Why Flight Centre needed to raise capital – and fast

With the Australian share market rallying strongly in April off the 25 March low, there has been a spate of capital raisings by cash-strapped companies looking to reduce debt and/or ‘pay the bills’. One of those is travel retailer, Flight Centre (ASX:FLT). In this 2-part blog, I outline our assessment of the business in the face of COVID-19 risks and the likelihood of negative earnings for the foreseeable future.

The raisings have been done with a combination of placements to new and existing shareholders as well as rights issues, and in general have been heavily oversubscribed as new and existing investors alike view the steep discounts as attractive to invest in the business.

Many of these businesses are facing significant disruption or have a vastly different outlook compared to Pre-COVID-19. The list so far is wide-ranging, and includes companies like Cochlear, Oil Search, IDP Education, Webjet, QBE, Invocare – with many more expected over the following months.

At Montgomery, the team have assessed almost every opportunity and looked to participate (and have participated) in a number of these raisings. However, given the uncertain outlook for many of these businesses and the lack of earnings guidance, how are investors looking at valuing these businesses?

A quick look at Flight Centre’s capital raising

Flight Centre operates as a retail travel agency operating under a number of brands, with a global store network and a significant online presence. FLT predominantly generates revenue through selling travel packages for Leisure and Corporate purposes, based on a percentage of Total Transaction Value or “TTV”.

FLT’s share price peaked in August 2018 at around $69.36 per share, when the company generated a record underlying profit of $385 million for the 2018 financial year.

However, with all the restrictions on travel as a result of COVID-19, it is no surprise the company’s share price has been under severe pressure. The company entered into a Trading Halt on 19 March, as it looked to raise money to shore up its balance sheet to weather the downturn.

