Why this fund manager's top AI position is in South Korea's leading memory chip maker

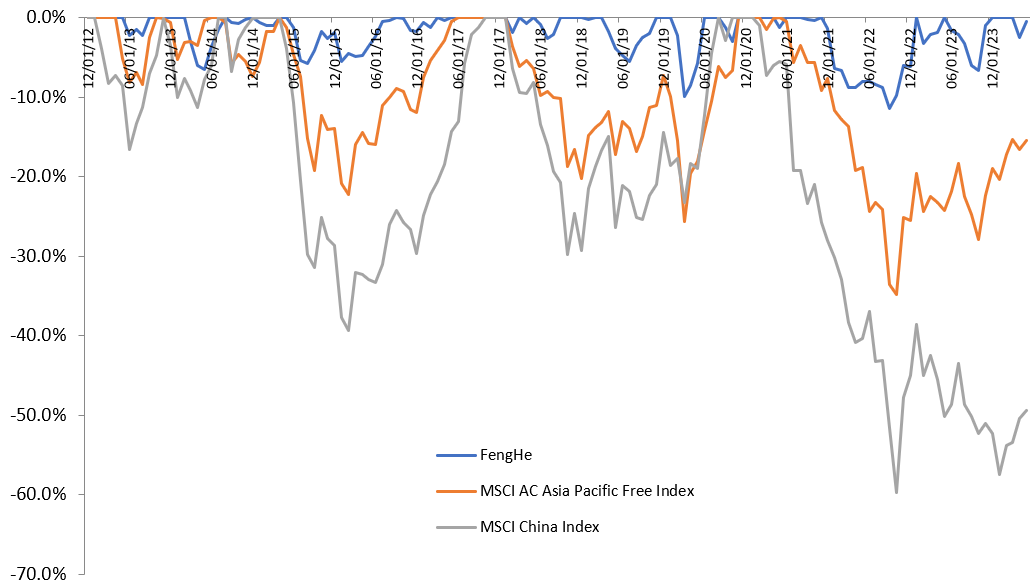

In a change of format, I’m interviewing Matt Hu this week, co-founder and CIO at FengHe Asia, a Singapore based L/S equity manager that invests in companies that are impacted by Asia’s economic transformation. In practice, this has manifested in a portfolio that is primarily focused on technology supply chain companies, and East Asia economies including China, Hong Kong, Taiwan, Korea and Japan. We started allocating to FengHe Asia in 2018 based on the quality of the team led by Matt. As the CIO of the Fenghe Asia strategy, Matt brings 34 years of investment experience across Asia. He was one of the early institutional managers in China and Hong Kong in the 1990s. His expertise in equity investment and research, combined with his strategic focus on technology supply chains, has been instrumental in making FengHe Asia strategy one of the most consistent and best-performing long-short equity strategies in Asia. Our private bank partners have been well served by allocating to Matt and his team, with 13% net annual returns since 2012 (+10% YTD mid-June 2024) , vol approximately 11%, Sharpe >1, and a highest drawdown since 2012 of ~11% (recovered within 3 months).

PdW: The AI trade has been a good one for you in recent years, is that still a theme that you’re focused on, and what’s your current favourite stock in that sector ?

