Why I invest thematically

Thematic investment is very popular. The idea of investing in "structural change" and the durable trends and investment themes of our time has struck a chord. However, for those whose job it is to advise others on investment, the problem is invariably the same.

Why this theme, with these investments, and why now?

I think it is okay for me to state the question in this way because I have run global thematic investment portfolios since 2008, at another firm first, now at Jevons Global.

In the world of investment, everything good starts with a good story. You can picture an investment team, sitting around a table, brainstorming ideas on how the future might look, and which particular areas of our lives will change irrevocably.

This is very much the mantra of the time, and there is often a new logo to prove it:

That snapshot is from a New York Times article on the Facebook rebrand. The social media giant will double down on the "metaverse" which is a shiny new not thing, in a future not world, which is destined to become a huge thing, at least for Facebook, um... Meta.

The New York Times' choice of photograph speaks to the zeitgeist about new new things. The art department was cynical enough to choose a photograph that showed a worker, in the real world, picking up litter from the grass verge of One Hacker Way.

Art directors can be like that. Pointed. Perhaps, they see the future more clearly?

Thematic investors can talk a big talk. However, I am also a seasoned investor who founded a thematic investment firm, so I am very careful to own up to some of the problems which can easily derail a promising thesis. This is an investment style that is all in the execution.

Every day the investment team sits around the table evaluating their themes about how this world is changing about us. They will do so each day, and every day, especially after meeting with prospective clients to discuss their latest investment theme.

Here is one I remember, not from a firm I worked in, but the name is very memorable: Dark Matter. We are going to invest in Dark Matter.

That is just fantastic. Who would not want to own a piece of Dark Matter?

You can imagine the dinner party conversation...

"How is your investment portfolio travelling Mr Spock?"

"To its logical place of termination, Jim."

"Where would that be, Mr. Spock?"

"The Moon, Jim. The Dark Side of the Moon. I bought Dark Matter at 5 3/8."

It was the 1960s. They did not quote on the NYSE in decimal. It was all fractions then.

Things have moved on, but I think you will be happy to agree, human enthusiasm for the non-understandable new new thing that sounds cool has not. We all enjoy talking about it.

Remember, Facebook is now Meta. There will be a new universe along very soon.

I have done a lot of dumb things in my investment career. Fortunately, I did most of the really dumb things with my own money.

However, sometimes those dumb things were only proven to be dumb with hindsight. With my own money, I bought into the last rare-earth boom by taking a chunk of stock in Molycorp, the US rare-earth miner that went broke.

They are back now, as MP Materials. It is the same mine, different management, and I still believe in rare earths, but I am not invested in them right now.

What changed? Many things, but my thematic interest in rare earths, the weird metals that are used to make the super strong magnets in electric vehicles, wind turbines, and other high tech applications, has not changed. I am just a bit more careful about where and when to invest.

I am very very comfortable about the why of such investments, just not the when. The timing does not seem so favourable now, as China has decided, once more, to expand production. This bothers me right now, because history has shown rare earths to be a cyclical industry.

To pick up the thread once more, we know that thematic investment is popular, because the story as to why you might invest appears simple. In the case of rare earths, there is a massive global trend towards electric vehicles.

This is all part of the wider visible trend of the energy transition. We should all want a piece of that action, because it is clearly here to stay.

However, life in the real world may not follow such a simple script as that of Mr Spock and his farsighted investment in Dark Matter, whatever that may be. There is the humdrum rhythm and cycle of everyday life. The world spins on its axis, prices move, fortunes alter.

Oftentimes, thematic investment sells us on an overly simple story: There are megatrends reshaping this world before us. Get on board for 'destination future'. Get on board now, forever.

There is nothing wrong with the sentiment behind this story. It is both enervating, and feels empowering, to know where the world is going, and what the future might bring.

The only fly in this ointment is that we don't actually really know the future.

We can know something of what is coming, but not the details of how it will really pan out. Apple has been a great success for investors in the last 20 years. However, it had a very rough patch from about 1993 through 2000, when the firm lost its way. Microsoft was king during that period, but then lost its way, and only made new post-2000 highs in 2016.