FLT – the need for a capital raising

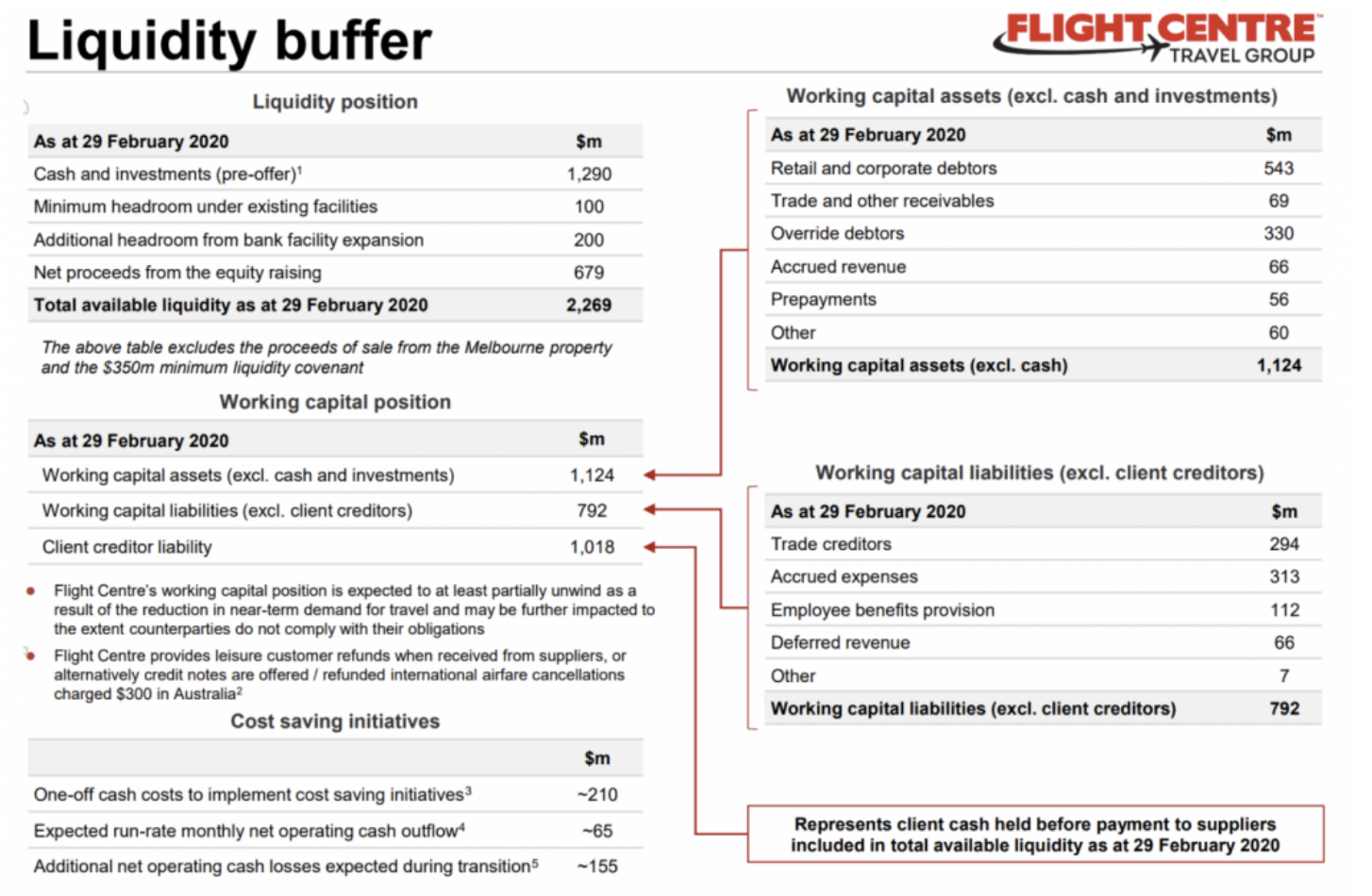

Prior to FLT’s capital raise, the company had a positive working capital position of roughly $700 million – which assumes no bad debtors on the company’s Receivables (FLT management assesses this risk at around 4-5 per cent as at early April). Total available liquidity was approximately $1.4 billion, but this is largely offset by net creditor liabilities of around $700 million and also excludes bank borrowings of $215 million as at 31 December – i.e., the often ignored liabilities on the balance sheet. FLT’s pre-existing working capital position is laid out in its presentation, below.

Source: Company filings

The company had a cash-burn rate of $227 million per month, which gave FLT less than 3 months of headroom before burning into available debt funding lines of $100 million (2 weeks), the drawdown of which the banks would likely have been opposed to without a remediation plan given the uncertainty around the immediate outlook.

Capital raising details

Prior to the capital raising, the FLT share price closed at $9.91 per share on 19 March.

The company launched a placement and rights issue totalling around $700 million at $7.20 per share, with the issuance of an additional 97 million shares. The company effectively doubled its share count from 101.1 million shares to 198.4 million, assuming full take-up of the retail entitlement offer.

Net proceeds were approximately $679 million.

In conjunction with the placement, the company obtained temporary waivers on debt facilities, with an additional $200 million available for drawdown although subject to minimum liquidity requirements.

The raising, along with additional funding lines has given FLT around $1.6 billion of total liquidity, or $1.4 billion liquidity not subject to constraints on drawdown, after repairing and unwinding the various balance sheet items (assuming no bad corporate debtors).

What will FLT do with all the additional cash?

