Why rising yields are bad for tech shares but good for financial shares

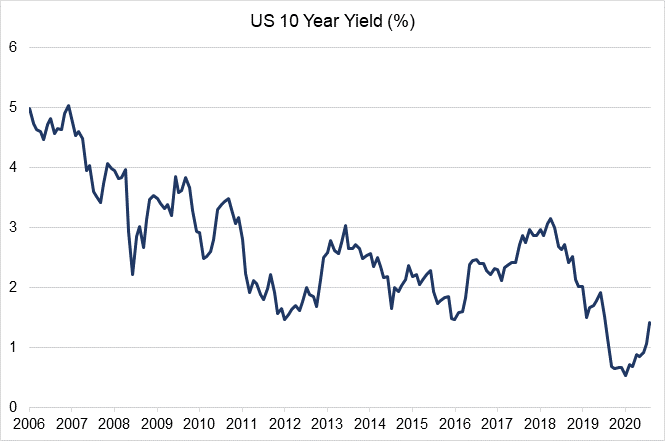

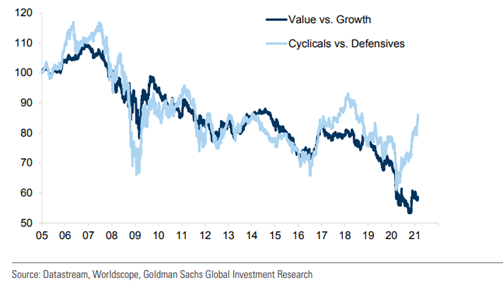

In recent months, the US 10-year treasury yield has moved sharply higher from 0.5% to 1.5%. Whilst broader share indices have been stable, a great rotation is taking place beneath the surface. We thought it would be useful for investors to dig a little deeper into the mechanics of bond pricing and explain why it is driving a rotation in asset allocation globally. Finally, we discuss portfolio positioning, to stay ahead of this rotation.

.png)

Source: Bloomberg, Watermark Funds Management

What is the 10 year yield?

The 10 year yield is the return one receives for buying a 10 year government bond and holding it to maturity. The nominal yield is a combination of the underlying real rate yield + inflation. The key determinant of both is expectations of future growth. Higher future growth will push up expectations for both future real interest rates and inflation. This links directly into the short-term cash rate which is set by the central bank.

The yield on the 10 year bond is the cumulation of expectations of where the short term cash rate (set by the Central Bank) will be in each individual year. This is referred to as the term structure. The yield on the 10 year Sovereign bond is the "risk free discount rate" proxy used to value shares and other risk assets.

Why are yields moving?

In response to the pandemic, we have unprecedented government stimulus, alongside quantitative easing and the lowest cash rate on record. Consumer demand is expected to increase as household savings rates are high. This is coming at a time when we have the global economy emerging from lockdowns and reaccelerating rapidly. As central banks are expected to keep cash rates very low for years to come, inflation, and therefore, rate expectations are now rising in the medium to longer term.

Why does it matter for equities?

It all comes down to corporate finance 101: the time value of money. The value of a share is the present value of future cashflows discounted at an appropriate discount rate (the risk-free rate plus an equity risk premium). Very low interest rates have been a key driver of shares in recent years and especially those with long dated cash flows (growth shares).