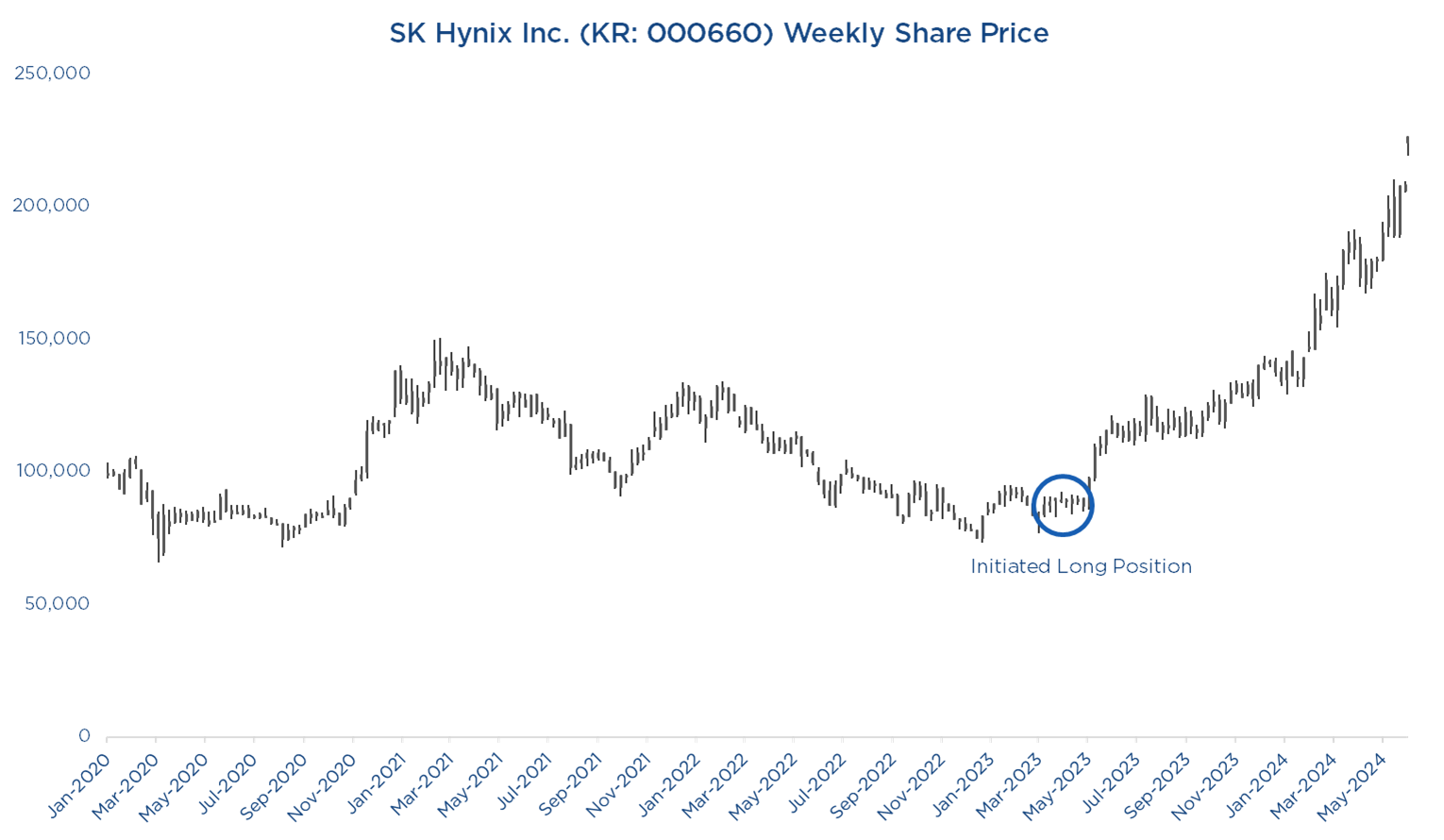

MH: Recent advancements in AI have generated significant market enthusiasm for semiconductor and tech-related stocks. While we are confident in the long-term structural growth prospects of AI, our approach to investing in these sectors remains focused on the medium-term, idiosyncratic product cycles of individual companies. Since inception, we've built our expertise around the world of tech supply chain. In recent years, between 60% and 70% of our net exposures are in technology hardware sectors. Our top winner in March 2024 was our long position in SK Hynix (a South Korean supplier of dynamic random-access memory chips and flash memory chips, the #2 memory chipmaker globally), Our current long position was initiated in April 2023, during a downcycle for both DRAM and NAND, we determined that the company's valuation already discounted the worst-case scenario of the downcycle. Leveraging our expertise in semiconductor cycles, we bought SK Hynix with conviction and a sufficient margin of safety despite market pessimism. Recognizing SK Hynix's grasp on High Bandwidth Memory (HBM) technology amid the rise of AI, we increased our position, making it one of our largest holdings.

