Why there is no inflation problem – and what it means for your portfolio

The RBA surprised markets by hiking 0.25% in October. The Bank remains hawkish. More rate hikes are set to follow over the rest of 2022. But the RBA’s move to slower hikes makes it the first central bank to acknowledge that a recession is both unnecessary and very avoidable. We expect the Fed to reflect that in coming months. This move to a pause will extend the economic cycle. And I argue that is going to be good for investors’ diversified portfolios.

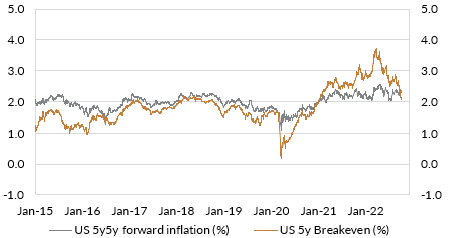

There is no outbreak in inflation expectations

The Fed's (and the RBA’s) aggressive rate hikes have helped restore some credibility that was lost earlier this year. The rapid tightening in financial conditions has also completely prevented an outbreak in inflation expectations. The 5-year breakeven rate is now at 2.00%. This is arguably too low given the Fed targets 2.00% core PCE – which would align closer to a CPI inflation breakeven of around 2.30%.

Chart 1: Measures of inflation expectations are at historically normal levels.

The University of Michigan inflation expectations measures have also collapsed lower. There is simply no evidence that inflation expectations are getting out of hand.

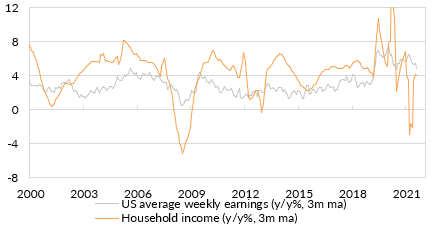

There is no wage spiral

Concerns about a wage spiral in the US are misplaced. There is no wage spiral. Average weekly earnings growth is trending lower quickly. Household incomes are growing around 4.00% over the past year. This is well below inflation. There is no justification for continuing to hike aggressively to prevent a wage-driven inflationary spiral.

Chart 2: There is no evidence of a

wage spiral driving inflation higher.

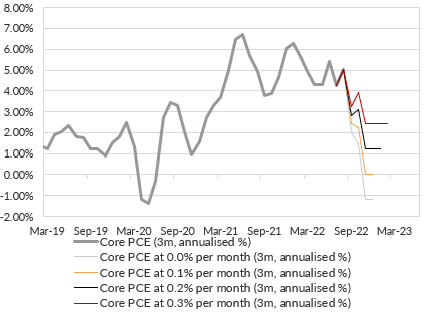

Inflation is trending lower – and will fall quicker than most expect

US core PCE inflation is already trending lower quite quickly. Chart 3 shows what annualised 3m core PCE inflation will look like in 3-6 months' time under different assumptions about core inflationary outcomes. We think these assumptions are reasonable.

Chart

3: Annualised core PCE inflation could fall much faster than many analysts

anticipate

We could be back at an annualised rate of inflation at around 2% by early 2023. That type of trend would surely warrant slowing the rate of hikes.

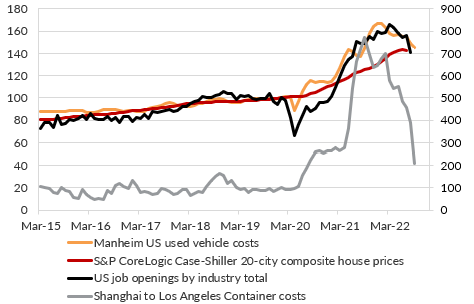

Other indicators of inflation have already turned. Shipping costs. House prices. Used cars. Job openings. Chart 4 shows these rolled over some time ago.

Chart 4: Inflation indicators are slowing in many markets

(indexed to 100 in Jan 2020).

The

bottom line for the Fed is the 3.00% of rate hikes so far is already having a meaningful

impact on demand. Another 1.00% of rate hikes by year-end push core PCE lower

much quicker than the market expects. Without a pause

soon, the biggest concern for the Fed will not be inflation, but will be

disinflation or outright deflation within 6-12 months.

Government bonds are more attractive than they have been in a long time.

10-year Australian government US Treasury yields increased to be above 4.00% in late September. At these levels, Australian government bond yields were looking attractive.

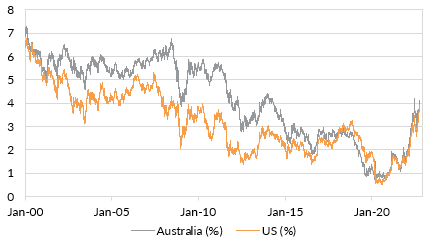

Chart 5: 10-year US and Australian government bond yields

above 4.00% were attractive.

Prepare for the pause

We expect both the RBA and the Fed are moving to a pause in the rate cycle, sooner than markets expect. The inflationary environment simply does not require the aggressive rate hikes currently priced in markets.

This is because:

- There is no outbreak in inflation expectations

- There is no wage spiral

- Disinflation or deflation will be the Fed’s bigger concern in 6-12 months.

In this case, longer-dated government bonds are offering good income, diversification, and downside protection.

The extension of the economic cycle – in contrast to the widely expected recession in 2023 – will also be supportive for Australian and US equities. Near-term volatility is likely to persist until the Fed begins to slow the pace of rate hikes – something we could see as soon as the November meeting.

And this will be a welcome outcome for investors after the bruising year that diversified portfolios have experienced year to date.

Never miss an insight

If you’re not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia’s leading investors.

And you can follow my profile to stay up to date with other wires as they’re published – don’t forget to give them a “like”.

2 topics