Risk free rates

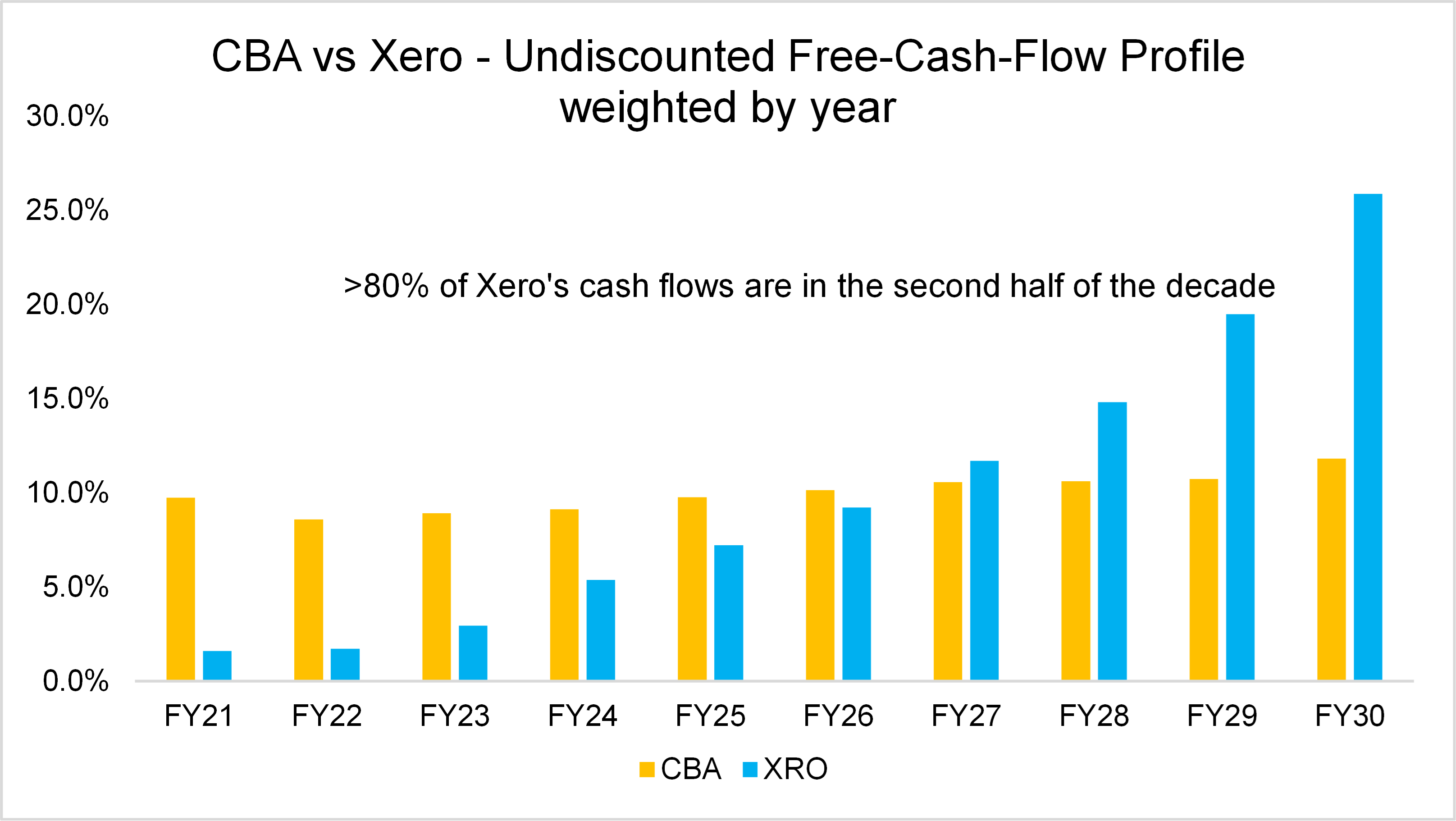

When the risk-free rate approaches zero, long dated cash flows are only slightly less valuable than shorter dated ones. This means technology/growth shares, where profits are further out in the future become vastly more valuable (see Xero’s cash flow profile below). In contrast, if we consider the cash flows of a mature value share, such as a bank, the cash flows are immediate and hardly grow through time. (refer to CBA in chart below).

Source: Watermark Funds Management

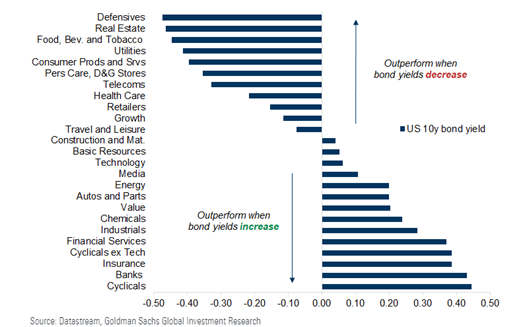

What does this mean for different sectors?

The nature of the pandemic makes some traditional relationships much more nuanced. The global economy is pivoting from "stay at home" to an "away from home" way of life. We go through ramifications in general terms below.

The winners

Financials

- Value/late cycle cyclicals

- Banks benefit from the higher income received by rising rates on their significant cash holdings

- Banks will borrow short and lend long - they benefit from a steepening term structure.

- As the credit cycle improves, they can release capital (unwind provisions)

Commodities

- Commodities are considered hard assets and a hedge against inflation

- Global demand is recovering quickly and the sector has underinvested since the mining downturn - commodity markets are tightening and prices are surging.

- Surplus cash to be returned to shareholders (nearer dated cashflows)

Cyclicals/Industrials

- Cheap and most impacted by the pandemic disruption

- Levered to a recovery in economic activity i.e. construction

The losers

Tech/Growth/Expensive

- Many digital platforms have benefited from the "stay at home" thematic which will unwind

- Fewer cash flows in early years, greater reliance on terminal valuations (year 10+ cash flows)

Real Assets - Property/Infrastructure

- Traditionally a yield sector, like a bond, rising yields are a negative

- Carry higher levels of debt, so rising interest rates are a headwind

- Certain sub-segments are benefiting as economies open up again, i.e. Airports and retail REITs

Defensives

- See minimal benefit from increased economic activity. Revenues similar to population growth

- Usually yield generative stocks with low-risk earnings, low beta

- Industries typically resilient during the lock down

How is Watermark positioned for this?

Whilst stock selection is the major driver in our investment process these major shifts cannot be ignored.

In the medium term we are looking for:

- Value/Financial/Industrial shares that benefit from the reopening of the economy. However, Many shares are cheap for a reason - we look to avoid structurally challenged businesses irrespective of the factor basket they are in.

Examples: Australia and New Zealand Banking Group (ASX:ANZ), Westpac (ASX:WBC), Virgin Money UK (ASX:VUK), Computershare (ASX:CPU), Incitec Pivot (ASX:IPL), Elders (ASX:ELD)

- Resources are well supported as the global economy recovers. A favourable inflation/yield environment is always good for commodities. There has been an underinvestment in the sector post the mining boom/bust- the shift the renewables and EV in particular will ensure commodity markets remain tight.

Examples: S32, STO, KAR

We are avoiding:

- We still believe the tech companies will generate huge amounts of shareholder value regardless of what the yield environment holds. However, speculative and expensive tech that has seen a valuation uplift from a low yield environment should be avoided.

- Defensive income shares such as infrastructure and utilities will underperform. However, we look favourably on those that will benefit from reopening, such as airports and Telstra (they lost $0.5bn of profit from pandemic principally international roaming fees).

Chart: 10 y correlation of weekly returns vs. the market. Global equities

Indexed returns in Europe since 2005

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

10 stocks mentioned