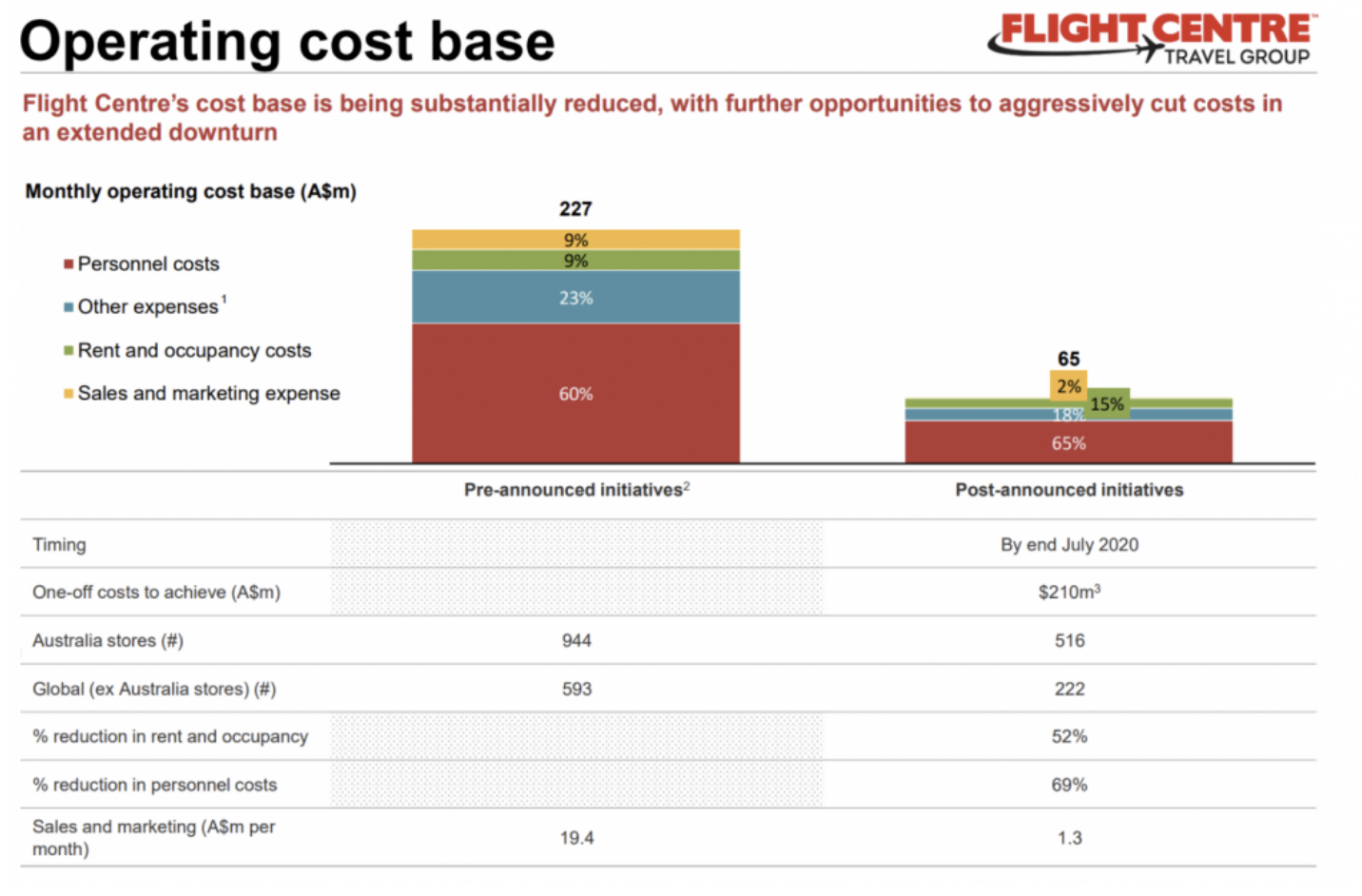

For a start, FLT management will look to reduce its store footprint and cash operating expenses.

Pre-COVID-19, $1.4 billion would have been enough for around 6 months of expenses at the current run-rate. Obviously, the revised reality is that these travel businesses won’t go from 0 to 100 overnight given travel restrictions will only be unwound gradually. As a result, revenue will be slower to recover and it will take time for FLT to break-even, especially on its current cost base.

So, as part of the rescue package, FLT is reducing its store and staff footprint by approximately half over the next 2.5 months, while minimising capex and discretionary expenses. This is expected to reduce the monthly cost profile from $227 million to $65 million by end July. The cost to implement (including redundancies, breaking leases etc) is expected to be $210 million, with total costs including net operating losses during the transition period of $155 million i.e. total costs to implement to July are a total of approximately $365 million.

Source: Company filings

After implementing all cost reductions, FLT is left with around $1 billion of liquidity from August, excluding the increase in available banking facilities subject to liquidity covenants of $200 million. However, to be conservative, it would be appropriate to apply a reduction in the collection of at least some retail and corporate debtors. As a very rough sensitivity – assuming 10 per cent on total working capital assets figure (more than double FLT management expectations) would suggest up to $100 million in potential losses, leaving FLT with $900 million of liquidity.

At a cash-burn rate of around $65 million, this would fund FLT’s operating requirements well into 2021 at minimal revenues before requiring a material pick-up in business. While this seems like a significant buffer given tentative signalling of easing some domestic restrictions, with the uncertainty around how long travel restrictions would be in place it appears FLT has “over-raised” to give it sufficient buffer for a protracted downturn on travel.

In part 2, I will talk about assessing the potential opportunity of FLT shares – bought on the discounted rights and placement price, as well as what the current market price may be suggesting.

4 topics

1 stock mentioned