Why the capital raising boom might be over: this week in capital markets

The past few weeks have been quiet in capital markets. Deals are still being done but the sentiment certainly feels more subdued than the 20-raise-a-week days of March/April.

Last year there was roughly $8b raised through placements, this year more than that was raised in the month of April. In March/April as the boom began, investor confidence developed at the top of the market with the big bank raises, travel providers and REITs and slowly made its way down to the small end for the June/July gold explorer and tech boom. The past few weeks has felt a bit like this was happening in reverse. There have been a number of high profile capital raises (particularly underwritten SPP/entitlement offers) that haven't been as well received on the after market. As alpha becomes harder to find at the top, the effects flow down the tail end of the market and it becomes necessary for growth companies to price in more risk.

There's been more than a few higher profile raises this past month that haven't delivered on expectations:

- Nearmap (NEA) raised $72m, now trading down 16.25%

- Orocobre (ORE) raised $126m, now trading down 1.98%

- Bubs (BUB) raised $28m, now trading down 11.25%

- IOOF (IFL) raised $452m, now trading down 12.86%

- FlexiGroup (FXL) raised $79m+, now trading down 11.4%

We think there's a few factors at play here:

-

The US election is creating uncertainty.

This hasn't been a standard presidential election. There's very little clarity available to investors about what will transpire, what policies and stimulus might be announced by either successful candidate or what industries will be favoured. We've even heard from the Trump camp that a peaceful transition of power could be off the cards... In response to all this, the VIX which is widely regarded as the "fear barometer" for the market has been trending up, suggesting that investors are expecting some chaos. Our markets here in Aus are invariably linked to the US, so uncertainty there will be making its way down under.

-

Tech stocks are probably too expensive.

The ASX's technology index is up more than 100% since April. Most of this growth has been driven by the ever-present 'Buy Now Pay Later' sector and eCommerce brands like Kogan and Temple & Webster. Lockdown restrictions have certainly accelerated our economy's transition towards digital, but many pundits believe that the extent of this growth has been overvalued by the market. Just look at BrainChip's meteoric rise and then fall as an example of the tech mania. From small cap to billion dollar company in the space of a few months, and now back on the way to small cap. The go-to-explanation for all this is that younger retail investors have been taking their stimulus cheques and heading to companies they can 'relate' to and understand. There is likely some truth to this...Afterpay has certainly delivered some impressive growth figures during the pandemic, but has the fundamental value of the company really increased by a factor of 5 as their share price would suggest?

-

Investors are no longer overweight in cash.

There have been a lot of capital raises this year. At least 3 time as much money has been raised versus the norm. All this funding has to come from somewhere, and will eventually become harder to attract even if investors are successfully at recycling their capital. Many investors would have started the March/April period with plenty of investible cash from the market selldown but tens of billion of dollars later and you have to start become a bit more selective. Back in the halcyon days of 5 months ago all you needed was a decent discount and a good theme and investors would be throwing in bids. Companies will need to start pricing in more risk and focusing on growth narratives in order to attract the same level of investor interest.

-

Stimulus is drying up.

Until recently it was widely believed that another stimulus package was due out of the US, this has been put on "hold" following the death of a supreme court justice and hospitalisation of the commander in chief. Here at home, JobKeeper/Seeker has been reduced and a tentative end date set for early next year. The extended lockdown in Victoria has further slowed the resumption of many industries and has a national impact. These events might not effect every individual or company, but it dampens confidence and confidence is very important for the capital markets.

If in fact this is the end of the "boom" then we expect there to be some changes to the status quo. Risk will need to be priced into capital raises, meaning we might start seeing more generous pricing. In terms of raise narratives, growth (particularly revenue, but also in terms of news flow) will become more important during investor presentations and in pitch decks.

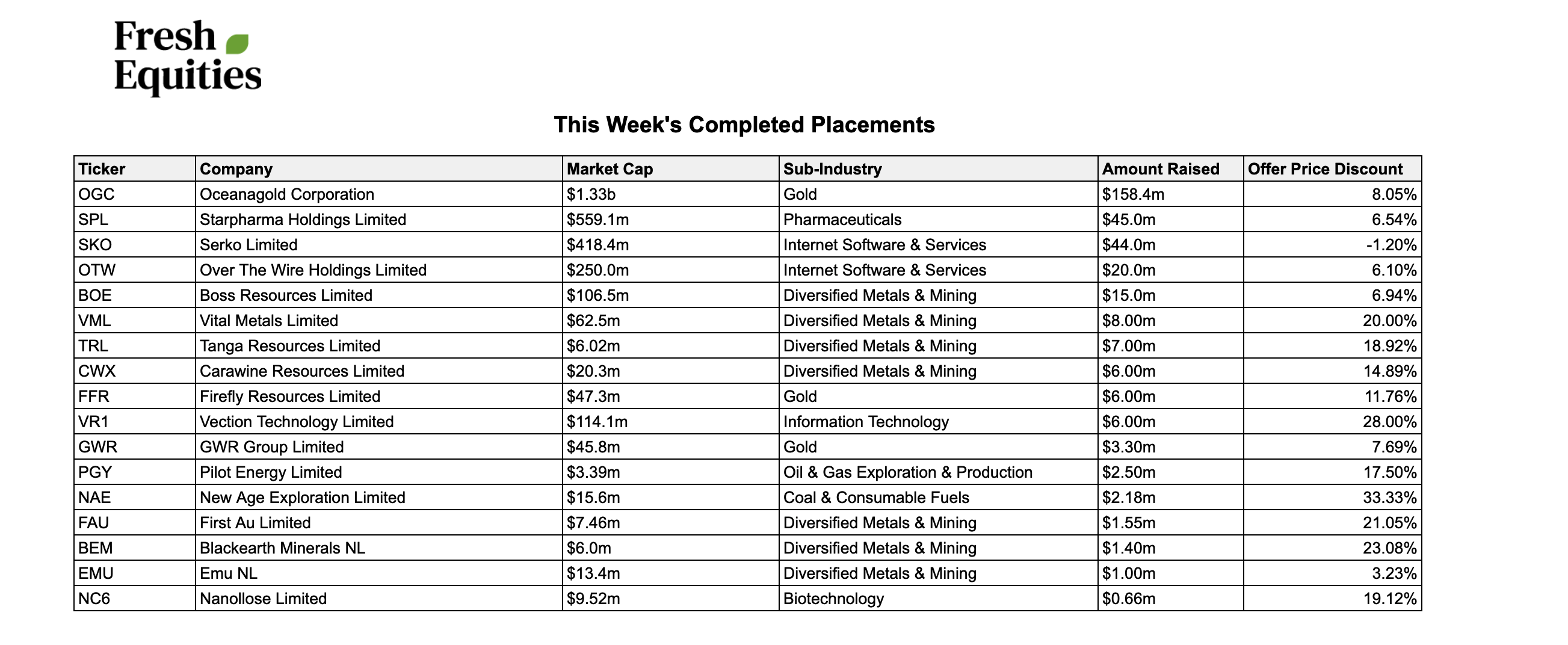

In any case, here's what we saw this week in capital markets:

Enjoy this wire? Hit the 'like' button to let us know. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

17 stocks mentioned