Why this bull market has further to run

The June Quarter of 2021 has been positive for equities as the prospect of recovery continues to wash over markets. M&A remains hot as do public listings, despite some minor signs of fatigue. Overall momentum looks set to continue across growth and value stocks on the back of extreme liquidity, record low interest rates and government stimulus.

Right now, equity risk premiums in most global stockmarkets remain highly attractive and will continue to underwrite interest in stocks and allow this bull market to trend further.

In this wire, I explore the key market activities that occurred through the past quarter, share six stocks that intrigued us and our outlook for the rest of the year.

What matters in markets?

A series of important market events unfolded from mid April that would act on investor comportment and prompt a rethink on portfolio positioning.

First, Bitcoin would peak at US$64500 on April 14, the same day Coinbase, a cryptocurrency market place, would IPO with a market cap of US$85bn before both unravelled, halving in value by mid May. Tesla purchased US$1.5bn worth of Bitcoin in February only to have founder Elon Musk turn antagonistic towards it by mid April. FEG (Feed Every Gorilla) and ASS (Australian Safe Shepherd) coins both arrived and crashed in 2021. Gold briefly drew succour from the cryptocurrency collapse but that would quickly pass.

Second, the reflation trade was repriced from early May as the market reassessed the durability of the economic recovery (and therefore pro-cyclical equity allocations) playing out across world economies. Base metals moved lower as bleatings from the Chinese central government about high commodity prices gave rise to threatened price curbs, new restrictions on speculators and State Reserve Bureau stockpile sales. These have traditionally been ineffective but did have the desired short-term effect on prices. Not unrelated to their jawboning campaign, for several months China’s PBOC had been slowing credit and money supply growth and generally tightening financial conditions in the wake of galloping inflation data.

Third, the US Federal Reserve issued its Federal Open Market Committee (FOMC) statement on June 16. In short, the recovery was not yet complete, the Fed was looking through the price volatility around ‘re-opening’ sectors (e.g. lumber, autos and various services) but was keen to wind back stimulus/support. Late 2023 (previously late 2024) is likely to see a lift-off in rates according to the ‘dot plots’. Several board members were eager for earlier action (read 2022) on rates. Fascinating that the US treasury yield curve had been flattening from the close of the prior quarter, reflecting investor angst around the recovery’s resilience. US 10-year notes rallied and regained much of the ground lost in the previous period. This would prove to be an interesting juxtaposition to the Fed's June statement.

Merger and acquisition activity continues to be a dominant force globally. The US was on track for ~US$2tn worth of deals by mid year as cashed up SPAC’s began investing their booty. Goldman Sachs estimate the value of Australasian M&A at $148bn CYTD, 2.6x the five year average. Interesting to note are the greater number of contested/hostile bids and the growing interest from foreigners in local assets. Too numerous to mention, but deals worth noting include:

- Autodesk (US) bid for Altium;

- Realestate.com.au's move on Mortgage Choice;

- Cavalry’s bid for Japara;

- Centuria’s takeover of Prime West; and

- Orocobre’s proposed merger with Galaxy.

Initial public offerings endured through the three months to June close, capping off a busy 12 month period of fund raisings. Interest from buyers remains high and vendor expectations around valuation appear reasonable. There are however emergent signs of deal fatigue with a number of fancied newcomers, such as Keypath Education, Latitude Group and Pepper Money currently languishing at or below their float prices. Near daily headlines on the Nuix IPO abomination have had an impact on deal fervour around the edges. A growing number of IPO aspirants are struggling to get to the line through a combination of valuation, depth of investor interest or concerns about the vitality of secondary markets.

The Morrison Government tabled a constructive budget in May that outlined $96bn in new spending initiatives over the budget cycle. On balance, the planned expenditures were well received by the market

6 stocks to watch

Locally, the ASX 200 and All Ordinaries each moved to new highs, with the former using the February 2020 resistance level at 7200 as support as the index congests this year's strong gains. Exciting to see the Metals & Mining Index testing the old high struck back in 2008.

The Small Resources Index does not look nearly as impressive when compared to historic share price action but is enjoying

improved momentum all the same - expect the up-trend to continue here. The Small Ordinaries Index at 3330 is in the midst of a bull-drive and enroute to 4177, a level we will continue to confidently

proclaim. Witness the solid outperformance (approximately 5.0%) small caps have had over large caps this past 12 months. Reassuring to

see 66% of small cap names are trading above their 100 day moving average.

