Why this tech behemoth is worth holding despite a woeful earnings report

When professional investors talk of companies that act as bellwethers for the world's largest economy, they don't come much bigger than this. Last month, we got an early clue from FedEx (NYSE: FDX). The shipping giant warned global volumes were on the decline and that a worldwide recession was on the way.

But while FedEx can talk about the supply chain, there is one company that can provide an extra level of insight into the economy. That's because it doesn't just deal in shipping.

It also deals in cloud computing through a billion-dollar web services business. It has a stake in electric vehicle innovation through a multi-billion dollar bet on Rivian Automotive (NASDAQ: RIVN). But most importantly, it knows the health of the consumer better than almost anyone through its Prime Days and its subscription streaming service.

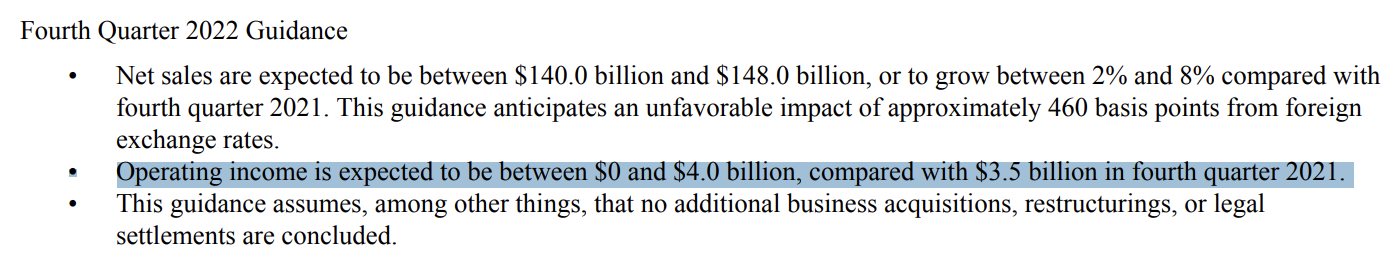

In its earnings report today, Amazon (NASDAQ: AMZN) proved how much the economic slowdown will hurt balance sheets. The company missed estimates on all its key metrics, with Q3 earnings just half of what it was a year ago. Its outlook was even more bizarre. The company's range of operating income for Q4 is between US$0 and US$4 billion.

No, that's not a typo, and if you don't believe me, here is the screenshot straight out of the report:

So what does Amazon's result say about the state of the world's largest economy? And is the company's earnings just another sign of investors' exhaustion around US big tech stocks?

I sat down with Kieran Moore at Munro Partners earlier today to discuss the result - and whether he'd buy, hold, or sell the world's fifth most valuable company by market cap.

.png)

Note: This interview was conducted on Friday, October 28th, 2022. Amazon is a top 10 holding in the Munro Global Growth Fund.

Amazon (NASDAQ: AMZN) Q3 Key Results

- EPS of 28c/share, vs 22c/share estimate

- Revenues of US$127.1 billion, vs US$127.46 billion estimate

- Operating income of US$2.5 billion, vs US$3.11 billion estimate

- Amazon Web Services revenues of $20.5 billion, vs $21.1 billion estimate

- Sees Q4 net sales of between US$140-148 billion, operating income guidance between $0 and US$4 billion

- Expects to see a 4.6% negative FX impact on revenues

(Source for all estimates: Bloomberg)

In one sentence, what was the key takeaway from this result?

Clearly, it's a difficult operating environment from a top-line perspective and a margin perspective. There's clearly a lot of things Amazon has to deal with in FX, which is impacting their top line but they have a lot to do on the margin progression as well. So it's still messy coming out of COVID and still difficult for them but I don't think it's unsolvable.

What was the market’s reaction to this result? In your view, was it an overreaction, an under reaction or appropriate?

Overreaction at first instance, appropriate in the after hours.

The market reaction is pretty severe here. Earlier in the year, they said they would start to show an improvement in the profitability metrics. They did that in Q2, and they showed you that improvement that they could get this operating structure under control. That to an extent went a little backward this quarter. It wasn't the improvement the market or consensus was expecting, particularly on the Q4 operating (income) guide.

That was a disappointment. In our view, and in the long run, stocks always follow earnings. On the back of this, consensus earnings have to come down and the stock price has effectively followed those earnings down aftermarket. It does look like a big number and there's probably a bit of conservatism baked into the guide but on the whole, the stock is down because the earnings are down. It's as simple as that.

Were there any major surprises in this result that you think investors should be aware of?

To have the midpoint of the operating income guide for Q4 come in at two billion instead of the five billion consensus is a meaningful haircut to earnings, which was disappointing from our point of view. We think they can get back on track in the medium term, but it will require some solid management execution.

The growth guide for Q4 surprised us a little bit. Clearly, there are some FX dynamics at play here so we need to be mindful of that. The business, from a fundamental point of view ex-FX, did improve on the top line in Q3 so that was pleasing. But management has given a fairly conservative - or fairly sombre guide into Q4, which is typically the best season for an e-Commerce business. They've also had a second Prime Day in Q4 this year which means the top line in the e-Commerce business should be better than it is.

The second surprising - or slightly disappointing thing around these earnings was around AWS. The Q4 guide implies AWS will continue to decelerate in terms of its growth. It's decelerated from 36% in Q1, Q2 33%, and Q3 was around 27.5%. The guide implies another deceleration which is a little bit disappointing and something we thought was going to be a little more resilient.

Would you buy, hold or sell Amazon on the back of these results?

Hold

We're going to wait and see. We have got good confidence in Andy Jassy turning this around, but they really need to continue down the path of building their efficiency in their operating model and showing that through margin expansion over time.

We've got full confidence the business can get back to pre-COVID margin levels from a retail point of view in particular. You've got the second-largest retailer on the planet effectively losing money in their e-Commerce business at the moment. But we think that won't last forever. But it's going to take time and this is a big business. The size of the dollars flowing through the platform does mean it takes time for them to work through these issues.

We're going to back him in. We like what we see so far, but that was maybe a sideways step this quarter.

Will next quarter's earnings provide a little more clarity as to whether it will be a more firm buy or sell?

We started to see the first signs of operating margin expansion in Q2. They guided to a small operating profit in Q3, which they did. We wanted to see that continue upwards in Q4. So for them to produce US$2.5 billion in Q3, you want to see the guide mid-point be at least a sequential improvement on that 2.5 figure. I don't think the investment case is over here. I think they can get back to these margins, but we just need to see it in the guide and in the numbers that come through.

What’s your outlook on Amazon and its sector over FY23? Are there any risks to this company and its sector that investors should be aware of?

On the retail side, we want to be a bit careful around exposure to the consumer in the current macro environment. There's clearly some damage done in economies around the world with central banks raising rates as fast as they are. We want to be a bit careful around consumer exposure. It's been a difficult period for businesses that have to adjust quite quickly to consumer demand profiles.

On the AWS side, this is where we are a little more positive. Clearly, there is a long runway for workloads that have to shift to the cloud. That should continue and it should be a much more resilient part of their business in 2023. We're still quite comfortable on AWS, but on the whole, we want to see that margin progression come through.

They do have a stake in Rivian Automotive but they report that below the line so that increased during the quarter. The way we look at this stock is EV/EBITDA, as a proxy for cash flows. We don't actually look all the way down to earnings for Amazon from a valuation perspective for our model just because things like the Rivian stake makes a lot of quarter-to-quarter noise.

Catch all of our US Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this US quarterly reporting season.

2 topics

3 stocks mentioned

1 fund mentioned

1 contributor mentioned