Human stories. Business stories. National stories. They are all stories.

Like any good story they have a beginning, a middle and and end. The problem is that we can easily mistake the middle for the end, or not realise that a new beginning is, in fact, the end.

Right now, there is a national story playing out in China. It is firmly guided by Xi Jinping, and the central government of the Chinese Communist Party, towards a new destination.

The destination is common prosperity. There is commentary. However, right now it is very difficult to know, for sure, where that nation will wind up. It is changing right before us.

If thematic investing is no more than the use of stories and narratives to help us understand where the world is going, then it is a fraught endeavor. We need more than that.

Like any investment process, thematic investing requires some principles and guard rails to help answer the all important question facing every investor: Why this investment and why now?

At Jevons Global, we have evolved a systematic process to help us answer this question.

The process starts with a durable set of investment themes that do not change. These are the elements of how the world divides up into different categories of product and or service.

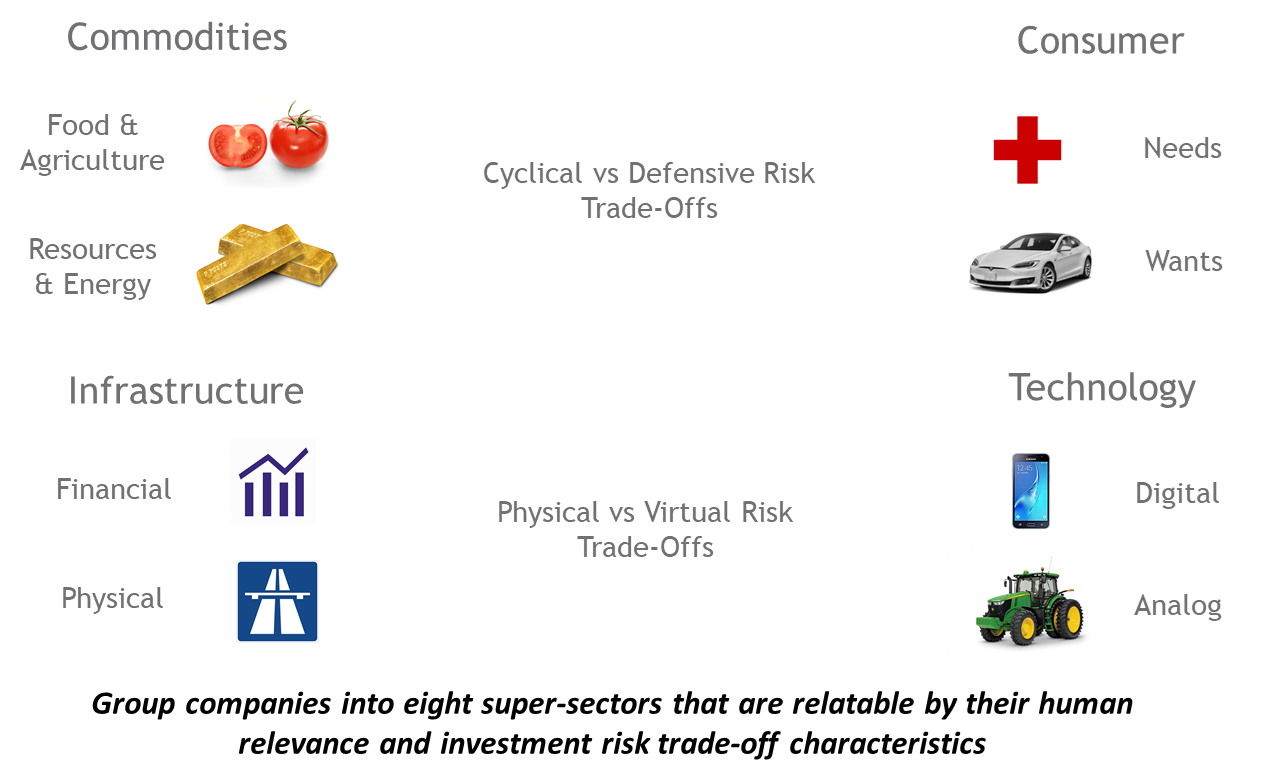

While the world changes all the time, there are some elements that do not change:

- Consumer products divide into needs (must have) or wants (like to have)

- Infrastructure services can be tangible (like housing) or intangible (like finance)

- Industrial technologies might be intangible digital or tangible physical

- Commodity inputs comprise food or materials and energy.