Pepper Money (PPM) is a specialist residential mortgage and asset finance lender operating in Australia. PPM has a history of specialising in non-conforming and near-prime loans, an area underserviced by traditional banks. We see PPM as more entrepreneurial and opportunistic than other operators in the space. For example, in the mortgage broking channel, where customer service and approval times are critical, PPM’s investment in technology, particularly in its distribution capability, has positioned it well for further market share gains. The company was priced on a P/E of 10.5x and whilst its debut has been soft, we are optimistic about the company’s future, particularly as credit growth in Australia continues to recover post The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

We added to Pilbara Minerals (PLS) at the expense of Lynas Rare Earths (LYC) during the period. This was very much a relative call, with PLS at the early stages of an earnings upgrade cycle, driven by both volume and spodumene pricing upside. It also has strategic optionality near term, with the re-commencement of the acquired Altura operation seemingly the only visible hard rock lithium units to come to market over the next 6-12 months. Conversely, LYC has skilfully executed on a number of its strategic priorities and already enjoyed significant earnings growth on the back of very strong prices recently. It’s also in the midst of a capital intensive phase with little volume growth until the Kalgoorlie cracking and leaching facility is commissioned. It is uniquely positioned over the medium to long term, but we felt a better relative opportunity presented in PLS near term.

PEXA (Property Exchange Australia, PXA) is a digital property settlements platform, that undertakes over 4m billable transaction in the Australian market. As various state governments have embraced / mandated digitisation over the last few years, electronic settlement now makes up over 70% of all transactions, of which PXA has a c.95% share. We are very discerning when it comes to IPOs, however we had the luxury of gaining in depth knowledge of the business in 2018 (when an IPO was first explored) and were able to follow it through listed player Link , who retain a ~42% shareholding. The business has excelled over that time frame, growing from ~40m revenue then to in excess of 200m today. PXA exhibits a number of high quality features that we look for in a business, specifically: 1) a capital light business model, 2) dominant market share in a robust industry and 3) growth optionality. We think the latter comes from monetising the unique data set it has (real time property settlements and financings) and investing in new markets (specifically other Commonwealth countries) like the UK, NZ and Canada.

Specialty chemicals and dangerous goods business DGL dual-listed in May. We were attracted to founder Simon Henry’s

experience and vision having established the business over 20years ago with one site and growing it to 26 sites, 280ppl and

serving 1300+ customers. $100mil of new capital was raised in the IPO to fund ongoing growth with Henry retaining his

entire holding, a rarity in today’s capital markets transactions. Specialist licenses and significant scale positions DGL as the

leader in chemical manufacturing and logistics across the Tasman, with the top 20 customers having on average over 9 years

of tenure. With sound financials, management alignment and large end markets, DGL is quality industrial addition to the

portfolio.

BlueBet (BBT) is a niche wagering operator founded by industry veteran and former Sportingbet CEO Michael Sullivan in

2015. Mobile first with innovative wagering products, BBT has grown to over 90,000 registered customers, with significant

growth in betting turnover (>$340mil). As customers have moved away from the local TAB and migrated online particularly

during 2020, BBT has been well positioned to pick up market share, particularly from regional customers looking for

alternative wagering product with a quality mobile and in-app experience. Being cloud native, BBT is well positioned to

adapt to changing consumer expectations and positions it well to target smaller states in the US with it’s competitive B2C

wagering solution. With a significant runway ahead in Australia, as BBT becomes more synonymous with race followers,

and a strategy to target the significant US market, we were attracted to the initial public offering and participated

accordingly

Our holding in Elders (ELD) was quit from portfolios during the quarter in response to a share price run up ahead of a strong interim result in May. We believe Elders is presently 'over-trading’, notwithstanding a continuing flow of self-help initiatives via acquisition integrations and eight-point plan wins. The group is well leveraged to livestock prices and is presently booking outsized earnings largely from record cattle prices (via voracious re-stocker demand). Management concede recent high cattle prices are unsustainable and have disengaged from international benchmarks. The La Niña weather episode has also underwritten a solid winter crop. Management execution to date has been close to faultless but history has shown that optimal agricultural conditions are usually the time to fold and move on

Outlook for the rest of the year

This isn’t the first time I have referenced Richard Farleigh’s excellent investment tome, Taming The Lion. It’s difficult to fault his many sage observations and his "prices move in trends and go further than generally expected" is perhaps his most valuable and simple dictum. Doubtless, this one perplexes most investors as this market has since March 2020.

