Why China's biggest uncertainties provide opportunities for its equities

China’s economy is in recession. The nation’s zero COVID-19 policy and property market woes have led to a collapse in growth. China’s authorities no longer even pretend they can achieve their 5.5% growth target. The tiger economy faces both structural and cyclical challenges. But China’s equity market has discounted a lot of the bad news - having tanked 38% peak-to-trough.

Through this downside risk, we see opportunities for China in the wake of the 20th National Congress underway in Beijing. In this wire, I set out five risks and five opportunities facing investors in China right now.

Chart 1: China’s equity market has collapsed almost 40% peak-to-trough

Five risks

- China becomes “uninvestable”: Earlier this year, media attention focused on analysts that deemed China’s tech stocks as uninvestable. We think this term is inappropriate. But it does highlight some challenges to Western capital looking to invest in China. This includes:

- Regulatory uncertainty,

- foreign relations and political tensions,

- US-imposed sanctions,

- China’s relationship with Russia, and

- China’s steadfast opposition to Taiwanese independence.

- Property market crisis: Restrictions on real estate leverage became a property developer crisis. That ensures that stoking growth through the property sector is not on the cards. We think China’s authorities have the willingness and ability to prevent a wider systemic crisis. But there is still a downside risk to China’s medium-term economic outlook.

- A shrinking working-age population: China’s population growth contributed to outsized growth over the past four decades. Growth has given way to a demographic headwind. The population is now shrinking. We expect that to contribute to potential growth closer to 3.5% over the coming decade. The transition to slower growth represents some downside risks over the medium term.

- Trade disputes will persist: China is no longer just a producer of cheap products. It has moved up the value chain and is competing with global tech producers. This increases the risk of trade disputes. This week, we have seen new US export controls that will disrupt the Chinese tech industry. Chip equipment suppliers suspended sales to semiconductor manufacturers in China. There is a risk of further disruptions to China’s trade and tech ambitions in the medium term.

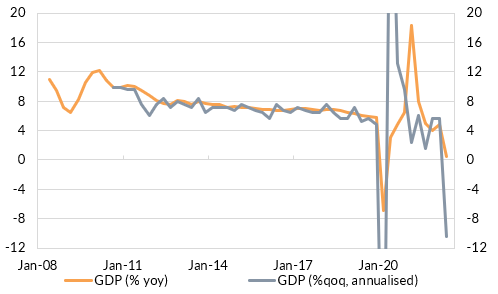

- China is in recession: China’s data deteriorated sharply this year. We classify this as a recession. China’s zero-Covid policy is a clear culprit. There is a risk this policy remains in place longer than we anticipate. That could have a longer-term impact on China’s economic potential.

Chart 2: China’s economic data indicate a recession is already underway

Five opportunities

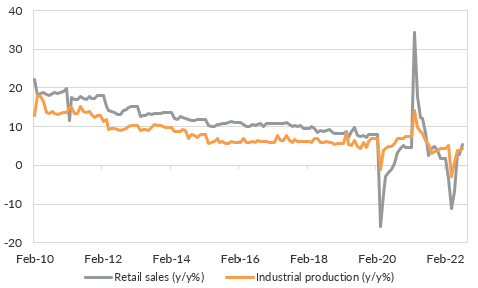

- Focus on consumption: The corollary of a shift away from the property investment as a source of growth is a focus on consumption. President Xi’s opening speech at the National Congress said China would “better leverage the fundamental role of consumption in stimulating economic growth”. Consumption has been battered by China’s zero COVID-19 policy. We expect more support over 2023 to help revive domestic consumption – and this has started to show through a V-shaped rebound for retail sales (Chart 3).

- Focus on the private sector: President Xi’s speech declared unwavering support for the private economy. This will be a relief for investors who looked at the volatile regulatory regime changes that impacted the education and tech sectors through 2021. Some improvement in regulatory certainty could narrow the risk premium demanded to hold Chinese equities.

- Focus on zero-Covid reopening: Investors have found it difficult to look beyond China’s zero-Covid policy through 2022. We think a soft reopening is underway. President Xi has travelled outside of China. Hong Kong has reopened. We expect the internal border between Hong Kong and China will begin to reopen towards end-2022. Other countries’ experience with reopening suggests this is a considerable upside risk to the economy and to equity markets.

- Focus on policy headroom: China’s authorities have been incrementally easing policy over the past year. This has included monetary and fiscal measures aimed at supporting the economy through the impact of weaker global growth and subdued domestic demand. We expect further policy is likely after the National Congress as growth pumps are primed ahead of a gradual rollback of the zero COVID-19 policy.

- Focus on the Greater Bay Area: President Xi’s speech targeted a “moderately prosperous” society by 2035. That entails a GDP per capita level equivalent to a median developed economy. And that will require GDP per capita to double by 2035. We think that can only happen if China’s Greater Bay Area develops rapidly. The GBA is a region of 9 cities in mainland China, Hong Kong, and Macau, representing more than 80 million people and approximately $1.5 trillion USD in GDP. We expect to see rapid development in the GBA providing opportunities to investors over the medium term.

Chart 3: China’s focus will be on domestic demand to support growth through 2023

What does it mean for investors?

China is facing both cyclical and structural risks and opportunities. With a nearly 40% decline from its peak, China’s equity markets have priced in the recession the economy is now experiencing. We think China is past its economic low point. China’s authorities may implement more supportive policies in the wake of the National Congress, including a further gradual reopening from China’s zero-Covid policies.

Further near-term volatility is almost a certainty for investors in China’s equities. China’s equity market is historically more volatile than most developed market economies. The risks around the National Congress will ensure that remains the case for some time to come. But with a lot of bad news already baked into the price, we think China provides some upside to investors that have risk tolerance.

Never miss an insight

If you’re not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia’s leading investors.

And you can follow my profile to stay up to date with other wires as they’re published – don’t forget to give them a “like”.

4 topics