This amounts to a simple animal-vegetable-mineral classification:

This system is readily implemented as a set of rules to classify all investments globally. Under the Jevons Global System, they naturally reduce to simple labels for all listed companies.

Since this is a pretty simple classification system to understand, it is pretty easy to explore the question of why we make an investment. If there is no obvious reason why a new company can serve a basic durable source of demand then it is not clear why we should invest in it.

To illustrate, the Facebook initiative in the "metaverse" clearly belongs in technology, but as a consumer facing product or service it really is not clear if it is a need or a want, or whether the idea will actually fly, at scale.

Yes, it could be the ground floor of something big, but so have many previous innovations that did not pan out. 3D televisions were a thing once.

When I explain things in this way, it becomes much clearer about how we think about thematic investment. The types of investment we understand are those which we think can well answer the "why" in a very direct and logical way. Take energy — clearly we need less carbon-intensive energy, but the concept that the economy needs energy inputs is not new.

When we overlay a constantly changing world on this framework, then we can begin to see how a visible theme in the real world might create opportunity. For instance, there are automobiles in the category of "consumer wants" but electric vehicles will use different materials. Services like ride-sharing may alter the landscape of who owns the car, and promote digital services.

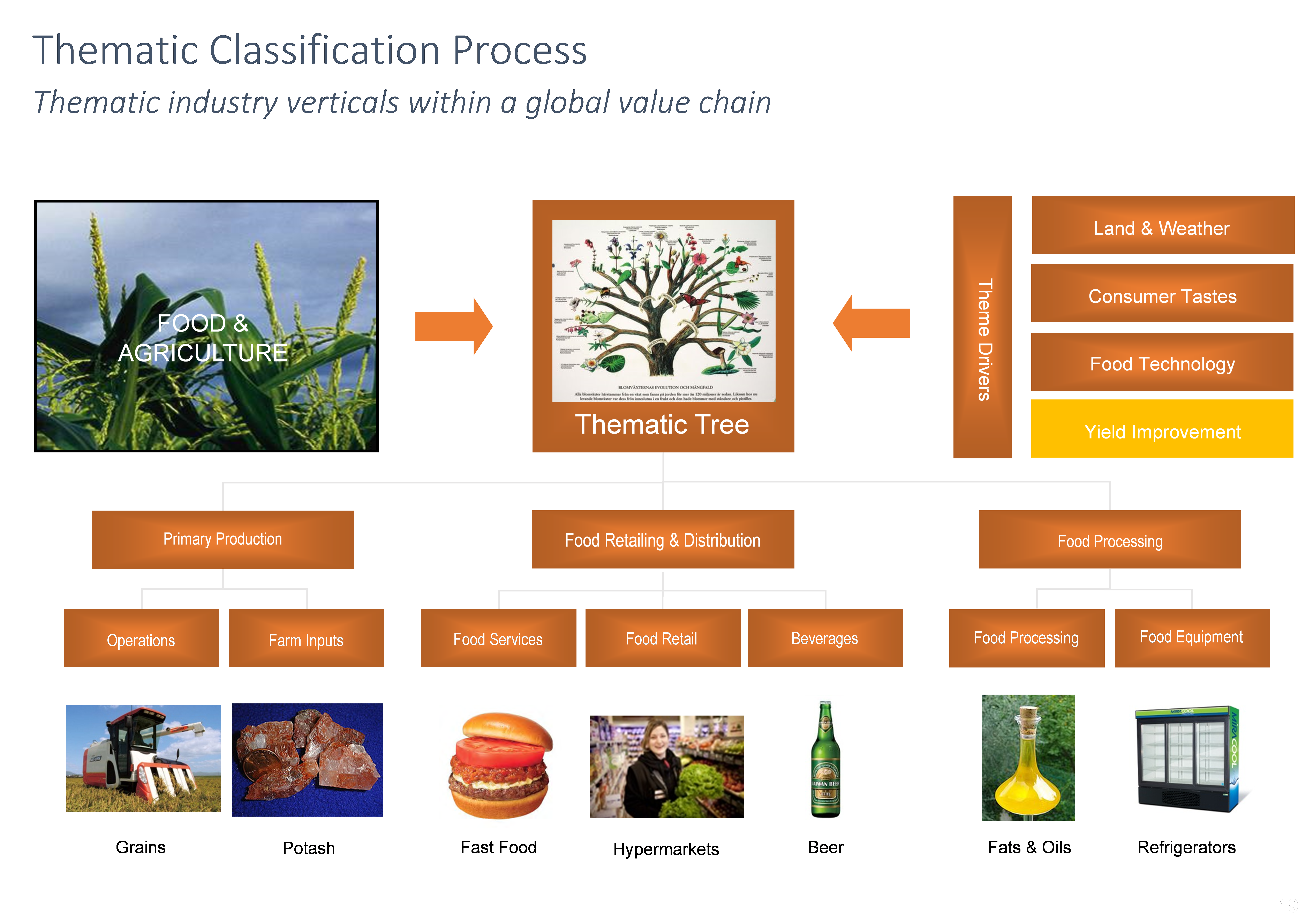

The thematic research we do at Jevons Global answers this simple question: How does structural change reshape supply chains?

We have taken the view that food inputs are a durable form of demand, but how does the move to a low carbon economy reshape the trade in food production?

This might lead to research into animal husbandry and how much animal feed input is needed to produce each kilogram of animal protein, or vegetable protein substitute. When we start to think in this way, it becomes clearer how a thematic like "decarbonisation" plays out.