Today, SK Hynix is a consensus buy on Wall Street, and many see the company as a core holding for the AI theme. However, it's important to remember that this is still a cyclical business at its core. With Micron and Samsung now entering the HBM market, based on our understanding of the memory cycle, we are bound to reach a stage where there is excess supply. This is a matter of when, not if. Through our experience and expertise, we will continue to carefully monitor margins and valuation, and exit at suitable points.

PdW: Much of the media coverage on AI, EV, IoT and some of the other technology themes you trade is focused on the US and China, it sounds as though you see opportunities to trade those themes in other regional markets, is that correct ?

MH: That’s correct, across our coverage, we observe that many East Asian companies like SK Hynix and Samsung in Korea and Socionext and Ibiden in Japan are benefiting from the geopolitical tensions between the US and China. The EV and tech supply chain companies based in Korea and Japan face strong competition from China. However, due to restrictions on their Chinese competitors, many Korean and Japanese companies now dominate global markets outside of China.

PdW: Are you investing in China currently, and how do you see that market ?

MH: Despite the challenging investment environment in China, we continue to maintain selective exposures there, and in the last month we’ve increased our Chinese (A+H+ADR) gross exposures to almost 17%, the highest level in the past year. The enduring uncertainty in the Chinese economy, coupled with a prolonged bear market spanning nearly three years, has posed significant challenges for both Chinese companies and investors alike, but as the economic tide in China recedes, it becomes increasingly apparent which companies are well-prepared and resilient, and which ones are vulnerable.

Despite the prevailing economic challenges, a select few high value-add companies have not only weathered the difficulties but have also demonstrated quality, vitality, and even growth. Notable amongst these names are Futu and Tencent, both of which we have recently added to our portfolio. Many may remember Futu, an online brokerage, as our best performing position in 2021. Since we exited that original position that year, its stock experienced a selloff in line with the broader decline in Chinese equities, despite its business being largely independent of China's faltering domestic economy. With its technological prowess, user-friendly interface, and strategically sound team, Futu has aggressively expanded into international markets such as Singapore, Malaysia, and Japan, capturing significant market share within just three years. Leveraging our deep understanding acquired from years of in-depth monitoring, we are bullish on Futu’s profitability and future growth potential.

Tencent is currently our largest Chinese position (3% weighting) and we hold a particularly optimistic view on its growth drivers. Firstly, it continues to gain market share in user engagement for video accounts and faces a promising path to monetisation even in its early stages. Secondly, gaming, after a subdued period last year, is poised to resume growth from the second quarter of this year with new launches. Thirdly, the company's wise strategy of scaling back low-margin businesses over the past two years has significantly improved growth quality, with gross profit now growing at twice the rate of revenue. Moreover, Tencent's announcement of a HKD100 billion buyback plan shows sound management to combat the ongoing pressure from Prosus's continuous reduction of their stake in Tencent holdings. We foresee that both Futu and Tencent will be able to achieve high-quality growth of over 20% this year, despite the challenging macroeconomic conditions.

PdW: Describe FengHe Asia’s investment strategy ?

MH: FengHe Asia’s investment strategy prioritises capital preservation and drawdown management through disciplined risk management. Key features include a conservative approach to leverage, a focus on fundamental bottom-up research, and avoiding directional market views. FengHe Asia’s proprietary research framework supports a fundamental long-short approach, resulting in a resilient and diversified portfolio. Central to our strategy is a commitment to maintaining low concentration and low correlation across sectors and markets, along with active and disciplined risk management to adeptly navigate market volatility. In terms of coverage, we have 13 sector specialists, each responsible for in-depth coverage of around 30 specific companies, which gives us our ‘research farm’ of about 400 names, from which we generate a long/short ideas pipeline of 150-180 names, and eventually a portfolio of 50-100 names.

