Why competing narratives mean you should be underweight equities

There are so many competing narratives in the market right now. Soft landing. Hard landing. A banking crisis and credit crunch. The potential for US default as the debt limit looms. It is all unusually noisy. And when narratives dominate the hard data, then it makes for a low conviction market. In this environment, it makes sense to remain defensive and keep an eye on some key data points to signal the way forward.

Be wary of backwards looking data

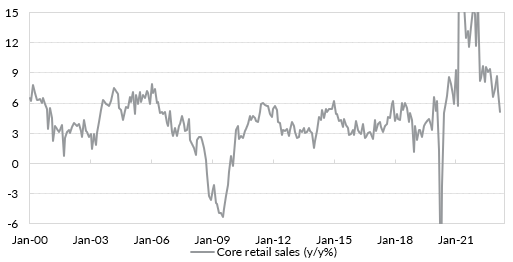

The economy looks fine from the rear-view mirror. The 5.00% of rate hikes delivered by the US Federal Reserve has not resulted in an economic collapse. The household sector in particular appears to be fine. Jobs growth remains robust. Retail spending has been bolstered by excess savings. We are not in recession yet.

Chart 1: Retail spending has held up in the face of aggressive Fed rate hikes.

But these are lagging indicators. And we can see over a long history that the labour market in particular does just fine in the run up to downturns – until it doesn’t. And when the economy snaps, the low unemployment rate can rapidly deteriorate.

Chart 2: The unemployment rate can deteriorate rapidly even from very tight levels.

If the backward-looking data are not useful to gauge economic risk, what can we look at?

Identify data that can challenge narratives and manage risk

Narratives can help illuminate risks when the outlook is particularly uncertain. The complexity of competing narratives in the market right now create a confused picture. It is useful to monitor some hard economic data to gauge the likelihood of these different scenarios occurring.

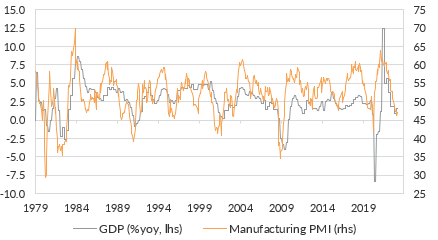

Chart 3: Focus on the Manufacturing PMI for turning points.

The US economy is no longer manufacturing dominated. But the ISM Manufacturing PMI historically has been a great indicator for turning points in the economy. A reading below 50 indicates below-trend growth. A reading below 45 is recession. The PMI is at 47.1 now.

The US economy grew below trend in Q1. I am carefully monitoring the PMI to determine if we stabilise into a soft landing – if the reading manages to remain above 45 – or if we tip into a hard landing. Soft landings are rare – 2015/16 is an example, but it could happen.

Chart 4: Use oil prices to monitor global growth.

Predicting oil prices is difficult. Recall the serious calls from many strategists that oil would reach $300/barrel in 2022. Similar calls have been made in the wake of production cuts from OPEC in recent months. I don’t try to predict oil prices. It is not an asset we trade in. But the price can convey information about economic growth. And prices have fallen sharply even through production cuts have been announced. That suggests that global growth is slowing and a soft landing may not be achieved.

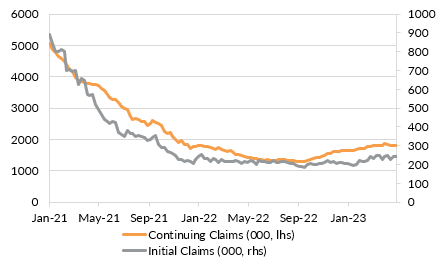

Chart 5: Ignore the unemployment rate and focus on claims.

The unemployment rate has remained low despite the Fed’s rate hikes. The unemployment rate is a lagging indicator. I am focused on initial claims to gauge the extent to which the labour market is deteriorating. It has the benefit of being released weekly. Right now, initial claims are trending higher. But they remain relatively low compared with recessionary levels around 300k plus. If the indicator can remain around 250k-300k, then it could indicate a soft landing.

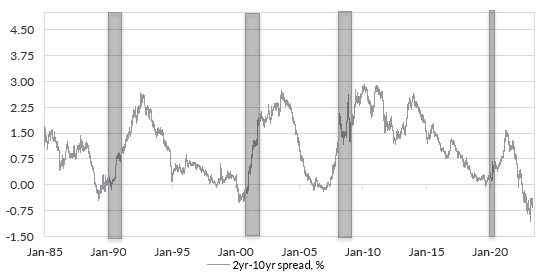

Chart 6: A normalising yield curve is coincident with recession.

Alongside economic indicators, I am watching an important financial indicator. The yield curve – the difference between the 10-year and 2-year US Treasury yields – is inverted. That has historically preceded recession. But the recession begins after the curve normalises back through zero and into positive territory. The grey bars above are NBER recessions. Since the banking crisis, the US yield curve has steepened from more than 1.00% to below 0.50%. This is a good indicator to follow to gain a sense of how much the banking collapses in the US are pushing the economy to recession.

Avoid chasing narratives in a low conviction world

Conflicting narratives tempt investors to chase market movements. The prospect of a soft-landing supports equity and credit positions. The risk of recession suggests adding short-dated government bonds. The potential for a credit crunch suggests reducing credit exposures. Markets are likely to be volatile as these narratives resolve themselves into an actual outcome. In this environment, the risk of being whip-sawed is high.

Manage positioning with a bias to remain defensive

What can investors do? My strategy has been to carefully manage positioning with a bias to remain somewhat defensive. I think the risk of recession is elevated and there are more downside risks. I think the data support that, but I don’t have very strong conviction and I don’t want to take lots of portfolio risk as a result.

How have I managed the low conviction? In our equity sleeve, we have increased our allocation to quality value and variable beta managers. This retains exposure to equities but provides some protection against a sell-off.

In fixed income, I have tilted towards high quality government bonds. Shorter-duration US and Australian government bonds are offering high yields relative to history if there is a soft-landing, and diversification and downside protection if there is a hard-landing. Where I hold credit, it is the highest quality we can get and short spread-duration.

Overall, I think a recession likely. There are some good signposts to monitor against that risk. But it is difficult to build really strong conviction in markets like these. A good strategy right now is to avoid being whip-sawed and carefully manage positions to increase the chance of success.

3 topics