Indeed, with the shift away from beef, we are seeing firmer demand for soybeans since this is a high source of protein, to replace direct consumption of beef, in products like tofu. We can ask further "why" and "how" questions that lead directly to a simple "what": What investments benefit from a shift away from animal protein?

All business requires customers, and the big shifts in society reorganize the global economy into a new web of interconnected trade and commerce. sumamry

The structure of the supply chain is key to understanding how structural change plays out in practice. Very often supply chains cross traditional sector lines. Some farm inputs, such as potash fertiliser, are mined, whereas others, like refrigeration, are manufactured.

Food service refrigeration, in grocery stores and supermarkets, is a major source of energy use, and hence potential carbon footprint. Perhaps it is worth digging further into this area?

These thought patterns are typical of the thematic research we do. Make a map of the investment world, and figure out where the landscape has changed to create a buying opportunity.

In summary, that is why Jevons Global approaches investment thematically.

Our purpose is to understand why certain investments make more sense at different times in the context of how the world is changing.

The process of understanding the world through the lens of sector classifications, supply chain analysis, and traditional valuation metrics, gives us confidence in what investments to make, and which factors to monitor most closely.

Thematic investing is about story telling but the stories follow a simple script: Why this investment, and why now?

The process involves research, but that research is all about how to find the underlying story of change in society. We cannot know the future, but we can look for the pinch points in a supply chain, or in the changing patterns of consumer demand, to improve the odds of success.

We don't yet know the future of the metaverse, but we do know to ask this question: Why the metaverse, and why now? Perhaps the answer is as Mark Zuckerberg sees the world. Perhaps it is to look more closely at display technology?

The goal of thematic investors is simply to ask the "why" questions and go look for answers.

Our belief is that curiosity matters in the search for opportunity. That is why I invest thematically.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up todayto get free access to investment ideas and strategies from Australia’s leading investors.

2 topics