Right now, equity risk premiums in most global stockmarkets (including Australia and the US) remain highly attractive and will continue to underwrite interest in stocks and allow this bull market to trend further. The tug of war between secular growth stocks, like tech, and value/cyclical stocks that started late last year, suggests it pays to have a bet in both camps at present.

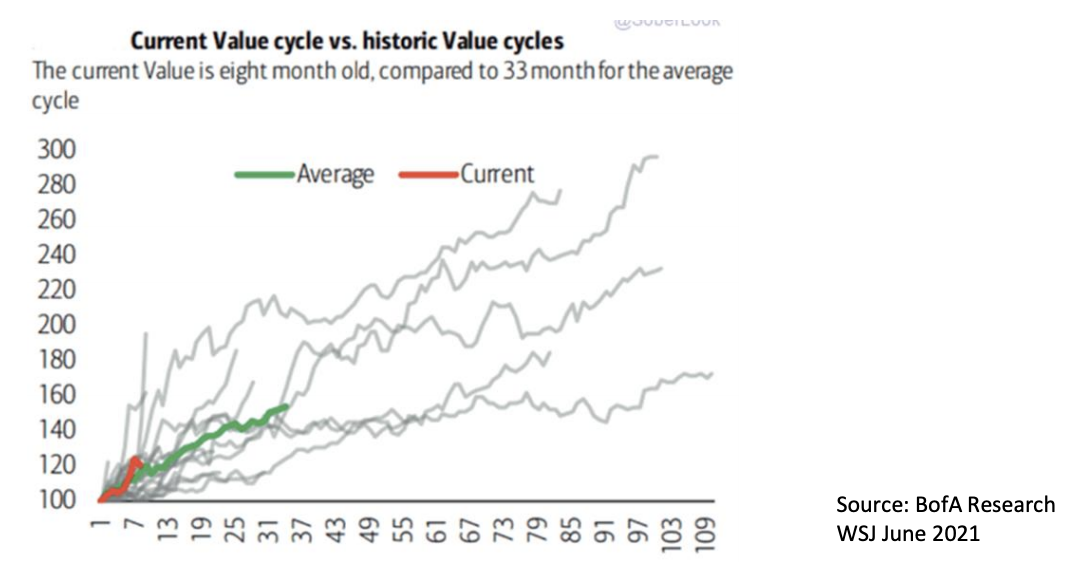

The chart from the BofA US Quant team below highlights the average duration of a value/cyclical cycle is around 33 months compared with the current drive that has been running for around 8 months. The rally in these stocks is a long way from tiring.

The importance of the slope of the yield curve in driving this is well known. The last two economic expansions (2000 and 2008) saw the 2-year and 10-year section of the yield curve steepen by nearly 300bp over 3 years. The latest steepening has seen ~150 bps in 1 year.

When armed with the extraordinary amounts of liquidity, low interest rates and government safety nets (although moderately lessening in impact now) it is easy to see how cyclical stocks can continue to shine in the short-medium term. Valuation differentials between growth and value are also stark, suggesting a lack of confidence in the latter’s earnings prospects.

We are presently in the midst of one of the more benign earnings confession seasons this author can recall. Over the next six weeks or so, corporates will begin reporting full year and interim results and expectations are that a good reporting period should be delivered. US companies will shortly report their June quarter results where expectations are also rather elevated. The local economic revival continues to amaze in its speed and breadth. Concurrent favourable NAB business and consumer surveys (virtually unheard of), positive credit growth, strong housing market and bullish ANZ Jobs Series data suggests the outlook is improving with the obvious caveat remaining the vaccine rollout and keeping state economies out of lockdown.

Right now I’ll stick with the Lion, convinced that stocks push higher from here!

Access Australia's most compelling companies

Eley Griffiths Group is a specialist at focusing on small and emerging companies in Australia. Their investment process and team have delivered consistent outperformance through all market conditions for 15 years.

If you enjoyed this wire click the like button and stay up to date with all our latest insights by hitting the follow button below.

3 topics

17 stocks mentioned