outpaced IPOs over the three years to 2023. While our secondary market remains strong, we need to assess whether this is a longer-term trend and the implications for companies and investors.

In response to changing market dynamics, we are expanding our market cleanliness work to assess transparency in debt and private markets. We are further supporting market integrity this year by:

- increasing our enforcement capacity to expedite investigations and referral for prosecution of illegal insider trading conduct;

- considering options to improve bond market transparency;

- assessing the governance arrangements of private equity and credit funds and stewardship of large superfunds; and

- conducting targeted transaction reviews to understand how confidential information is being handled and conflicts are being managed in fundraising and merger and acquisition transactions.

Managing inside information

All industry participants – including listed companies, investors, bankers, brokers and other advisers – have a key role to play to support market cleanliness. Inside information needs to be handled with care, with limits around who has access to it. This needs to be supported by robust policies and practices, and action should a leak occur. All industry participants have a part to play in promoting integrity in Australian financial markets.

Casually sharing a hot tip might lead to ASIC scrutiny of your insider lists, and may lead to fines or prison time.

ASIC’s award-winning surveillance and detection capability

We continue to look at innovative data science tools for market surveillance, such as artificial intelligence and machine learning. This will strengthen our ability to detect forms of insider trading not driven by announcements, such as front running.

Our real-time trade surveillance data, expertise, and tools can automatically hunt for and detect suspected market misconduct. It won ASIC the Australian Public Service Data Analytics and Visualisation Award last year.

Former corporate adviser Cameron Waugh was sentenced to two years’ imprisonment for insider trading offences following our surveillance and investigation, and was the first person to be sentenced and imprisoned in Western Australia under the new penalty provisions for insider trading.

Insider trading is not a victimless crime. It hurts investors on the other side of the trade, impacts share value and superannuation balances, and harms all Australians by increasing the cost of raising capital to the detriment of our economy.

ASIC has the systems, people and powers to detect and prosecute insider trading and will not hesitate to take action.

We are committed to ensuring that Australia’s markets remain among the cleanest and most transparent in the world. We remain vigilant.

Calissa Aldridge's biography

Calissa leads ASIC’s Markets Group, which manages the end-to-end process for regulating markets. This includes supervision, investigation and enforcement for market infrastructure, market intermediaries, corporate finance activities and trading on exchange and over-the-counter markets.

Since 2009, Calissa has had senior leadership roles at ASIC in Market Supervision and Market Infrastructure. Before joining ASIC, she held roles at the Royal Bank of Scotland in London, the UK Financial Services Authority (now the Financial Conduct Authority), Markit, and the Australian Treasury.

2 topics