Why Global X is betting on this trillion dollar investing megatrend

This is all at a time when investors are wary of funds with an ESG slant, and the issuer has found some aspects have resonated more with Australian investors than others.

I recently joined the Global X ETFs team for a presentation on why they are focusing on decarbonisation and the opportunities they see ahead.

The ESG roadblock

Decarbonisation is heavily linked to the world of ESG (environmental, social and governance) investing, a world that has increasingly faced performance challenges in recent times.

“When these styles of funds first came out, they were strong because they were typically overweight technology. Now, of course, as growth stocks - particularly tech - struggle, the performance of ESG funds have similarly struggled,” Blair Hannon, Head of Investment Strategy at Global X ETFs says.

The end result is that many investors have become wary of anything linked to ESG.

“You can play decarbonisation without it necessarily being ESG,” says Hannon.

What he means is that you don’t necessarily have to follow the usual critiques of ESG investing to access one of the most lucrative trends of our times. And in fact, if you were too rigid in your application, you’d miss some key exposures. After all, we still need mining for critical minerals in order to build the infrastructure required for decarbonisation.

The ESG roadblock has meant some of Global X ETFs decarbonisation listings have resonated more than others. Those offerings focused on green metals like copper and lithium have seen greater inflows than the listing focused on carbon credit trading for example.

%20(2).png)

The net-zero future

Concern over climate change has been one of the biggest drivers – though more recently, the need for countries to be self-sufficient when it comes to energy and supply chains has bolstered government support.

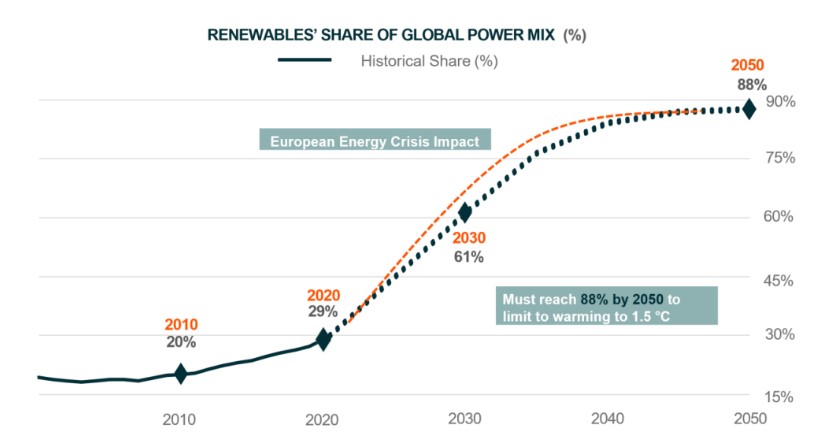

Renewables are tipped to be just shy of 90% of global power by 2050 and governments are pushing hard this way.

Source: International Energy Agency, 2021 a, 2021b, 2021c, 2020, 2019

Why lithium and copper?

While this year has been a more challenging year for lithium miners, lithium’s star is still on the rise. It is a critical component for battery technology and even with alternatives being considered, like sodium batteries, it’s fair to assume that lithium will still be the primary player in a decade’s time.

It has the added advantage of the movement towards electric vehicles (EVs).

Hannon notes that China is close to a tipping point for EVs which will be a gamechanger for supply and sales.

“China is close to price-parity for EVs compared to ICEs*. Research shows that people will make the choice for EVs if the costs are the same,” Hannon says.

Europe has also put in place bans for ICEs by 2025, so traditional companies are rapidly going down the path of EVs. One example is the Ford F150 Lightning. The US will receive the EV version of this car and the battery could power a house for 3 days.

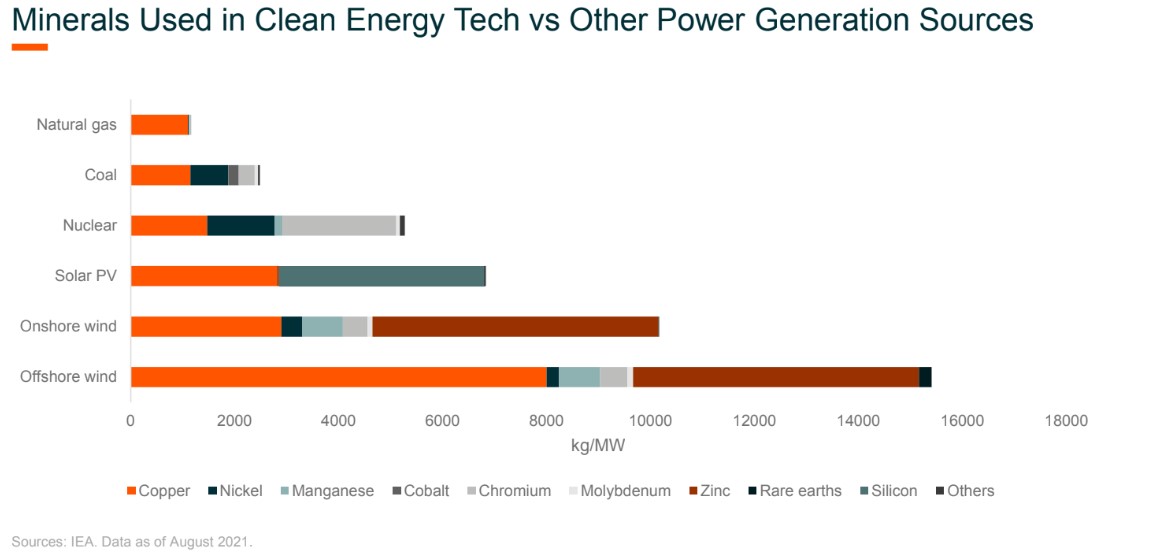

Copper, on the other hand, has a much longer history of use but the decarbonisation movement has added a new market for it.

“Copper is the best conductor at its price point for electricity so it’s necessary for that connection back to the grid,” says Hannon.

Given its long history, there’s less opportunity for sourcing new copper supply compared to lithium. This is critical because Hannon expects supply to be mismatched to demand in the coming year. Choices are dropping and M&A in this area has been focused on acquisition of existing mines, rather than exploration.

Global X ETFs has had a copper ETF available in the US for around a decade now, but only released an Australian version late last year, the Global X Copper Miners ETF (ASX: WIRE). It has already been well received.

Should you bet big on decarbonisation too?

Global X ETFs are not the first fund manager on Livewire Markets to discuss decarbonisation, and they won’t be the last, so you can easily investigate the theme more and decide if it’s a theme to add to your portfolio – in total or even in selective parts like critical minerals.

One of the bigger questions many investors might have is how to allocate.

Global X ETFs advocate a core-satellite portfolio where the core is built up of more passive broad-based exposures and the satellite as tilts related to specific goals or views. Decarbonisation comes in the satellite portion and the ETF issuer suggests an allocation of around 3-5%.

Do you have exposure to decarbonisation, or specifically critical minerals? Let us know what you use and why in the comments.

3 topics

2 stocks mentioned