PdW: Risk management is crucial in investment. How does FengHe Asia handle market volatility and risk ?

MH: FengHe Asia adopts a disciplined active approach to risk management based on a clear framework and process. Our risk management framework aligns with our aim to limit drawdowns and allow long-term compounding. Our gross exposure is capped at 150%, with historical average between 100-110%. For individual sizing, each position long position is capped at 6% of AuM sizing at cost and 8% MTM. We have individual stock and portfolio stop-loss protocols in place – indeed in April we instituted a 20% reduction in gross exposure mid-month after a peak-to-trough drawdown of -2.5% triggered our portfolio stop loss, in line with our risk management framework. In the 11 years prior to last month, we only executed this portfolio stop-loss procedure 11 times, and without exception, we’ve performed better after every reiteration.

We’ve navigated several challenging market conditions since inception and preserved capital well thanks to our robust and disciplined risk management framework (refer diagram below).

PdW: Has your risk management policy changed since launching the business, and do you come across new risks that require modification to your risk management processes and policies ?

We’re constantly refining our processes. As mentioned, we applied a portfolio stop loss in April for only the 12th time since we launched in 2012. Over half of our losses in April were due to FX volatility, and we experienced our worst FX impact in a single month ever, with a detraction of -1.6% due to the sharp appreciation of the USD against the JPY/KRW/TWD. Since inception, we have not had an active FX hedging policy because our equity returns have consistently driven our overall returns, and the FX impact has always been immaterial. As a bottom-up manager, we refrain from macro or FX views and have generally been comfortable with the resultant currency exposures from the net exposures in each market. Given the significance of our April FX loss, we have carefully reviewed our currency exposures and FX policy. We determined that the current volatility and macro uncertainty surrounding USD-JPY were too pronounced, and implemented a FX hedge on almost half of our JPY net exposures. Like all our key processes, this decision was driven by our bottom-up analysis and relates to the proportion of Japanese companies that mainly rely on the domestic economy and JPY revenues (many Japanese MNCs and export-oriented companies, such as Hitachi and Renesas, will benefit from a weakening JPY, thus eliminating the need for corresponding JPY exposure hedging). Similarly, we have not hedged our KRW and TWD exposures, as our holdings mostly relate to MNCs such as Samsung Electronics and TSMC. Going forward, we plan to assess the hedging of specific currency exposures on a case-by-case.

PdW: Noting that you’re a bottom-up investors, how is your portfolio positioned currently, relative to prior positioning ?

Following April’s stop-loss procedure, we conducted a thorough review of all existing positions to identify higher-conviction names and have begun adding to certain positions. This initial rebalancing includes adding to our positions in a few Chinese companies, as mentioned previously, such as Futu, which was our highest performing holding in 2021, and Tencent.

We also continue to have strong convictions in the tech supply chain sector. A good example is Hitachi, which we started closely following last year as a natural extension of our core tech supply chain focus. While many Japanese conglomerates are just beginning to streamline their operations and refocus their business strategies, Hitachi embarked on this mission over a decade ago. Hitachi has been making significant advancements across various segments through both hardware and software innovations and has also become one of the most important global power grid companies. A pivotal element of Hitachi's strategy has been Lumada, the classification for their AI-driven solutions platform. This categorisation will contribute to over 40% to Hitachi's EBITDA, demonstrating its growing profitability and recurring revenue. Their core businesses are currently benefiting from a virtuous cycle of cross-selling and converting one-off transactions into recurring sales, a key long-term structural driver for the company's value. Hitachi stands out as a rare example of a company that has successfully monetised AI innovation, positioning itself as a global powerhouse. Consequently, we maintain a highly positive outlook on Hitachi, and it is currently our largest position in Japan.

5 topics